From the Ring to the Octagon: Fan Insights

Following the news that World Wrestling Entertainment (WWE) and Ultimate Fighting Championship (UFC) will combine, HundredX dove into the data to learn from “The Crowd” how the businesses may complement one another.

Analyzing 45,000 pieces of feedback from real sports fans, February 2022 through February 2023, we find:

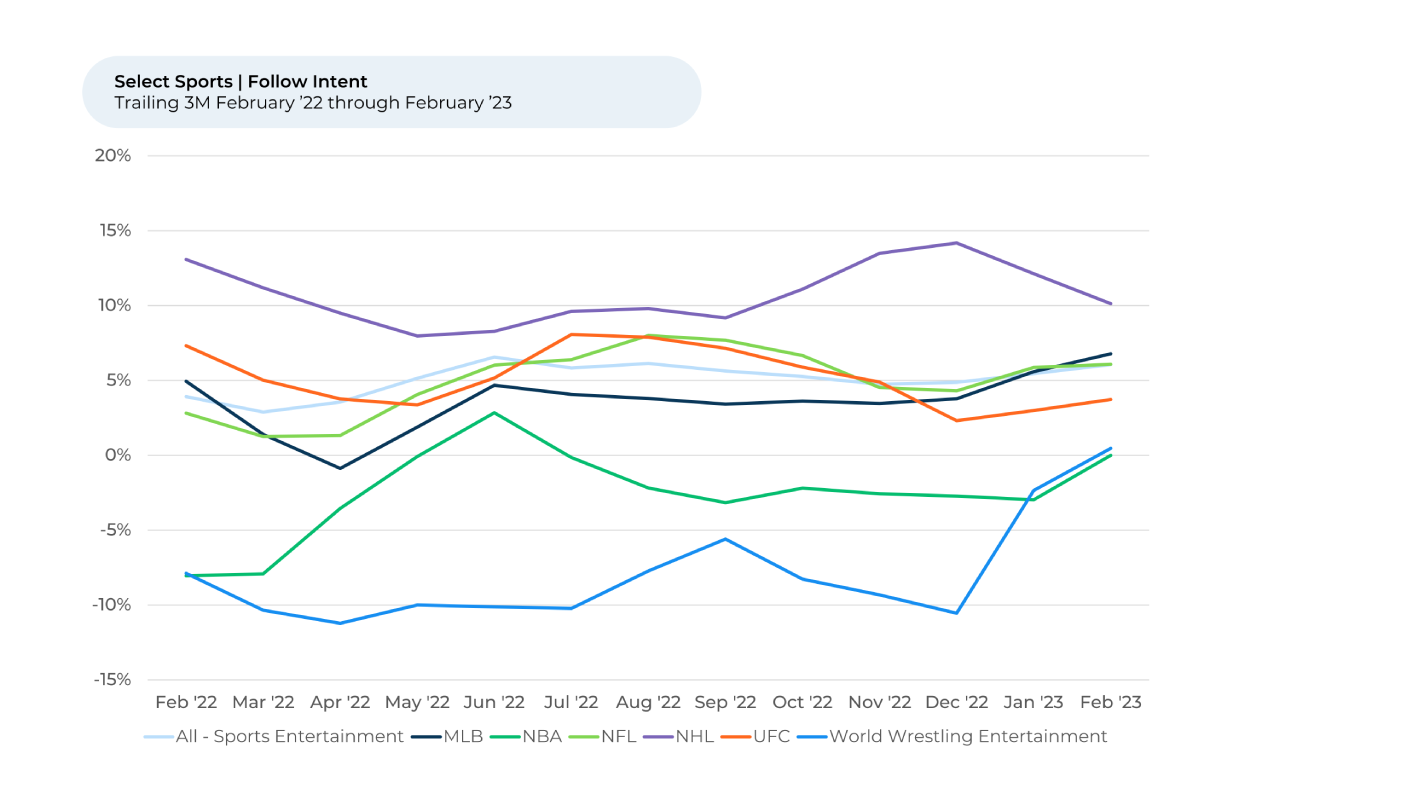

- The recent surge in WWE fans’ intent to follow (“Follow Intent”)¹,² and sentiment³ towards the sport would indicate it should financially benefit its new owners.

- The fan bases are very similar, with UFC’s skewing younger

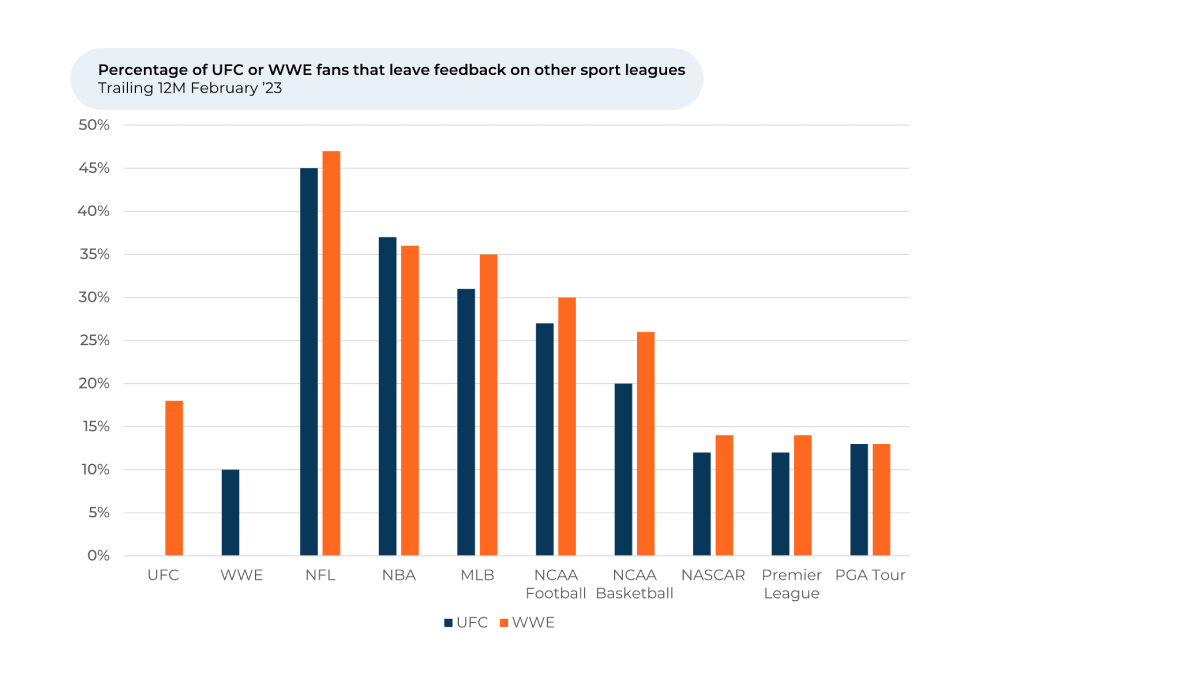

- The overlap⁴ in fans leaving feedback on UFC and WWE is lower than it is between UFC or WWE and other sport leagues, indicating there may be an opportunity to make more fans of each league become fans of the other. Both have the highest overlap with the NFL.

Follow Intent increased significantly for WWE over the past few months, as did sentiment towards almost every driver of fan satisfaction. WWE’s Follow Intent increased 11% from December to February, the largest gain for any sport during that time. Follow Intent for WWE is now the highest it’s been in over a year.

WWE’s recent Follow Intent leap seems to coincide with the return of WWE founder Vince McMahon as Chairman. He was unanimously voted to return in January following an internal investigation into accusations of misconduct. At the same time, WWE’s annual Royal Rumble event, held in January at the Alamodome in San Antonio, Texas, smashed previous viewership and ticket sale records by more than 50%.

Over the past year, WWE fans have felt happier about almost every aspect of the sports league. Notably, over the past few months in particular fans like the entertainment, action, and TV presentation of WWE far more (sentiment towards them all are +9% to +13% in the last six months). Each is top five drivers of fan satisfaction with sports entertainment.

“I love my male, adult soap opera,” one fan recently told HundredX. Another shared, “I have been watching WWE for years. Love the spin-off reality shows.”

The indicators from “The Crowd” of UFC fans are more mixed. Follow Intent fell sharply in 4Q 2022 before recovering some in the 1Q of this year. It remains ahead of WWE, though WWE narrowed the gap significantly. Over the last six months, the UFC’s lead over other sports in sentiment towards Entertainment and Athletes/Stars has fallen to parity and it now lags in TV Presentation and Live

Events/Games. It still retains a lead in Action, Commentators, and Drama.

Fan bases are similar, with UFC’s skewing younger

Based on the mix of feedback volumes, UFC fans skew a little younger. 31% of the feedback to HundredX on UFC came from fans 18-29 years old vs. 20% for WWE. They have very similar representation from 30–39-year-olds while 54% of WWE’s feedback was from fans 40 and older vs. 42% for UFC. In terms of household income, the fan bases look very similar, with each league within a few percent of the other for each income range.

In terms of growth potential and loyalty, both leagues are strongest with 18-29 year olds. The net percentage of fans looking to follow the sport more is 13% for UFC and 15% for WWE as of February. This is far ahead of the -5% to +5% range for the other age groups across both leagues.

Both WWE and UFC fans like the action, drama, and commentators of the sports more than the average sport. This isn’t surprising: the leagues are known for their dramatic one-on-one fights and rivalries as well as their heavy-hitting action, both real and staged.

A UFC fan recently said, “UFC is good for people that like fighting and like getting entertainment by it.” Another fan said, “The most exciting sport to watch. Anything can happen at any moment and that makes it must watch TV.”

Opportunity to make more UFC and WWE fans of both sports?

WWE and UFC fans also seem to like football. About 50% of fans from either league have also left feedback on the NFL, which is about 40% more than the average respondent. NFL Follow Intent among WWE fans is 6% higher than compared to the Follow Intent of the rest of The Crowd. It’s 3% higher for UFC fans.

Interesting, only 18% of WWE fans leave feedback on UFC, while 10% of UFC fans leave feedback on WWE. That’s still more than the average respondent, but fans of these brands leave far more feedback on most other sport leagues. This implies there’s some overlap in fans, although it’s less significant than the overlap between, say, UFC and NASCAR, or UFC and almost any other sport.

Given they appeal to similar demographics, it appears there may be an opportunity for the owner of both leagues to more aggressively cross-promote the leagues so there are more fans of both leagues in the future.

- All metrics presented, including Net Follow Intent (Follow Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Follow Intent is the percentage of customers who expect to follow a sport more over the next 12 months, minus the percentage of customers who expect to follow it less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- HundredX evaluated overlap on a trailing twelve-month basis.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article