Sector Snapshot: Travel

This Month in Travel: January 2023 Update

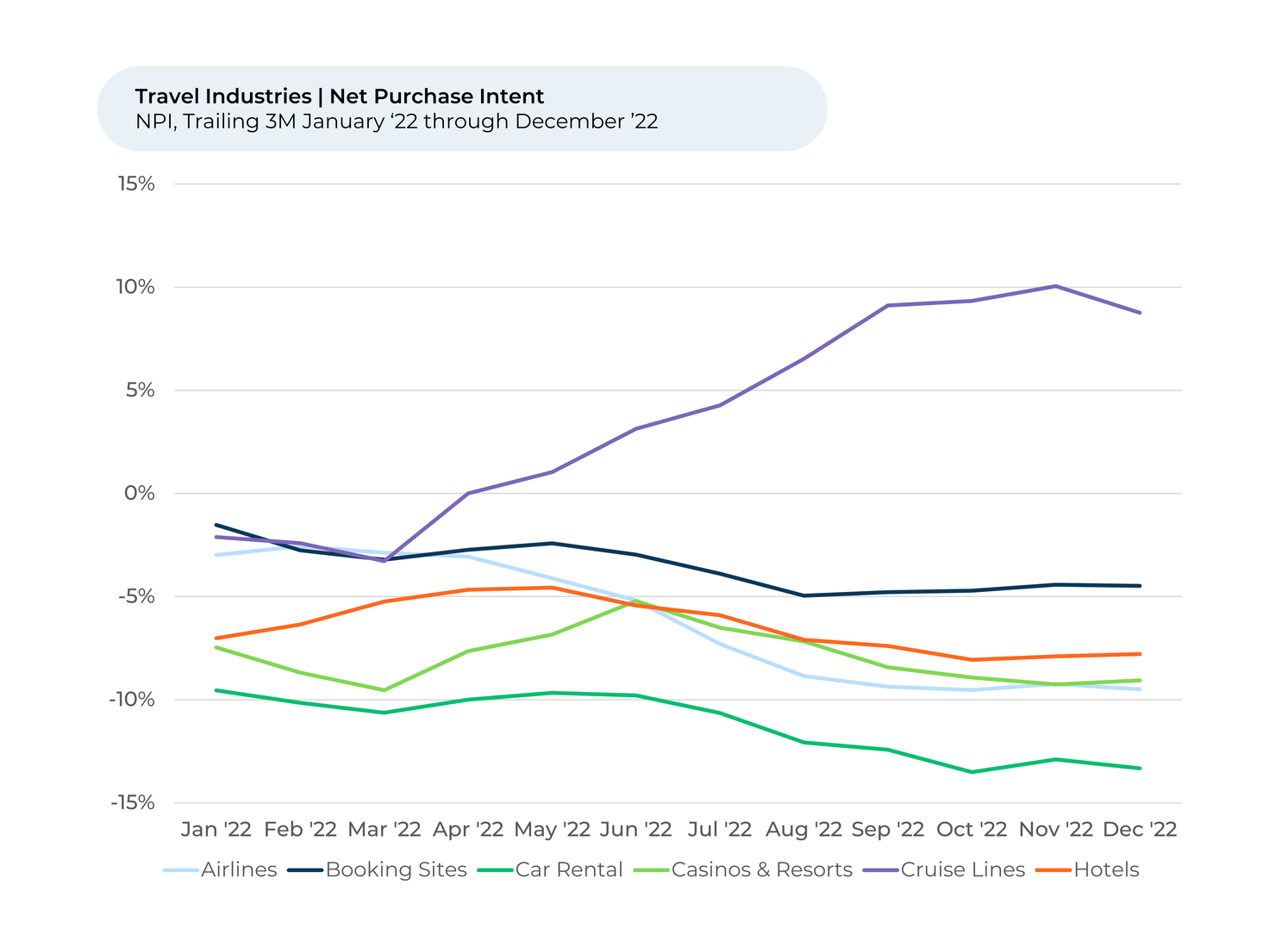

- Purchase Intent¹ across the Travel sector was generally stable and negative for December, with Cruise Lines (the only sector with positive purchase intent) seeing a slight dip in December.

- National Car Rental shows the biggest increase in Purchase Intent. Sentiment towards Price, Availability and other factors surged, potentially helped by its high-profile sponsorship of the PGA Jr. League Championship.

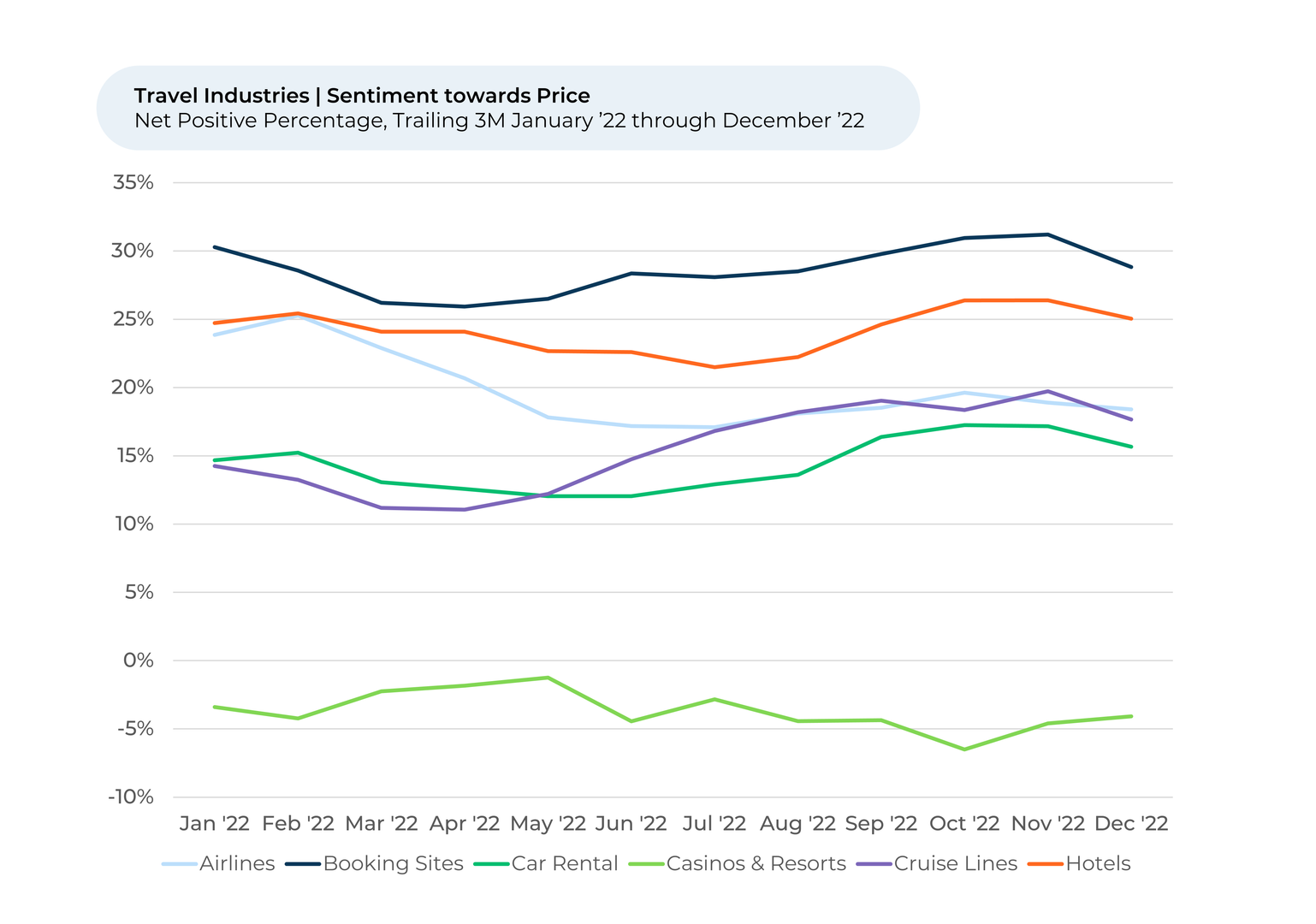

- Customer sentiment towards Price dropped for all travel sectors in December except for Casinos, which increased but still lags all other sectors.

- Major hotel chains Holiday Inn, Marriott Hotels, and Hilton see some of the biggest gains in sentiment toward Price.

- Purchase intent and sentiment towards Southwest remained stable despite significant woes for its travelers in December. We will watch for a potential impact on its metrics in January.

Purchase Intent remained relatively stable across the Travel sector over the past three months. It remains mostly negative, with Cruise Lines the only industry where Purchase Intent is positive.

Despite maintaining a positive Purchase Intent, Cruise Lines saw the biggest drop from November to December, falling about 2%. Sentiment towards most aspects of Cruise Lines also dropped from November to December, with Food & Beverage, Staff Availability, and Room falling the most.

Purchase Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. For cruises, it represents the percentage of customers who intend to take another trip with the brand in the next twelve months, minus those that do not.

Biggest Travel Purchase Intent Improvers

Pricing Sentiment

- All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a mission-based data and insights provider . HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact .

Share This Article