‘Are you still watching?’- Shakeup Likely for Streaming Services

Shakeup Likely for Streaming Services

1Q 2022 Recap

2Q 2022 Update

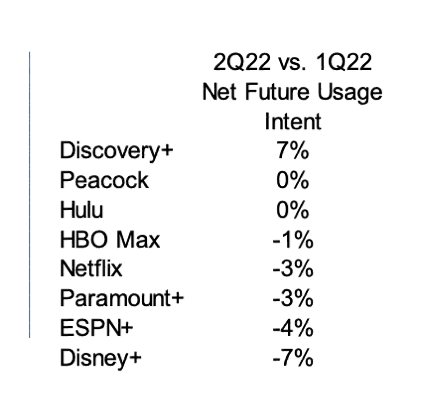

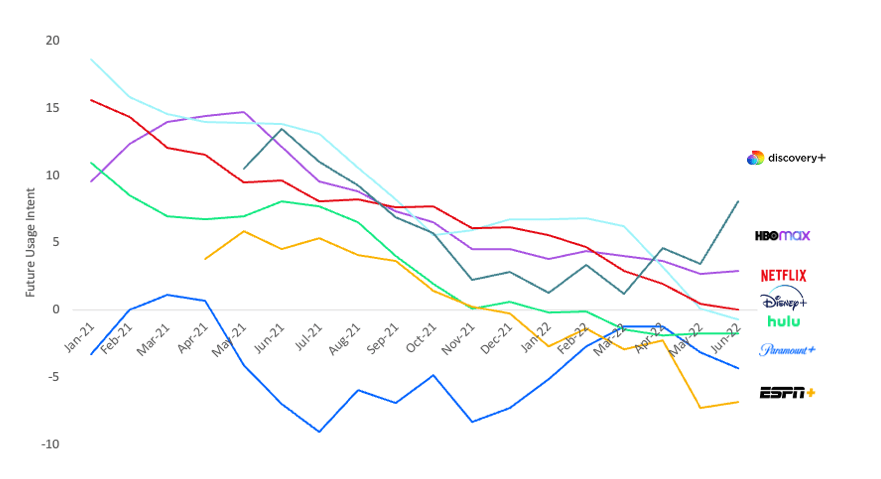

Discovery Gains, Netflix and Disney+ Soften

Further Struggles for Netflix?

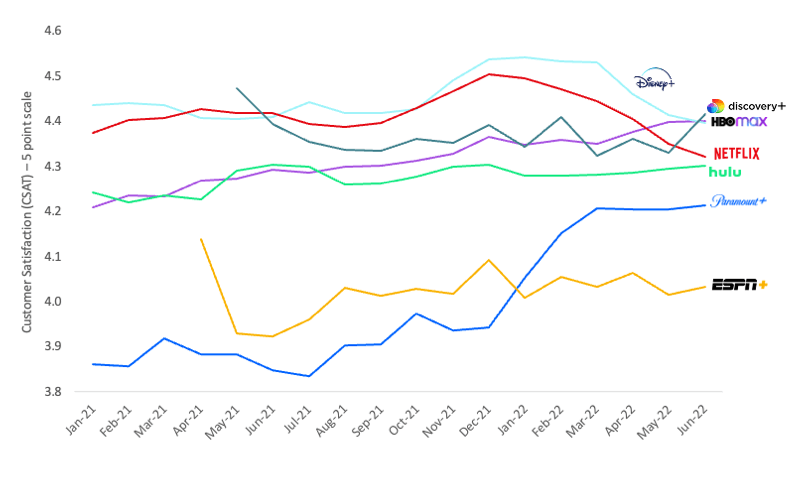

We see customer sentiment on ‘Price’, the top selected driver by Netflix customers, continue its decline from 1Q 2022 into 2Q 2022. HundredX believes Netflix’s softness in subscriber growth may be attributed to several factors – including Netflix’s price increases as well as declining sentiment towards its value, content, and subscription options.

For Those Still Watching…

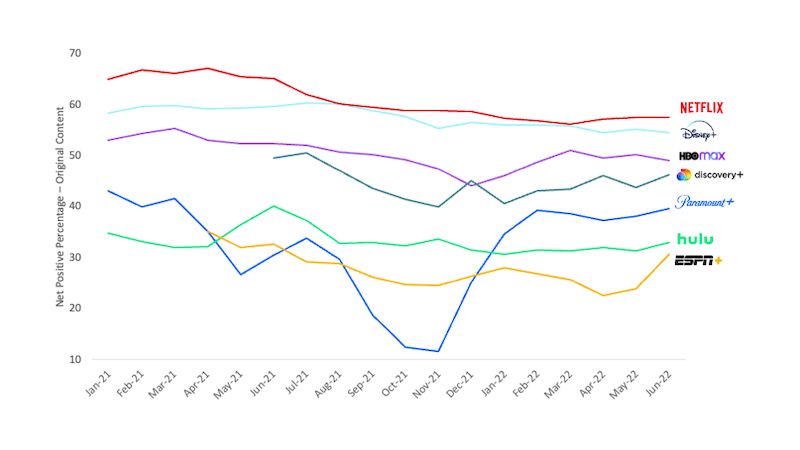

One place Netflix still sits atop sentiment for the streaming group for ‘Original Content’, perhaps in conjunction with the recent release of Season 4 of ‘Stranger Things’. We note, the top position for sentiment towards content could be in peril for Netflix.,Discovery+ has significantly narrowed the gap with Netflix this year on consumer views of the quality of its original content (see the chart below) and completely closed the gap on the amount of programming it offers – Discovery+ now only lags Disney+, contact us for further details.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

Share This Article