Fast Food: McDonald's to Enhance Burgers

In a move to please customers and boost sales, McDonald’s is turning its attention to upgrading its core menu items, with a particular focus on its signature burgers. As highlighted in a recent CNN article, the fast-food giant is introducing a series of changes aimed at elevating the taste and quality of its burgers. These enhancements include softer buns, meltier cheese, adding onions to patties right on the grill, and more Big Mac sauce.

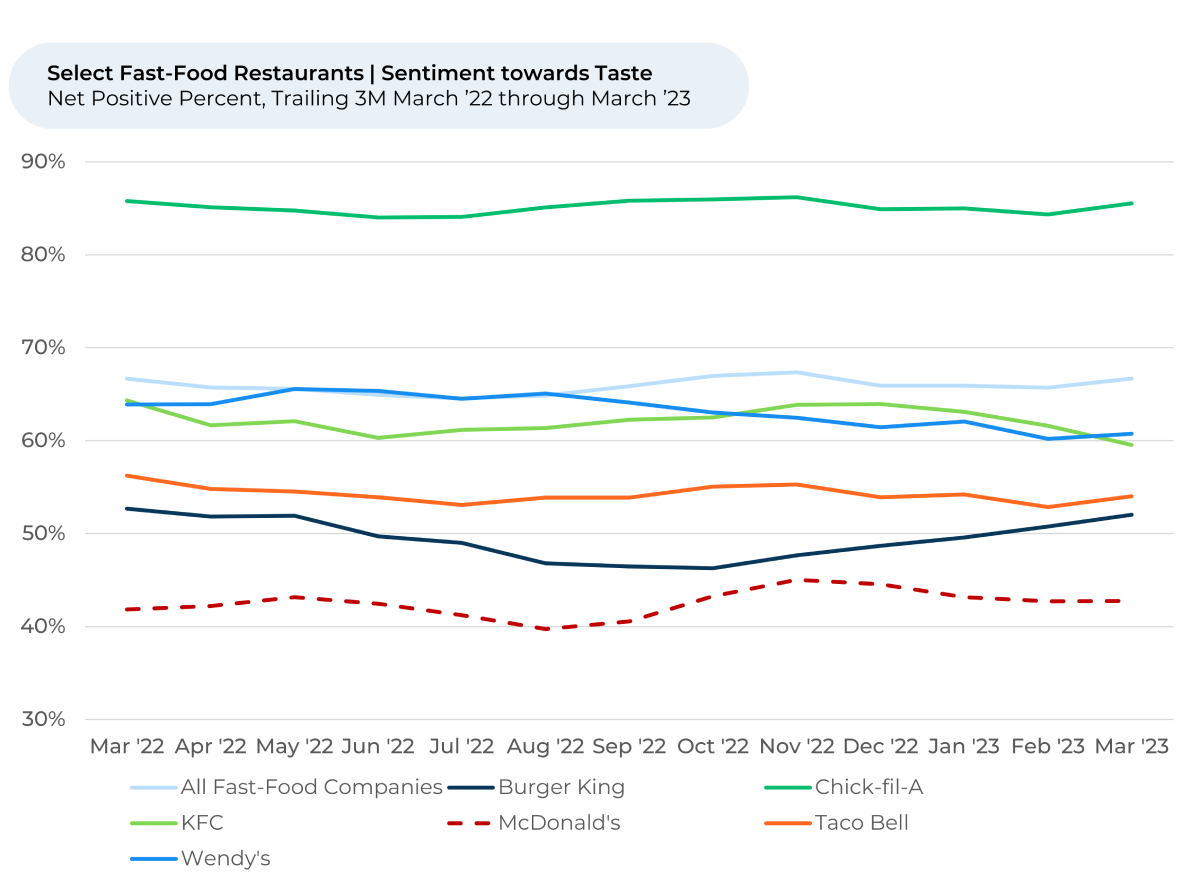

By looking at close to 400,000 pieces of feedback from “The Crowd” of real customers of almost 180 Quick, Fast, Casual restaurants, March 2022 through March 2023, we find that burger enhancements appear to be a smart investment at a good time for McDonald’s.

- Taste is the most selected reason¹,² a fast-food customer likes or dislikes a restaurant, followed by speed, price, and order accuracy.

- Customers like the taste of McDonald’s food, but an upgrade to its burgers could help the chain better compete with peers “The Crowd” believes taste better.

- Our proprietary Resource Allocation model says Quality and Taste have the highest impact on the future Purchase Intent³ of McDonald’s customers.

- Burger King’s recent Purchase Intent improvement on the back of better customer sentiment towards the taste of its food could provide an encouraging blueprint for McDonald’s.

We find that McDonald's customers like the taste of its food, but sentiment lags peers. In March 2023, McDonald’s sentiment towards taste stands 43%, lower than competitors like Burger King (52%), Chick-fil-A (86%), and Wendy's (61%). The average sentiment towards taste for all fast-food companies is 67%.

We look to Burger King, which has seen a notable increase in Taste sentiment and Purchase Intent over the past few months

after its own taste-related changes, to understand how McDonald’s may benefit from its own enhancements.

Though Burger King still lags the industry, its Purchase iItent has improved from 12% below the industry to 6% below in the last six months. Burger King’s taste sentiment is up 6% over the same period, after it introduced new chicken sandwiches and new flavors of Whopper Melts. Similar to McDonald’s, Burger King has started upgrading its kitchens and retraining its staff to improve the taste and quality of its burgers.

One customer recently shared, “I really like eating at Burger King. I like that they have a great selection of foods on their menu that you can choose from and they aren't too expensive either. I really like their whopper and chicken sandwiches as well.” Another commented, “I love love love. love the Impossible Whopper! Please do not get rid of it. It is so tasty and always fresh.”

The burger enhancement initiative seems like a smart investment decision for McDonald's. As the fast-food chain rolls out the upgrades, we will look to see if strengthening customer sentiment towards taste and quality follow, drawing it closer to its competitors' ratings and boosting growth. As McDonald's and others continue to innovate and refine menu offerings, it will be exciting to see their impact on share in the fast-food market.

- All metrics presented, including Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Purchase Intent is measured by the percentage of customers who plan to visit the brand more during the next 12 months minus the percentage that intends to visit less. We find businesses that see Purchase Intent trends gain versus the industry have often seen growth rates for domestic users and engagement also improve versus peers.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article