Will Rising Prices Inhibit Leaders' RTO plans?

The Latest Insights from the Crowd - Rob Pace, CEO of HundredX

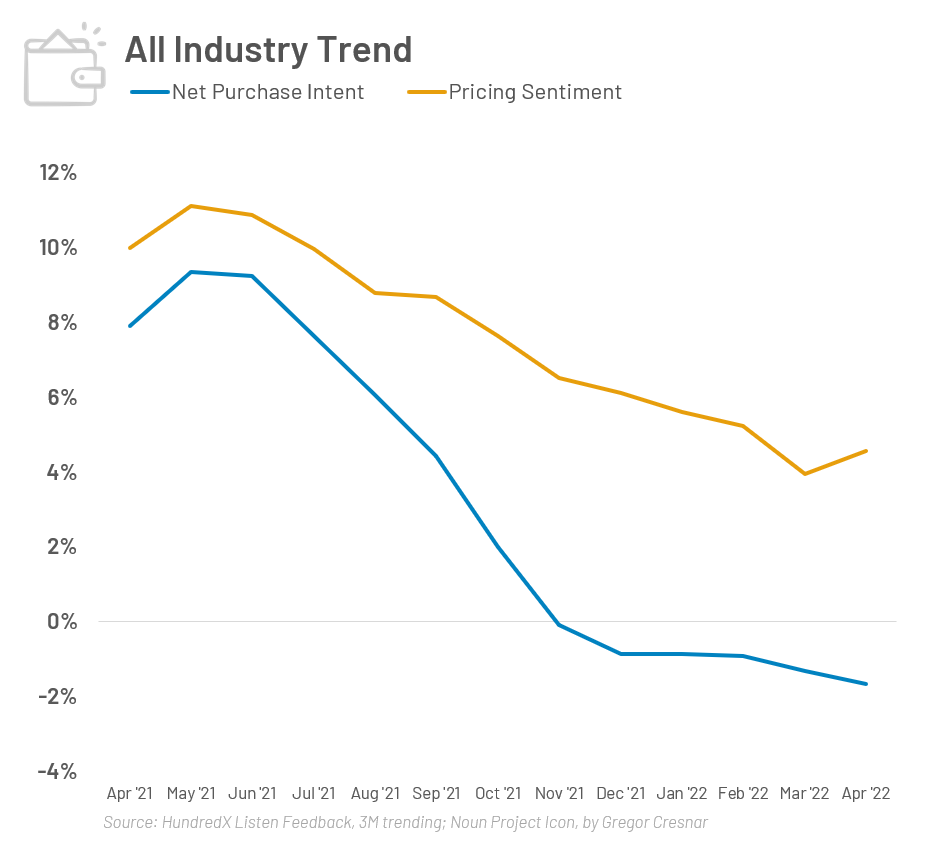

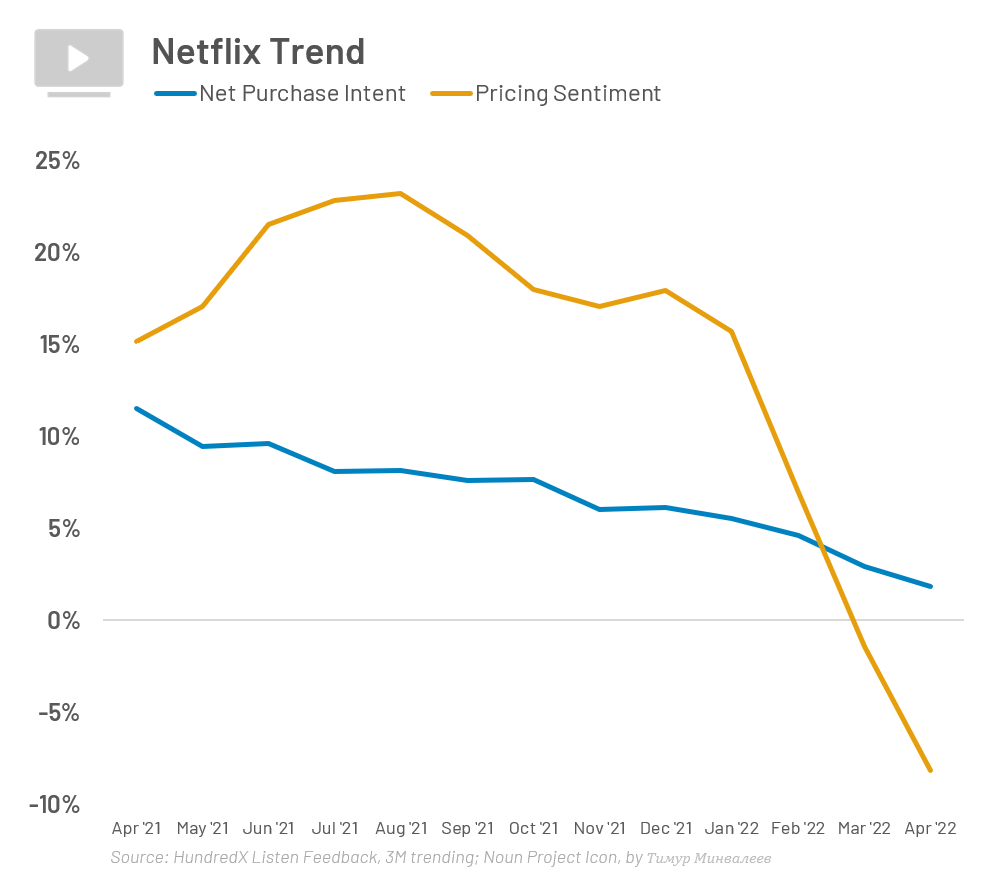

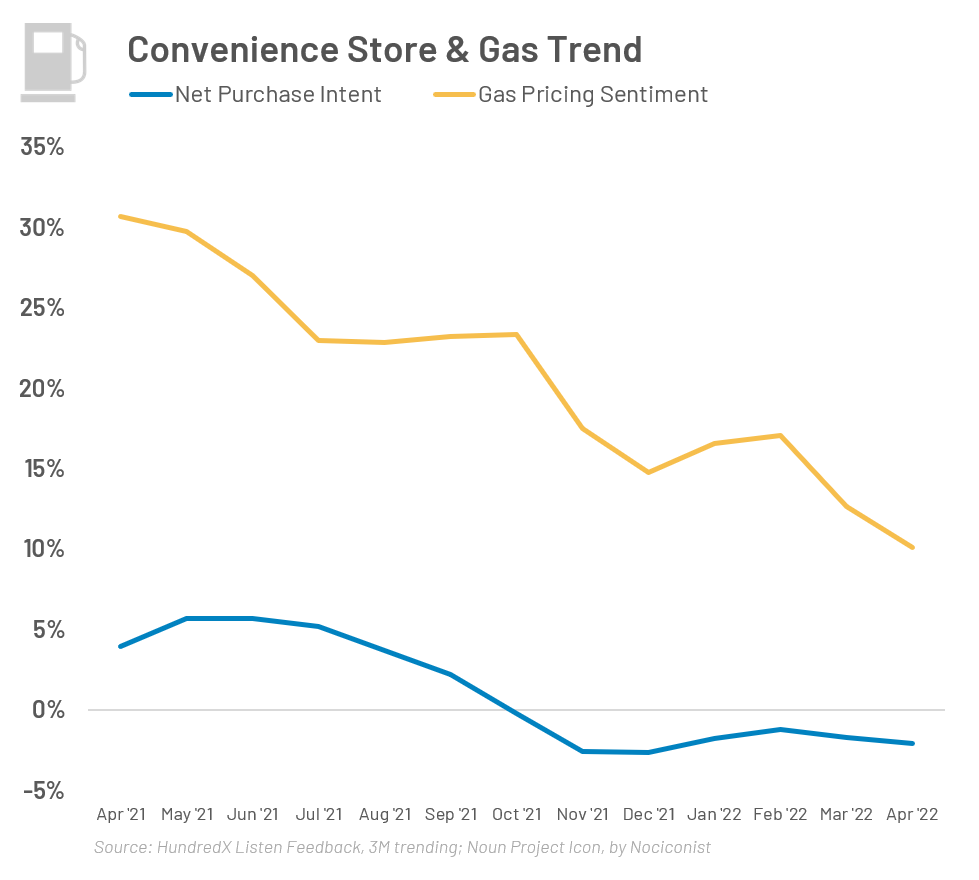

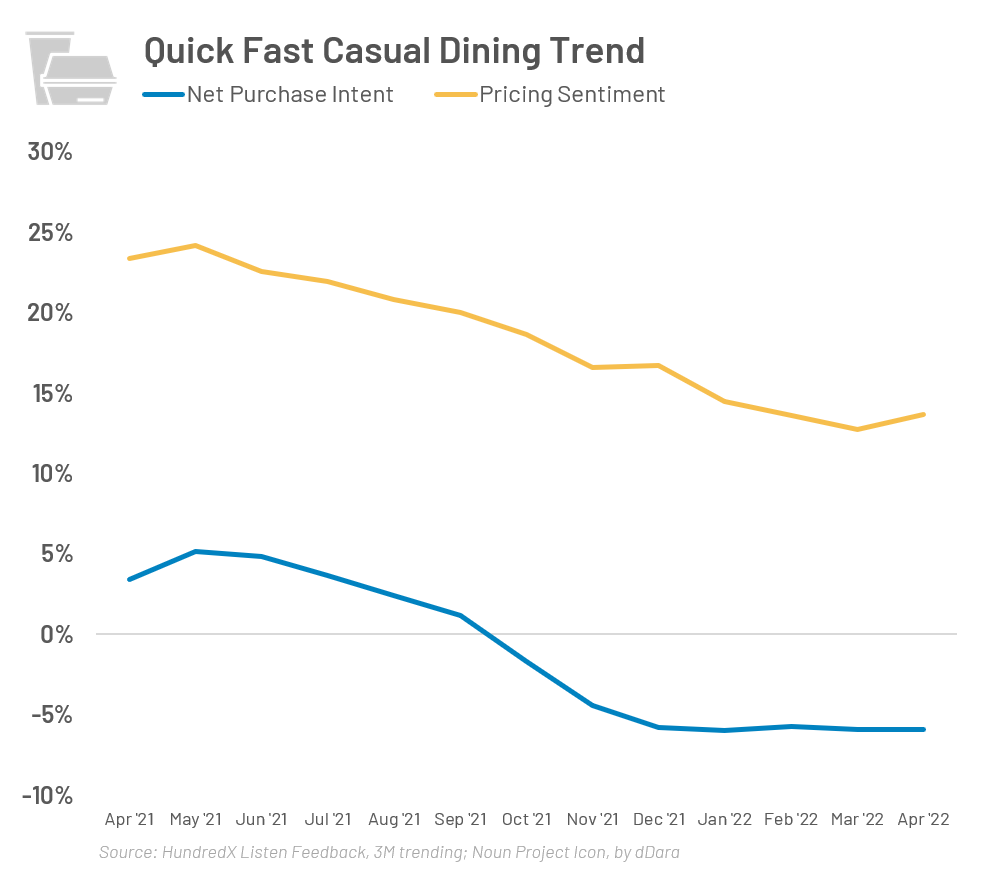

On the topic of leadership strategies, the discussion around employees’ return-to-office (RTO) is especially pertinent. Recently, the FT posed an interesting questio n - will rising food and gas prices impact the pace of employees’ return to office? It’s a compelling question that hasn’t been high in the mix of the top considerations for CEOs as they formulate their return to office plans. Examining our customer experience data, we think the FT is likely onto something here. As shown in the chart below, not surprisingly, across-the-board we see the impact of price impacting consumers’ decisions. This trend has rapidly accelerated over the past six months suggesting consumers are no longer feeling as confident with their financial outlook as they were during the early stages of the pandemic given unprecedented levels of government assistance.

Learn more about HundredX and our solutions by requesting a demo.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

Share This Article