Winning at Coffee: The Coffee Chains Powering America's Workforce

America may run on coffee, but as inflationary pressures persist, coffee chains are navigating new challenges to keep operations brewing.

It's clear coffee continues to power the American workforce. But what powers these coffee chains today? As part of our regular

coverage of the Restaurant industry

and following Starbucks Investor Day, we leverage our insights from “The Crowd” ― real coffee-drinking customers who share

immediate feedback with HundredX

― to understand the changing demands on coffee chains and who is handling them best. Leveraging HundredX’s proprietary listening methodology, we evaluate more than 38,000 pieces of feedback going back to January 2021. Feedback is provided from direct customer experiences at 11 major coffee chains across the country for insight into consumers’ future purchase intent, drivers behind intent changes, and customer satisfaction (CSAT).

Recent Indicators from "The Crowd"

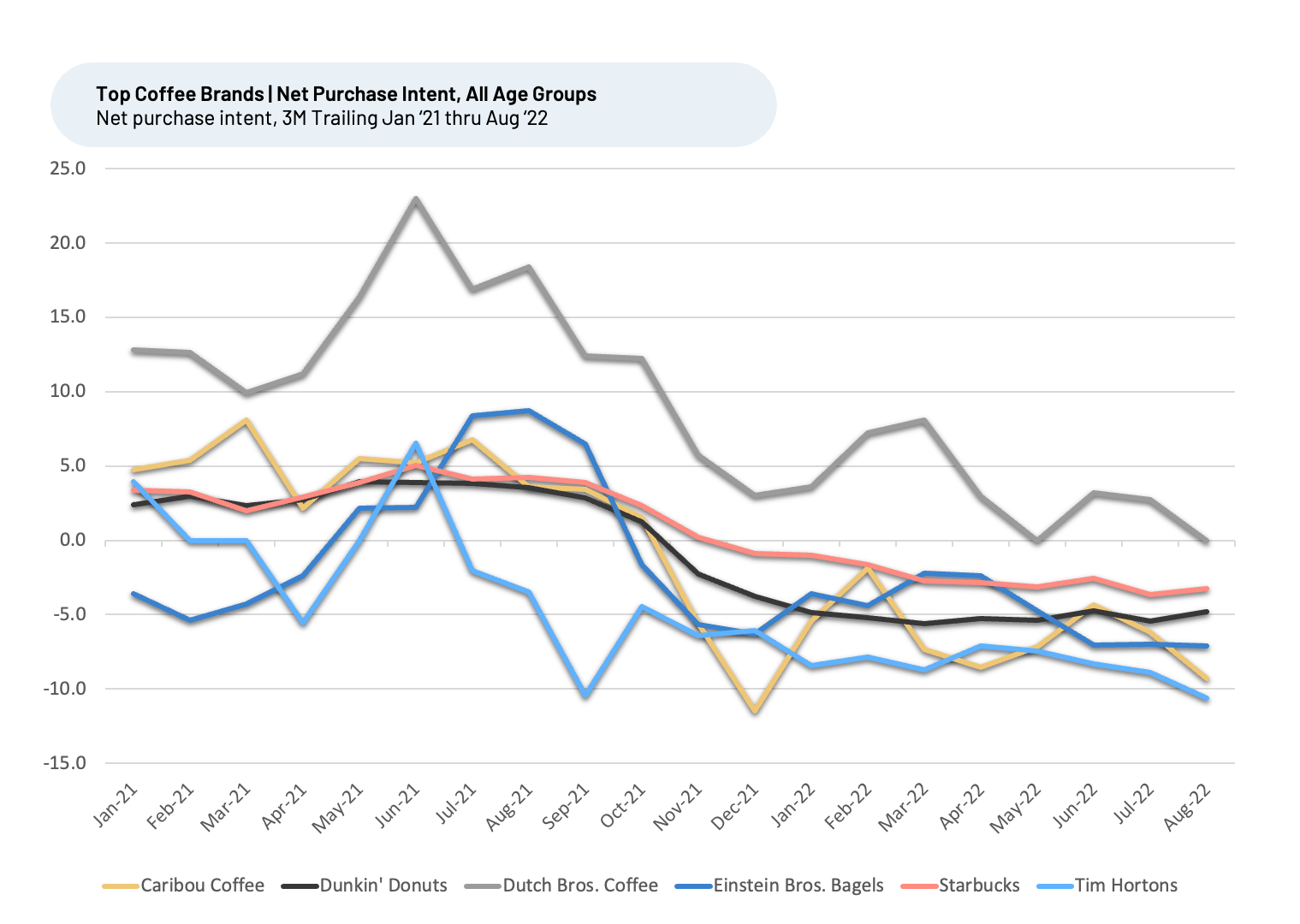

HundredX data and analysis shows that demand growth for the major chains will likely continue softening, with inflation being the most likely culprit, though price sensitivity is not eroding nearly as dramatically as across many other dining and retail industries. After dropping significantly from summer 2021 into winter 2021, trailing three months (T3M) Future Net Purchase Intent (NPI) remains negative, declining very slowly most of this year through August 2022 for pure-play coffee chains (primarily market coffee and breakfast items). NPI reflects the percentage of customers that plan to visit coffee stores more over the next twelve months minus the percentage that plan to visit less.

Starbucks‘ NPI dropped from 4% for T3M August 2021 to -1% for T3M January 2022, and to -3% for T3M August 2022 . Starbucks’ growth in U.S. same-store sales visits slowed from 12% vs. the prior year for the quarter ended January 2, 2022, to 5% for the quarter ended April 3, 2022, to 1% for the quarter ended July 3, 2022.

Dutch Bros., the Oregon-based chain with more than 600 stores across the U.S., has enjoyed the strongest NPI, but it has also seen a drop, from 18% for T3M August 2021 to 4% for T3M January 2022, to 0% for T3M August 2022. Dutch Bros. reported systemwide same-store sales growth drop from 10% for the quarter ended December 2021 to 6% for the quarter ending March 2022, and -3% for the quarter ended June 2022 .

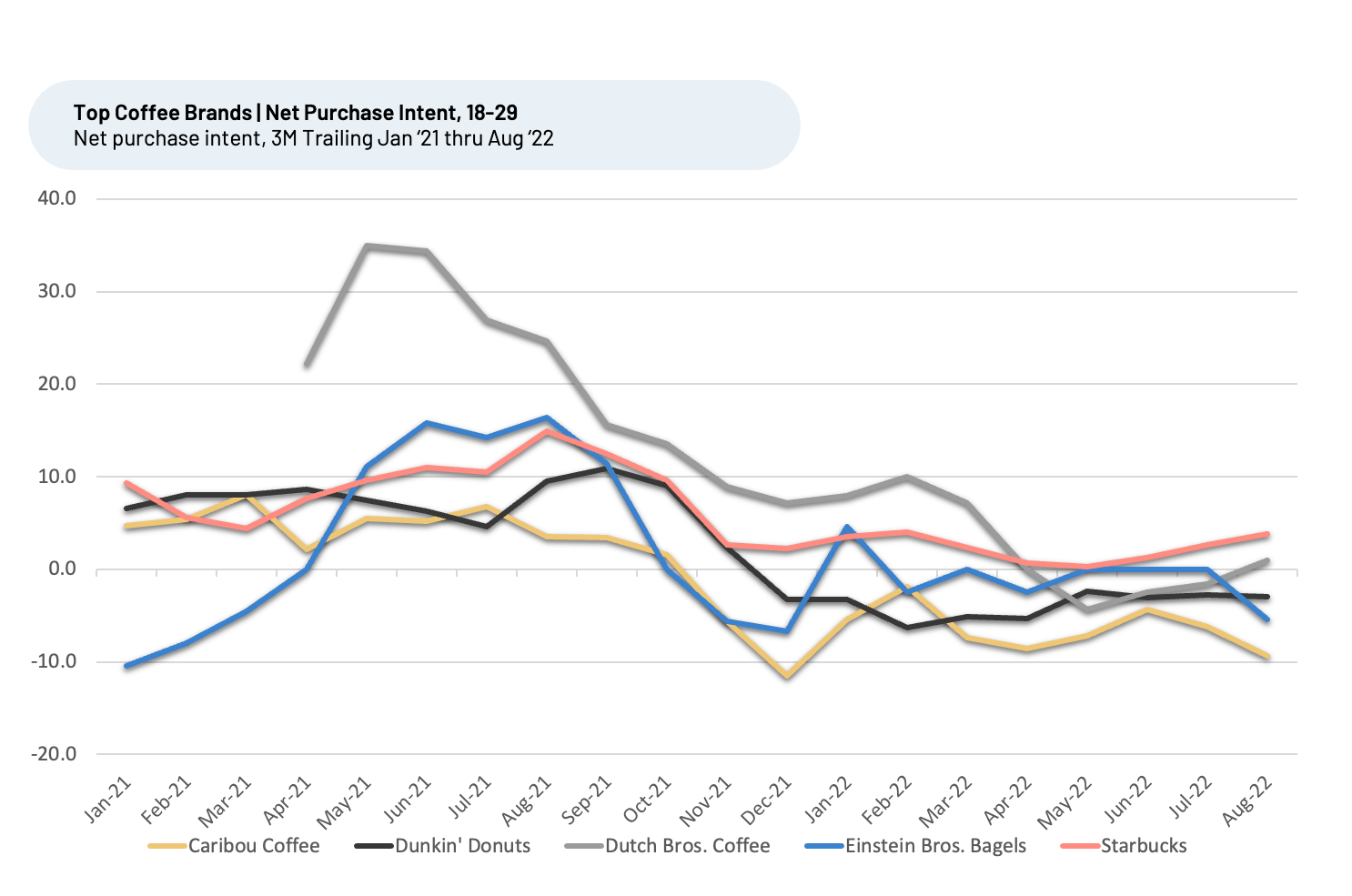

When looking at NPI, it’s worth noting that, while Starbucks, a mega-brand with more than 15,000 thousand U.S. locations, falls in the middle of the NPI pack and is negative in terms of NPI when looking across all age groups, it’s the winner among 18- to 29-year-olds. When looking at this cohort, Starbucks boasts an NPI of +4% for T3M August 2022, compared to an NPI of -3% across all age groups.

During

Starbucks’ Q3 2022 earnings call

, outgoing CEO Howard Schultz noted the brand remains popular among Gen-Z (age 10-25) consumers, who share pictures and videos on social media offering tips on how to best customize the chain’s cold drinks. Cold beverages accounted for 75% of Starbucks’ sales in Q3. To capture more Gen-Z consumers, Starbucks announced on Sept. 12 that it would soon pair its popular rewards program with an NFT platform, allowing customers to use loyalty points to purchase digital assets.

A Winning Formula for Coffee Chains

Dutch Bros. and Starbucks stand out, having the strongest NPIs, maintaining their lead over the peers we evaluate. We look to understand why these brands beat the competition with respect to customer intent to visit more, digging into specific purchase intent drivers to uncover “the why behind the buy." Our analysis indicates coffee chains with the best Customer Satisfaction (CSAT) tend to do a better job than the peer group at delighting customers on Taste, Price, and Speed.

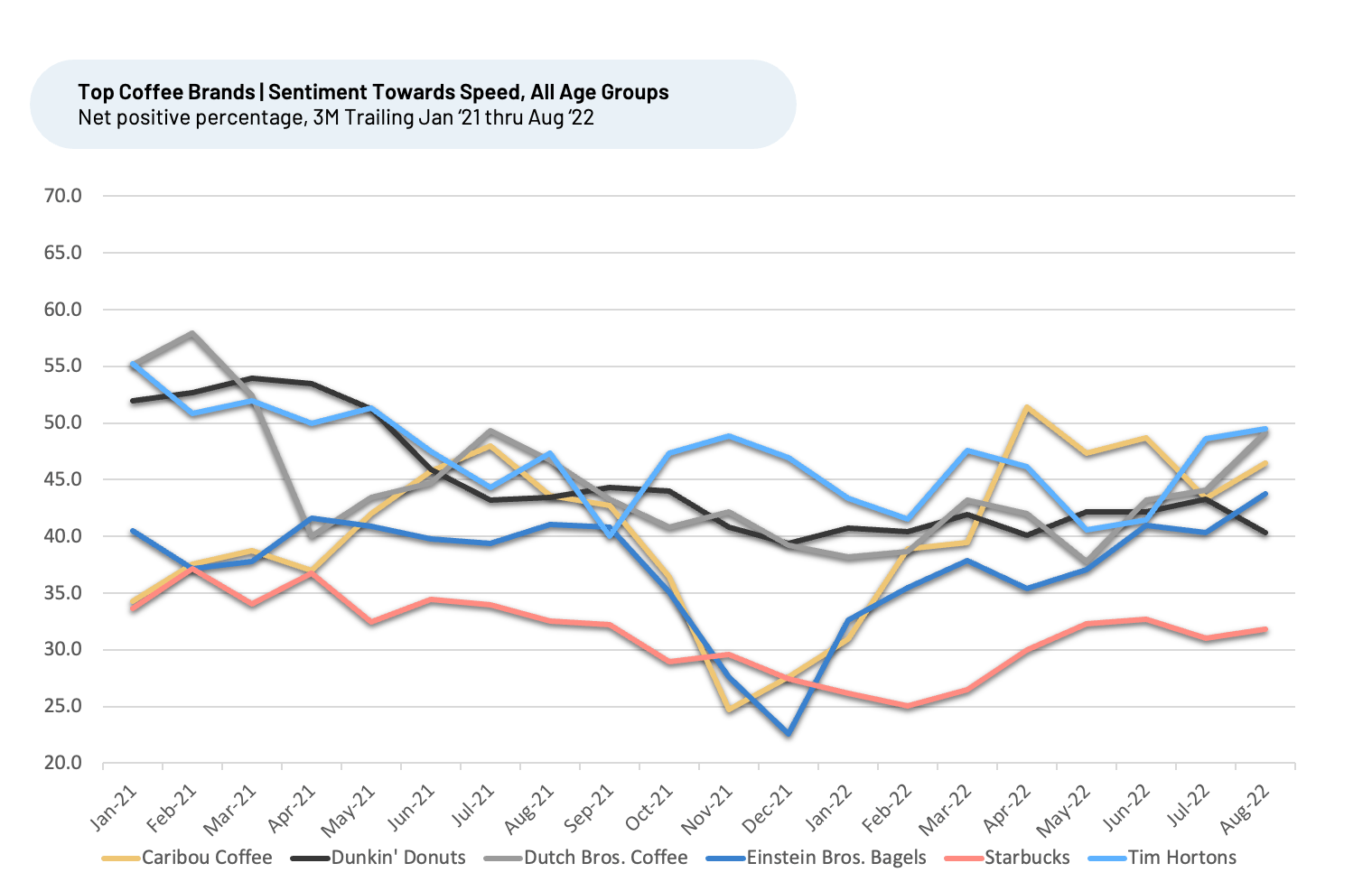

Speed

Tim Hortons, the Canadian coffee chain with about 5,000 locations worldwide, and Dutch Bros. are winning with customers in terms of sentiment toward “Speed.” Sentiment is measured using Net Positive Percentages (NPP), which represents the percentage of customers who view a factor as a positive (reason they liked the products, people, or experience) minus the percentage who see the same factor as a negative. For T3M August 2022, both had NPPs of 50%, well ahead of the coffee group’s 36% average.

Tim Hortons and its parent company RBI have prioritized speed recently, partnering with technology-vendor Verifone to roll out remote, contactless payment stations for drive-through lanes. The new digital experience, introduced to

Tim Hortons and Burger King brands in 2020

, is speeding up the drive-through experience, according to RBI.

During an earnings update earlier this year, RBI announced Tim Hortons’ 2021 annual

sales remained about pre-pandemic levels

, as more people return to the office and stop at the company’s drive-thru stations for their coffee fix.

Meanwhile, Dutch Bros. has long-listed speed as one of its core values, alongside quality and excellent customer service. The company is known for its efficient drive-thru experiences.

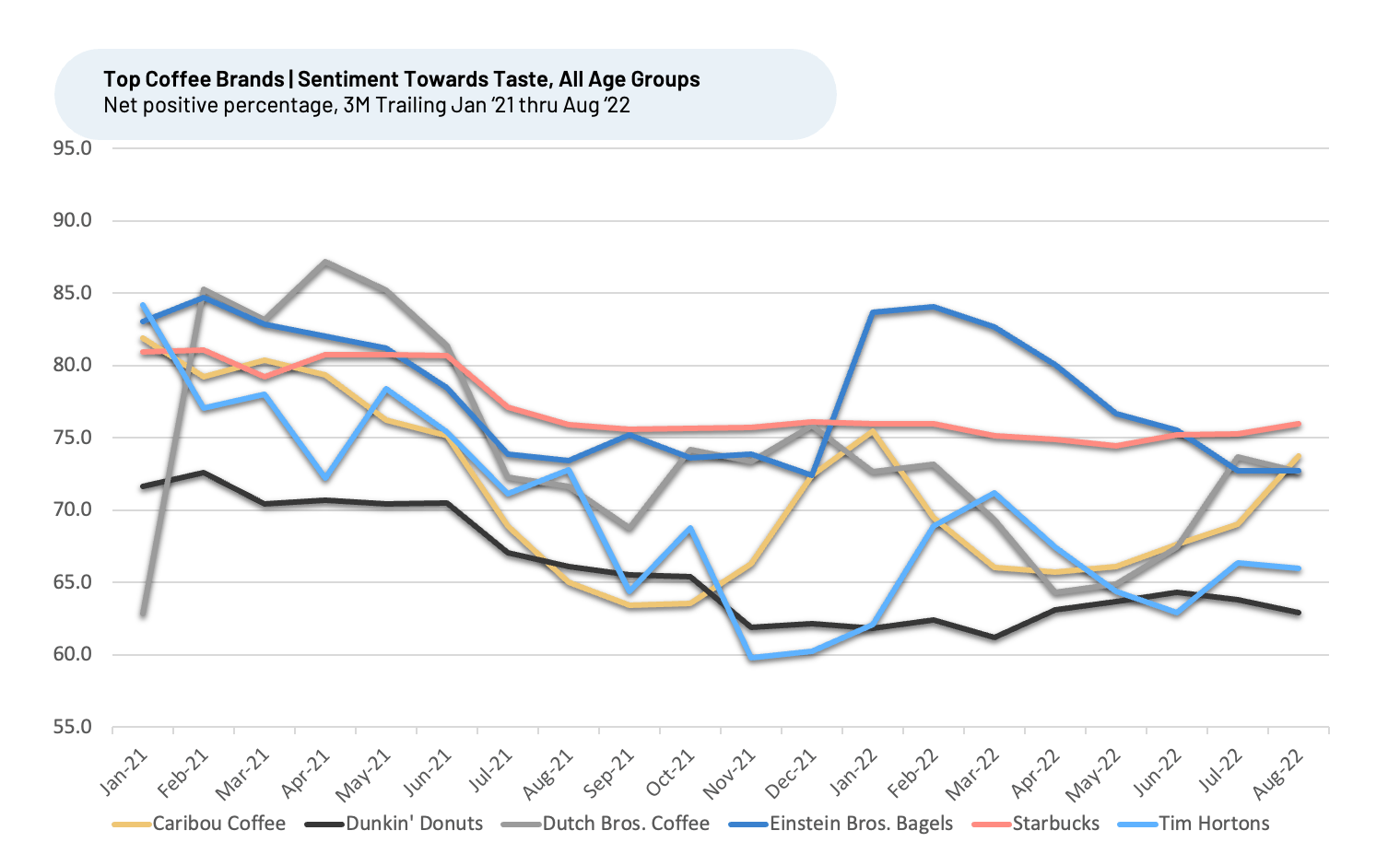

Taste

Regarding “Taste” Customer Satisfaction, Starbucks consistently remains near the top. NPP for T3M August 2022 was 76% vs. the peer group average of 74%. A quick look at food critic and influencer reviews of Starbucks products shows why ― Starbucks just tastes good. Indeed, comments provided to HundredX say the same:“A favorite go-to place for great quality coffee, both hot and cold,” one consumer told HundredX. Another said, “Delicious coffee in the morning!”

Also notable is the significant ground Caribou Coffee made up recently, rising from one of the weakest in Taste, with a 66% NPP in T3M March 2022 to reaching parity with the group, hitting a 74% NPP in T3M August 2022. Recent customer comments to HundredX indicate that Caribou’s investment in flavors is paying off. One recently said, “As an avid coffee drinker, I love to try new flavors and places ― while this one is not in my area, I love to frequent it when we are around one!”

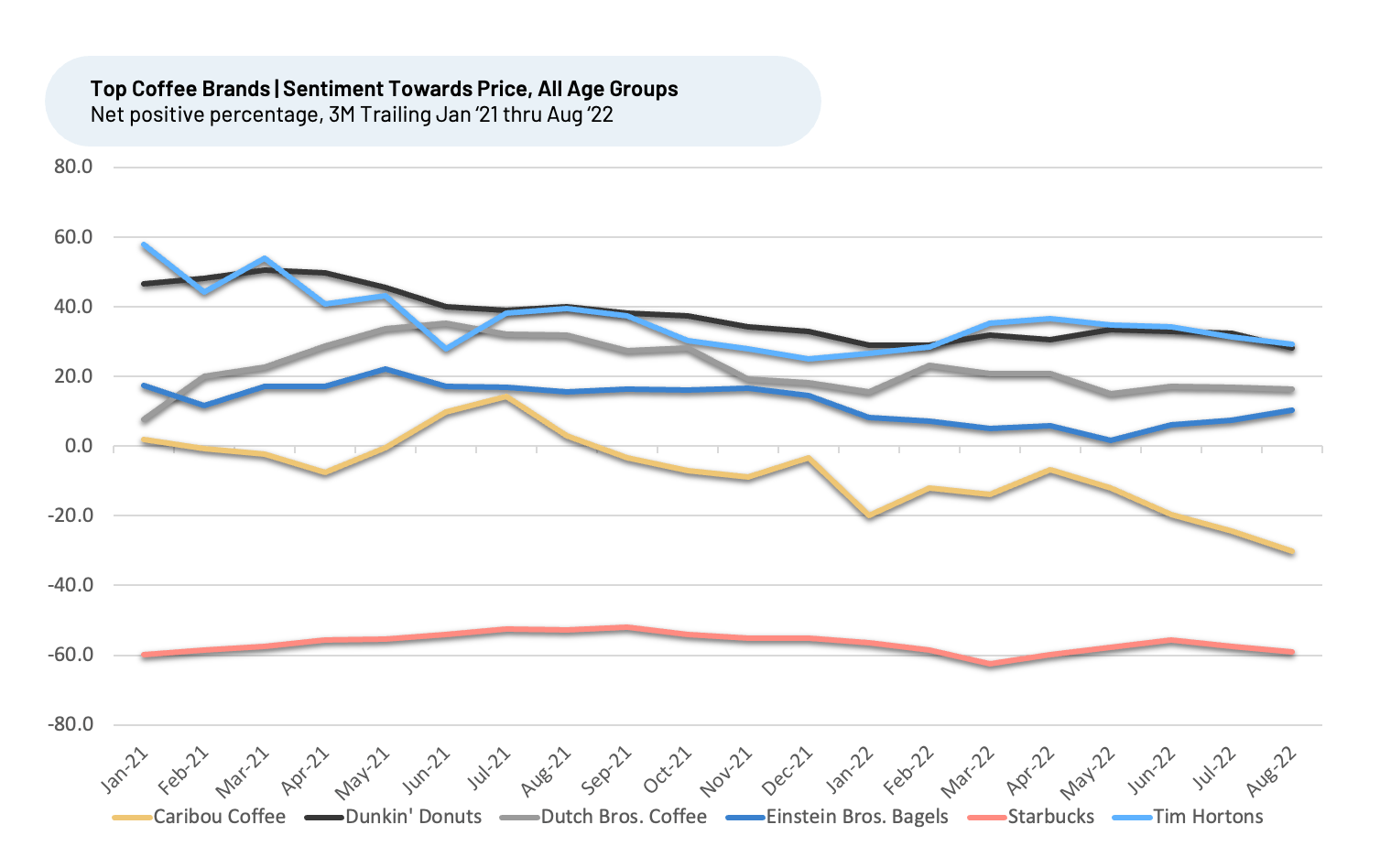

Price

Sentiment toward “Price” has been slowly and steadily eroding for all, including leaders Tim Hortons and Dunkin Donuts, which both posted a 29% NPP for T3M August 2022, well ahead of the peer average -42%. The impact of inflation and price increases has concerned many industry executives, with the CEO of Dutch Bros. expressing concern on its 1Q 2022 earnings call.

Dunkin’ Donuts and Tim Hortons offer similarly low-priced coffees, donuts, and breakfast sandwiches compared to their peers. Since January 2021, this sentiment has remained stable among the Crowd ― despite price increases at both chains. “Coffee prices are good,” one person said to HundredX. Although, they said, “Donut prices are a little high.”

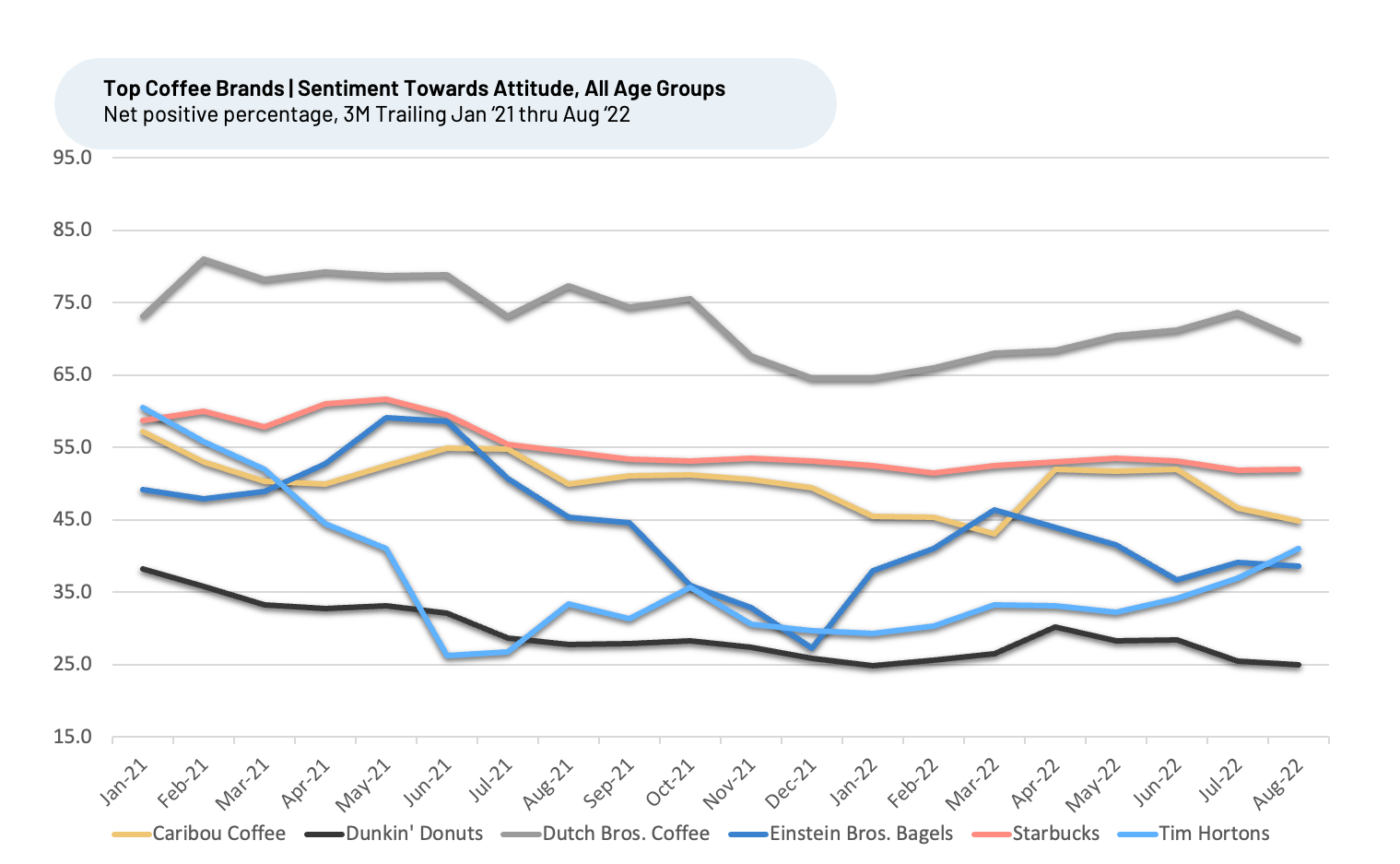

Attitude

While associate “Attitude” is not among the top-three drivers of Customer Satisfaction, we take a closer look, given it’s the fifth most selected driver out of 16, and likely to remain in focus and potentially become a bigger differentiator during coming months, as the entire industry deals with labor shortages. Associate training and retention were major topics at Starbucks’ analyst day.

Dutch Bros. has been the consistent leader in customer sentiment towards “Attitude” since January 2021, with T3M August 2022 NPP of 70% vs. the peer average of 51%. One happy customer told HundredX, “Everyone working there is positive and outgoing. They ask questions about you, your day, where you're from, etc. Looks like a fun place to work, and they have a great product.”

The landscape for selling coffee continues to evolve. Inflation and labor shortages will likely give way to new challenges over time, but we remain confident the changes in the ways we see everyday consumers want to order and consume their coffee are probably here to stay. Coffee chains that invest in taste and speed, along with managing associate attitude well will not only retain customers loyalty but put themselves in a better position to gain market share.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on the metrics for Coffee Chains, Restaurants, and any of our 75+ industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact

Share This Article