Sector Snapshot: Health + Fitness

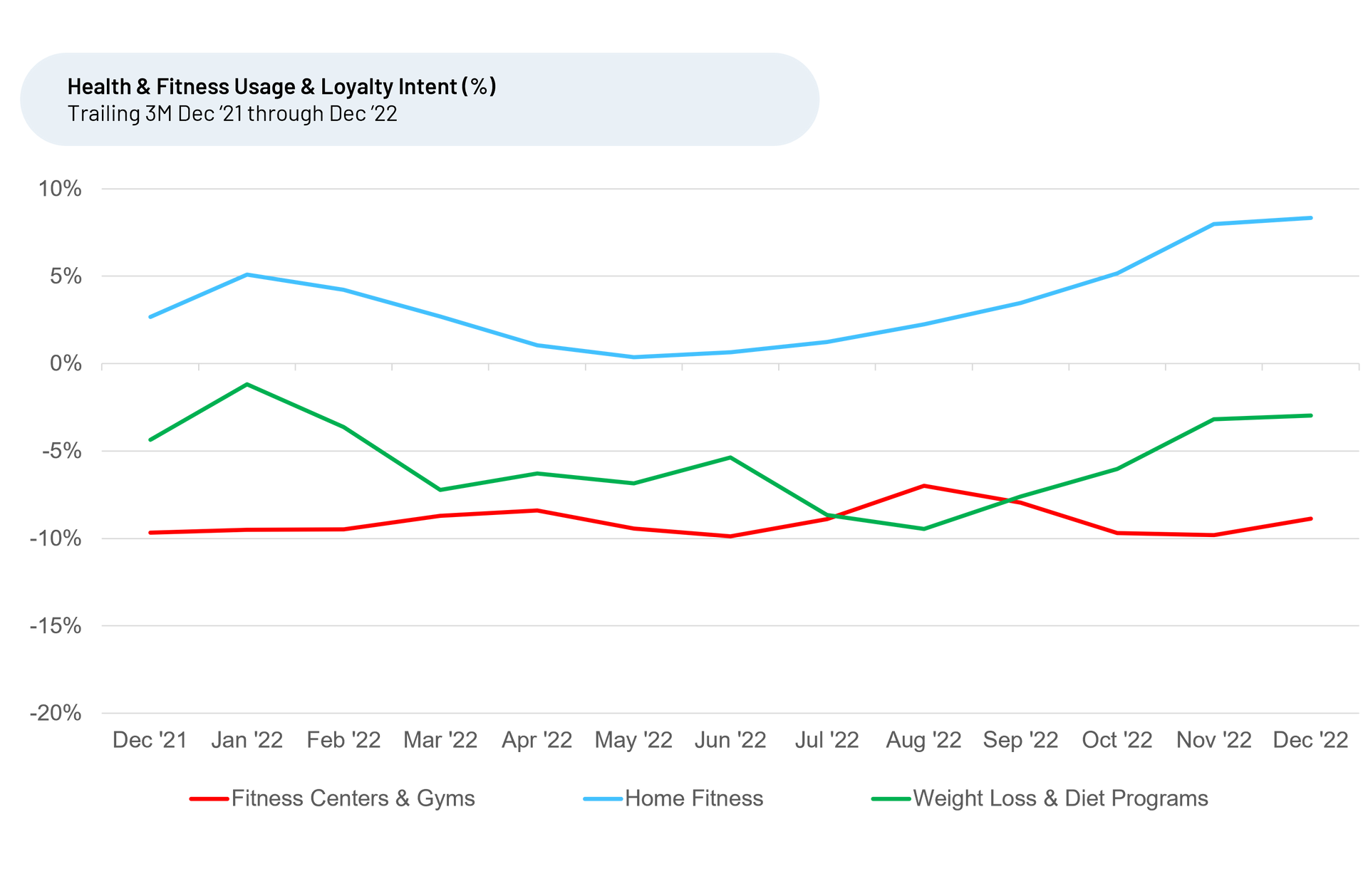

- Positive demand trends continue for Home Fitness.

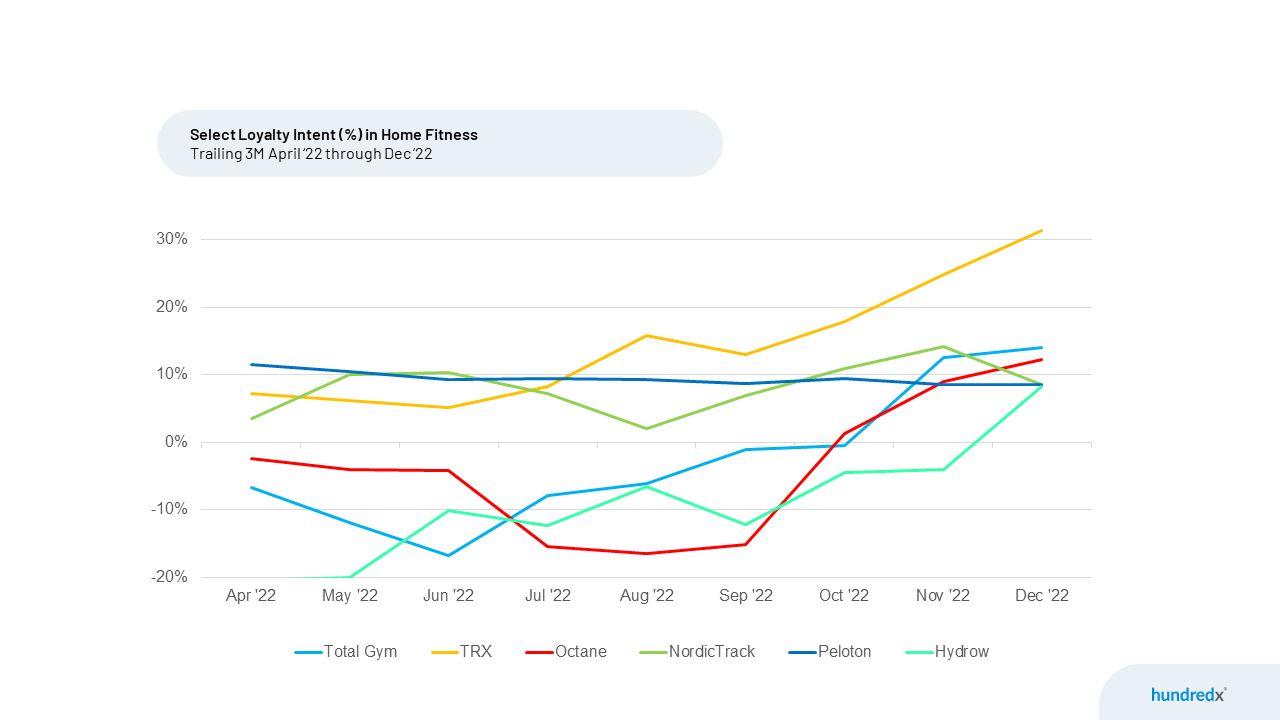

- The loyalty winners in Home Fitness include TRX, Total Gym and iFit. NordicTrack is the best positioned of the largest brands. They all do a great job of satisfying customers with their Equipment, Quality, Design, and Technology.

- NordicTrack sentiment on value and price surged the last few months, while Peloton's loyalty remained stable.

- Fitness Centers & Gyms continued to experience lower usage intent, remaining negative but stable after a steep decline in the summer of 2021.

- Weight Loss & Diet Plans continued a steady rise, beginning August 2022.

Leveraging HundredX’s proprietary listening methodology, we evaluate more than 90,000 pieces of feedback from real customer experiences across the country. We use that data to analyze insights into customers’ future Loyalty Intent¹ for the Fitness sector, focusing on Home Fitness brands, and which companies look to benefit most.

Overall loyalty intent for Home Fitness increased to 8% in December 2022, rising from a low of 0% in May 2022. The Crowd is telling us that demand growth for Home Fitness products may continue outpacing other fitness areas in the future.

Top overall Home Fitness Loyalty leaders

With price cuts and membership changes introduced in May of 2022, Peloton's Loyalty Intent remained stable throughout the year. NordicTrack has shown improved loyalty since August 2022, with customer sentiment towards value and price surging the last two months.

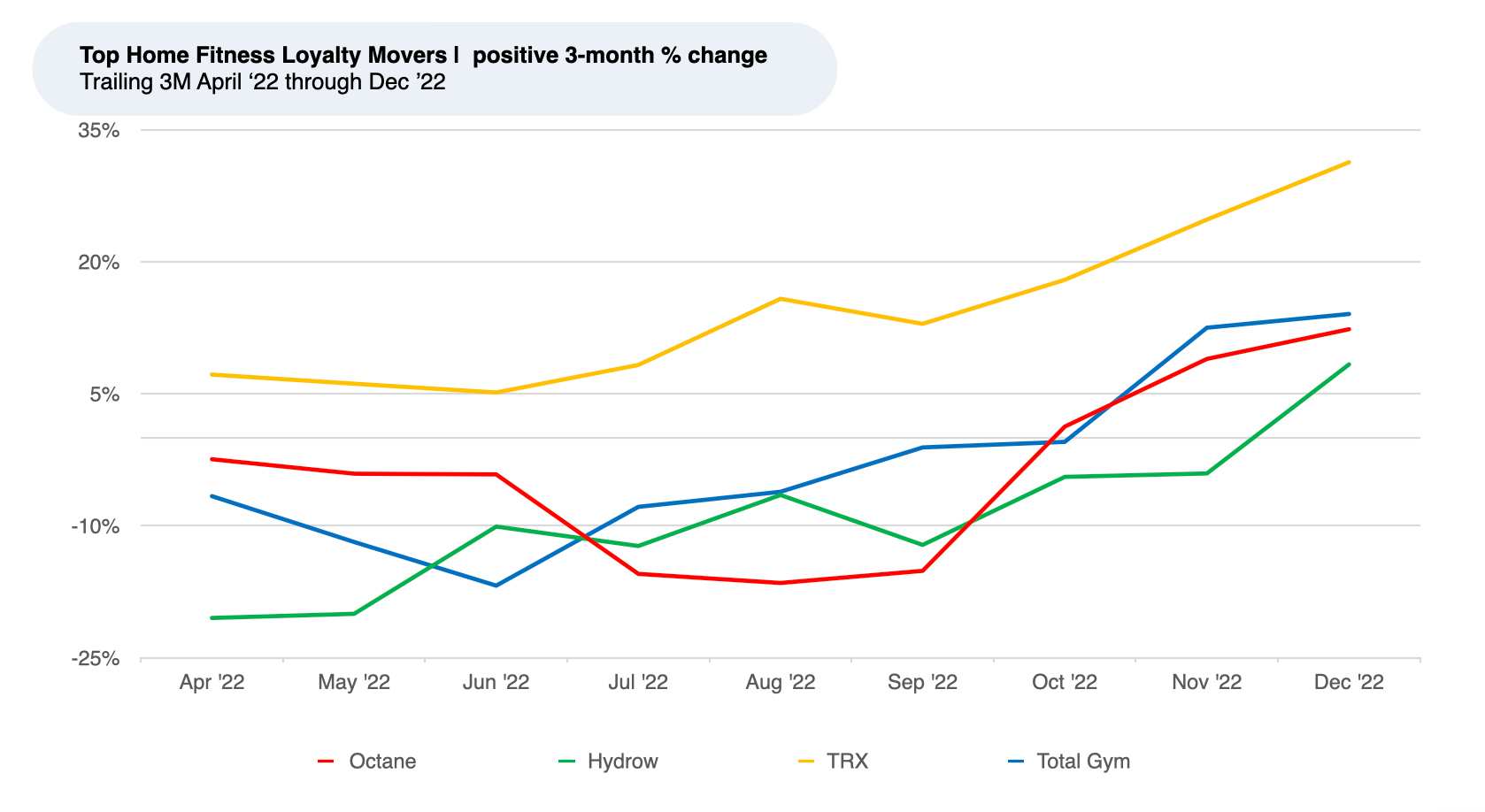

Largest Home Fitness Loyalty movers

Top Loyalty movers highlights

Octane Fitness, which makes higher-end, professional-grade home equipment, had loyalty intent improve from -15% in September 2022 to +12% to December 2022. Octane specializes in elliptical machines and their zero-gravity runners. The Crowd’s sentiment became much more positive on Octane’s Equipment, Quality, Instructions, and Purchase Options.

Customer Satisfaction

While The Crowd tells us that the overall outlook for usage intent will most likely continue its mixed trend, select Home Fitness brands making strides in the areas customers care about the most are poised to gain market share relative to the broader sector. We continue to monitor trends to see what changes emerge in 2023.

All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a mission-based data and insights provider . HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact .

Share This Article