Lululemon: Increased focus on Menswear

Capturing Market Share in Menswear

For a brand like LULU that was built on addressing the needs of female consumers, there are two key questions to answer:

- Do LULU’s products meet the needs of male consumers?

- Will LULU be able to convince male consumers to buy their products when the association in many consumers’ minds is that LULU is a brand that makes products for female consumers?

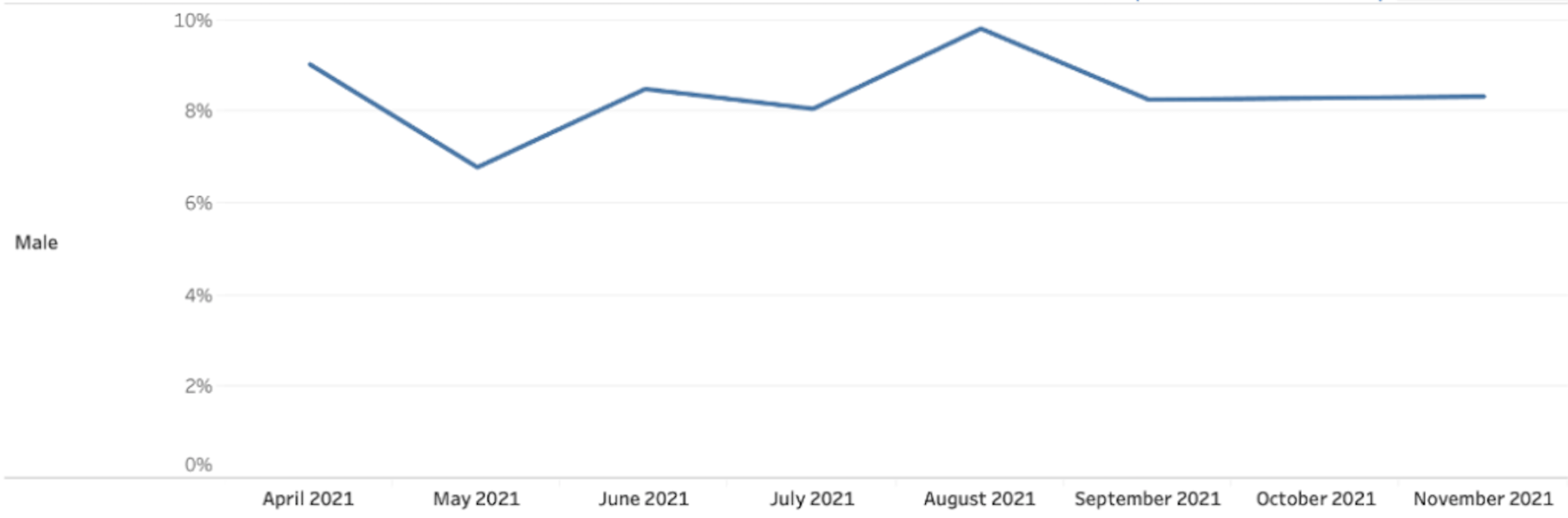

Does LULU have products that men love and want to buy?

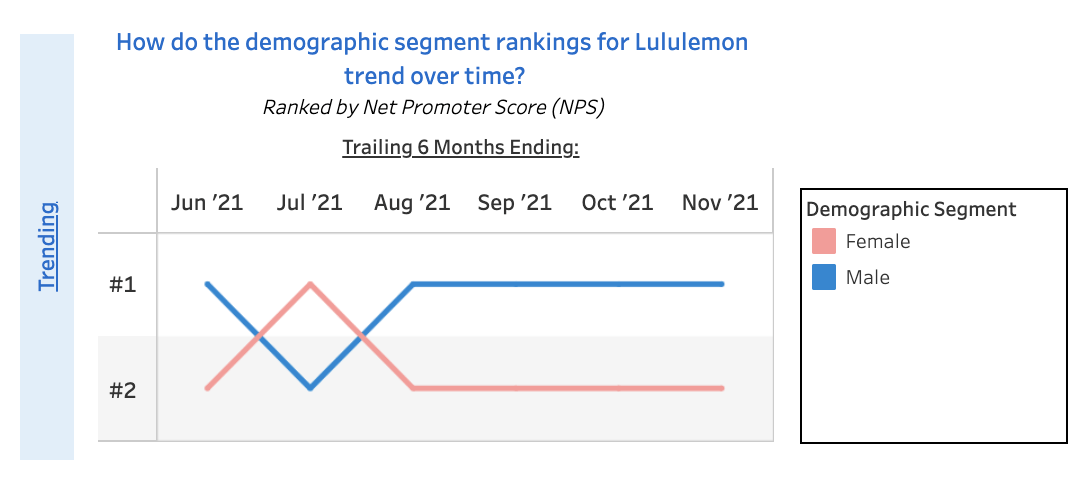

HundredX Demographic Segment Rankings (Gender) - Trailing 6 Months Trend

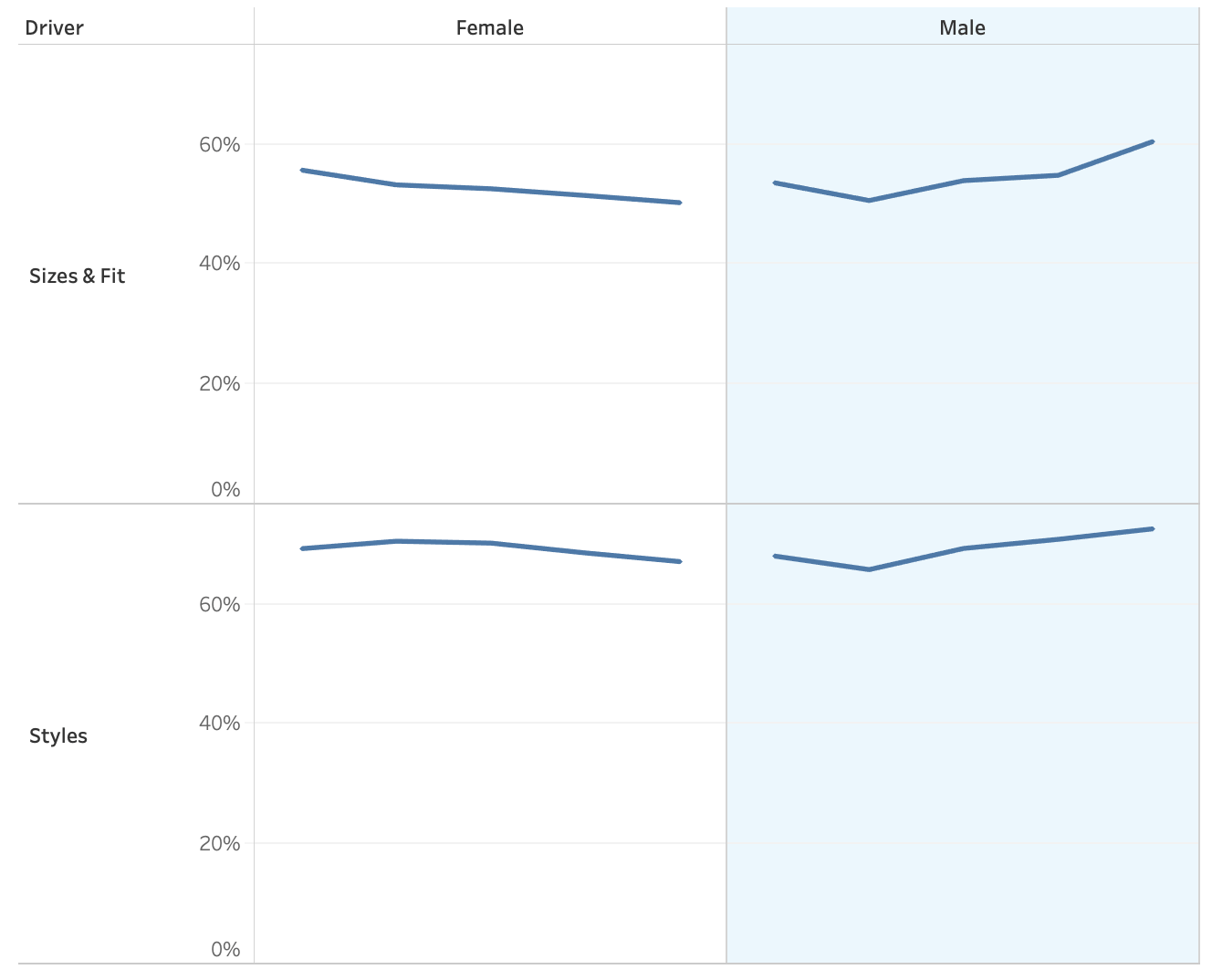

HundredX Driver Trends by Gender - Trailing 3 Months Trend

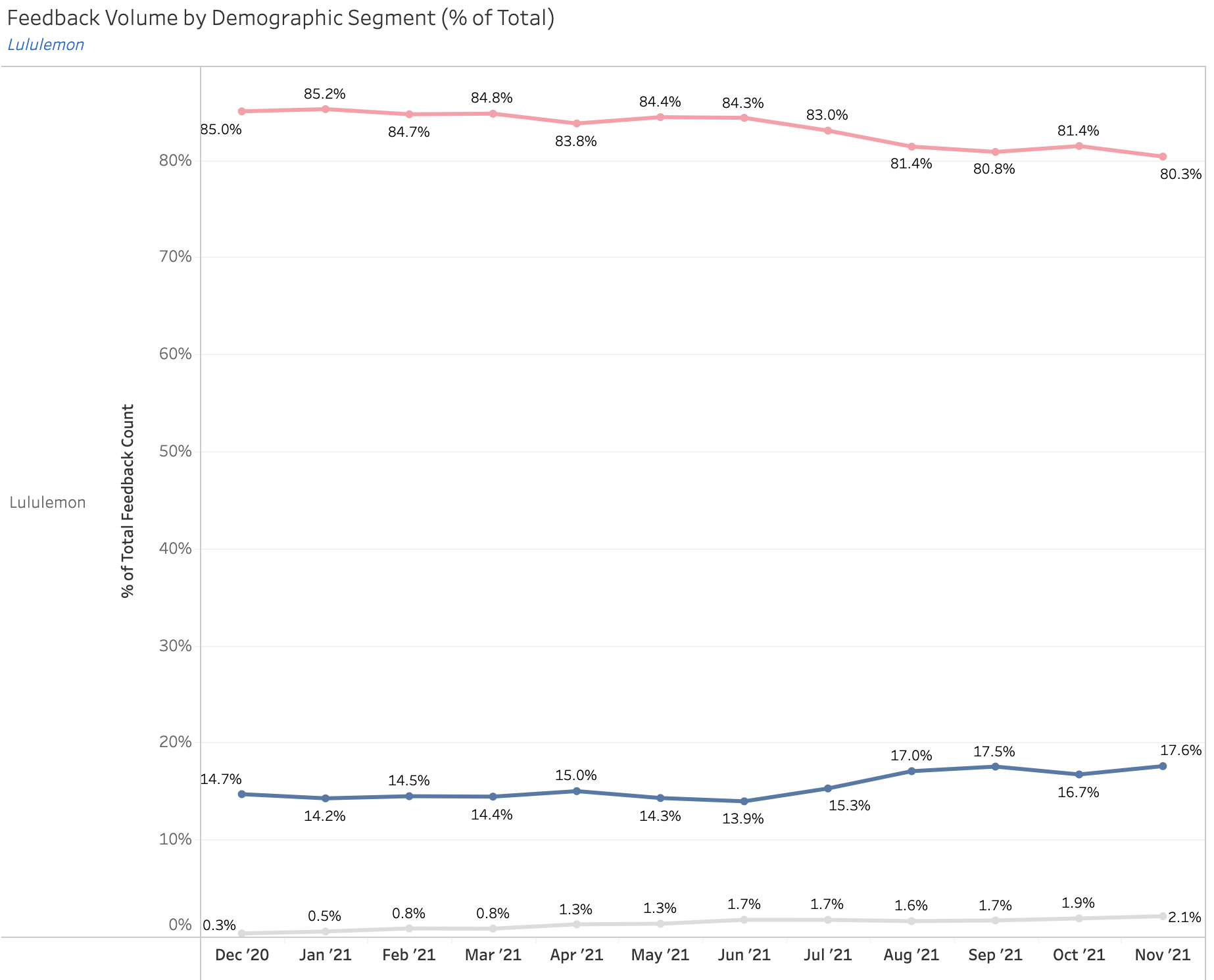

Will LULU continue to convince more and more male consumers to buy its clothing?

HundredX Feedback Volume by Gender for LULU, Trailing 6 Month Trend

*Selection of LULU management references to growth goals in male consumer segment:

- CNBC article from April 2019 discussing Lululemon’s goals with male consumers: Lululemon CEO: 'We have very low brand awareness with men,' but that business will double by 2023

- Lululemon Athletica Inc. (LULU “Power of Three” Strategic Plan - Apr 2019

- Lululemon Athletica Inc. (LULU) Q3 2021 Earnings Call Transcript

This analysis is based on HundredX's proprietary data, developed from consumer feedback collected through the HundredX Causes Program . Nothing in the HundredX data constitutes professional or investment advice on the part of HundredX.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

Share This Article