Travel Update: Young Adults Cruising into Spring Break

It’s almost spring, and while it might not feel like it for people recently covered in snow in California and the Northeast, younger travelers seem to be hopeful about the upcoming warm weather.

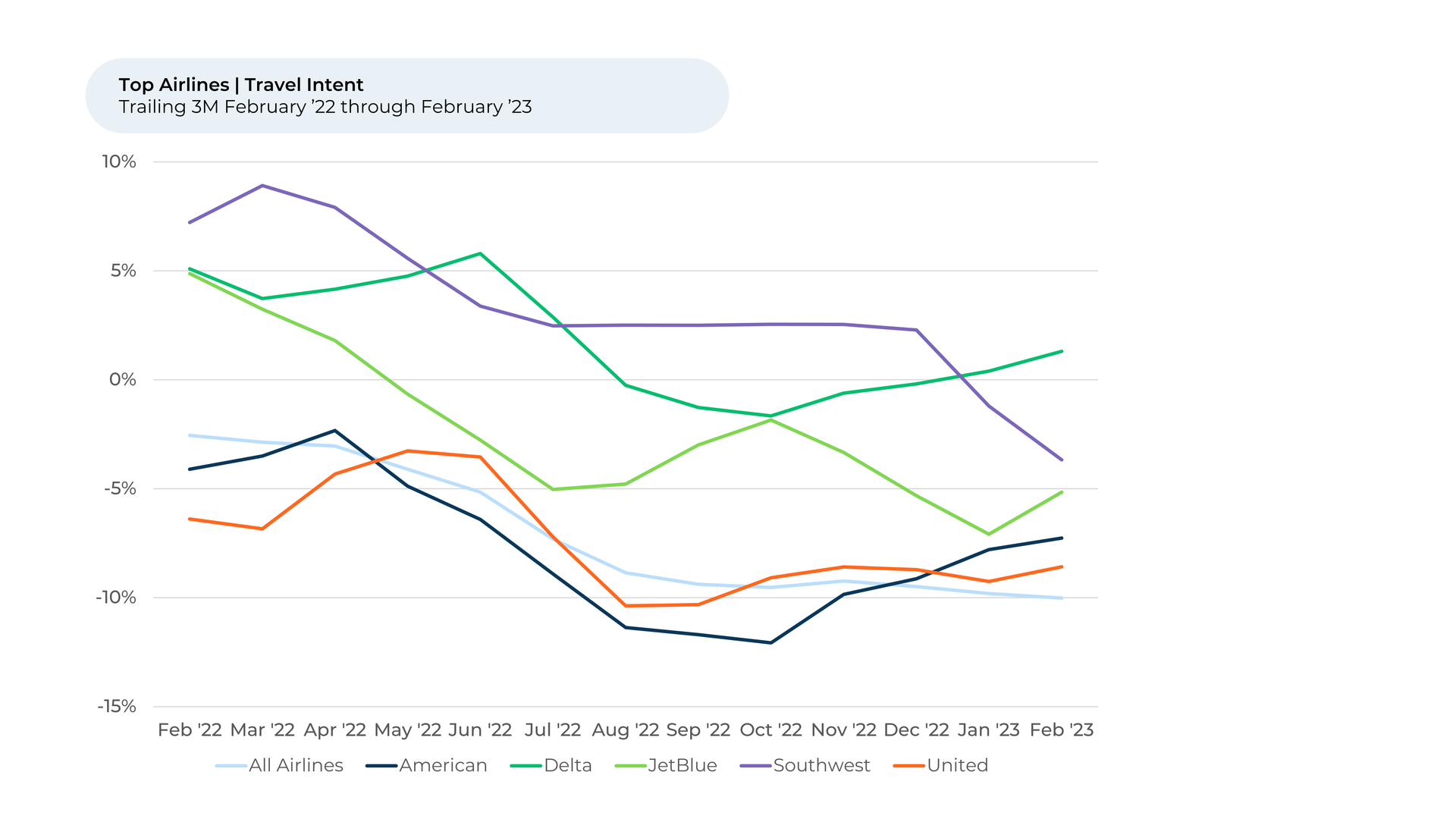

Last month, we saw that Delta appeared to be the winner coming out of the holiday travel season that saw thousands of flights canceled or delayed. Customers criticized some airlines and praised others, including Delta. Travel Intent¹'² was also the highest for the cruise industry.

This month, we’re taking a deeper dive into cruises, analyzing more than 275,000 pieces of feedback across the travel sector and 25,000 pieces of feedback from cruisers.

Scouring our data, we find:

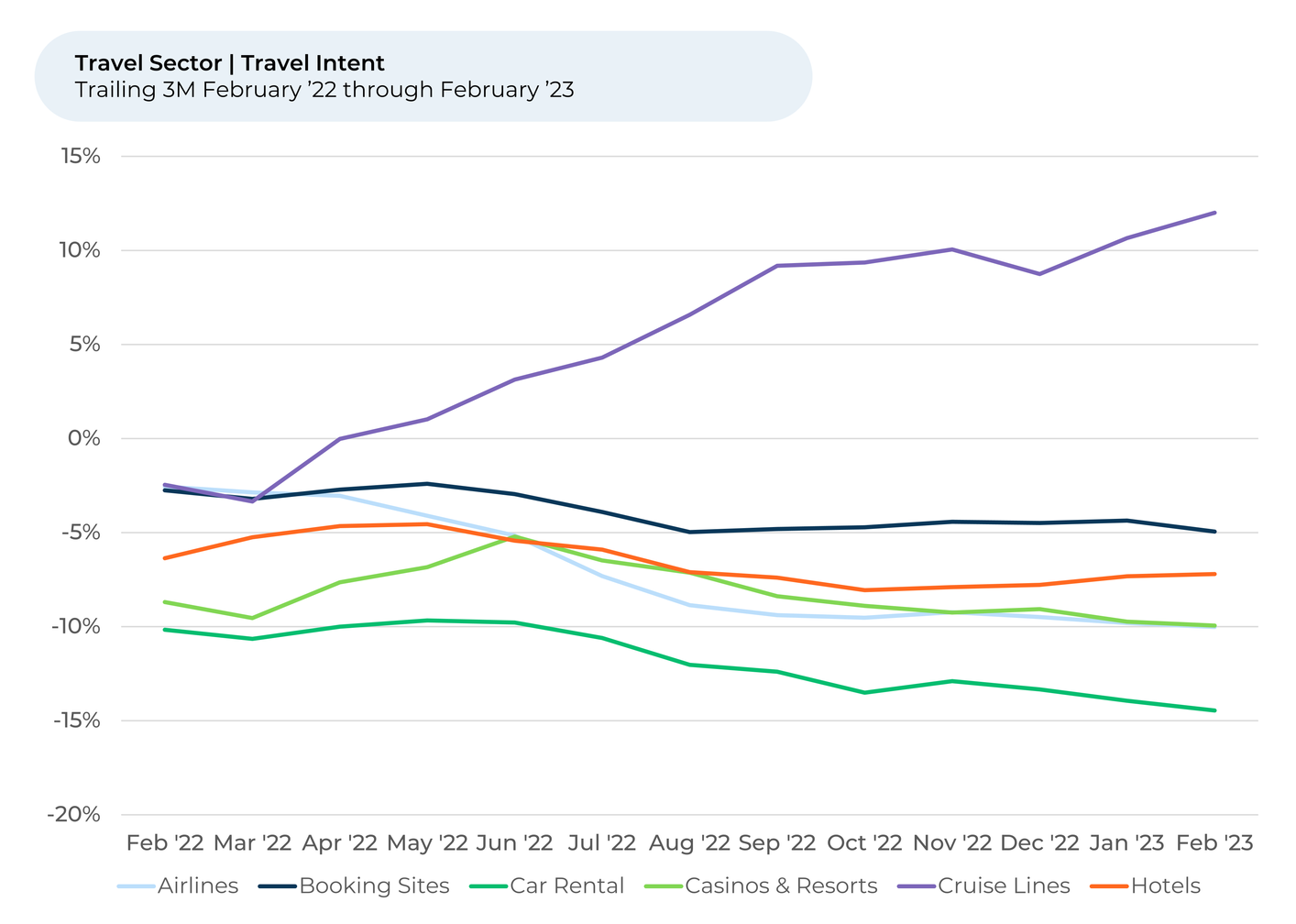

- Out of all the travel industries, the cruise industry is still the only one with Travel Intent up from a year ago and the only one with an increase in February.

- Delta continues to be the relative winner among airlines in the wake of industry challenges this past holiday season, adding to its customer Travel Intent lead in February. American has gained the most since October, but still lags most of the largest airlines.

- Young adults seem poised to book flights and cruises as colleges celebrate spring break. Travel Intent is surging for the youngest age demographic in the cruise and airline industries.

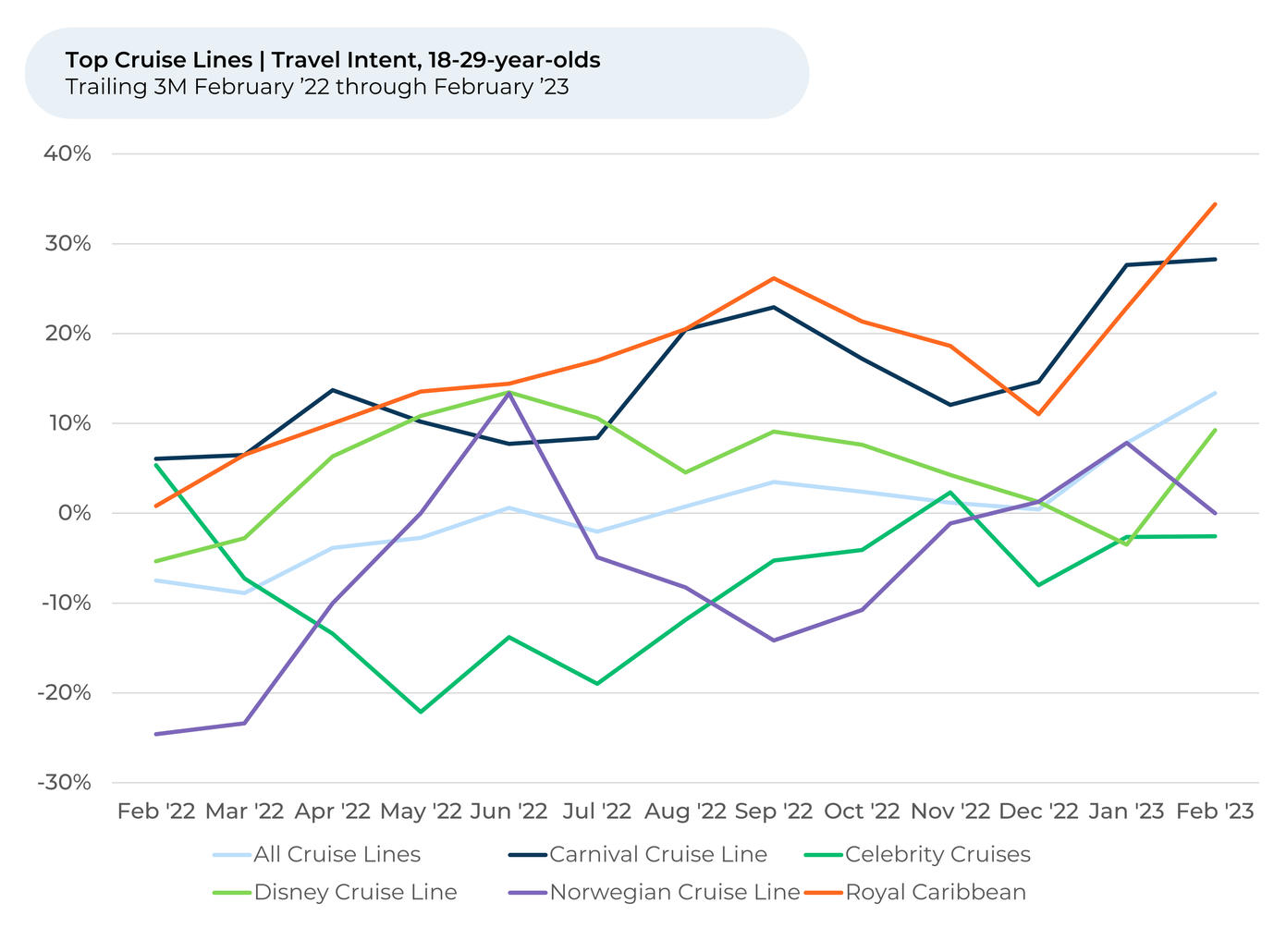

- Carnival Cruise Line and Royal Caribbean International seem to be scoring big with young adults as they heavily advertise spring break deals and activities.

We start by seeing how airlines are faring after poor weather and technology issues grounded flights during the holiday season. Delta, which came to the rescue of thousands of stranded travelers, continues to come out on top among the big airline companies. Its travel Intent increased 1% from January to February, building on the 2% increase from October to January.

Delta has enjoyed the highest Travel Intent among the biggest airlines since January. American, though sporting lower Travel Intent than most of its peers, actually has seen the biggest Travel Intent increase recently, moving up 5% since October.

Looking across the entire travel sector, the cruise industry is still the only travel industry that enjoys a positive Travel Intent. From February 2022 through February 2023, Travel Intent for the cruise industry increased by 19%, far more than any other travel sector.

The momentum doesn’t seem to be stopping. Travel Intent for the cruise industry increased by 2% over the past three months, while intent decreased for most other travel industries.

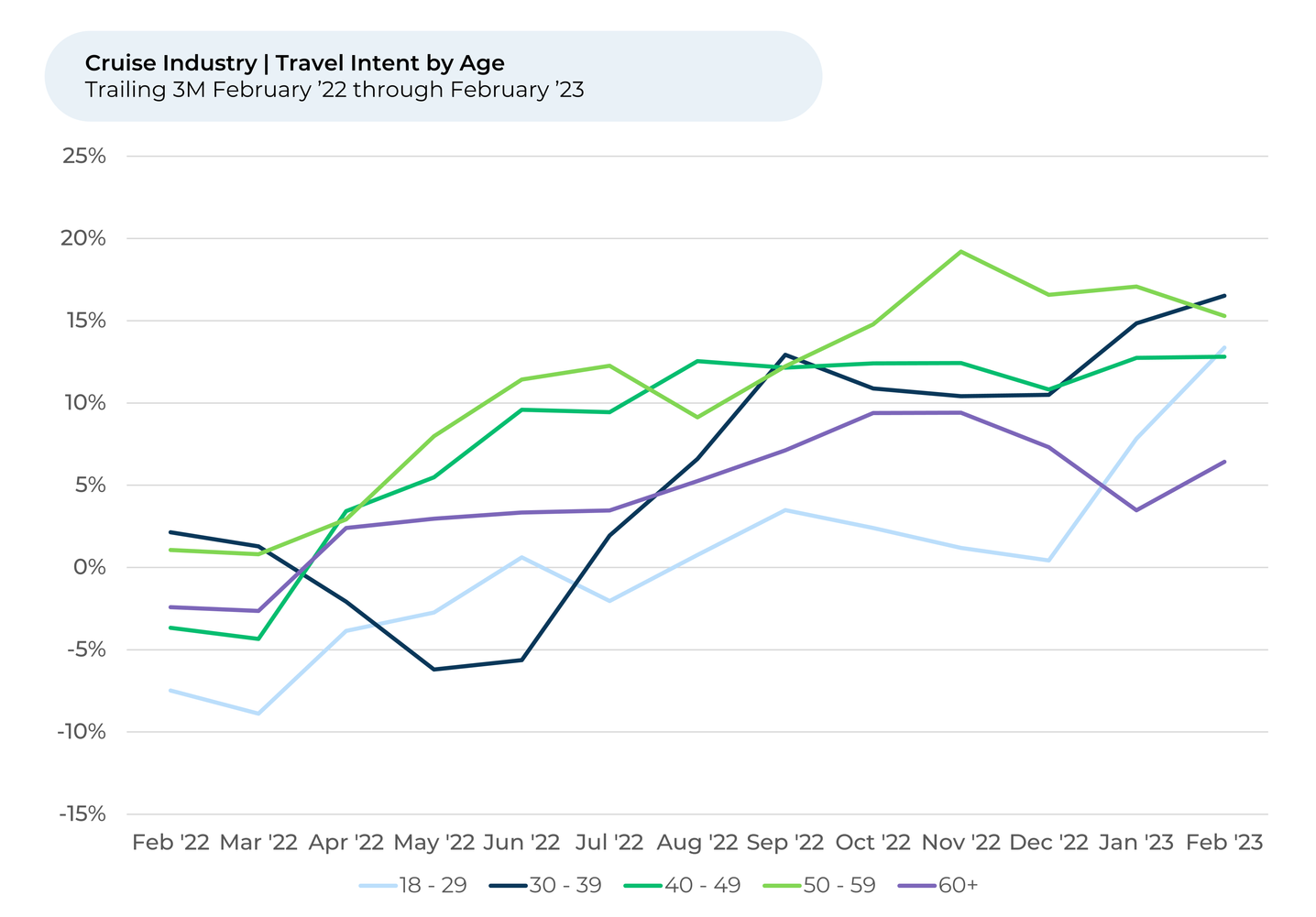

That recent increase, seen in the months preceding the Spring break season for U.S. colleges, is largely powered by young adults.

Travel Intent increased 12%, November through February, for 18–29-year-old would-be cruise-goers, far more than any other age group.

Looking at Travel Intent by income bracket, we find Travel Intent for both cruise lines and airlines increased the most for people in households making less than $25K per year. This shows strong alignment with the surge we saw for 18-29-year-olds, likely because studies have shown that income and age are correlated, with income typically rising along with age until around the age of 50. Said another way, there’s a reason ramen noodles are so closely associated with college students.

With college Spring breaks in March and April, it’s likely no coincidence that young adults had travel front of mind the past three months. By all accounts, the 2023 Spring break season will see a lot of people traveling, mostly to warm, coastal places.

Miami International Airport and George Bush Intercontinental Airport, among others, recently issued notices saying they expect record travel during this year’s Spring break season. Airline lobbying group Airlines for America is predicting 2.6 million people will travel a day in March and April, representing a 1% increase from 2019. The American Automobile Association (AAA) has predicted major increases in Spring break travelers compared to last year, with Debbie Haas, Vice President of Travel for AAA, noting “…AAA has seen very strong bookings for beach destinations, cruises, and attractions.”

Which Cruise Line to Book?

While Travel Intent is up with young adults for most major cruise lines, it increased most over the past three months for Carnival Cruise Line and Royal Caribbean International. Since November, Travel Intent climbed 16% with young adults for both cruise lines, slightly higher than the average of 12% across all cruise lines.

“Carnival is a very fun cruise to go on. All of the activities on the cruise have given me and my family great memories to remember,” one young adult Royal Caribbean traveler told HundredX.

Meanwhile, another young adult Royal Caribbean traveler recent said, “Love the activities and new ships.”

Entertainment and activities are important to younger cruiser travelers. Food and beverage and entertainment and activities are tied for the top reason why an 18-29-year-old feedback respondent likes or dislikes a cruise. Young adults like³ the entertainment and activities of Royal Caribbean the most of any other major cruise line, followed by those of Carnival.

Royal Caribbean and Carnival have been aggressively advertising Spring break travel deals and activities over the past few months. The efforts have seemingly paid off – cruise news site Cruise Hive noted Carnival is

expecting fully-booked ships in March and April.

HundredX will keep an eye on the cruise industry to see if these Spring break travel predictions hold true in the coming months.

- All metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. For cruises, it represents the percentage of customers who intend to take another trip with the brand in the next twelve months, minus those that do not.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article