Getting the Max from merger of HBO and Discovery

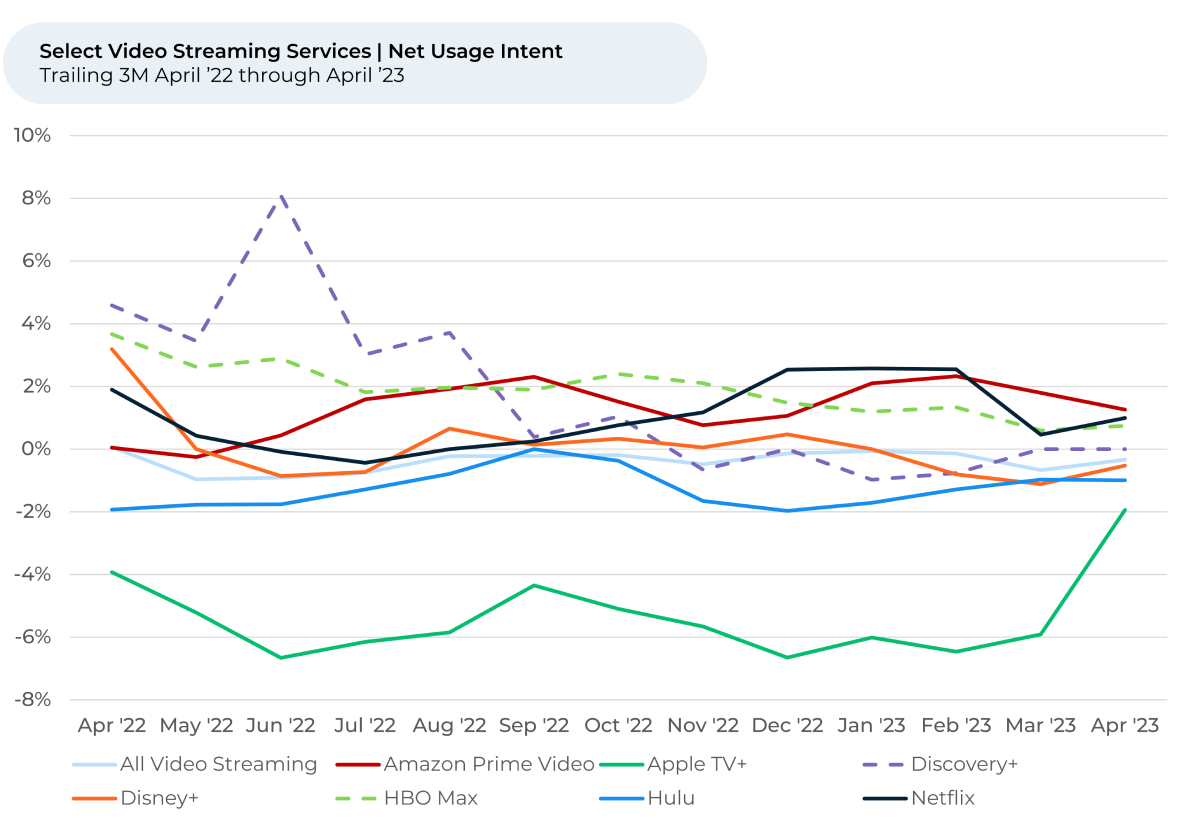

In our April video streaming update, we found that the industry’s Usage Intent¹,² dipped slightly, with Netflix contributing with a 3% drop from February to March. This decline followed the launch of its cheaper ad-supported tier and content budget cuts. Despite the Usage Intent dip, customers have shown increased satisfaction³ with Netflix's ease of use and navigation, likely due to app improvements.

This month we look to “The Crowd” of real customers to analyze more than 530,000 pieces of feedback across the entertainment sector and 100,000 pieces of feedback on 17 video streaming services to understand which streaming services are best positioned for growth. We particularly focus on the opportunities for the new Max streaming service to succeed and Apple TV+, which has become much more interesting to its customers lately.

Examining this feedback, we find:

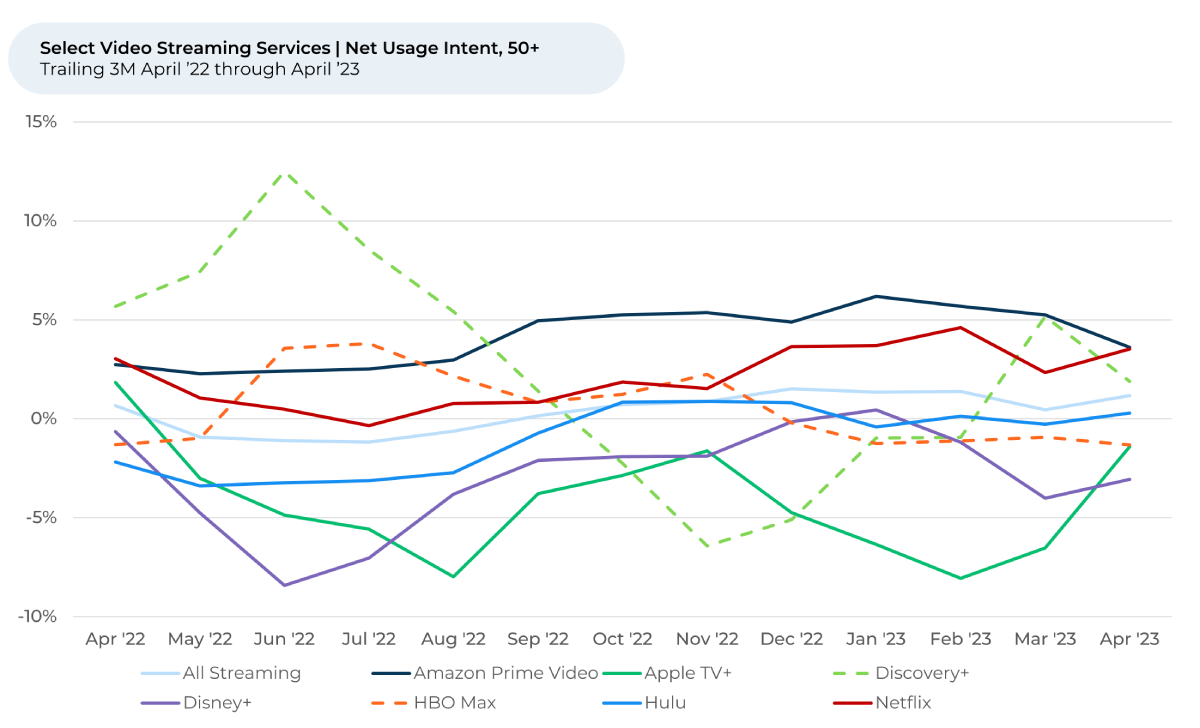

- HBO Max, Disney+, Amazon Prime Video and Netflix have all seen Usage Intent fall in the last three months. Only Apple TV+ and Discovery+ are up in the last three months. US subscriber growth for many has stalled, leading them to focus on pricing power and margins.

- We believe the recently launched Max platform’s success will hinge on Warner Bros. Discovery’s ability to rectify certain shortcomings of the standalone platforms, invest smartly in content and marketing, surface relevant content to its expanded user base and forge new partnerships.

- Max launches with a content volume advantage over key competitor Disney+. We believe it is smart for Max to continue investing in this advantage, as streaming customers are currently prioritizing content variety over price, creating an opportunity to capture price and margins.

- Max could benefit from advertising on Reddit, Tumblr, Pinterest and Nextdoor, platforms where feedback overlap with HBO Max and Discovery+ is well above normal.

- As more streaming services pursue sports content deals, Max may want to consider one with the NHL (currently partnered with ESPN+). Both HBO Max and Discovery+ subscribers leave 3x more feedback on the NHL than the average respondent.

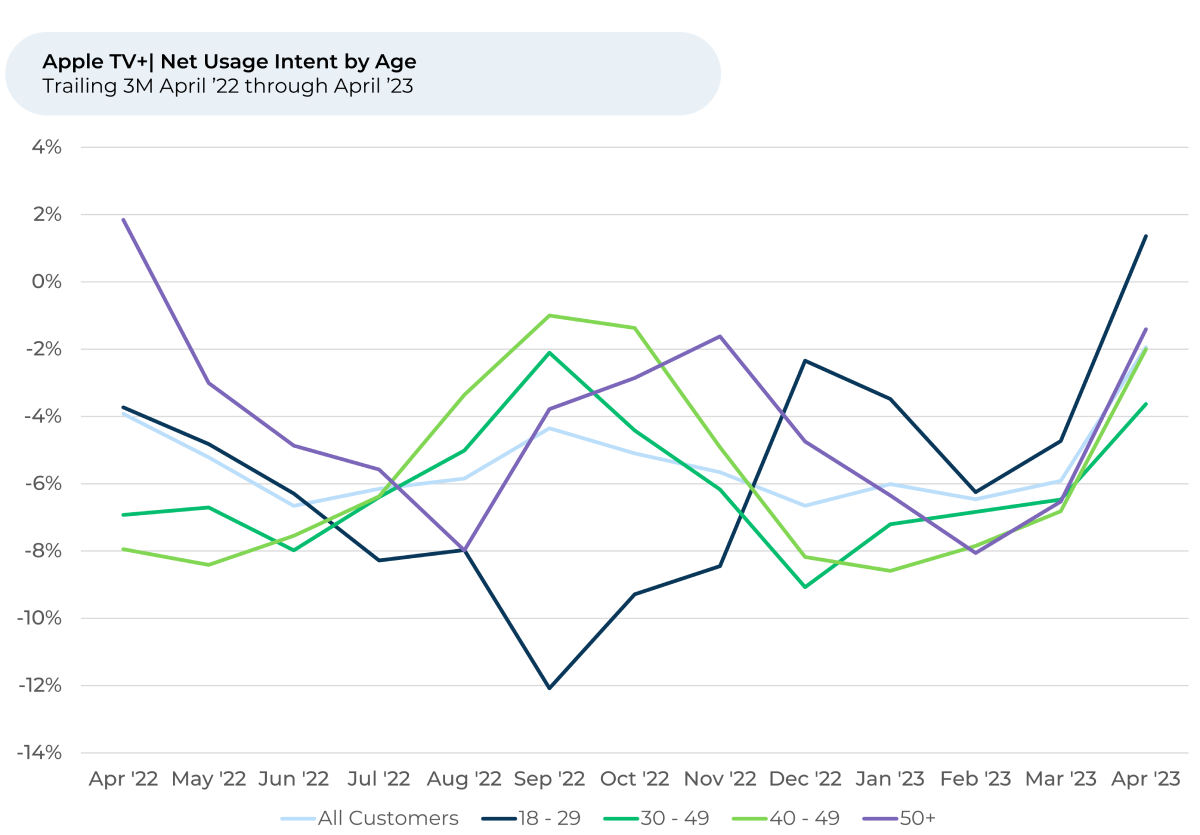

- Apple TV+ continues to lag peers but has seen a recent surge in Usage Intent, particularly with 18-29-year-olds (a key segment for Max). The surge has been driven by interest in its new content.

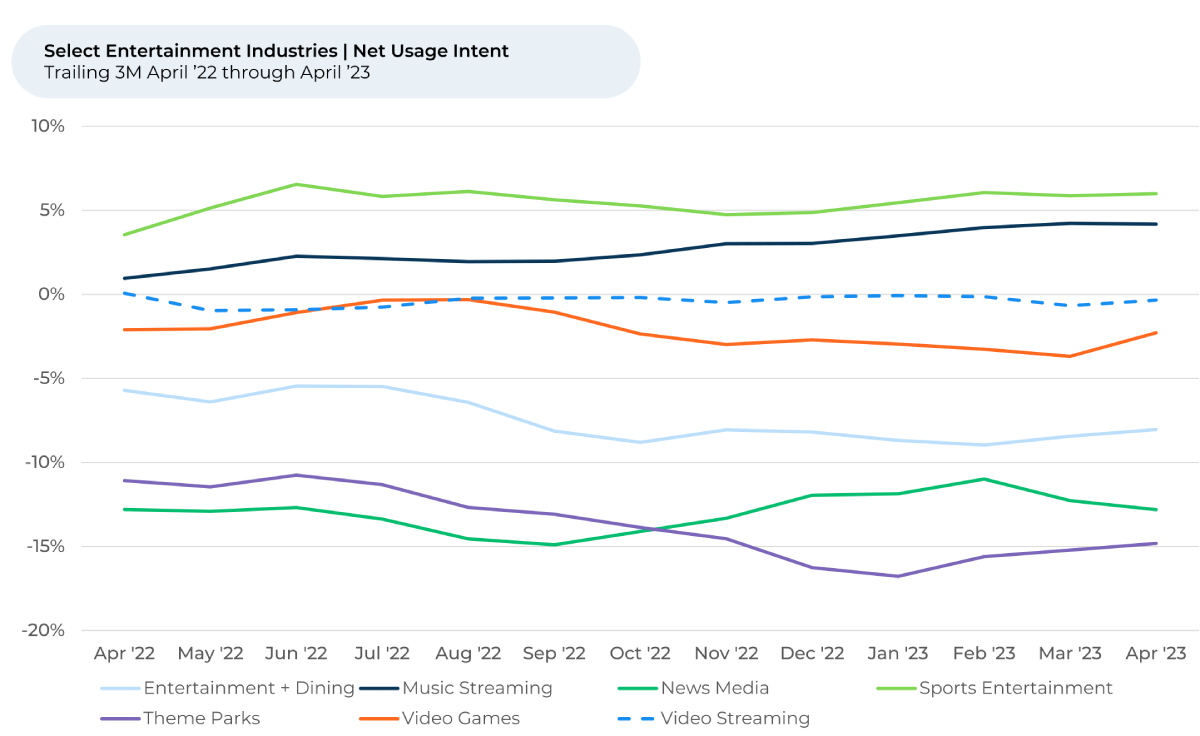

Looking across the broader entertainment sector, we see the video streaming industry has largely maintained its standing as a way for people to spend their time relative to the rest of the entertainment sector. The industry's Usage Intent was steady in April, as it has been over the past year.

Most other areas of entertainment were also stable, though a few have seen subtle shifts. Usage Intent for video games rose by 1% since March 2023, indicating games may be gaining some mindshare from other areas. By contrast, news media was down slightly.

The “Max” platform debuts at a time Usage Intent is dropping for most streaming services

The streaming industry continues to mature, fostering consolidation as platforms seek enhanced scale and stronger market positioning. Warner Bros. Discovery underscored this trend with the launch of Max on May 23, 2023, merging the premium original content of HBO Max with Discovery+'s diverse reality programming. Other platforms are following suit: Paramount+ and Showtime are set to merge next month, and Hulu and Disney+ are planning content integration by the year's end.

The new service launches when HBO Max, Disney+, Amazon Prime Video and Netflix have all seen Usage Intent fall in the last three months and US subscriber growth for many leading platforms has stalled. Unsurprisingly, businesses are looking at ways to strengthen their offerings to defend market share and improve pricing power and margins.

The Under 30 crowd loves HBO Max, while the biggest Discovery+ fans are middle-aged and 60+

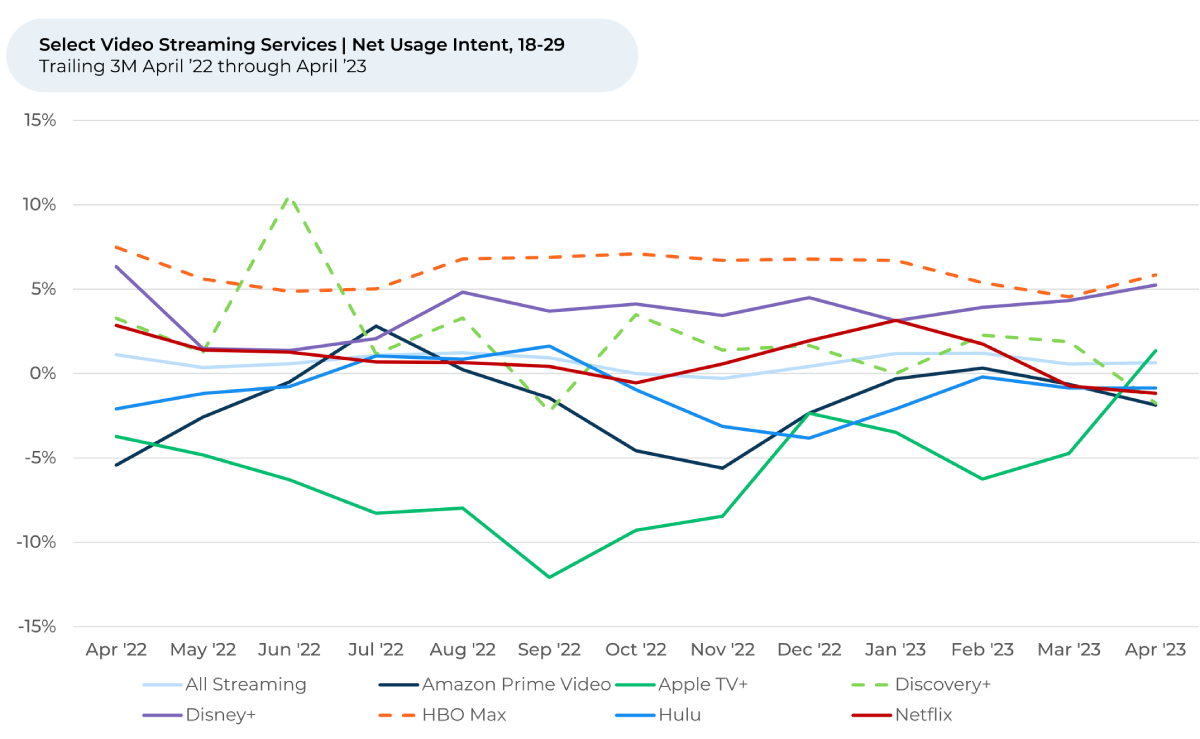

HBO Max has found a strong ally in 18-29-year-olds with its offerings of anime, DC superhero content, and premium television shows. Notably, alongside Disney+, it earned the highest Customer Satisfaction⁴ levels from that age group among the leading video streaming services. Its Usage Intent among young adults is also higher than it is for any of the leading video streaming services, implying it should see market share gains with this group.

Disney+ is steadily closing its Usage Intent gap with HBO Max, however. As of April 2023, it trails by only 1%, down from a 3% lag in January. Feedback from real young adult viewers of Disney+ show improved sentiment towards its original content, diverse offerings, and tailored recommendations is evidently chipping away at HBO Max’s share with this group.

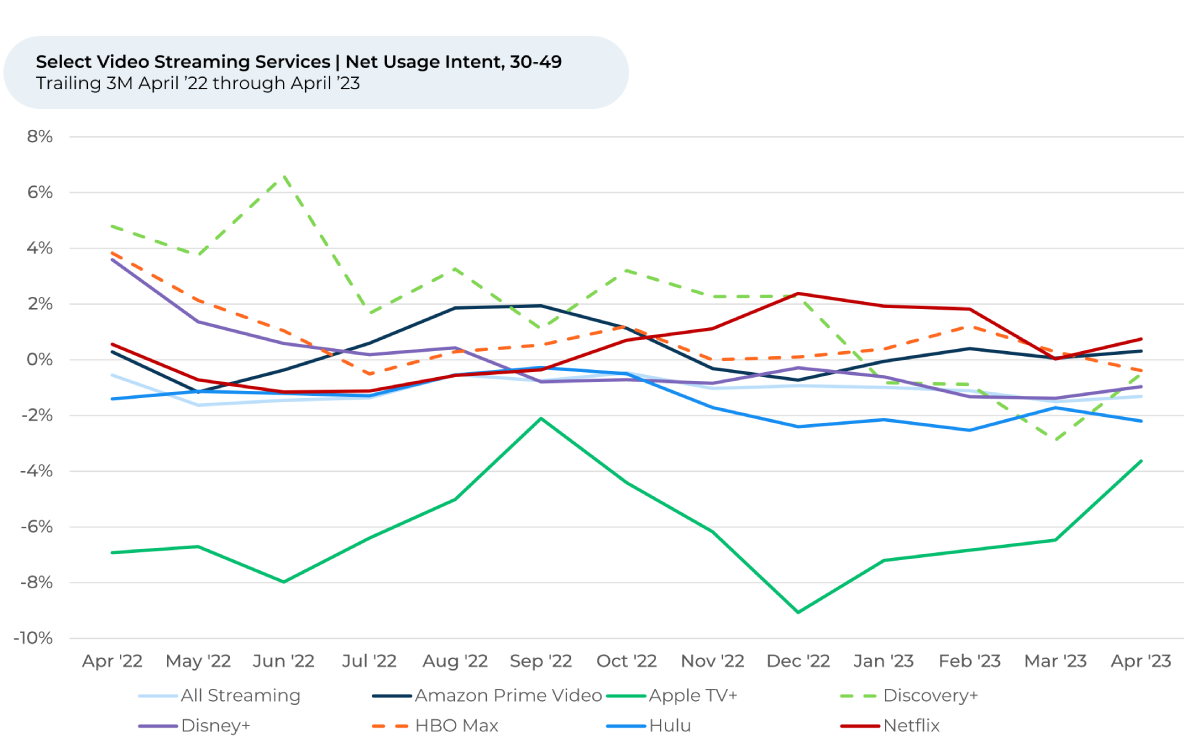

While it doesn’t perform as well with young adults as HBO Max or Disney+, Discovery+ captures a middle-aged audience with a variety of reality TV, true crime, and home improvement content.

Discovery+, alongside Disney+, lead competitors in Customer Satisfaction for 30-49-year-olds. Both platforms are also poised to grow more with 30-49-year-olds compared to the industry average, though their Usage Intent lags action- and drama-heavy platforms Netflix and HBO Max.

Despite Discovery+'s notable appeal to middle-aged viewers, its best positioned to drive growth with the over 50 demographic. Over the past three months, Discovery+ Usage Intent for viewers over the age of 50+ increased 3%, even as it stayed stable for HBO Max and the average video streaming service. It lagged only Apple TV+ and Netflix. Discovery+ Usage Intent for 50+ viewers is also higher than any other age group.

A blend of HBO Max and Discovery+ content could gain Max more viewers across all age demographics, improving its ability to charge more for ads and higher prices to subscribers. Max could stand to gain by cross-promoting content: bringing Discovery+'s offerings to the 18-29 age group, where it traditionally didn't perform as strongly, and introducing more HBO Max content to middle-aged viewers.

Finding success with this strategy will be key as Disney+, one of Max's main rivals and a favorite with young and middle-aged adults, begins to add content from Hulu and raise prices over the coming months.

Getting Max(imum) interest from the merger

To put Max into the best possible position against Disney+ and Netflix, Warner Bros. Discovery’s will have to rectify certain shortcomings of its standalone platforms, invest smartly in content and marketing, surface relevant content to its expanded user base and forge new partnerships. It’s already taking steps to do this.

In recent months, user dissatisfaction with Discovery+ has grown, with sentiments around ease of use and content variety seeing declines of -6% and -9% respectively. HBO Max, however, performs well with ease of use, especially among its young and middle-aged audiences. Moreover, by inheriting the combined libraries of HBO Max and Discovery+, Max increases the variety of content it offers to subscribers, addressing Discovery+’s content variety shortcoming.

Max launches with over 35,000 hours of content, double the volume of its HBO Max predecessor and more than Disney+, one of its biggest competitors. We believe it is smart for Max to continue investing in making Max easier to use and increasing the variety of its content.

Adding to its content advantage will be particularly important, as streaming customers are prioritizing content variety over price, creating an opportunity for the best-positioned platforms to capture pricing power and margin. We’ve found that, as of March 2023, streaming customers providing feedback to HundredX more often choose variety than price when selecting⁵ reasons why they like or dislike a streaming service.

This could be important as Warner Bros. Discovery tries to woo current Discovery+ subscribers to upgrade their subscriptions to the broader Max service.

While the company is shuttering HBO Max, it’s keeping Discovery+ as a separate service. At $4.99 per month for an ad-supported subscription and $6.99 per month for an ad-free subscription, Discovery+ is one of the cheapest video streaming services around. HundredX respondents have consistently shown their appreciation for the platform’s pricing scheme – customer sentiment towards Discovery+’s price is higher than any other competing streaming service except for Peacock. However, sentiment towards Discovery+’s programming quality and original content is only modestly ahead of peers, while it lags on variety and new releases.

Meanwhile, price sentiment is lowest for Netflix, with HBO Max close behind. Max largely sticks to the same pricing scheme as HBO Max -- $9.99 per month for an ad-supported subscription, $15.99 for an ad-free subscription, and a new, $19.99 subscription that supports 4K and Dolby Atmos. This is also very similar to Netflix’s subscription costs, although Netflix’s ad-supported tier is a bit cheaper at $6.99 per month.

Pricing sentiment for premium-priced offerings is often weaker than peers. Given HBO Max enjoys sentiment towards new releases, original content and programming quality all well ahead of peers, the new combined platform may be able to enjoy even stronger pricing over time.

Max should take advantage of where HBO Max and Discovery+ customers share likes

Feedback patterns observed by HundredX suggest promising potential for Max to persuade HBO Max or Discovery+ subscribers to upgrade. As of April 2023, HBO Max subscribers are 5x more likely to leave feedback on Discovery+ than the average HundredX respondent, and vice versa. For HBO Max, this rate of feedback overlap with Discovery+ exceeds Netflix, Hulu, Disney+, and Amazon Prime Video. Similarly, for Discovery+, the overlap with HBO Max surpasses Hulu, Amazon Prime, and Netflix.

However, viewers of both Discovery+ and HBO Max are more likely to leave feedback on Peacock, Paramount+, and Apple TV+, implying there is further room to increase affinity. We see potential for Max to do so with smart pricing, investments in its content and user interface, and effective marketing.

As Warner Bros. Discovery deploys a massive budget to market the platform, we believe Max could benefit from advertising on Reddit, Tumblr, Pinterest and Nextdoor, platforms where feedback overlap is well above normal. HBO Max subscribers leave more than 5x more feedback than the typical respondent on Reddit and Tumblr. Discovery+ subscribers leave 4x more feedback on Pinterest and Nextdoor – after all, Discovery+ has countless hours of lifestyle and home improvement content. They also leave more than 3x more feedback on Reddit – potentially an important overlap Max could capitalize on.

If Max successfully boosts subscriber growth, its diverse customer base could facilitate the creation of new unique partnerships. For example, as more sports leagues ink partnerships with video streaming services, Max may want to entice a league to stream content on its platform. The NHL, currently partnered with ESPN+, appears to be the best candidate, with both HBO Max and Discovery+ subscribers leaving 3x more feedback on the NHL than the average respondent.

Apple TV+ surge in Usage Intent driven by tons of new content

As we work through the outlook for the new Max service, we call attention to the recent surge in Usage Intent for Apple TV+, a key Max competitor that’s particularly appealing to 18-29-year-old viewers.

While Apple TV+ lags competitors in overall Usage Intent, it managed to significantly narrow its gap vs. peers from January to April 2023, with most of that gain from March through April. The primary reason behind this surge appears to be tied to new releases.

A closer look at Apple TV+ Usage Intent data by age reveals that the platform's recent success is mainly driven by the 18-29 and the 50+ age groups, two key areas of strength for legacy HBO Max and Discovery+. The 5% jump for 18–29-year-olds and 50+ year olds from January to April 2023 aligns with a surge in sentiment towards new releases and original content this year. This suggests Apple TV+ is effectively targeting and engaging younger audiences, known for their appetite for fresh, innovative content, while also managing to keep older audiences interested.

Apple TV+ has exploded in new content recently. Launched in late 2019 with only a handful of shows and movies, the service now has close to 200 shows and movies, including the Ana de Armas spy comedy Ghosted, released in April, and season three of Ted Lasso, released in March.

“Bought an Apple TV+ subscription recently to watch the new Ted Lasso season and I started Severance. Such a great show,” one Apple TV+ viewer told HundredX.

Another said, “Love Shrinking. Love Ted Lasso. Loved Dear Edward. Keep the good and original content coming.”

The landscape for video streaming businesses will continue to evolve rapidly, as leading players move into the next chapter of the arms race for content by seeking share consolidation that will help to support pricing power and better profitability. We will continue to closely watch how Warner Bros. Discovery manages the rollout and expansion of its Max service, along with other developments by heavyweights like Netflix, Disney, Amazon and Paramount.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Usage Intent reflects the percentage of customers who plan to use a specific brand during the next 12 months, minus the percentage who plan to use less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- HundredX measures Customer Satisfaction, or CSAT, on a 5-point scale.

- Our “listening” methodology allows customers to select the brands that matter to them and then summarize their usage, experience, and future spending intent. Selection Frequency represents the percentage of customers who decided to provide feedback on a brand and then select a given “driver” of customer satisfaction (such as Price, Speed or Brand Values & Trust) as a reason they think the product or service is good or bad. Selection frequency is an indicator of how important a driver is in determining how customers as a whole feel about the brand.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article