Luxury Fashion

Gen Z and nostalgia puts luxury fashion in a position to grow

Louis Vuitton recently hired musician Pharrell Williams as creative director for men’s clothes, a move seemingly meant to reinvigorate its men’s wear and to increase interest from young shoppers. Luxury brands, and Louis Vuitton in particular, have seen an explosion of interest from Gen Z and Millennial customers in recent years who have seen their favorite celebrities frequently sport outfits from well-known, and expensive, fashion brands.

As luxury brands increasingly gain young followers on popular social media platforms like TikTok and Instagram, HundredX examines if young shoppers are positioned to drive the most growth for them, and why. By looking at more than 18,000 pieces of feedback from “The Crowd,” January 2022 through January 2023, including 20 luxury brands, we find:

- Purchase Intent¹ for Luxury Goods dropped in 2H 2022, aligned with slowing growth rates from 2H 2021 peaks observed for most of the largest luxury brands.

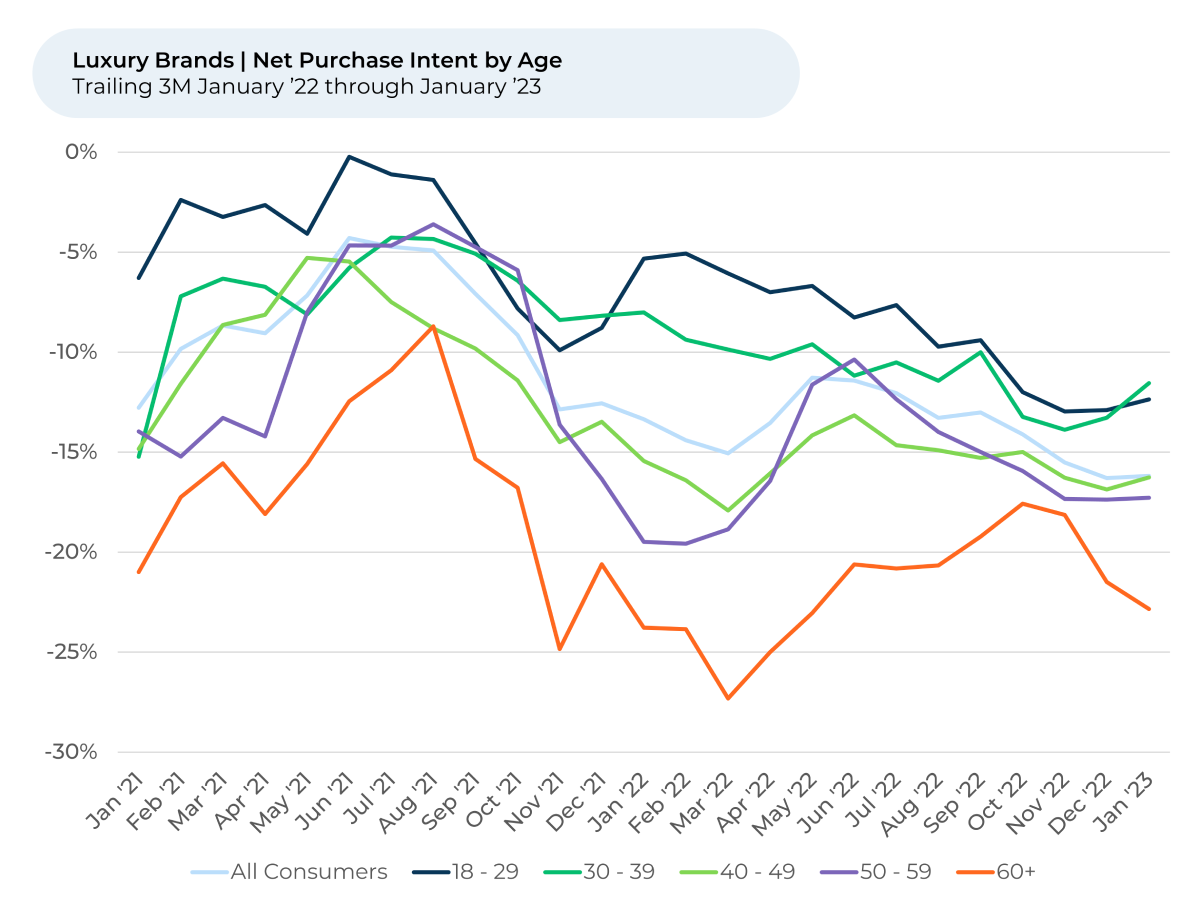

- Purchase Intent is strongest among 30-39-year-olds for the Luxury Goods group overall, closely followed by 18-29. For Louis Vuitton, Purchase Intent is strongest among 18-29-year-olds.

- Dolce & Gabbana’s Purchase Intent rose the most in the last three months, supported by a surge in sentiment towards Quality and Price. The brand appears to be getting credit for its recent partnership with Kim Kardashian and the Nostalgia movement popular with younger audiences.

We are seeing interest in luxury goods for younger demographics outpacing older ones. Purchase Intent is strongest among people aged 30-39, with people aged 18-29 a close second, indicating the youngest age groups appear to be positioned to have the fastest growth for the average Luxury Brand. In its 2022 Luxury Resale Report , TheRealReal, an online marketplace for reselling luxury goods, noted Gen Z visited TheRealReal 35% more in 2022 than it did in 2021, the largest increase of any age demographic. Millennials, meanwhile, represent the largest volume of buyers and sellers on the platform.

Purchase Intent reflects the percentage of customers who plan to buy more of a specific brand in the next 12 months minus the percentage that plan to buy less. We tend to focus most on the sequential trend for Purchase Intent and the relative spread between businesses or demographic groups when interpreting. We find that Purchase Intent for a business, industry or group improving (or weakening) versus others has been an indicator of an increase (or decrease) in future market share for that business, industry or group.

For Louis Vuitton, Purchase Intent is by far strongest for people between 18-29-years-old, recently jumping from -26% in October 2022 to -8% in January 2023, seemingly reflecting credit for its efforts to target the group. It is the only age group that had Purchase Intent improve in the last three months. Louis Vuitton has 7.7 million followers on TikTok and more than 47 million likes, far more than many of its rivals. The brand released an ad campaign with soccer stars Cristiano Ronaldo and Lionel Messi in November 2022 that went viral, quickly bringing in millions of views .

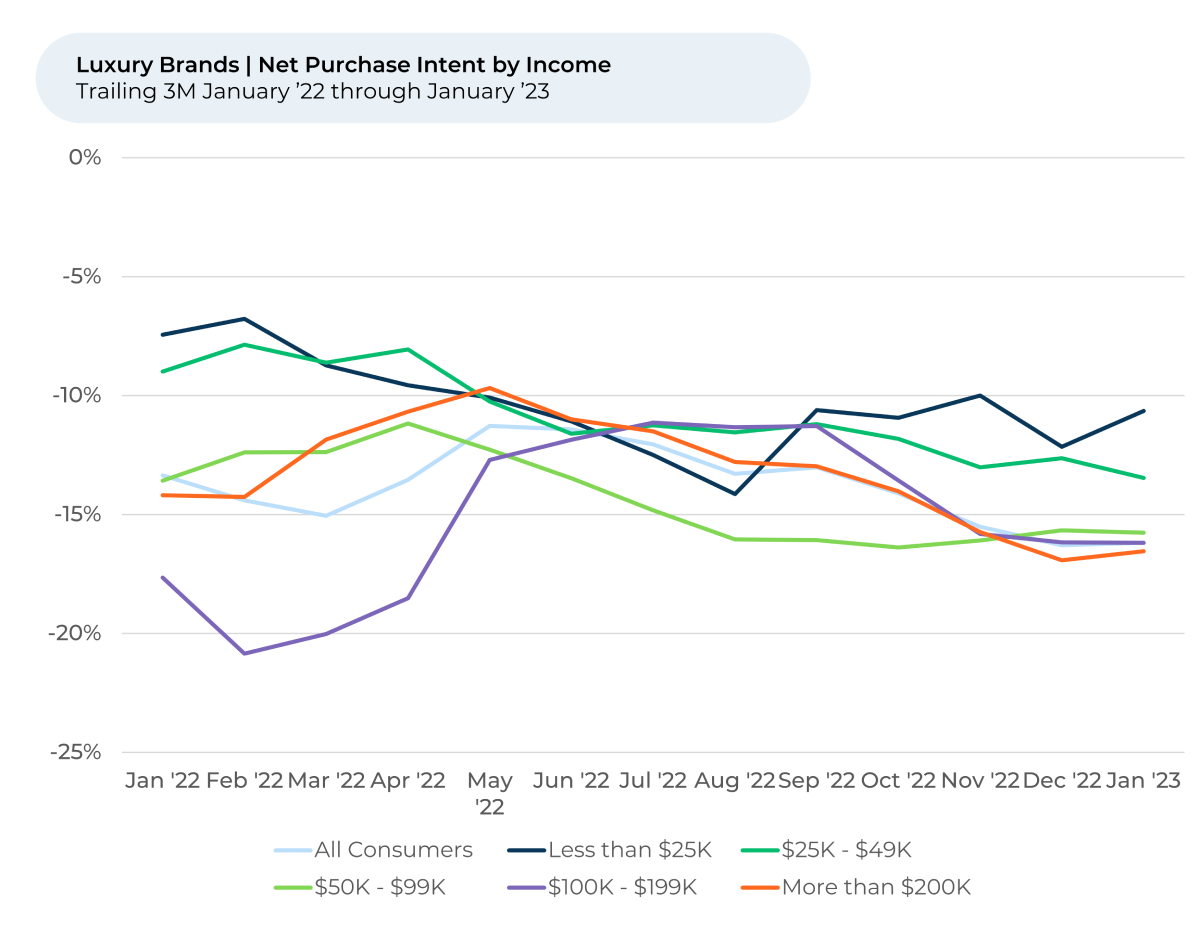

The lowest household incomes also have the strongest Purchase Intent for the average Luxury Brand. We believe this is probably because of some correlation between age and income. While younger and lower income people are showing the strongest purchase intent, we note that 40% to 50% of covered luxury brands’ feedback still comes from the core middle-aged (40-60 years old) consumer.

So, why are more young, lower-income people saying they plan to buy more luxury brands than older consumers? U.S. Census data indicates that more than half of U.S. 18-24-year-olds live at home with their parents. While this group makes the least, their disposable income is around $360 billion, according to research firm Gen Z Planet. Consulting giant McKinsey & Company has found that Gen Z is willing to spend on luxury goods, even if that means saving money for a while to afford them.

“I saved 3 years and worked to save for my [Louis Vuitton] bag, I want more but don't see how right now. Everyone loves it and compliments me, worth the investment,” one person 18-29 years old told HundredX.

Louis Vuitton, by bringing in musical artist Pharrell Williams as its new men’s creative director, seems to be further appealing to younger shoppers perhaps feeling nostalgic for their childhood days. Among his numerous hits, Williams is behind “Happy”, the mega-hit song from

Despicable Me 2

.

Dolce & Gabbana purchase intent up the most recently

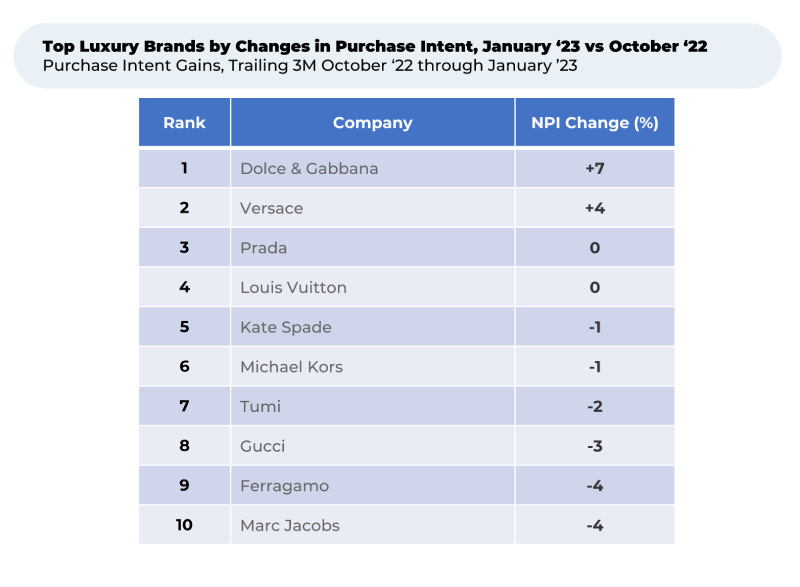

While Purchase Intent has dipped by 2% over the past three months for the overall Luxury Goods industry, a few brands outperformed.

Purchase Intent for Italian luxury brand Dolce & Gabbana rose 7% from October 2022 through January 2023. The brand rose significantly in customer sentiment towards Quality, Price, Presentation and Convenience during that time, each up 8%-11%. We find Quality and Price are the top two reasons why customers say they like or dislike a Luxury Goods brand.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

Like Louis Vuitton, Dolce & Gabbana recently sought help from a celebrity popular with younger shoppers, this time Kim Kardashian. During Milan Fashion Week in September 2022, Dolce & Gabbana announced that Kardashian curated its Spring 2023 collection. The collection looks to the past and draws on nostalgia: Kardashian chose her favorite 90s and Y2K Dolce & Gabbana pieces, which designers updated for the collection.

Ensuing media coverage praised the collaboration, and the brand’s advertisements about the partnership reached hundreds of thousands of views on its official TikTok channel – far more than most of its other content.

Versace, the only other Purchase Intent gainer the last three months (+4%), also drew on nostalgia for its Spring 2023 collection. Promoted by Paris Hilton, the line draws on the 90s and Y2K styles, styles increasingly promoted and reborn by Gen Z influencers. Jenna Ortega, star of Netflix’s Wednesday , has also been seen wearing Versace recently, including at the premiere of the Addams Family spin-off show in November 2022, which made her an overnight icon with Gen-Z. Subsequently, customer sentiment towards Price, Presentation and Online Experience all rose 12%-23%.

“[Versace has] great products and lots of styles to chose from,” one respondent recently told HundredX. A review of all recent comments shared with HundredX indicates the sunglasses and fragrances are particularly popular.

What does all this mean? Well, Gen Z indeed appears positioned to drive future growth for the most expensive fashion brands. Brands are taking advantage of this, capitalizing on 90s and Y2K revival trends and bringing celebrities popular with younger generations onboard as collaborators and employees. HundredX will continue to monitor how these trends show up in data and insights throughout 2023. With the winter Milan Fashion Week coming up, we’re sure we will have more to report on soon.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

- HundredX examined the following luxury brands: Burberry, Bvlgari, Canada Goose, Christian Dior, Dolce & Gabbana, Ferragamo, Gucci, Hermes, Hublot, Jimmy Choo, Kate Spade, Louis Vuitton, Marc Jacobs, Michael Kors, Montblanc, Persol, Prada, Stuart Weitzman, Tumi, Versace, and Yves Saint Laurent.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article