Sector Snapshot: Specialty Retail

What do people do in their free time? Some read, some play sports, others play with their pets. Whatever the hobby, most need something to get started: a book, a football, a dog. HundredX looked at more than 65,000 pieces of feedback at 17 brands that sell hobby items to discover what types of hobbies people plan to spend more money on.

By looking to The Crowd, real people who leave feedback with HundredX in real-time, HundredX can help predict where customers spend their money and why. After grouping 17 major retail brands into five categories – Arts & Crafts; Books, Games, Toys; Hunting & Outdoors; Pet Supply; and Sports – we find:

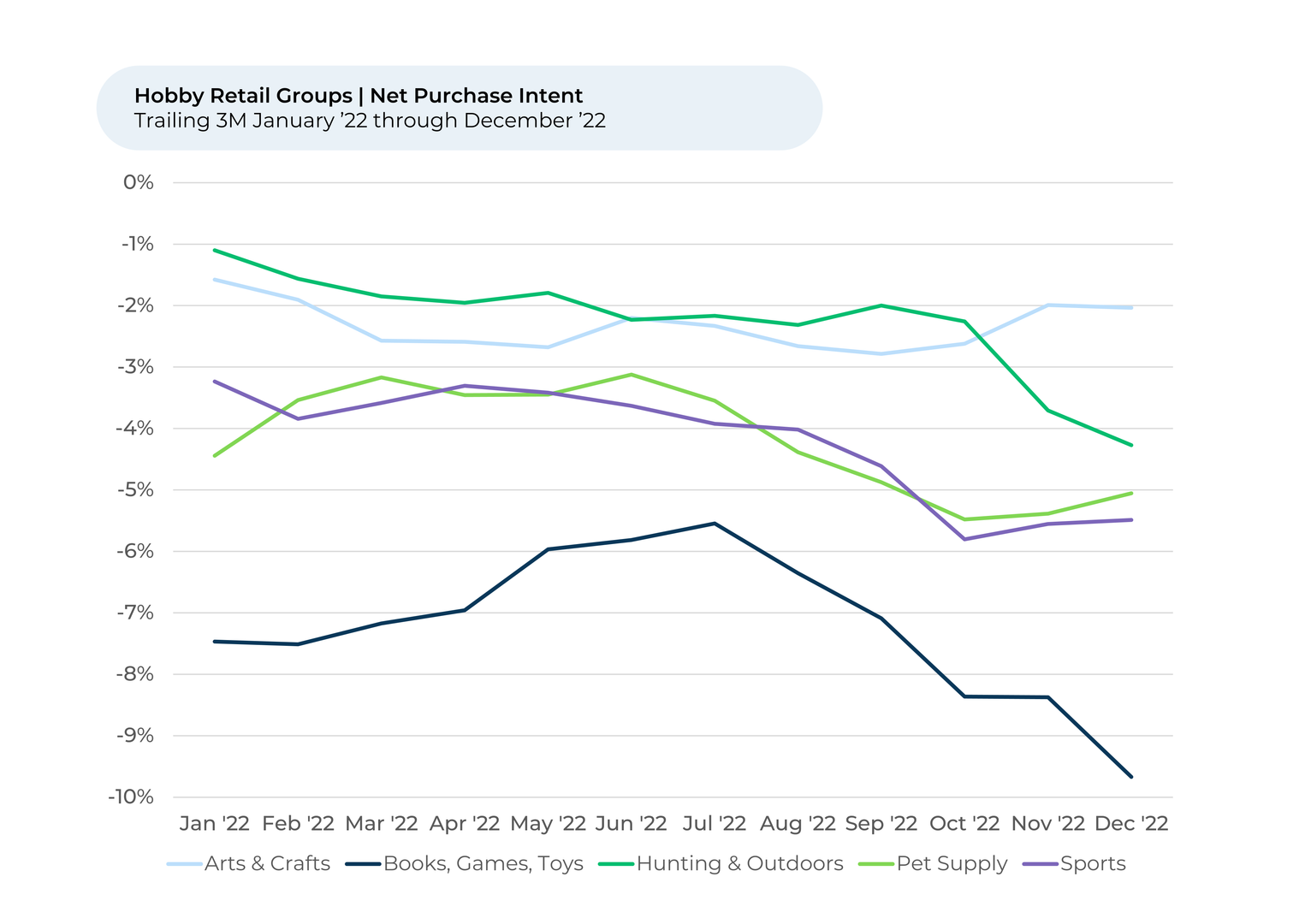

- More customers intend to spend more money with Arts & Crafts brands compared to other hobby stores. It’s also the only group to have gained in Purchase Intent¹ since September.

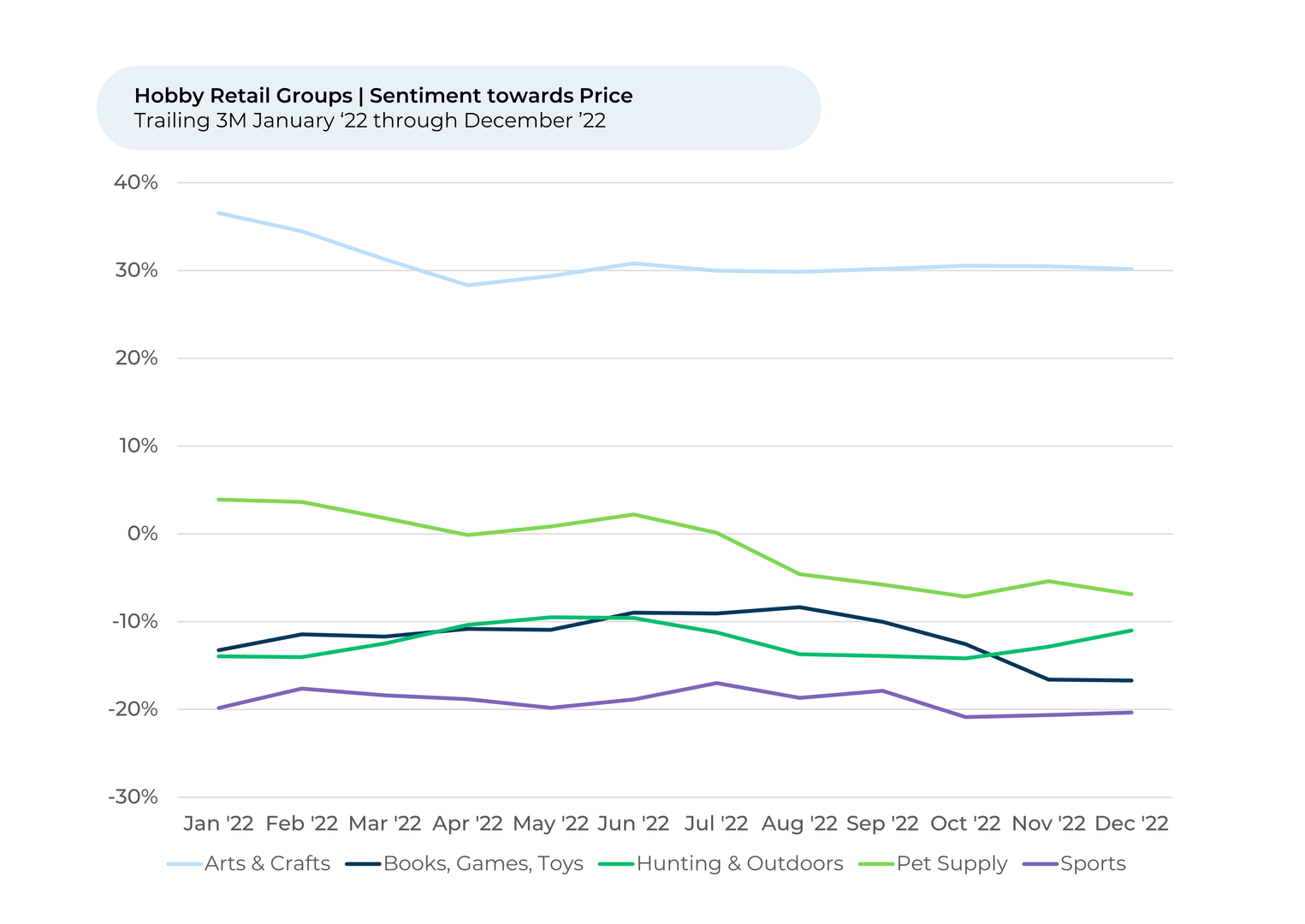

- Customers on balance feel positively about the prices of Arts & Crafts brands, but negatively about the prices of other hobby brands.

- However, only the Hunting & Outdoors group gained in sentiment towards Price over the past three months.

- Out of the selected brands, only American Girl and Michaels gained both on Purchase Intent and sentiment on Price since September.

Arts and Crafts has the strongest Purchase Intent of the Specialty Retail Sector

Interest in arts and crafts surged during the COVID-19 pandemic, keeping people mentally active during a time when many people didn’t want to leave the house. Among the pandemic winners was Jo-Ann Stores, the Ohio-based crafts and fabrics retailer, which posted a 23% net sales increase in FY2020 compared to FY 2019.

While sales for arts and crafts brands have come down since the height of the pandemic (Jo-Ann Stores revenue declined 9% year-to-date vs. 2021), it seems people haven’t completely lost their interest in making things at home. Purchase Intent, though slightly negative, remained in a range for Arts & Crafts over 2022, with the group seeing higher absolute Purchase Intent than other groups of hobby retailers. It’s also the only group to post a gain, though slight at 1%, over the past three months. We believe that the small bump is likely due to the seasonality of arts and crafts brands. In its annual report, Jo-Ann Stores notes sales and operating profits are typically higher from September through December, coinciding with the major U.S. holidays.

“Love Hobby Lobby! I could spend hours in the store looking at the beautiful displays and the countess items. Wonderful shopping experience which I hope to do more of,” someone told HundredX of arts and crafts giant Hobby Lobby.

Purchase Intent for Retail reflects the percentage of customers who expect to spend more at a retailer over the next 12 months minus the percentage who plan to spend less. We find brands that see their spread in Purchase Intent improve vs. peers tend to see stronger growth rates and market share gain.

Of the Arts & Crafts brands HundredX covers, Michaels was the only one to have an increase in Purchase Intent over the last three months, up from -4% in September to -2% in December. Customer sentiment towards its Selection, Prices and Value were all up 3%-4% over the last three months. It appears the company likely got some credit for their stock of Halloween and holiday items as well as sales run throughout the season.

Arts & Crafts has the best Price sentiment, but Hunting & Outdoors had the biggest recent increase

Customers’ sentiment on Price is also highest for Arts & Crafts groups – it’s the only group to boast a positive sentiment on Price throughout 2022. While it came down at the beginning of the year, Price sentiment has remained stable at around 30% since April.

Despite starting the year off with a positive Price sentiment, the Pet Supply group dropped about 10% from January to rest at -7% as of December. Trade publication Pet Business Professor , run by longtime pet industry sales and marketing leader John Gibbons, says inflation rates for pet supplies and services passed national rates in July. In October, inflation for pet supplies hit 12% according to Gibbons, putting it well above the 8% for consumer prices across the nation. It’s no wonder customers’ sentiment on Price for Pet Supply brands fell rapidly from June through October.

HundredX measures sentiment as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like the brand.

As Price sentiment fell for Pet Supply, it rose by 3% for Hunting & Outdoors from October (-14%) through December (-11%). Hunting & Outdoors is the only group to have risen over the past three months.

“Excellent prices on camping gear,” someone recently said of Cabela’s to HundredX.

Still, when it comes to individual brands, only American Girl, makers of the long-loved American Girl dolls, and Michaels rose in both Purchase Intent and Price sentiment over the past three months. It appears American Girl benefited from marketing and product coverage over the summer. The New York Times reported in July that American Girl memes had overtaken the internet, with people across social media posting humorous and inventive memes featuring American Girl dolls. Vogue wrote about the release of Claudie, a Black girl wearing clothes from the 1920s Harlem Renaissance designed by Sammy B, a trending design company based in Harlem. The brand dominates other specialty retailers on customer sentiment towards Uniqueness (+31% vs. covered brands), Presentation (+24%), and Quality (+15%).

“Unique assortment of dolls and accessories. Great gift for little girls. The store is a memorable experience,” one person said of American Girl to HundredX.

HundredX will continue monitoring the retail space throughout 2023 to see how hobby stores deal with the economy, inflation, and COVID.

- All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article