Activewear's Rising Purchase Intent

Activewear clothes, especially athleisure, are meant to give those that wear them comfort and mobility while exercising or just lounging around. That is why sportswear has become a staple in many shoppers’ wardrobes. Numerous companies have profited, with Lululemon more than doubling its revenue from $2.6 billion in 2018 to $6.2 billion in 2022. Gap-owned Athleta believes its sales will reach over $2bn in 2023, up from $978 million in 2019.

HundredX looked at more than 250,000 pieces of feedback, March 2022 through March 2023, on over 200 covered apparel brands to understand how “The Crowd” of real shoppers, view the activewear industry. We home in on 14 of the top activewear brands to find:

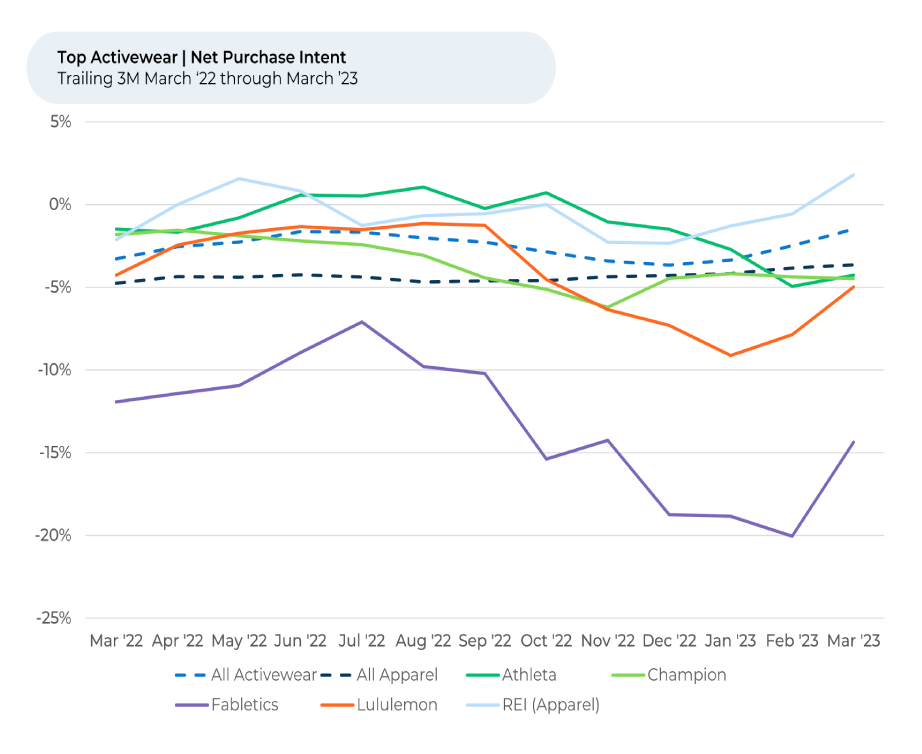

- Purchase Intent¹,² is slightly higher for activewear than the broader apparel sector. Warmer temperatures seem to be pushing Purchase Intent seasonally higher.

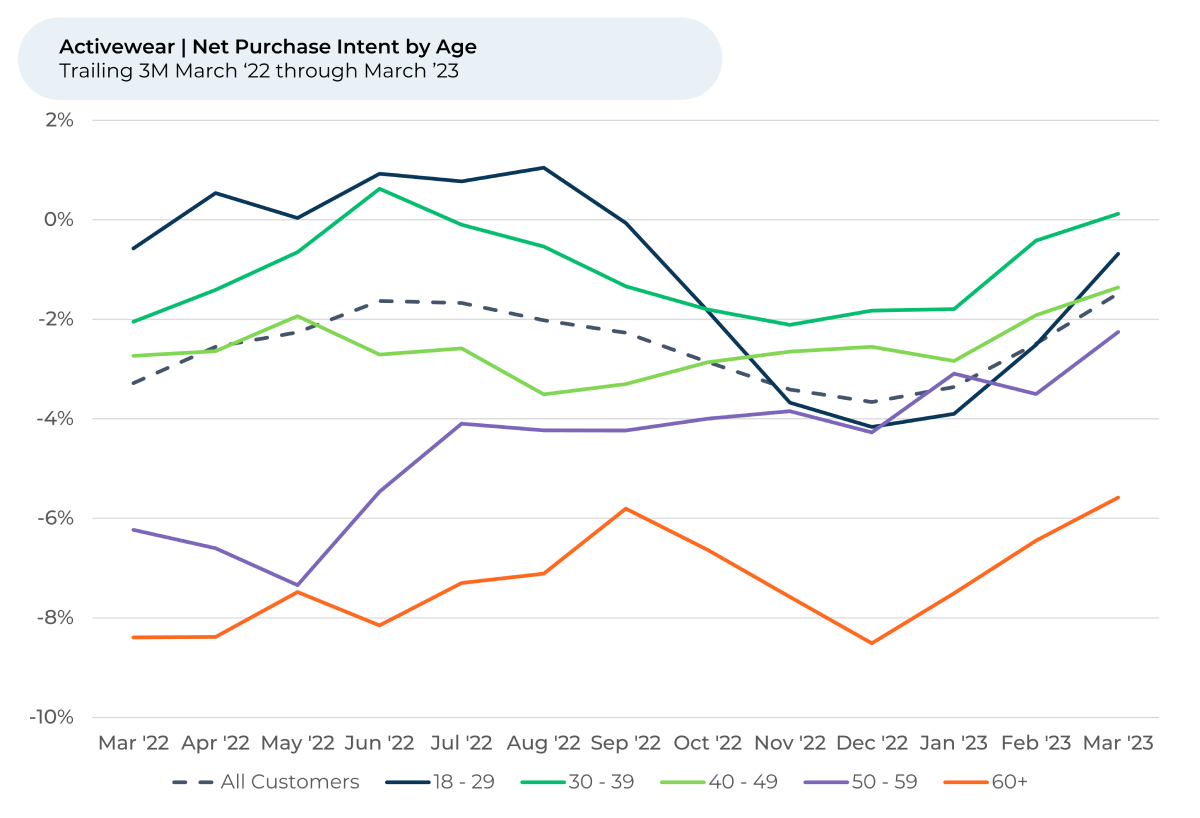

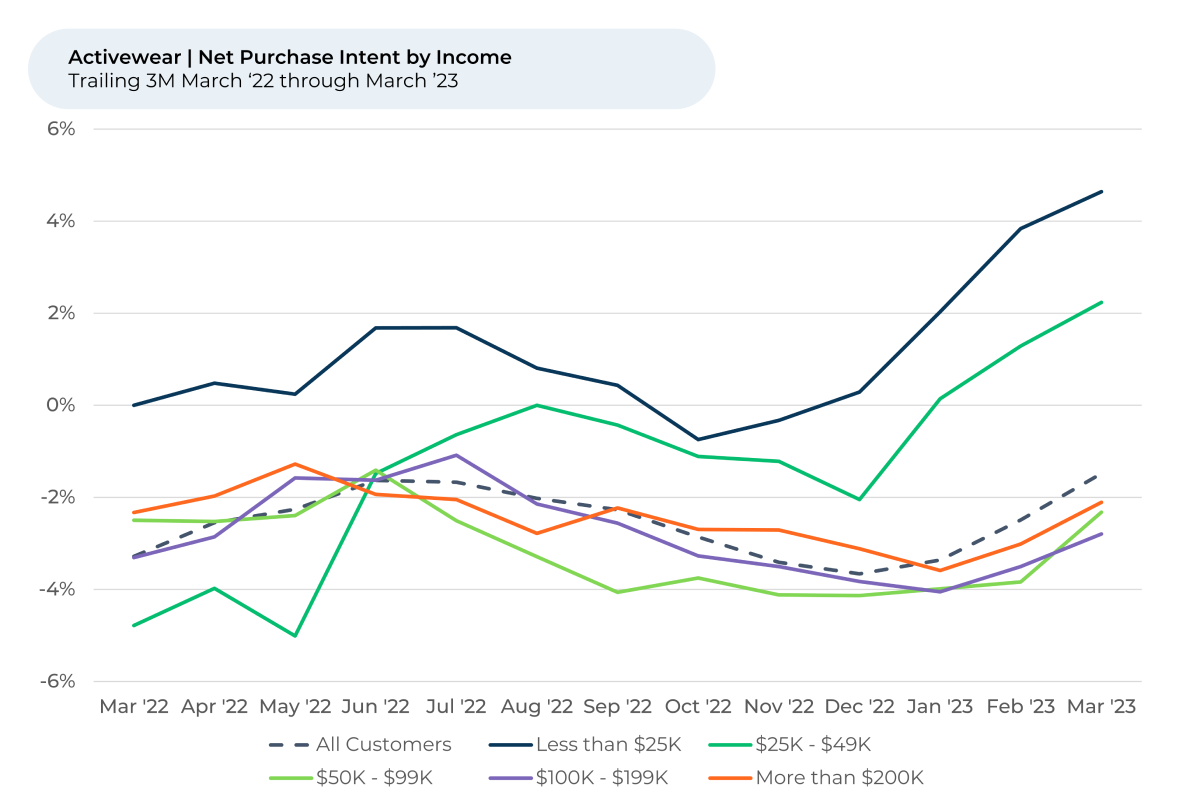

- Purchase Intent for activewear is rising fastest over the last three months for customers that are 18-29 years old and making less than $50K per year.

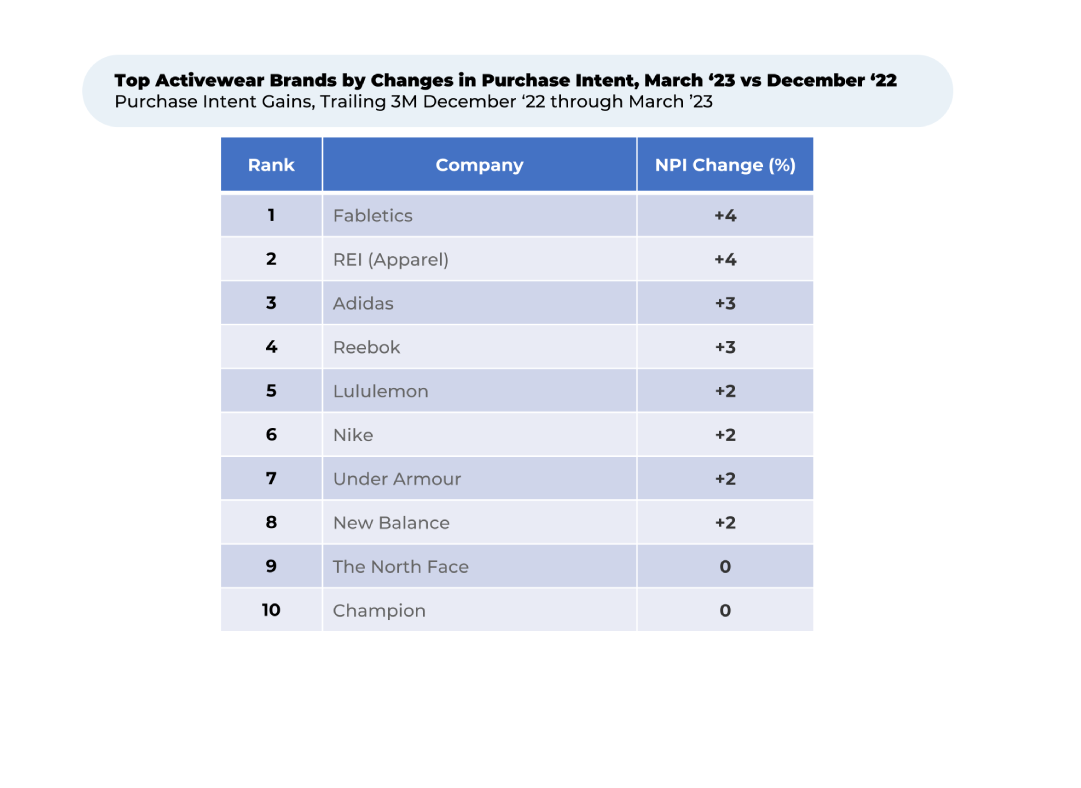

- Adidas enjoyed the biggest three-month increase in Purchase Intent for 18-29-year-olds, appearing to benefit from investments that focused on Gen Z customers over the last 18 months.

- Sportswear brand REI rose in both Purchase Intent and sentiment³ on Price in recent months, an indicator that recent sales and policy changes are paying off.

Purchase Intent up most for young consumers, Adidas Gen Z investment paying off

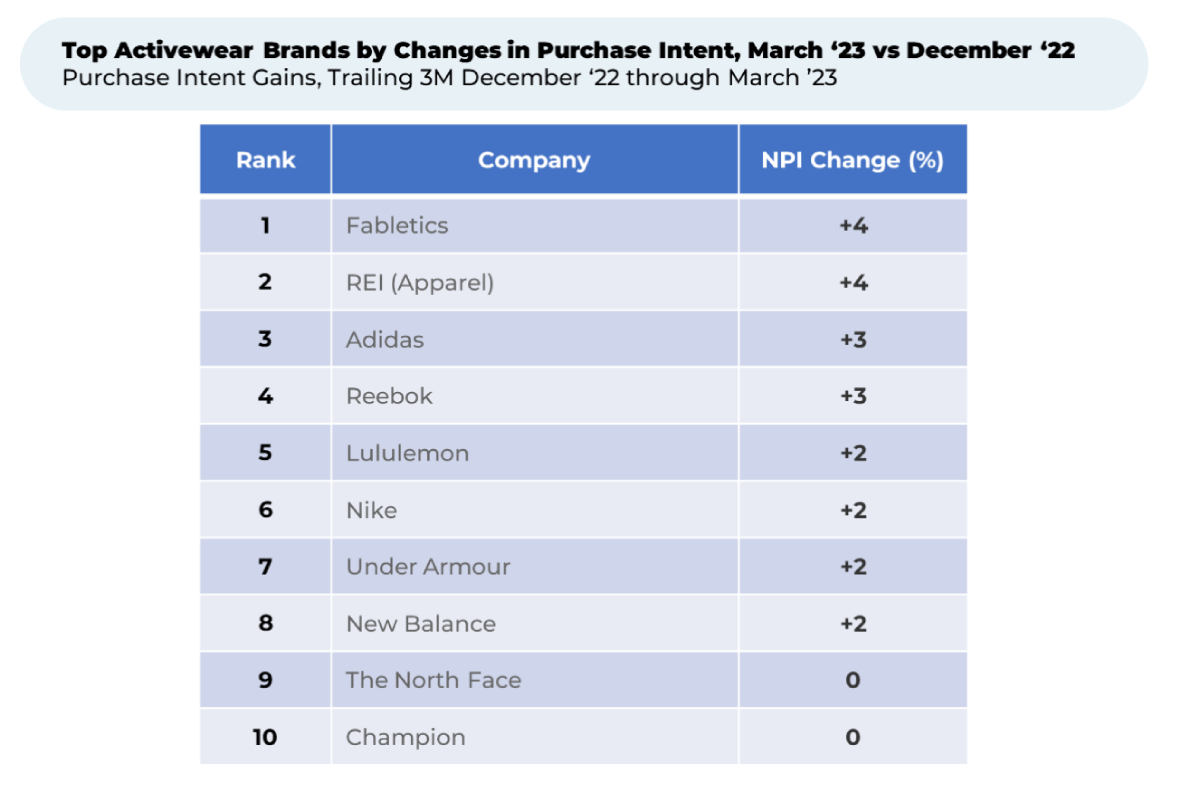

Purchase Intent for activewear has risen in recent months. While Purchase Intent for the broader apparel sector remained relatively stable over the past few months, it rose for activewear⁴ by 2% since December 2022. The group’s increase features early turnarounds for popular athleisure brands Lululemon and Fabletics, which saw Purchase Intent fall from September through January.

Purchase Intent for activewear does seem to follow a seasonal pattern, rising in the spring and summer before falling in the colder months. Activewear sales tend to be higher in the months when people do more outdoor activities and sports.

Customers’ age and income also seem to be playing a role in Purchase Intent trends. As of March 2023, Purchase Intent for activewear is highest for people aged 30-39, followed by people aged 18-29. It rose most sharply over the past few months for 18-29-year-olds.

Adidas enjoyed the biggest three-month increase in Purchase Intent for 18-29-year-olds, rising 5%. The company appears to be benefiting from investments that focused on Gen Z customers. In February,

Adidas launched a new, trendy, fashionable Sportswear line geared towards Gen Z customers following 18 months of development. The move aims to help the brand better compete with other popular Gen Z activewear brands, including Champion and Nike.

Meanwhile, households with the lowest annual incomes appear positioned to be the fastest growing for the activewear industry. While Purchase Intent dropped for most income groups since the summer, it grew by 4% for customers making less than $50K per year over the past three months.

This is likely linked to age. We’ve found the lowest incomes are often linked to the youngest ages. In other words, we believe the upward trend in Purchase Intent for activewear is likely powered by young adults.

REI’s recent momentum driven by sales, policy shifts

Some activewear brands have been outperforming in recent months, with Price appearing to play a big part. Price is one of the most selected reasons a customer likes or dislikes an apparel brand.

Purchase Intent increased modestly (+4%) for the apparel of outdoor retailer Recreational Equipment, Inc. (REI) over the past three months, while its customers’ sentiment towards Price surged (+21%). REI is known for its high quality (and premium-priced) outdoor recreation items and sportwear, as well as its commitment to the environment.

REI’s surge in sentiment towards Price seems related to recent sales and membership price cuts. While customers still view REI’s prices more negatively than many of its peers, sentiment jumped 21% from December.

REI slashed winter apparel prices in February by up to 40% in well-advertised sales. The company also offered its Co-op members 20% off a full-priced item in March. REI shoppers seem to appreciate the membership-only sales.

“We love REI. Some items can be pricey, but the sales and membership perks make up for it,” one shopper said.

Another said, “We shop the member appreciation sales so that it becomes more affordable.”

REI also saw sentiment towards its Brand Image up 9% over the last three months and sentiment towards its Brand Values & Trust jumped 5% from February to March. In February 2023, REI announced it stop selling clothes and cookware with “forever chemicals” – chemicals that don’t break down over time and have been shown to cause environmental damage.

“REI is inclusive and excellent about standing behind their products as well. They also work towards sustainability and who doesn't love Earth,” one REI shopper told HundredX.

Another customer said, “Thanks for increasing supply and sustainability transparency.”

HundredX will continue to watch the activewear and broader apparel spaces throughout 2023, looking to share how brands’ strategies to target certain age and income groups are resonating, who is best navigating a tricky economic environment and more.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent is measured by the percentage of customers who plan to buy a specific brand more during the next 12 months minus the percentage that intends to buy less. We find businesses that see Purchase Intent trends gain versus the industry have often seen growth rates for domestic users and engagement also improve versus peers.

- HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

- We include the following brands in the “activewear” average: Adidas, Alo, Athleta, Champion, Columbia, Fabletics, Lululemon, New Balance, Nike, prAna, Reebok, REI (Apparel), The North Face, Under Armour, and Vuori.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article