The Crowd Report: Travel Industry Trends

Cruise lines continue to lead Travel — Iger inherits Disney Cruise

This Month in Travel: December 2022 Update

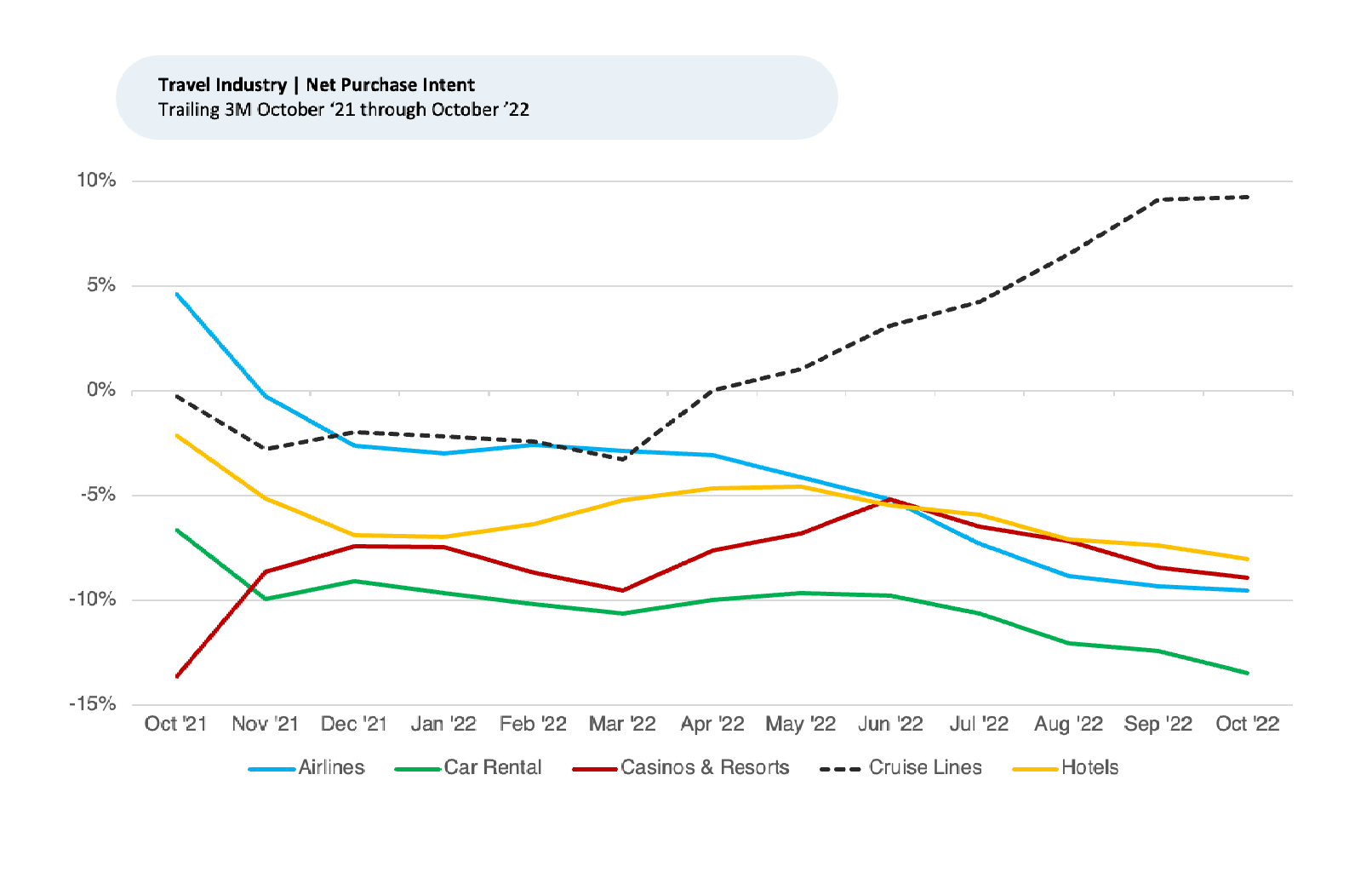

- For the Travel Industry overall, Future Purchase Intent 1 remains negative and continues to fall.

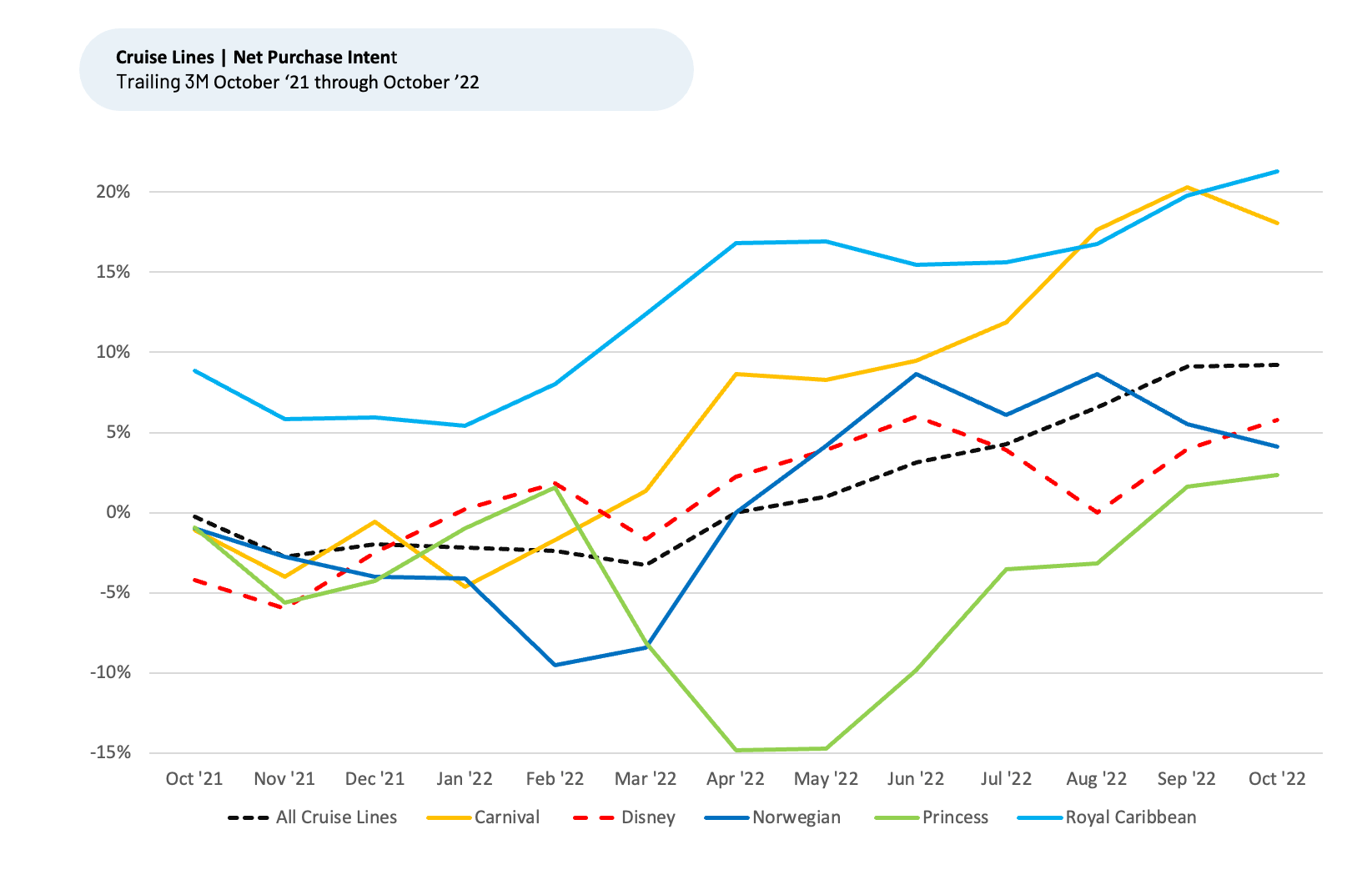

- The market share outlook for Cruise Lines continues to be robust, with Purchase Intent outpacing all other Travel sub-sectors.

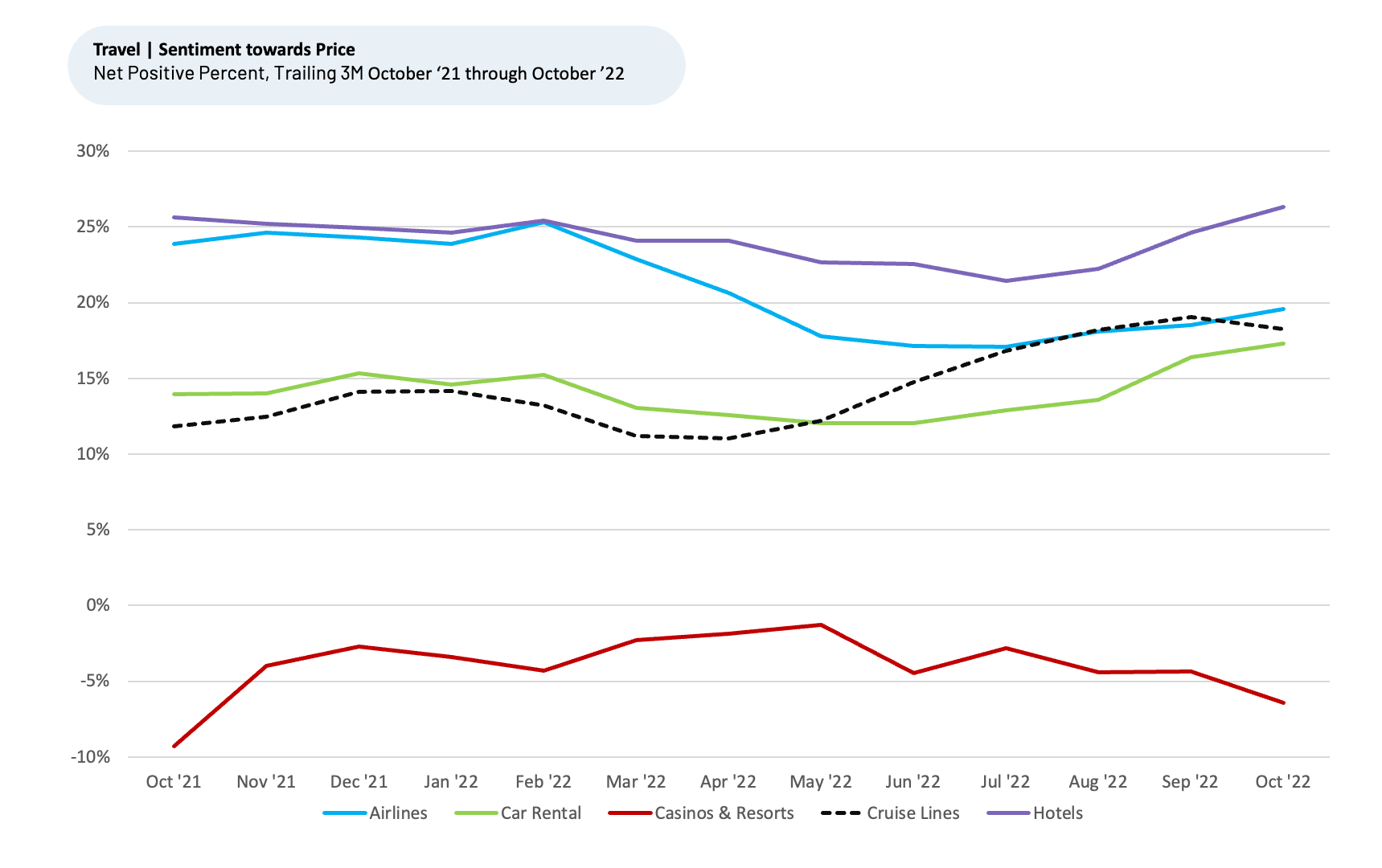

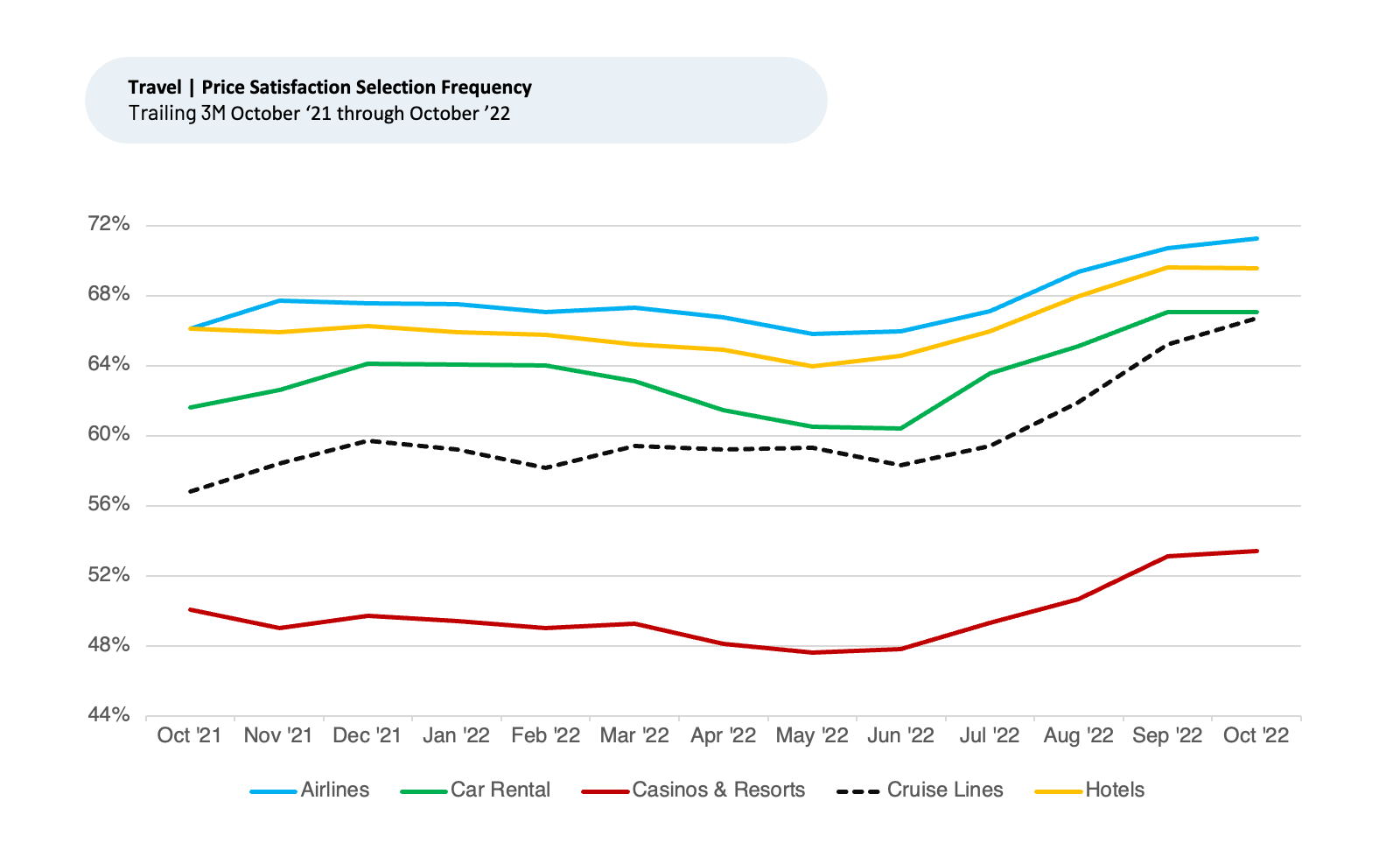

- Customer sentiment towards price remains mixed across Travel, but continues to favor Cruise Lines over other subsegments. Cruise’s lead has narrowed in recent months.

- Weakening sentiment toward Price and Value for Disney Cruise Line customers indicates management probably should not raise prices.

Monthly Recap

This economic uncertainty appears to continue weighing on outlooks across most travel sectors, except for Cruise Lines. Based on analysis of feedback to HundredX, more customers appear to have seen their pricing satisfaction for cruises rise compared to other areas of travel. Cruise prices currently remain near historic lows, which has helped spur bookings, as the sector looks to draw back business after its extended slump. Cruise purchase intent rose to 12% in October 2022, up from -3% for March 2022, making it the only positive or increasing travel subsector. Other travel subsectors saw purchase intent fall by 3% to 8% over the same period; all areas remain negative as of October 2022. Airlines fell the most, from -2% for February 2022 down to -10% for October 2022.

Purchase Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. For cruises it represents the percentage of customers who intend to take another trip with the brand in the next twelve months, minus those that do not.

Divergent price trends drive Travel purchase intent

With inflation pressuring most supply chains and businesses, prices have increased in many industries. For example, prices for airline tickets have risen 25% for the year, hotel rooms are up 15%, and car rentals are up 25%, as companies pass through higher costs to customers. Consequently, customer sentiment towards Price remains mixed across the Travel sector. For HundredX, sentiment is represented as the percentage of customers who selected a factor (or “driver”) as a reason they liked a product or service minus the percentage who saw it as something they did not like.

HundredX’s data shows the Cruise industry’s Price sentiment beginning to shift in March 2022, and then outpacing other industries during the next six months. Customer sentiment towards cruise pricing increased from 11% for March 2022 to 19% for September 2022 before easing to 18% in October. The other travel sectors are all flat to down over the same period, with airlines falling by the most.

Customers continue to cruise

Purchase intent increases for Cruises over the last seven months aligns with the surge in industry bookings for the largest publicly traded companies (Carnival, Royal Caribbean, and Norwegian). Carnival continues to see the largest increase in customer intent to cruise, both for the year and over the last three months. Insights from “The Crowd” indicate it is driven by improved customer sentiment towards its food and beverage and dominance on price sentiment (as detailed in our

September 2022 Travel sector update

).

We next take a closer look at Disney Cruise given the recent return of Bob Iger as CEO.

Disney Cruise as Iger takes the helm

Cruises have been a source of strong, high margin growth for Disney as bookings return to pre-pandemic levels. Customer’s intent to cruise with Disney rose significantly from March 2022 to October 2022. The industry average improved even more, however, indicating Disney may lose market share to peers.

Analyzing these factors, we find:

- Sentiment of Disney Cruise customers toward Food & Beverage, Ship Cleanliness, and Staff Attitude improved during the past six months, by a similar magnitude as the broader industry.

- The negative sentiment toward Price worsened significantly ― both on an absolute basis and relative to peers over the same period.

- Sentiment toward Value remained stable on an absolute basis but weakened vs. peers over the last six months.

- Given Price sentiment is weakening while the industry improves, and sentiment on Value weakened vs. peers, we believe management should probably not plan any price increases. If Disney chooses to raise prices, it should increase modestly and watch the impact on sentiment and related demand closely.

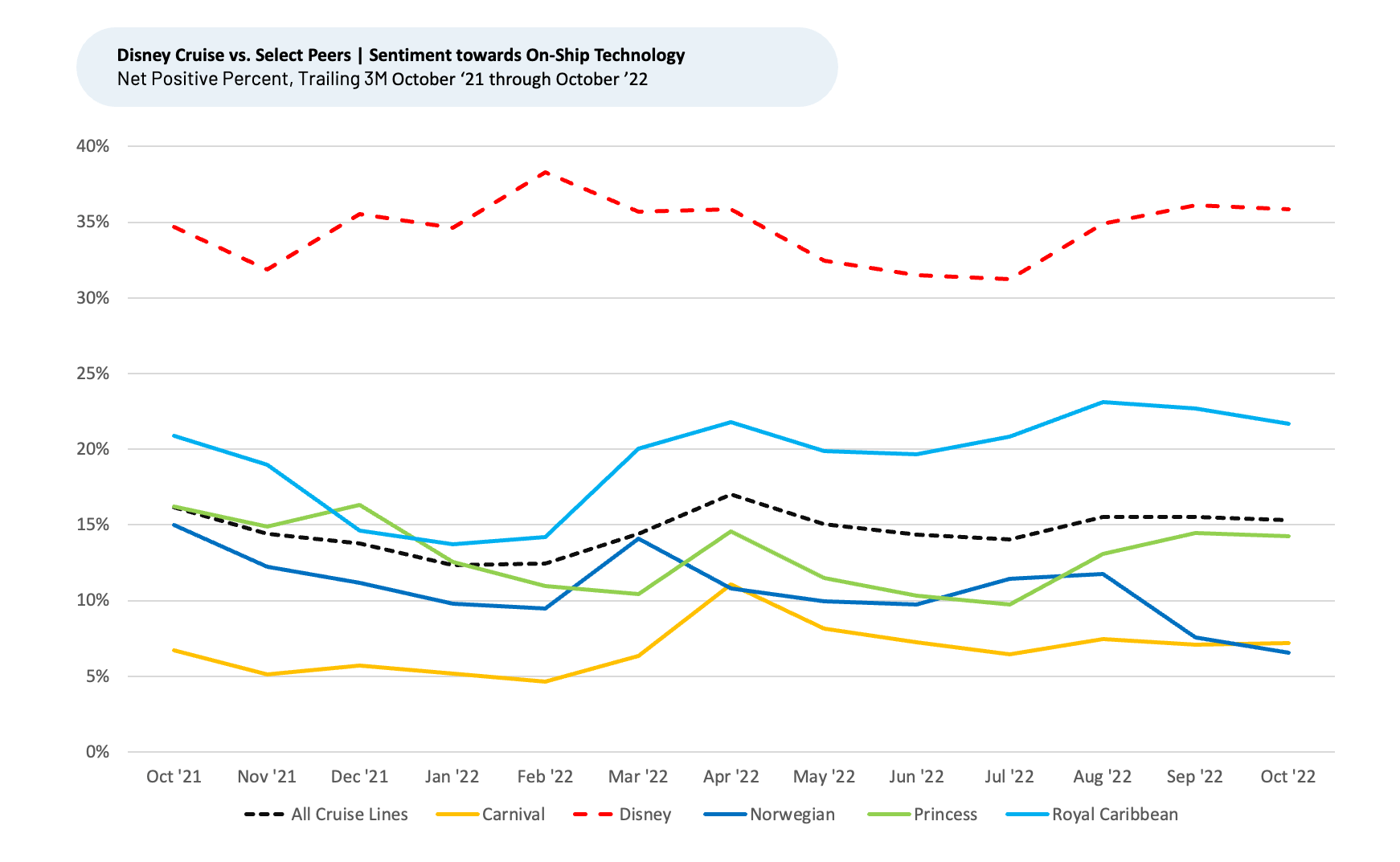

- The one factor that saw meaningful improvement in sentiment vs. peers is On-Ship Technology. While this driver might not impact overall growth, combined with other improving sentiment drivers, better on-ship services may help purchase intent.

Customer sentiment toward Price for Disney Cruises crashed from June 2022 to October 2022. Sentiment for the industry overall rose over the same period. It is possible management remains comfortable with the price sentiment decline given the Crowd’s satisfaction with Value was flat from May 2022 to October 2022. However, sentiment toward Value for Cruise Lines overall rose, indicating there could be some risk to Disney’s market share if sentiment toward Price continues to weaken.

1. All metrics presented, including Net Purchase Intent / Purchase Intent, Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we do believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our Travel industry data, brands like Disney and our other 2500+ companies, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article