The Meal Kit Delivery Boom

We explore the factors that have captured the attention of 18-29-year-olds and low-income households and how we believe their preferences should help to shape the meal kit delivery landscape. We also highlight the strategic actions of various meal kit delivery companies that are driving their success in this competitive market.

After analyzing 900,000 pieces of feedback across five food-related sectors, including more than 20,000 pieces of feedback across 26 meal kit delivery brands, we find:

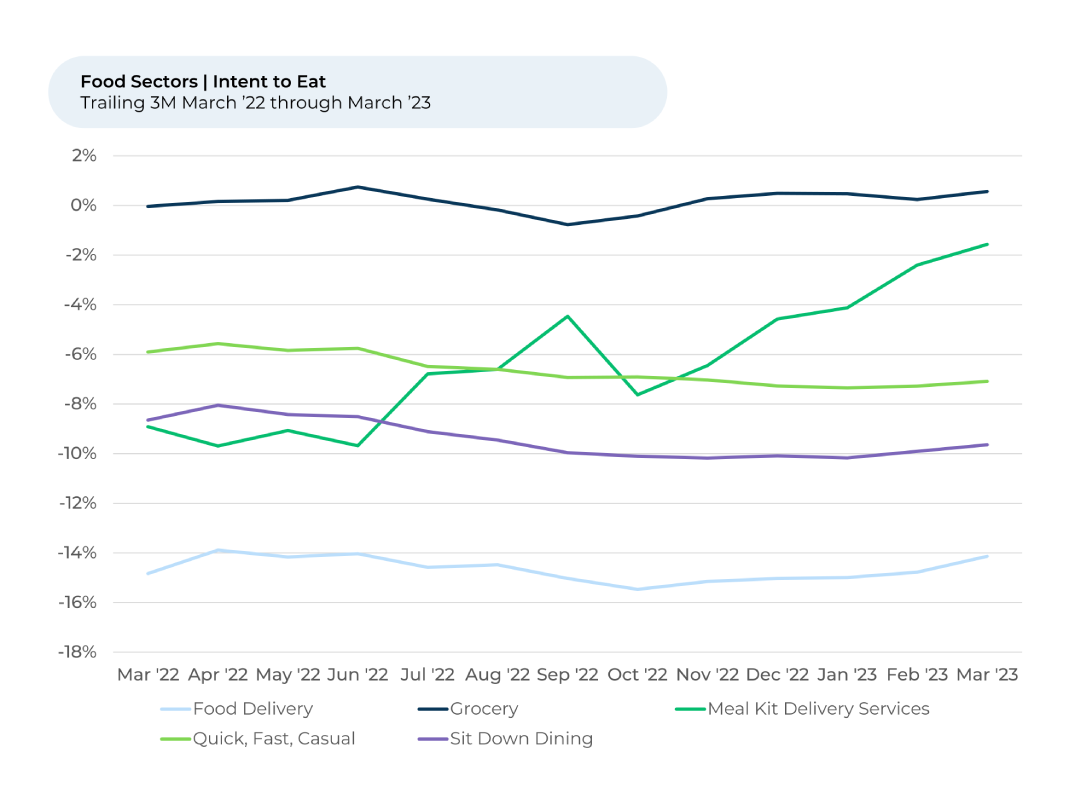

- Intent to Eat ¹ , ² for the meal kit delivery industry increased by 3% over the past three months, even as it stayed stable for other food-related sectors.

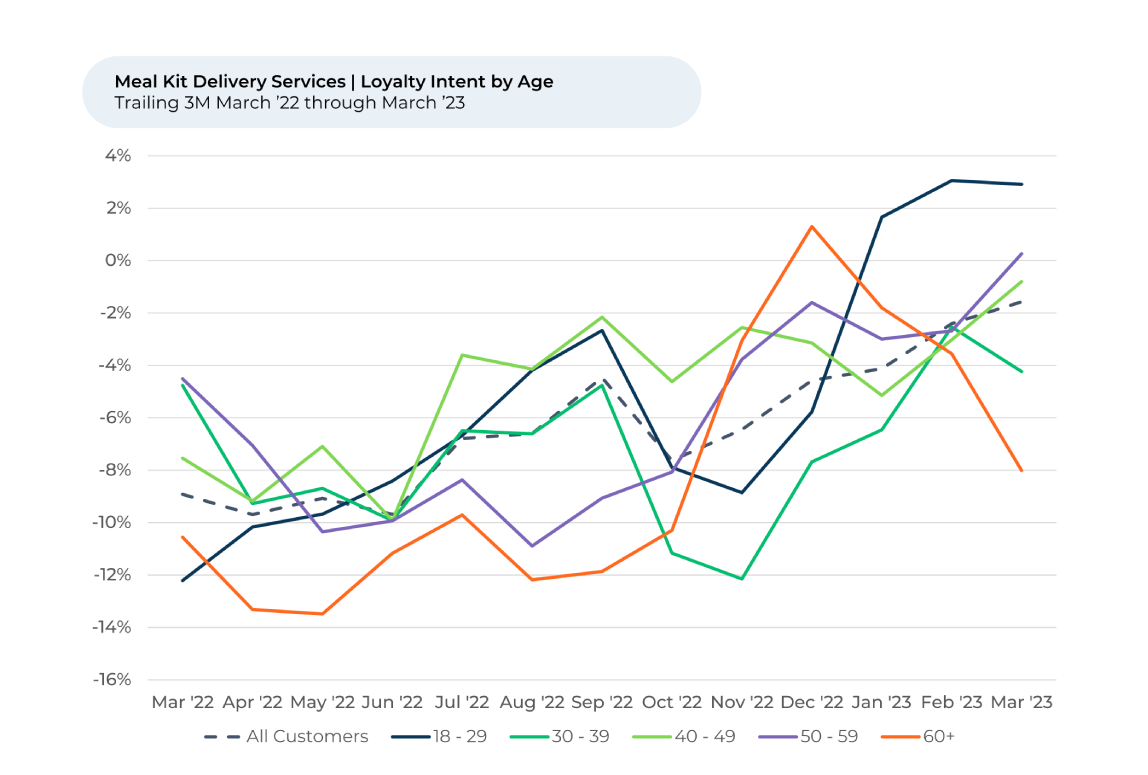

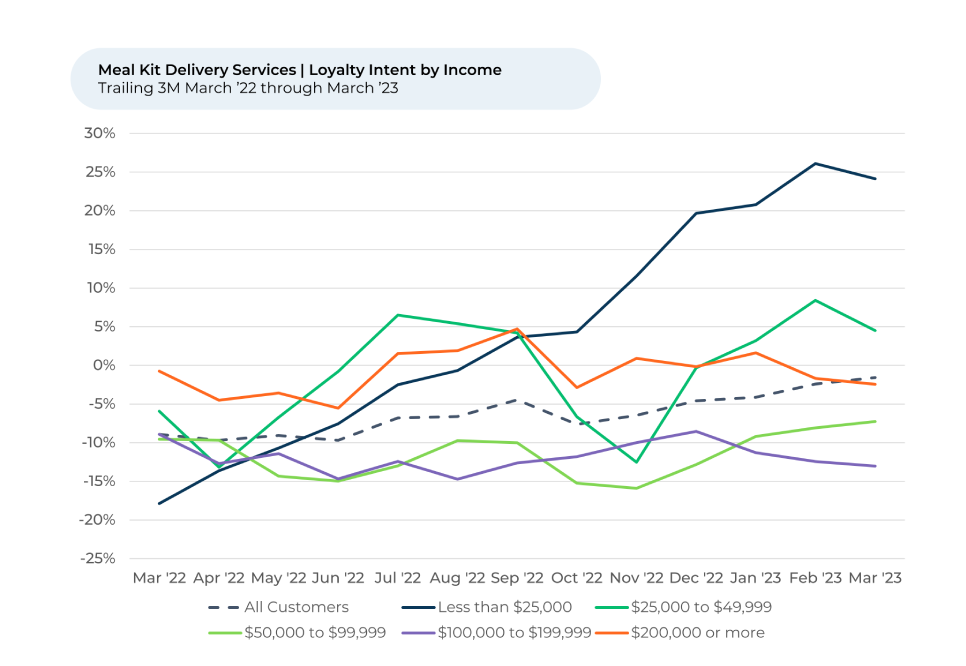

- The growth in Intent to Eat for meal kit delivery is predominantly driven by young adults and lower-income households.

- It appears Hello Fresh's significant investment in its social media presence is paying off, with it leading all meal kit platforms in Loyalty Intent with 18–29-year-olds.

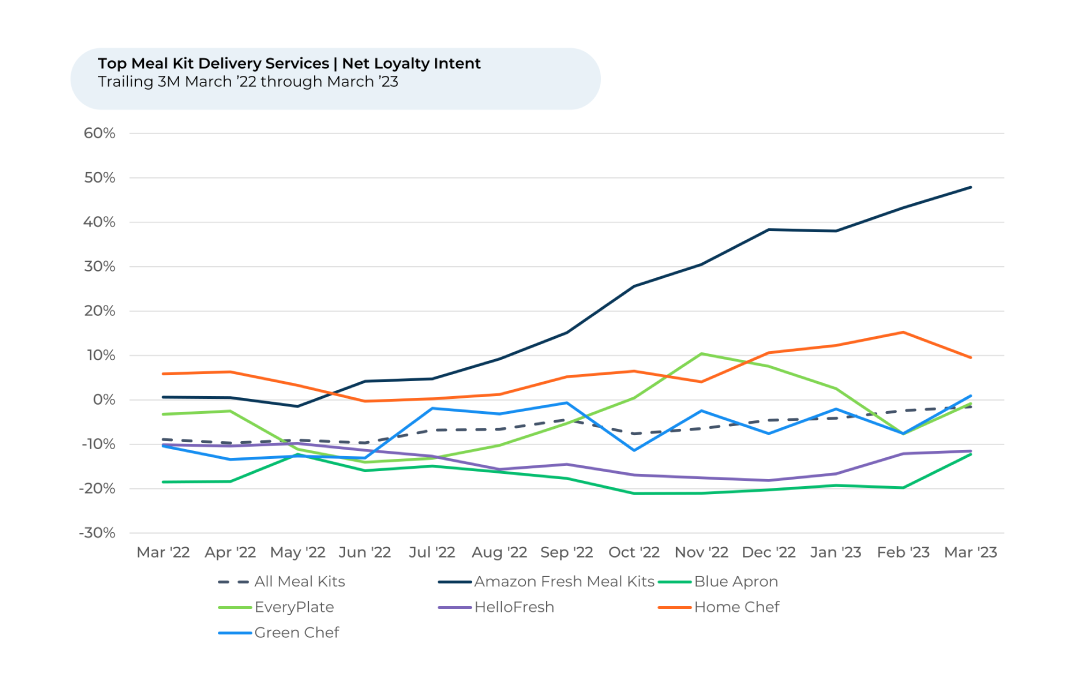

- Amazon Meal Kits has seen a major increase in Loyalty Intent recently, driven by its surge in customer sentiment ³ towards its healthy options, quality, and service and support.

“The Crowd” of real food industry customers says that the growth in people planning to keep eating meal kits is outpacing other food industries. While meal kit Loyalty Intent increased 3% over the last three months, Purchase Intent for other food-related sectors remains stable.

For a few years now, health influencers on social media, particularly TikTok and Instagram, have been popular with young adults. Some meal kit companies have been smart to notice and invest.

The TikTok accounts of Blue Apron and HelloFresh, two of the most popular meal kit service providers, have hundreds of thousands of views each. Videos tagged with #BlueApron have more than 15 million views on TikTok, and videos tagged with #HelloFresh have more than 300 million views.

“Great customer service and marketing techniques with the company,” a HelloFresh customer told HundredX.

HelloFresh in particular has a well-documented history of working with social media influencers and offers influencers an easy way to submit a partnership bid on its website. HundredX feedback providers, including those between 18-29, have left the most feedback on HelloFresh compared to other meal kit brands.

These trends collectively have made Loyalty Intent highest among 18–29-year-olds for all meal kit delivery services, not just leader HelloFresh. Since December, Loyalty Intent surged for customers between 18 and 29, rising 8% -- significantly higher than the 3% average increase across all ages.

Recent Trends and Winners

Among its competitors, Amazon Meal Kits are the only ones that customers can have delivered within two hours of ordering. They don’t require a subscription and are ordered completely through the Amazon website.

“Amazon Fresh Meal Kits are a great alternative to cooking a meal. Everything comes ready for you to warm up and serve,” one person told HundredX.

Another person said, “It's convenient and as fresh as it can be being packaged and delivered to my house. There's a variety of menu options and healthy choices. It's fast prep and easy to follow recipes. Tastes good, too.”

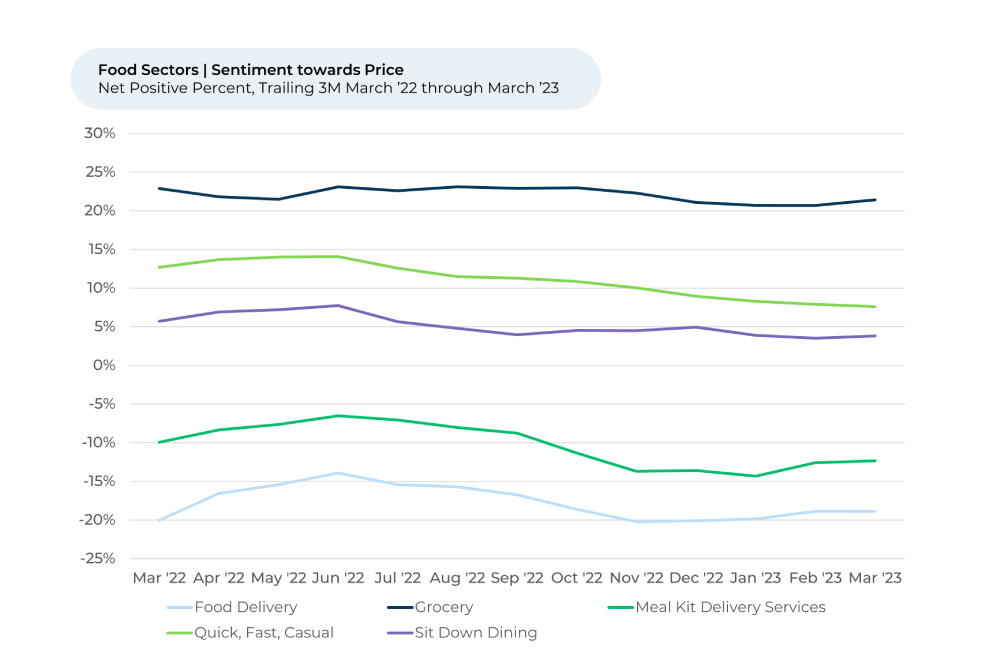

As meal kit delivery services continue to grow in popularity, we can expect to see further innovation and increased competition in the market. Brands looking to win should focus on expanding their breadth of healthy options, investing in taste and speed while remaining price competitive to appeal to a broader range of consumers, including young adults and lower-income households.

Stay tuned for future insights on movements in consumer preferences and brand strategies in the meal kit delivery industry. All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Intent to Eat reflects a way to compare the future intentions of customers across various food-related industries. It captures:

- Loyalty Intent for Meal Kit Delivery Services, which is the percentage of customers who plan to keep using the service minus the percentage who intend to cancel. It also captures Visit Intent for Groceries, Usage Intent for Food Delivery, and Purchase Intent for the dining industries, which all represent the percentage of customers who expect to visit, use or spend more on a brand minus those who intend to visit, use or spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article