Coffee Chains

Now that we’ve incited some cold vs hot coffee debates, we want to get into what really matters in the coffee world – which groups of people plan to visit coffee chains and why. By combing through more than 35,000 pieces of feedback during 2022 on 15 major coffee chains, HundredX finds:

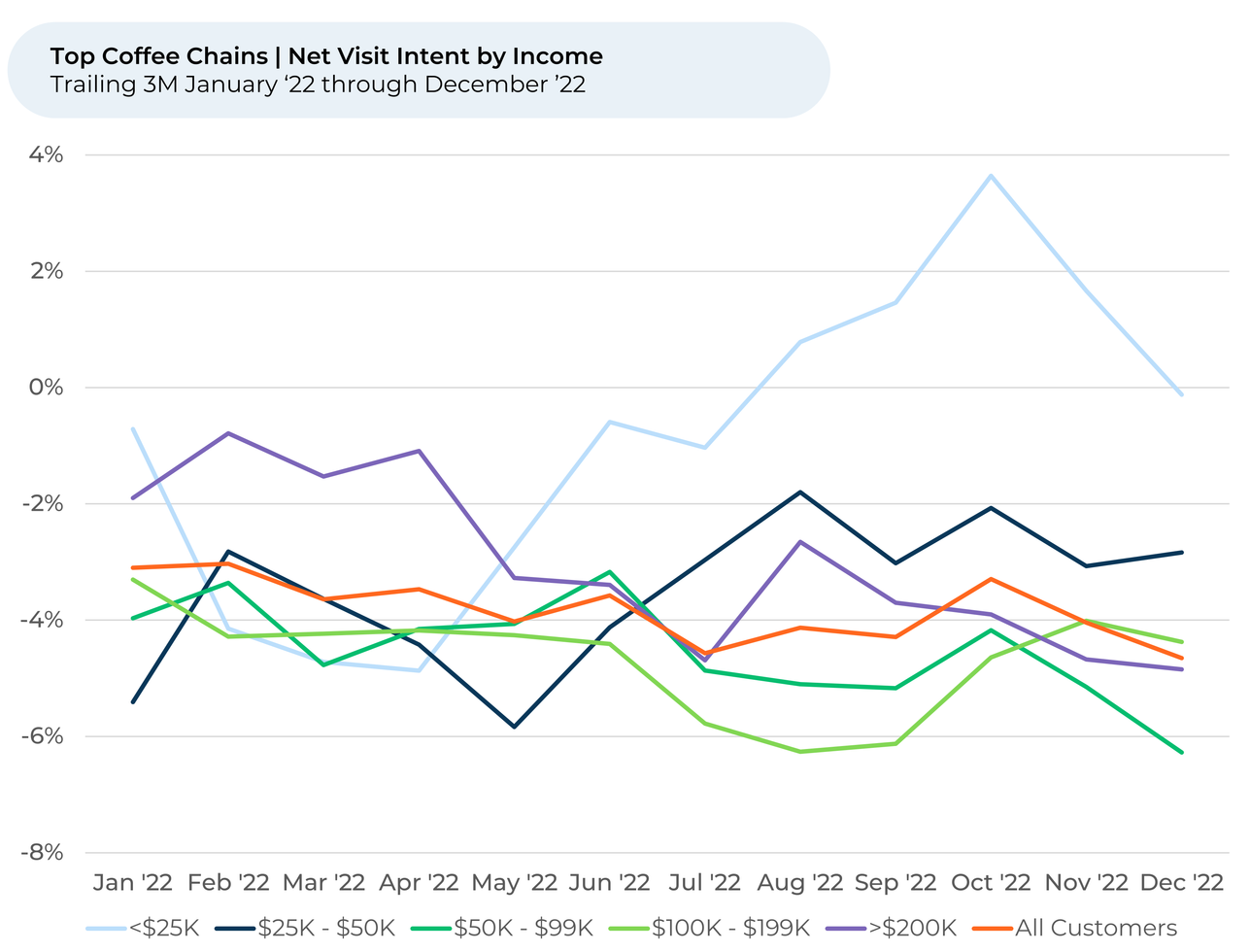

- Younger and lower income groups are positioned to drive coffee industry growth, but neither loved 4th quarter price increases.

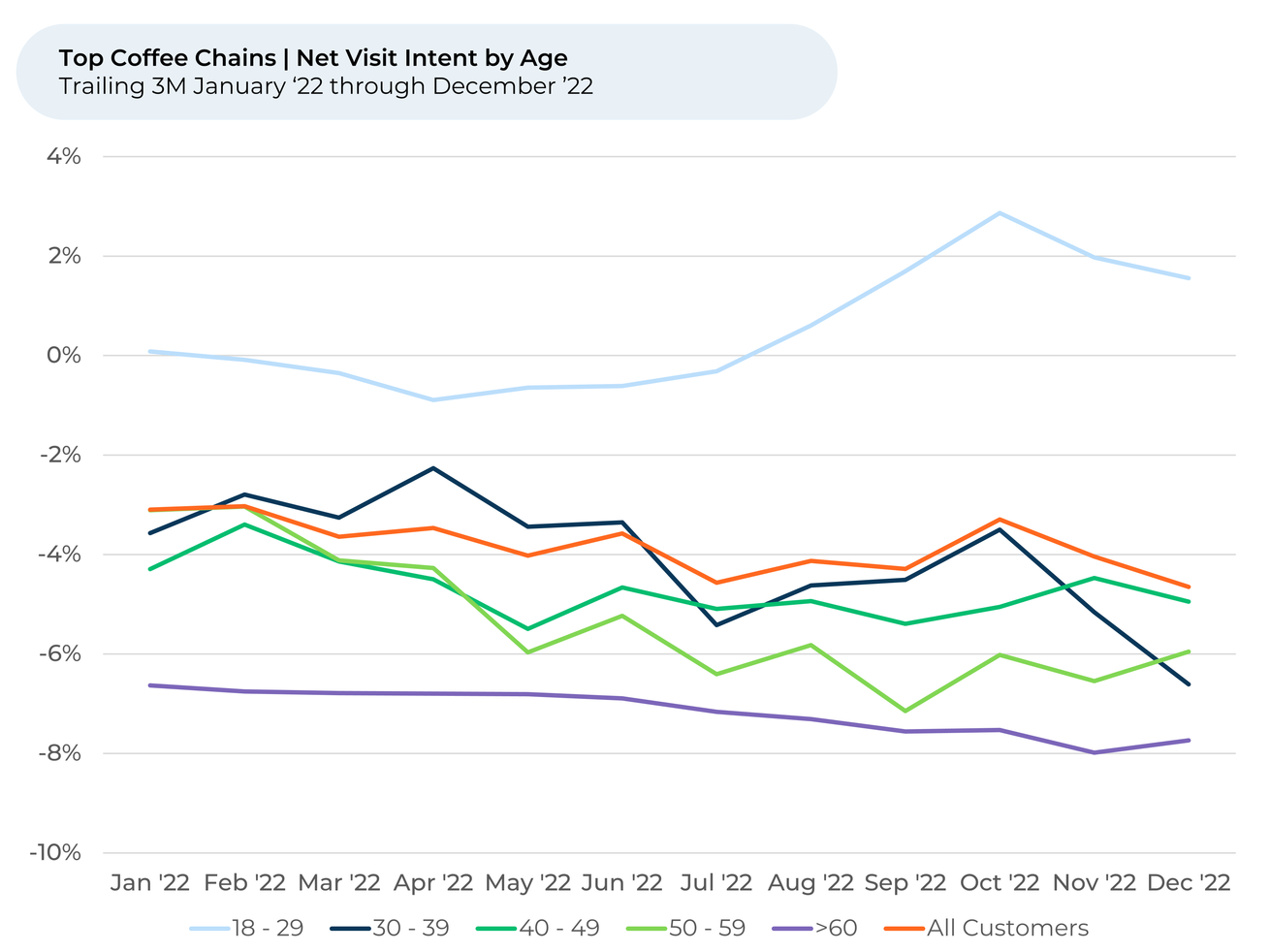

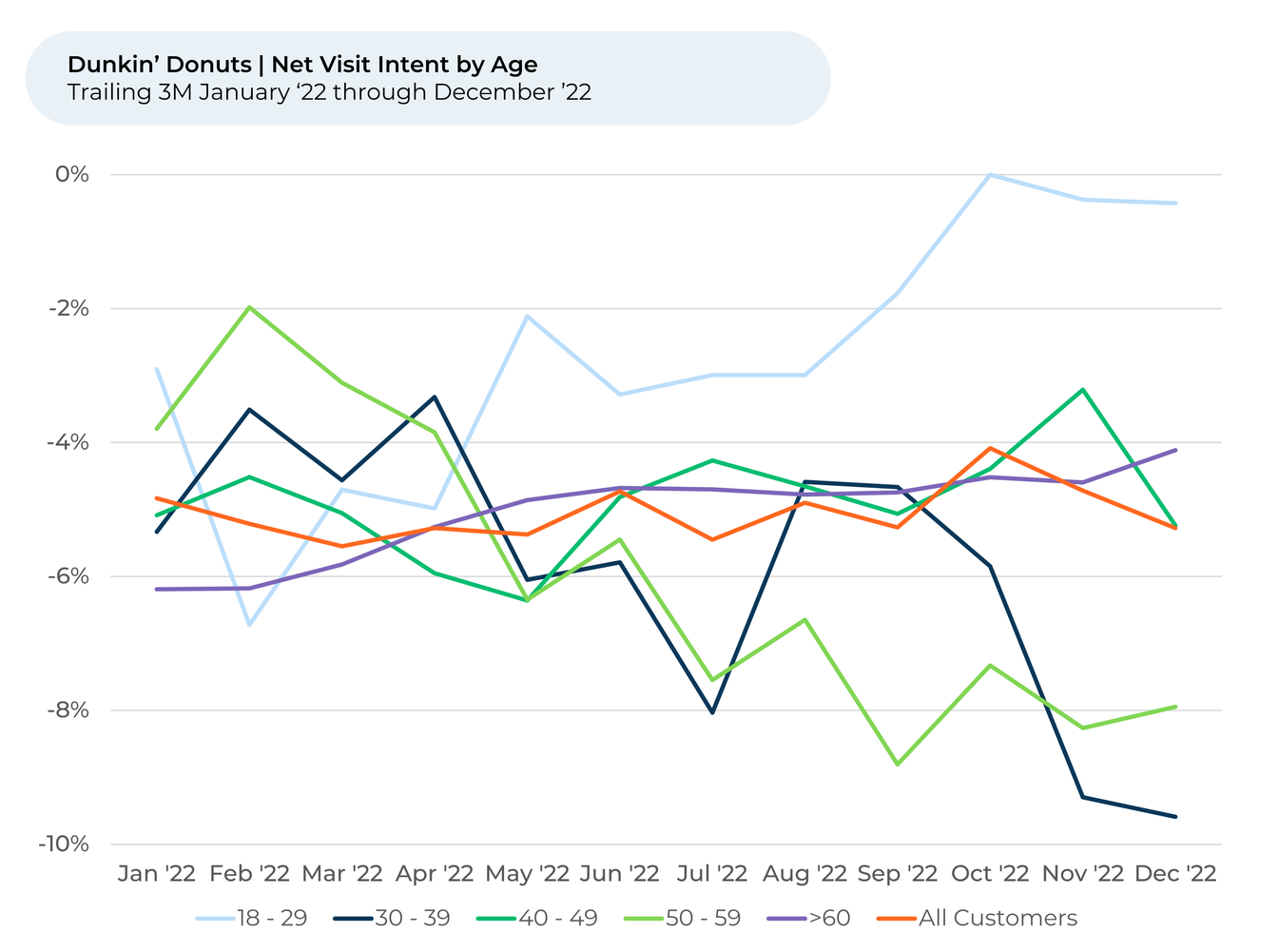

- Visit Intent for 18–29-year-olds is at 2% for December 2022, the only positive intent of the age groups we track.

- From the summer through December, customers felt progressively more negative about the prices and value delivered by their coffee chains.

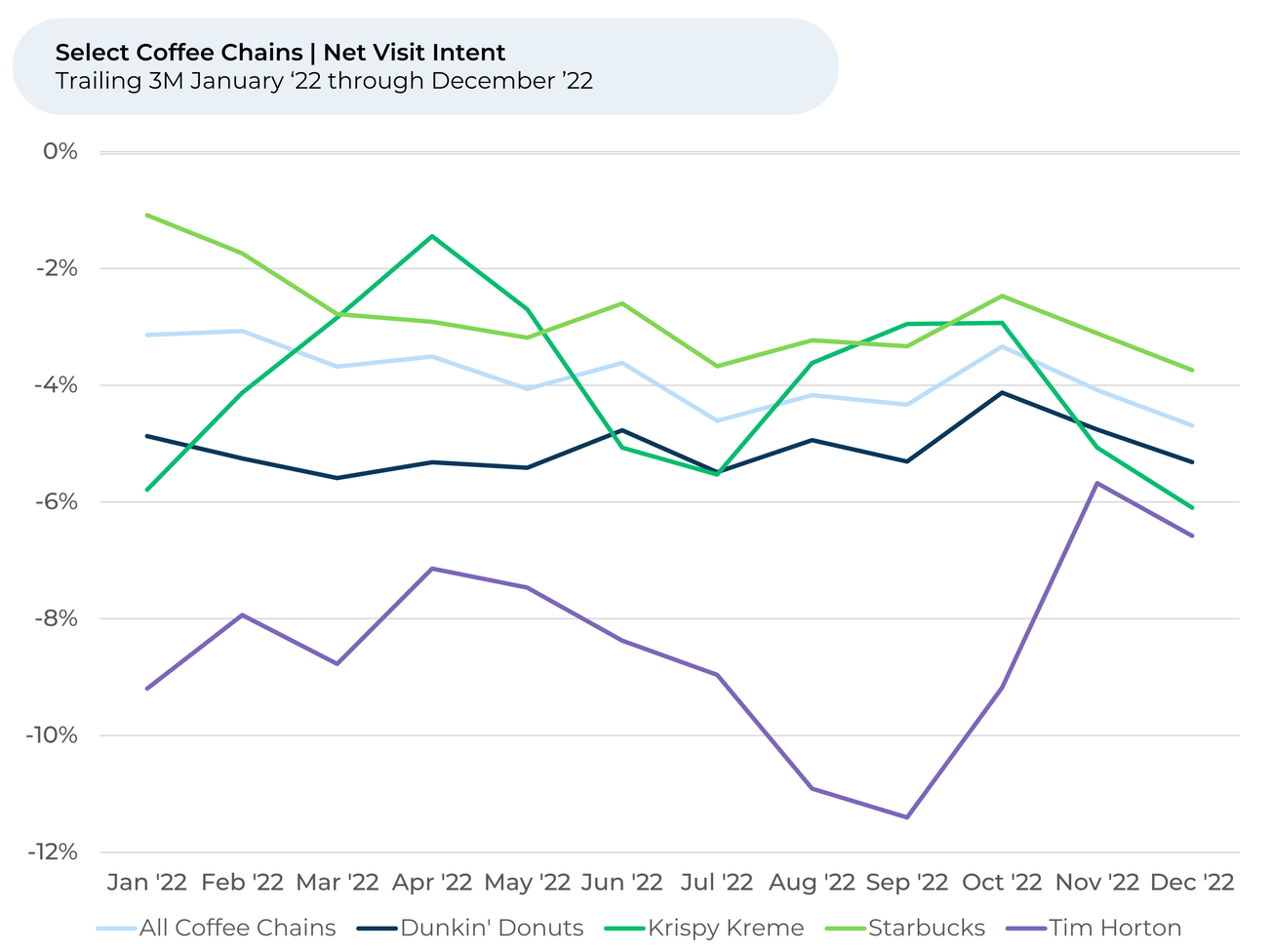

- 4th quarter price increases in response to cost increases have led to Visit Intent dropping the last three months, indicating margins may come under pressure. How customers respond to changes in rewards programs remains to be seen.

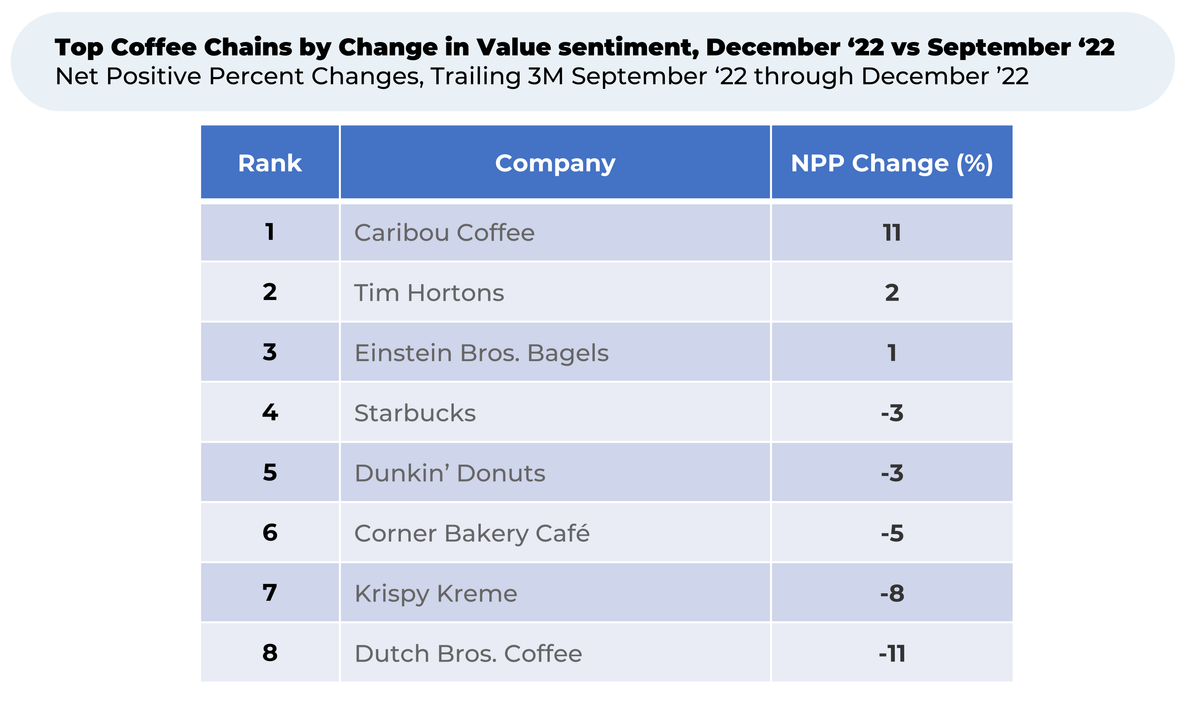

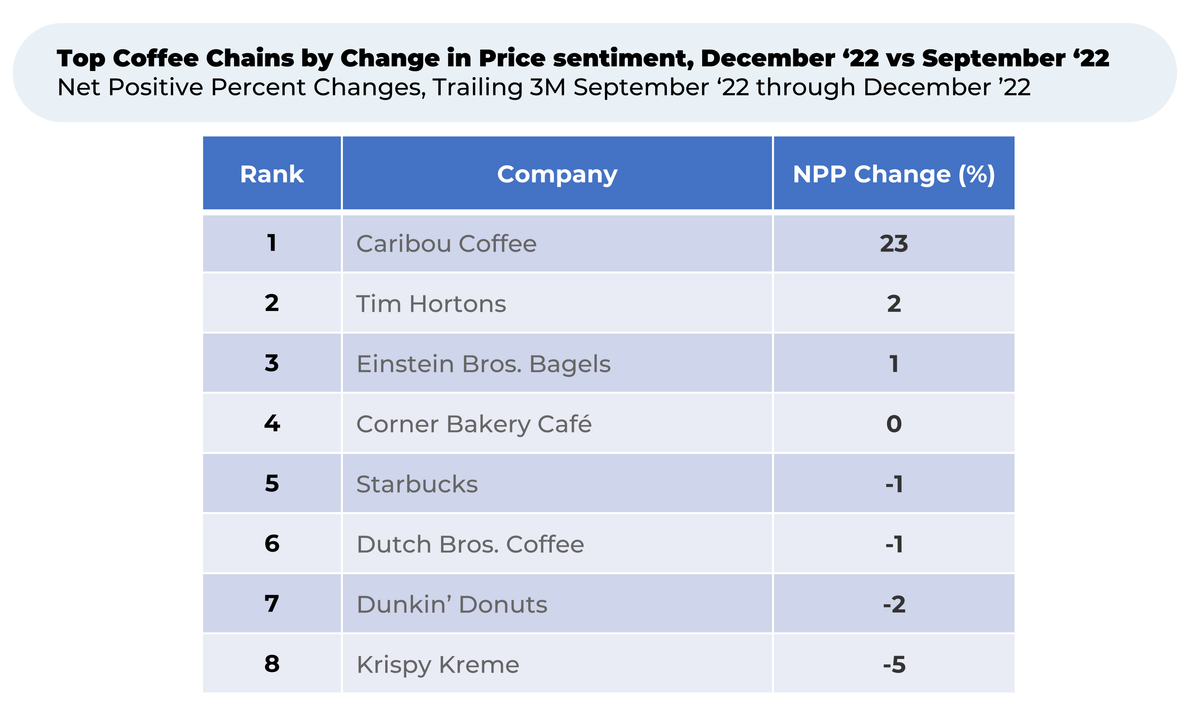

- Tim Horton and Caribou Coffee saw surges in customer sentiment towards price and value the last three months, reflecting credit for discount menus and reward programs.

Younger and lower-income groups positioned to drive coffee growth, but neither loved price increases

But, it’s not just the world’s largest coffee chain that appeals to young adults. Looking at feedback from “The Crowd” of customers of 15 of the largest U.S. coffee chains in the U.S., HundredX sees the demand growth outlook from 18-29-year-olds as more favorable than any other age group.

Visit Intent reflects the percentage of customers who plan to visit a specific coffee chain more during the next 12 months minus the percentage that intends to visit less.

We find Price is a top three reason why people say they like or dislike a coffee chain, behind Taste and Speed. We believe significant price increases during the 4

th

quarter at the major coffee chains is one of the top reasons purchase intent has been falling across all age groups since October. People drinking less iced coffee, a major source of revenue for some coffee chains, during the winter months also contributes to the decline. We find purchase intent fell recently for all groups of customers under 50 years old (greatest for 30-39), while it was actually up modestly for both 50-59 and 60+-year-old customers.

Customers turning more negative on industry price and value

Since June, coffee drinkers’ sentiment on Price fell 5% on average for major coffee brands. Their sentiment on Value fell 6% during that period.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

While we believe Value should be the factor most impacted by negative customer reactions to rewards changes, we see the potential for it to show up in sentiment towards App Ordering as well as overall Visit Intent. App ordering sentiment fell by 3% in the last two months for Dunkin’ Donuts while it was flat for Starbucks.

Over the past three months, we found customers’ sentiment on Value dropped 3% on average across the major coffee chains. While most chains saw decreases in Value sentiment, some coffee chains outperformed -- in particular, Caribou Coffee increased 10% and Tim Hortons increased 2%.

That’s all to say that coffee chains might not have the pricing power they think as they make changes to their rewards programs and menus. Food prices increased significantly across the board last year due to inflation. Breakfast-type foods were hit particularly hard. The U.S. Department of Agriculture says the prices of eggs increased 32%, cereals and bakery products increased 13% and dairy products increased 12%.

“Tim Horton's is very tasty and very reasonable,” someone told HundredX.

Caribou Coffee, based in Minnesota, refreshed its rewards program in September. The company didn’t increase the number of points needed to earn a free coffee – instead, it released a new mobile app and now allows loyalty members to earn points online. Members can use points for more items, including discounts on online orders. Customers seemingly like the value it provides.

The Dunkin’ Difference

“Glad they offer Senior Discounts,” one person told HundredX of Dunkin’ Donuts.

Another person over 60 years old said, “Dunkin' Donuts often offers good coffee/donut deals. Their coffee is always hot.”

What will coffee drinkers do in 2023? Time will tell. And so will HundredX. We will continue monitoring the coffee space to which brands best manage changes to prices, reward programs, apps and more to outperform.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article