Social Media

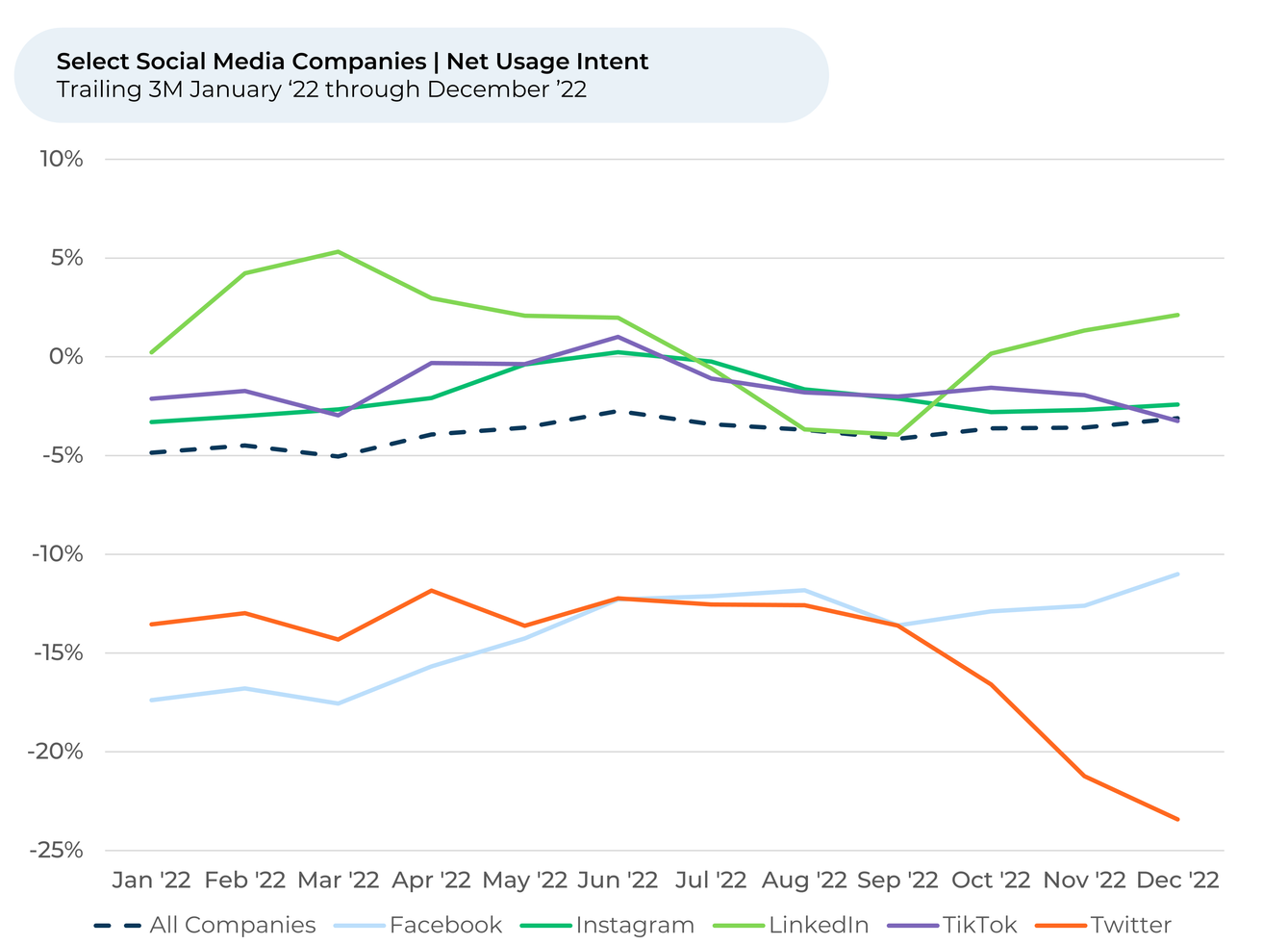

Social media usage reached new heights in recent years, as people looked online to communicate during the stay-at-home phases of the Covid-19 pandemic. From TikTok challenges and Instagram Stories to Twitter debates and Facebook groups, social media has become a central hub for how people interact with each other. HundredX looked at more than 80,000 pieces of feedback from “The Crowd” of real social media users on 23 brands in 2022 to understand where they intend to spend their time online. We find:

- Facebook Usage Intent1 rose more than the industry over both the last year and last three months, with social media overall essentially flat. Facebook still lags peers but appears positioned to see better relative growth over the next year.

- Meanwhile, LinkedIn Usage Intent rose significantly over the past three months to become the only major platform with positive usage intent (+2%).

- While lowest among social media peers, sentiment towards Privacy for Facebook increased the most during 2022 – reflecting credit for changes to its privacy policies mid-year.

Facebook continues its improved usage intent, driven by middle-aged customers

During 2022, Usage Intent for social media and search companies was up only 2% from January to December. Over the same time period, Facebook Usage Intent, while still negative and lower than the peer group, rose the most of the largest brands we track (+6%).

Usage Intent reflects the percentage of customers who plan to use a specific brand more during the next 12 months minus the percentage that intends to use less. We find businesses that see Usage Intent trends gain versus the industry have often seen growth rates for domestic users and engagement also improve versus peers.

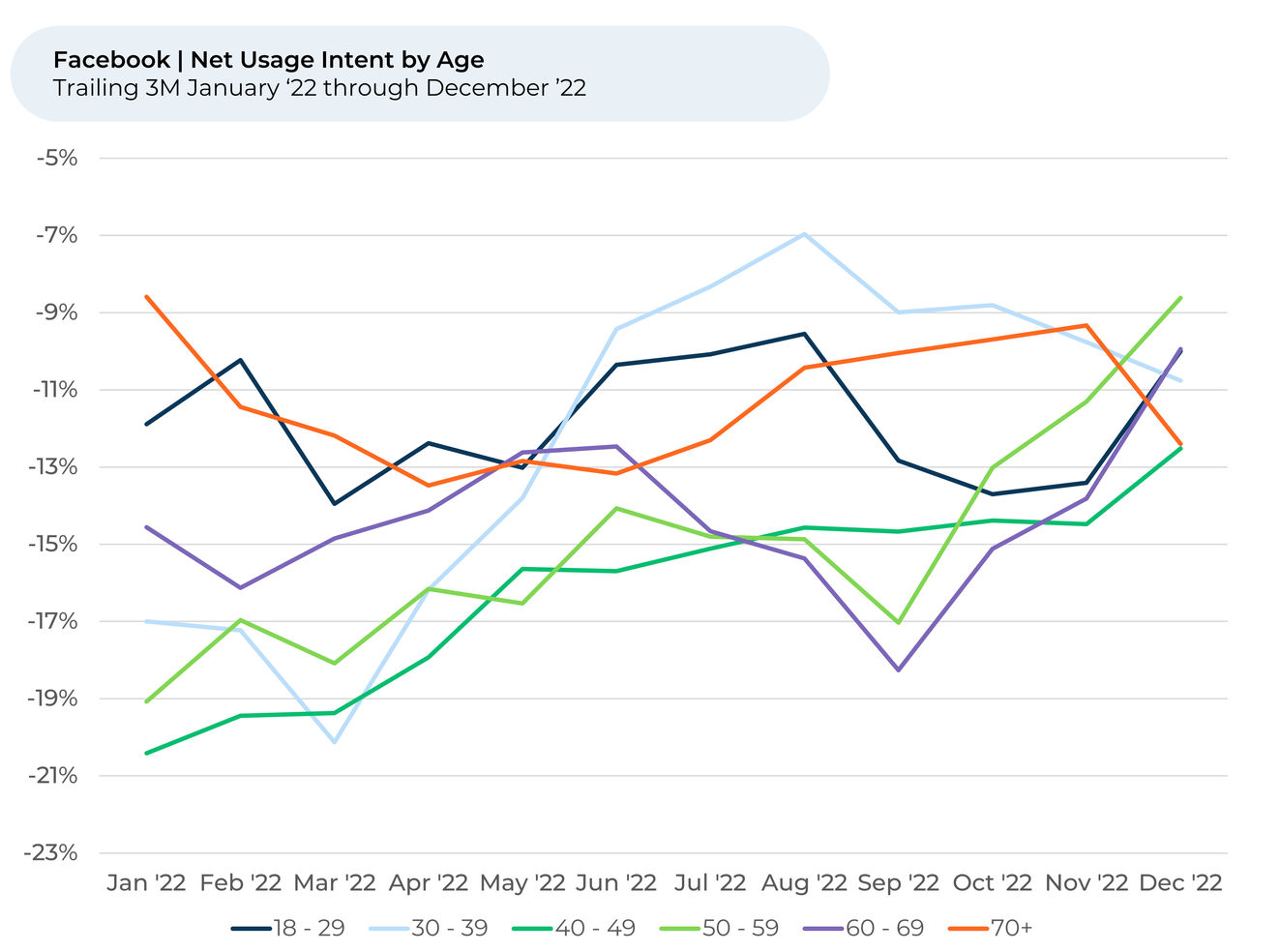

The increase in Facebook Usage Intent has been particularly strong in the last three months, with the greatest increase for people aged 50-59 and 60-69 (both +8%).

“(Facebook) keeps me in contact with my family, so it is a very valuable app for me,” one person between 50 and 59 told HundredX.

The only age group to see a decline in the last three months was 30-39-year-olds. This group is still up meaningfully since January 2022.

While Facebook navigated several controversies this year, this improvement indicates it is getting some credit from investments in its customer experience with initiatives including improving automated hate speech detection, simplifying searches for groups, and introducing new tools for creators to build businesses.

Facebook has also seen users’ sentiment toward Privacy rise by 8% in 2022. Sentiment remains lowest for Facebook compared to its social media peers, but its increase last year was the largest for the group. Meta revamped Facebook’s privacy policy in May to make it easier for users to understand. The new privacy policy includes visuals, examples, and shorter sentences to help users see how Meta users their data.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

Facebook isn’t the only Meta brand that’s made significant Usage Intent gains in the last three months. Virtual reality brand Oculus’ Usage Intent increased by 6% over the past three months. As we noted in our Electronics sector update following the holiday season, the move seems to indicate that Meta’s investments in the metaverse are seeing some pay off, at least where Oculus is concerned.

LinkedIn riding a recent pickup in layoffs?

LinkedIn Usage Intent rose by 6% over the past three months to become the only major platform with positive usage intent (+2%) as of December 2022. While LinkedIn has made several improvements to its job search functionality and accessibility in the last few months, the increase appears most likely to be related to recent layoffs by large companies.

Layoffs.fyi, which tracks layoffs throughout the year, saw a several-month low in September. Layoffs pickup up in October, impacting more than 17,000 people. In November, more than 52,000 people were affected. LinkedIn has also noted more people passively looking for jobs that better fit their values and preferences.

What will social media users think of their favorite platform a few months from now? HundredX will continue monitoring social media trends throughout 2023. By analyzing the thousands of feedback we collect, we can better predict which people will interact with social media and why.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article