Banking + Finance

With both individuals and corporations taking a close look at their financial well-being in 2023, HundredX looks to The Crowd to understand what real people think of their banks, credit cards, and payment apps. By analyzing 85,000 pieces of feedback on almost 100 brands shared in 2022, HundredX can better understand people’s financial habits in 2023. We find:

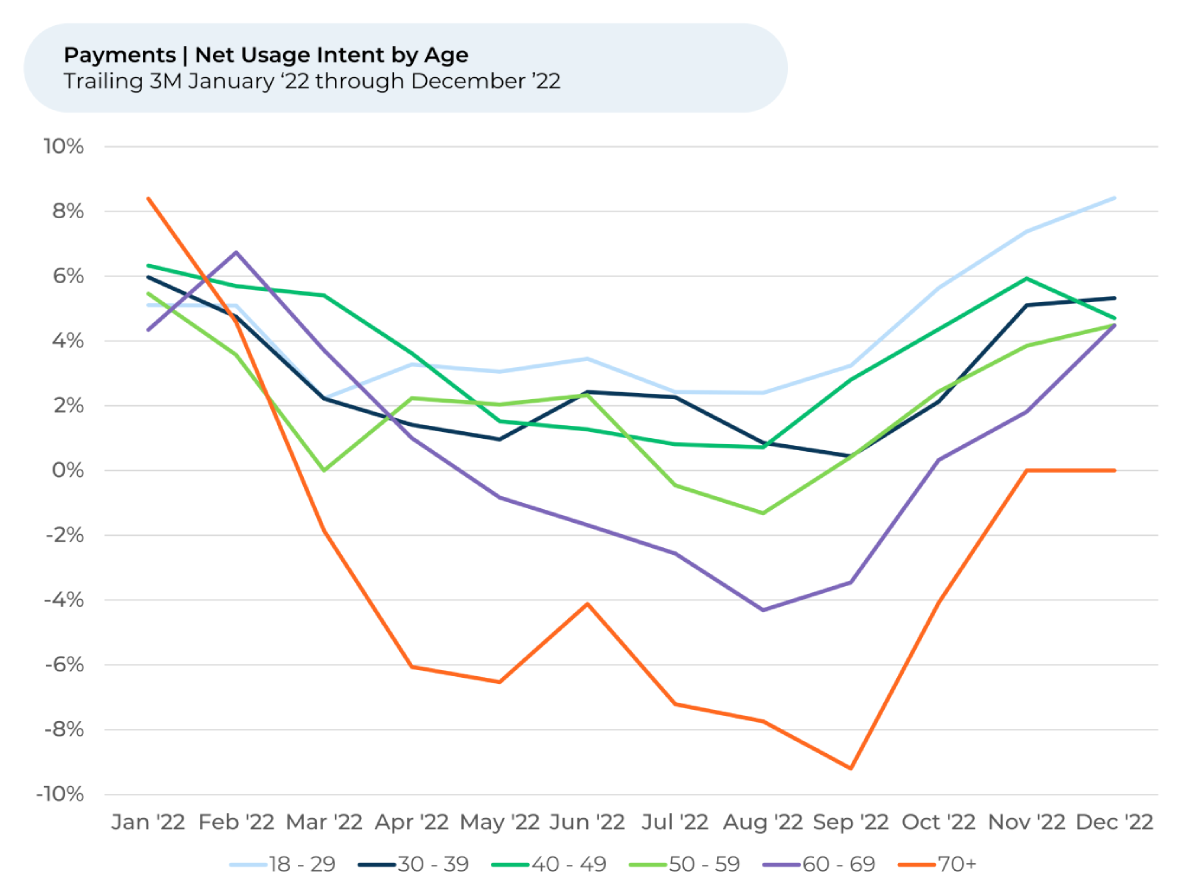

- Payments Usage Intent increases are widespread among most age and income groups. Over the past few months, the biggest increase came from users over the age of 60.

- The strong outlook for Payments relative to Banks seems to justify big banks’ efforts to create a digital wallet payment system to compete with Apple Pay, Google Pay, and PayPal.

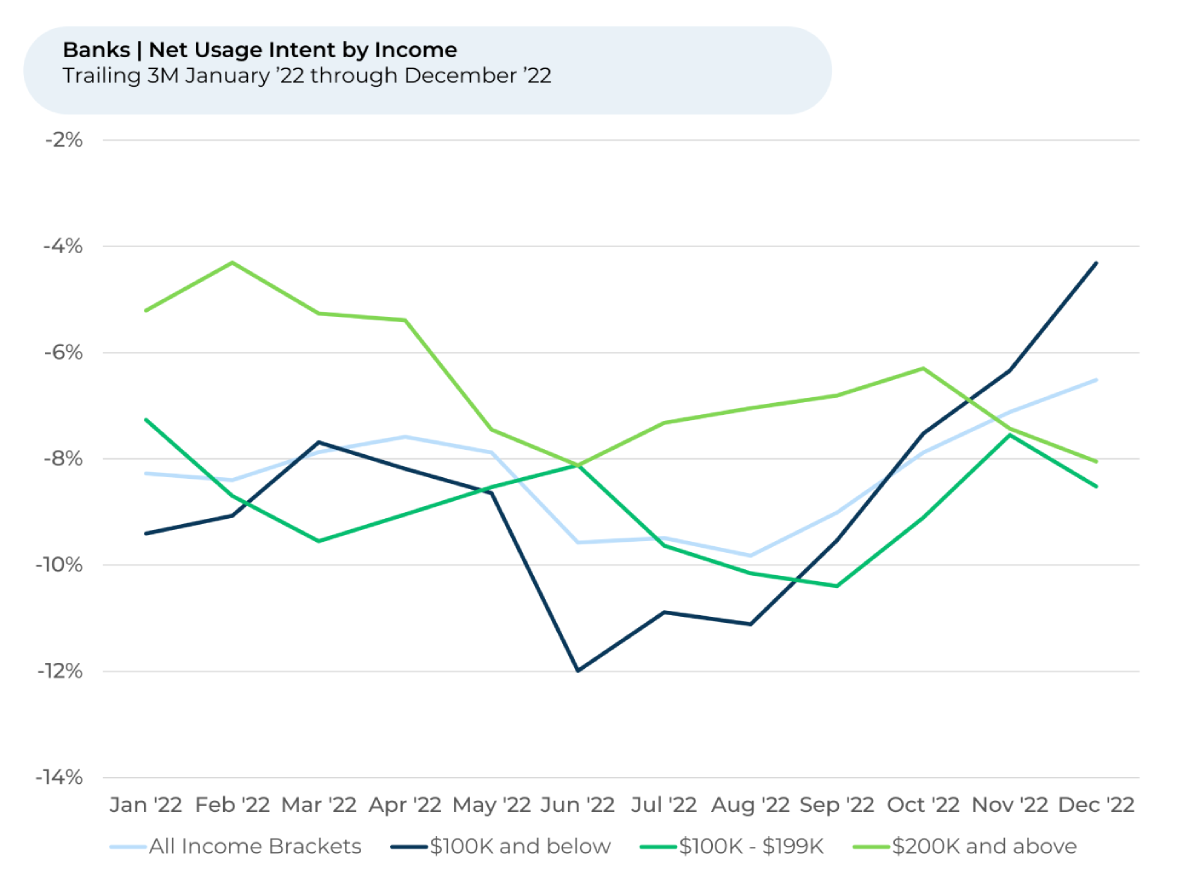

- Over the past few months, the number of households with income under $100K saying they will use banks and payment platforms more has skyrocketed.

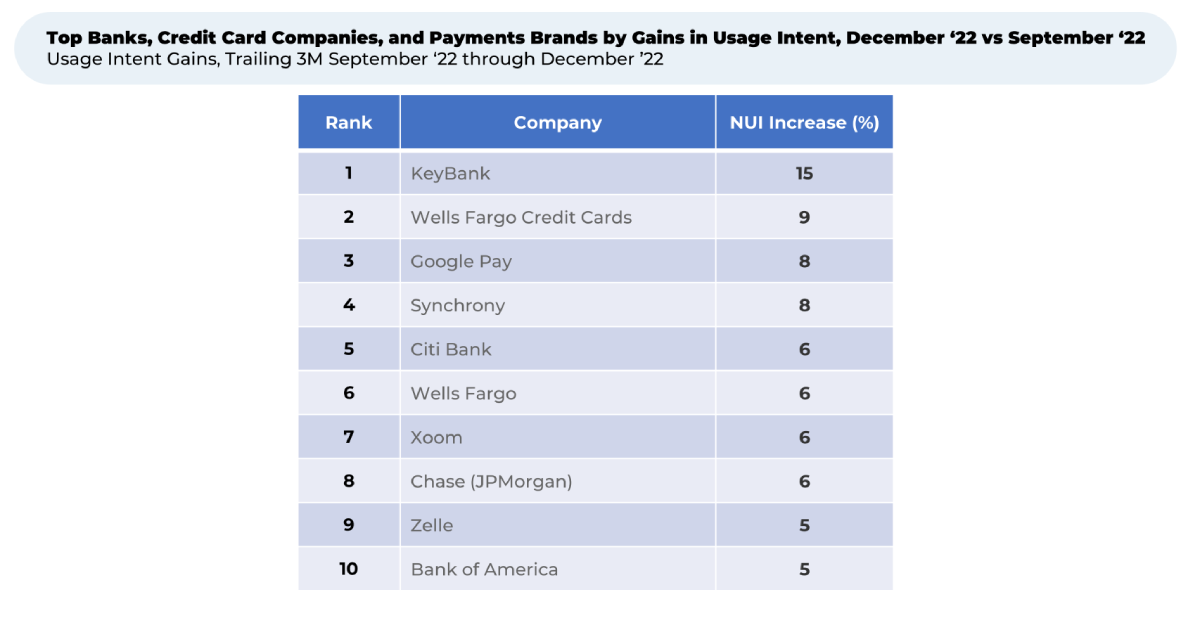

- Ohio-based bank KeyBank saw the single largest jump in Usage Intent¹ since September, seemingly getting credit for investments that have enabled customers to open new accounts in near real-time.

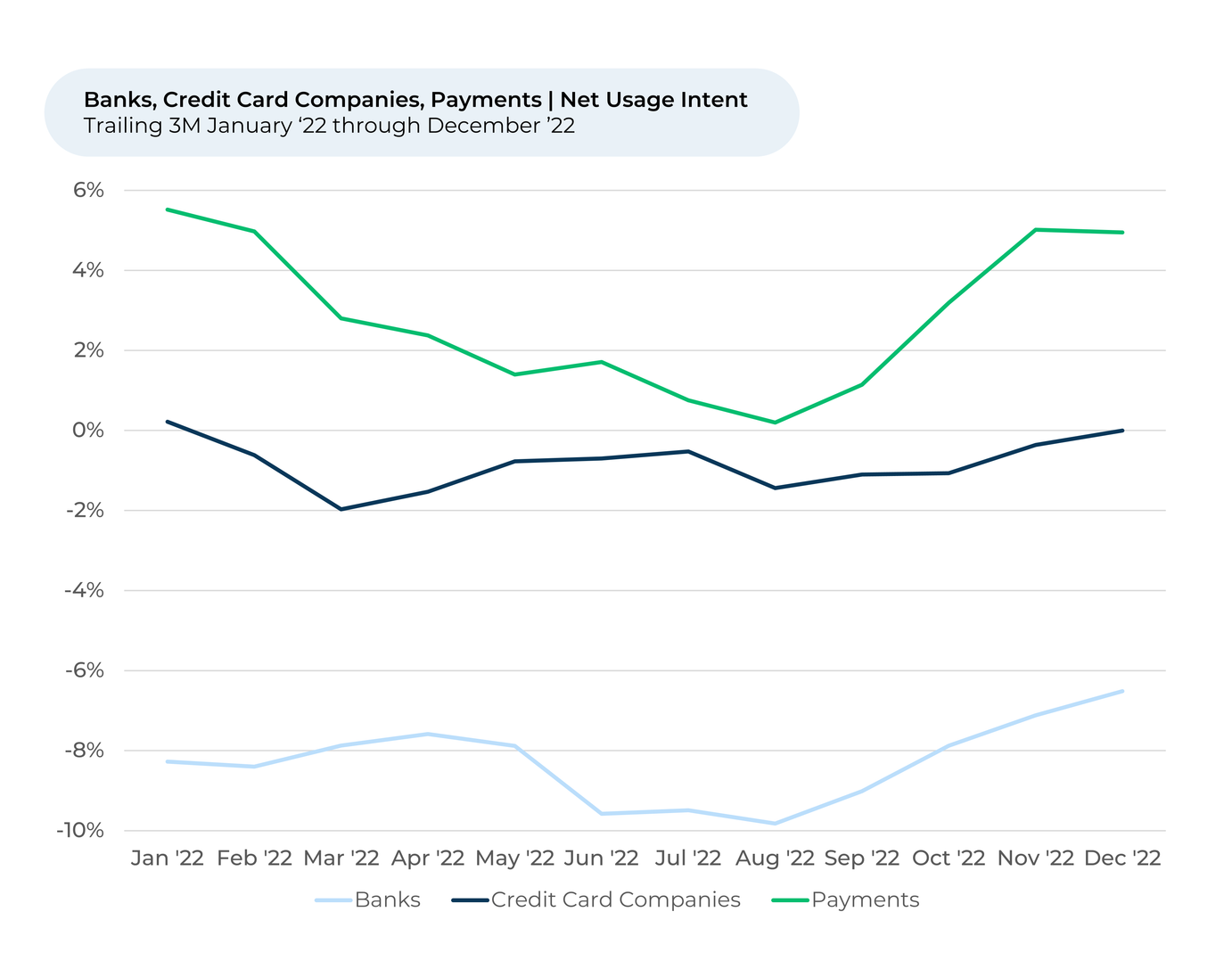

More customers plan to use their banks, credit cards, and payments platforms more now compared to the summer months. Usage Intent for Banks, Credit Card Companies, and Payments appears to be trending upward since September 2022, with Payments flat from November to December. Even so, Payments Usage Intent climbed 5% from August to December, easily outpacing the increase for Banks and Credit Card Companies.

Usage Intent reflects the percentage of customers who plan to use a specific brand more during the next 12 months minus the percentage that intends to use less.

The Wall Street Journal recently reported that Early Warning Services (EWS), the parent company of the popular payment app Zelle, plans to launch a new digital wallet service later this year. EWS is owned by a consortium of seven of the biggest banks in the U.S. -- JPMorgan Chase, Bank of America, Wells Fargo, U.S. Bank, PNC, Truist, and Capital One. The banks seemingly want a piece of the digital wallet pie, currently filled by Apple Pay, Google Pay and PayPal.

Never too old for new technology – Payments Usage Intent is surging

“PayPal is very functional, easy to use and necessary these days,” one person over 60 said recently. Another person over 60 said of a payments platform, “Being older it took me time to navigate but I have it now for online shopping.”

Banks and Credit Cards usage intent rising, though mixed by income

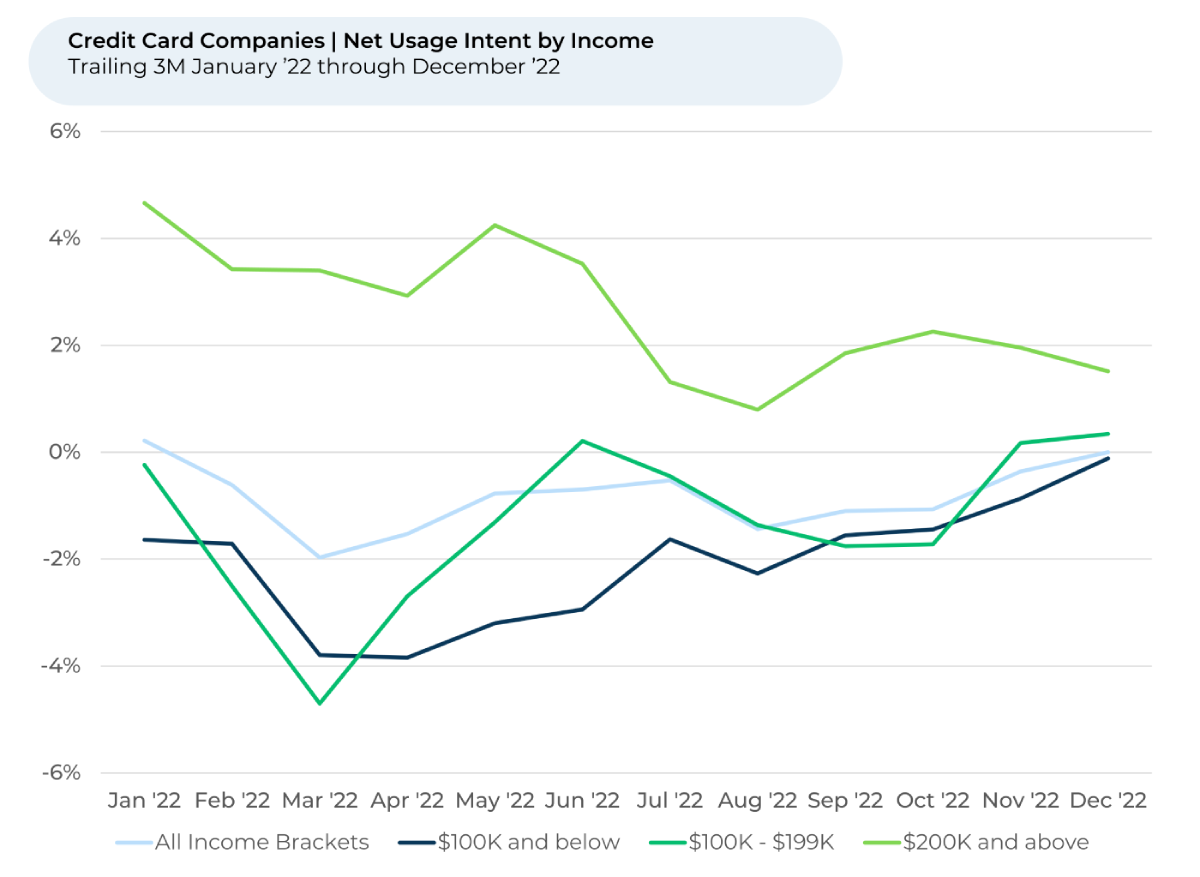

Households making the most ($200K+ per year) have the highest Credit Card Companies Usage Intent, followed by households making between $100K-$199K, and then those making under $100K. However, Usage Intent is dipping in the last few months for the wealthiest households and rising for the other income brackets.

Meanwhile, Usage Intent among all income brackets is negative for Banks but has seen significant improvement in recent months for households making less than $100K per year. Since August 2022, Usage Intent jumped by 7%, from -11% up to -4% in December among that group. Over the past month, however, Banks saw a decline in Usage Intent among households making $100K-$199K and over $200K.

That decline for the wealthier households highlights an issue

the Wall Street Journal recently reported

on – wealthy customers are moving money out of banks and their low-yield savings accounts into higher-yielding types of accounts. According to the WSJ, deposits at Bank of America’s wealth unit, which caters to high-net-worth customers, fell 17% in 2022. Deposits in the bank’s consumer unit only fell 0.6%.

Moving the Most

Since September, KeyBank saw its Usage Intent rise by 15%, with the largest jump monthly jump (9%) from September to October. Headquartered in Ohio, KeyBank operates more than 1,000 branches and 40,000 ATMs across the U.S. Over the past three months, customers’ sentiment towards several of the bank’s features improved significantly, including towards its Website/App (+18%), Associate Attitude (+15%), Service Speed (+12%), Fees (+11%), and Checkings & Savings (+10%).

“Love [KeyBank] and love the ease of their website and app,” one person told HundredX recently.

In late September, KeyBank announced it expanded its partnership with software vendor Oracle to modernize its underwriting workflow. The improvements enable KeyBank customers to open a new checking, savings, or credit card account in near real-time. Since that announcement, we see customers feel much more positively about KeyBank’s website and app.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

As the financial uncertainties of 2023 unfold, HundredX will continue following customers’ intent to use their banks, credit cards, and payment apps and which companies are best positioned to take advantage.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article