Winning at Convenience: The C-Stores Delighting Customers

When Americans adjust their driving habits, in-store convenience store sales decline.

According to the National Association of Convenience Stores (NACS) Q3 Pulse Survey, 59% of convenience retailers say customer traffic decreased in-store over the past three months. While convenience stores (C-stores) sell an estimated 80% of fuel purchased in the United States, they rely on in-store sales, not fuel sales, to drive profits.

Recent data from HundredX shows many, if not all, retailers will feel the dip in sales at the pump, while also revealing not all retailers will feel a dip with in-store sales as much as their C-store peers. According to “The Crowd” – that is, real C-store customers who share feedback with HundredX – specific retailers in the C-store space are outperforming the competition with a winning formula for in-store sales that appears to defy inflationary pressures.

Indicators from the Crowd

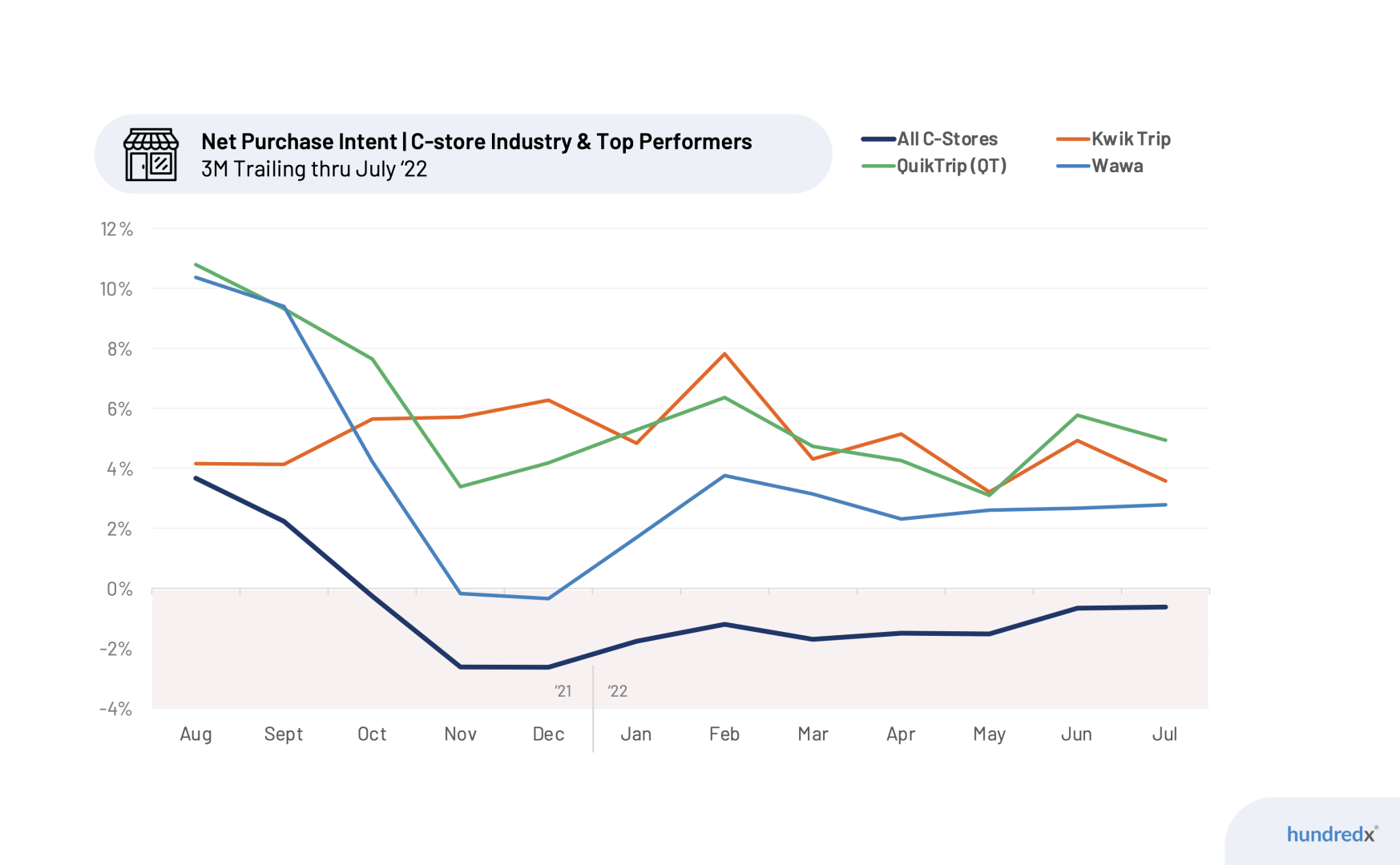

In August 2021, according to Net Purchase Intent (NPI) data, the Crowd indicated an impending drop in C-Store sales on the horizon. This downturn continued until leveling out in early 2022. NPI reflects the percentage of customers who plan to purchase more at a C-Store over the next 12 months minus the percentage that plan to buy less. During that same period, IRI transactional data for Grocery, Convenience, Drug Store, and Mass (Sam’s Club, Target, etc.) sales were directionally consistent with what the crowd shared. After C-Store growth outpaced the broader Retail Market in Q3 2021, C-Store sales growth dropped to 5% YoY in Q4 2021 vs. 6% for broader Retail and slowed further to 2% vs. 6% for broader Retail in Q1 2022. HundredX NPI data correlated with a slowdown in C-Store sales growth vs. these other categories.

- For the trailing three months ended (T3M) July 2022, QuickTrip had an NPI of 5%. QuickTrip has 900 locations operating in the Midwestern, Southern, and Southeastern United States.

- For T3M July 2022, KwikTrip had an NPI of 4%. Kwik Trip has 800 locations throughout Wisconsin and Minnesota as well as their locations in Iowa and Illinois that operate as Kwik Star locations (named as such to avoid confusion with QuikTrip locations in the same states).

- For T3M July 2022, Wawa had an NPI of 3% Wawa has 970+ locations throughout the Mid-Atlantic states and Florida.

We looked to understand why these retailers appear to be outpacing the competition, meaning their customers continuing to indicate an intent to spend more despite consumers in general tightening budgets as U.S. Consumer Sentiment fell to an all-time low in June. We looked at specific purchase intent drivers to uncover “the why behind the buy” shared by real customers of these top performers.

A Winning Formula for In-Store Sales

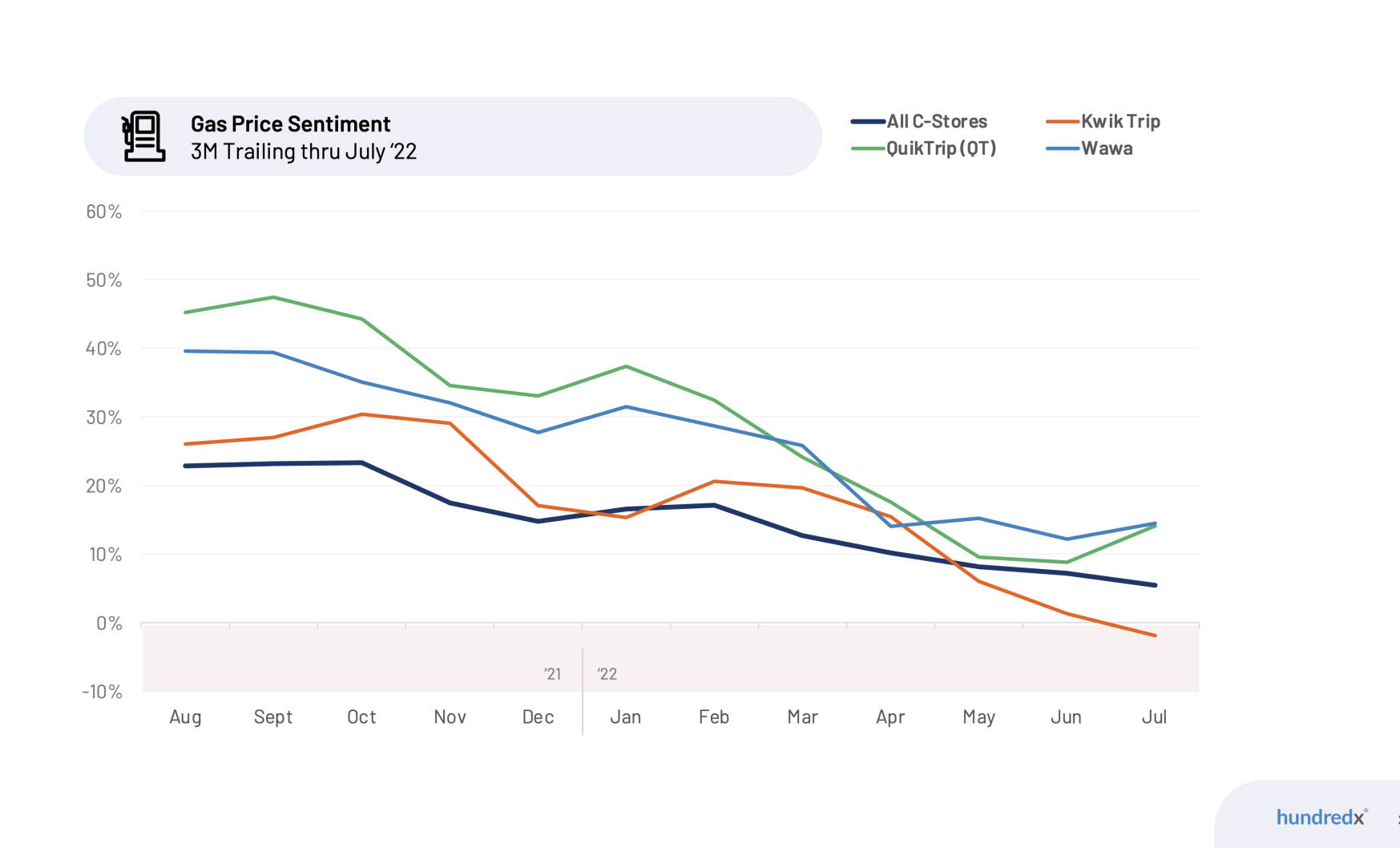

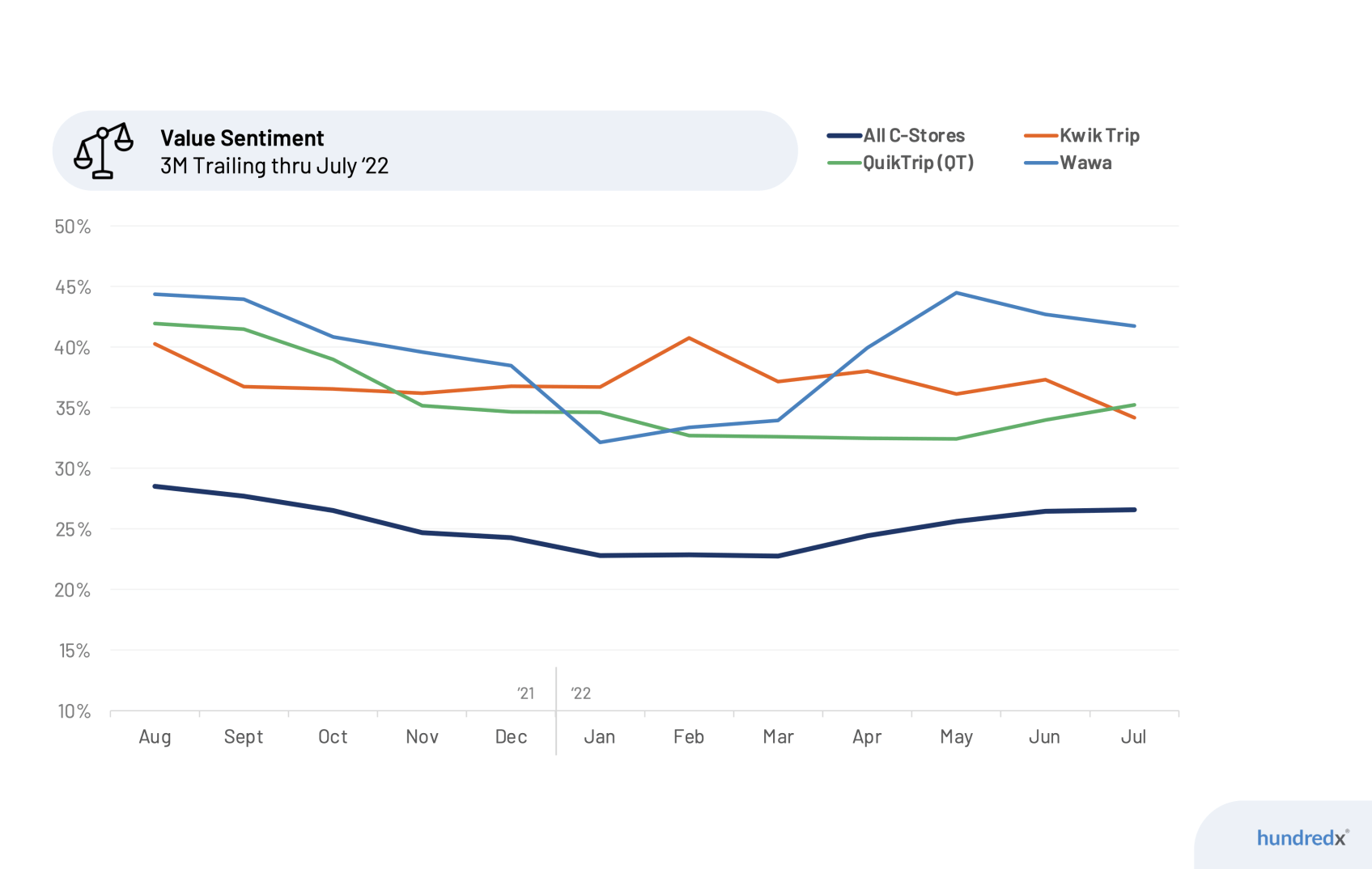

Sentiment towards “Gas Prices” among QuikTrip, Kwik Trip, and Wawa continues to decline in line with the industry average. However, our analysis of CSAT drivers indicates they most likely have customers who want to spend more despite high gas prices because these retailers do a better job than the broader industry at delighting their customers with respect to Food, Cleanliness, Attitude, and Value. Sentiment is measured using Net Positive Percentages (NPP) which represents the percentage of customers who view a factor as a positive (reason they liked the products, people, or experience) minus the percentage who see the same factor as a negative.

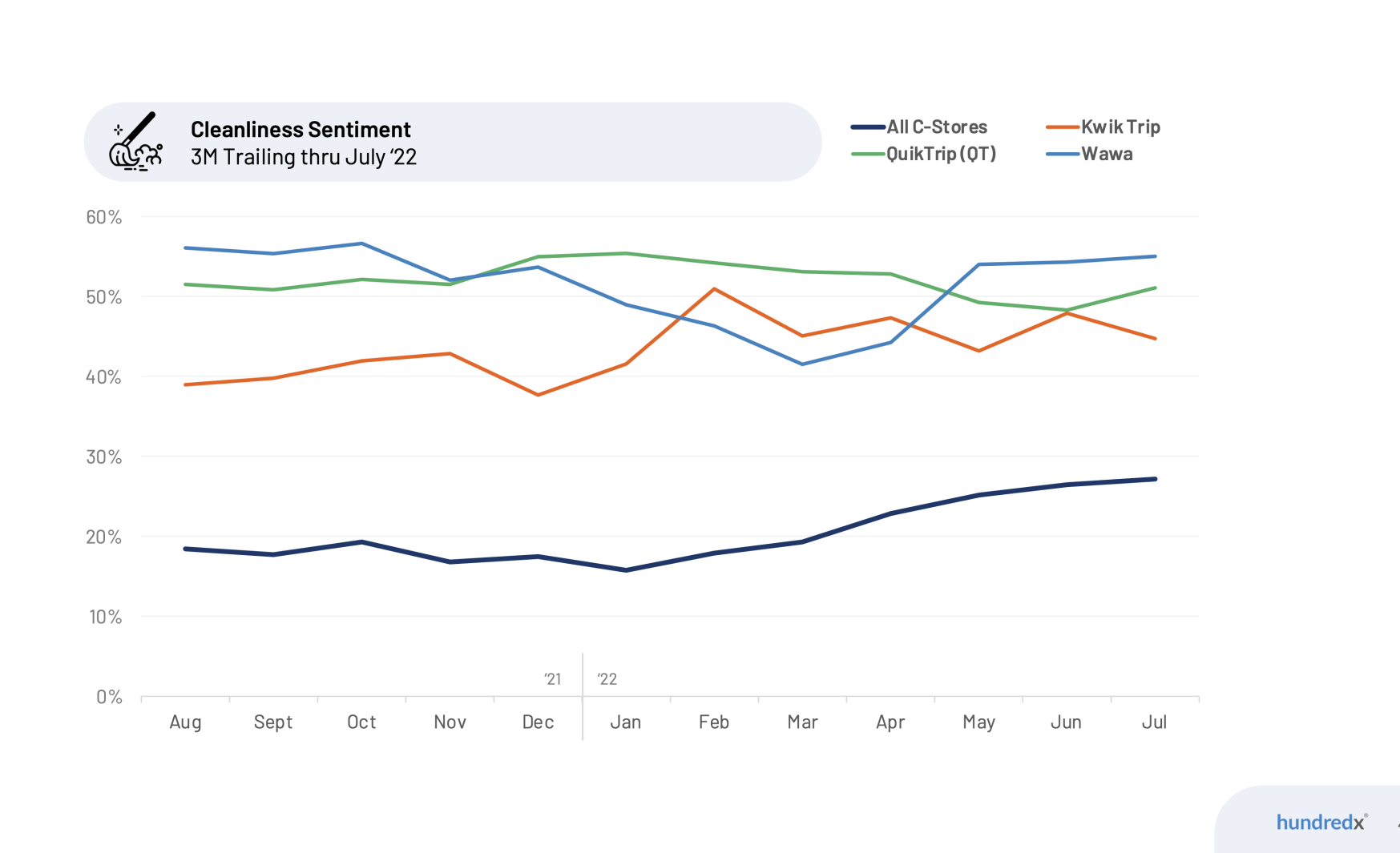

Cleanliness

While Wawa leads in ‘Cleanliness’ Customer Satisfaction, QuikTrip (QT) is consistently a strong performer with a 51% NPP T3M July 2022 and 50%+ in 8 out of the last 12 months. QuikTrip (QT) consistently treats ‘Cleanliness’ as an integral part of their Customers’ Experience – and the Crowd has noticed. One customer told HundredX, “We stop at a lot of QTs when we travel. Just appreciate the cleanliness of the stores and the variety of items. Staff are always friendly and will help.”

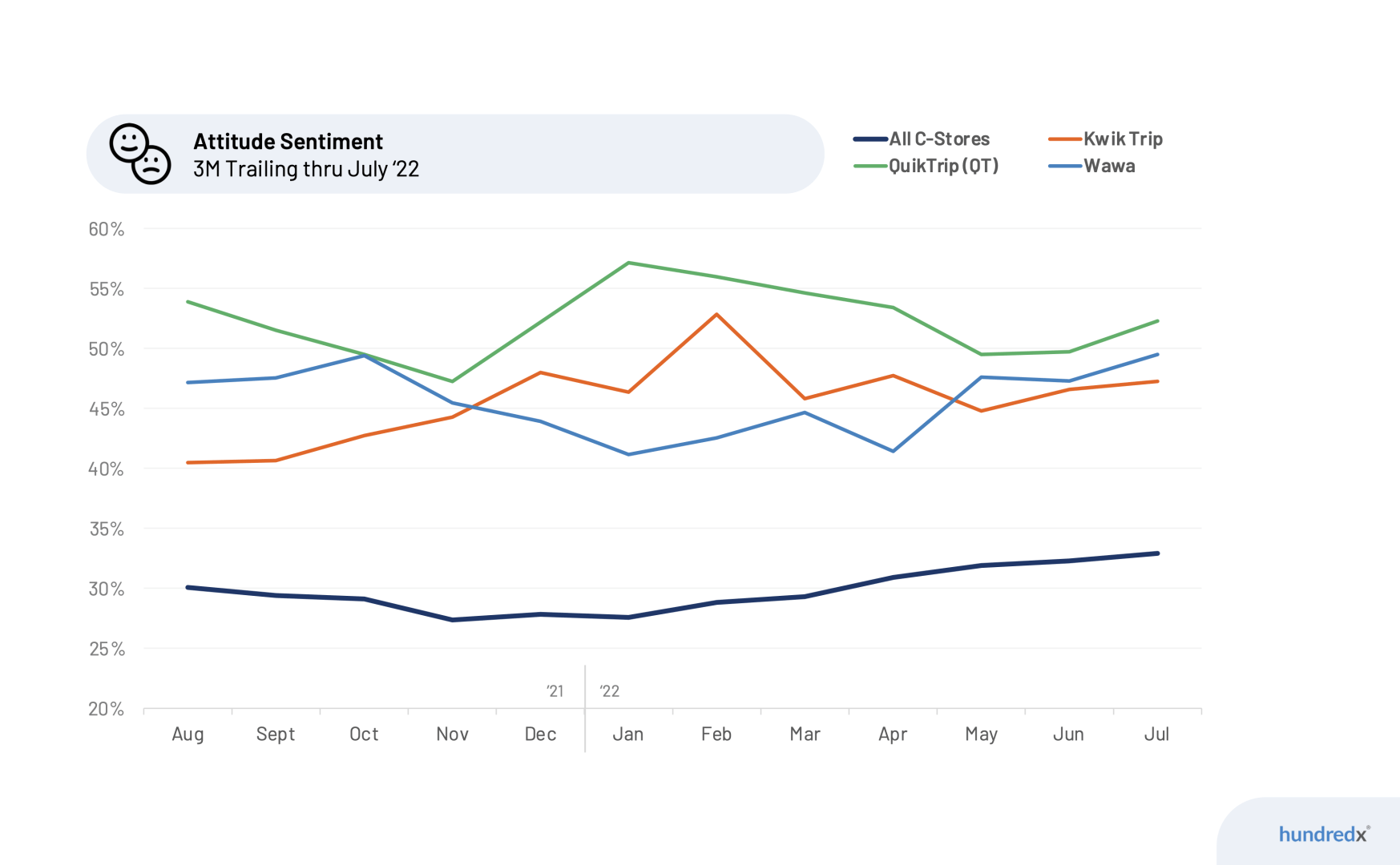

Attitude

Among the retailers highlighted, all perform within 5% of each other on ‘Attitude’ Customer Satisfaction. Making the most significant gain is Kwik Trip, rising 7% from its 12-month low in August 2021 to 47% ‘Attitude’ Customer Satisfaction. This is 14% higher than the industry average, which has been steadily increasing since early 2022. This comes as no surprise as Kwik Trip is known by its customers for its tenured and jovial personnel . One customer shared, “Employees are always friendly and helpful. Never put you in a rush, and usually will have small conversations with you. Most [sic] of the time the employees go above and beyond your average fuel staff”

Value

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on metrics for the Convenience Store sector and any of our 75+ other industries, or if you'd like to understand more about using Data for Good, please reach out:

https://hundredx.com/contact

Share This Article