Defying Turbulence: Service Sentiment's Rebound and Southwest's Recovery

Analyzing 285,000 pieces of feedback across the travel sector, including 80,000 pieces of feedback on 24 airlines, we find:

- Budget, long-stay hotels and motels, including Candlewood Suites, Comfort Suites, and Red Roof Inn, are still gaining in Travel Intent 1,2 , continuing trends we covered in last month's note .

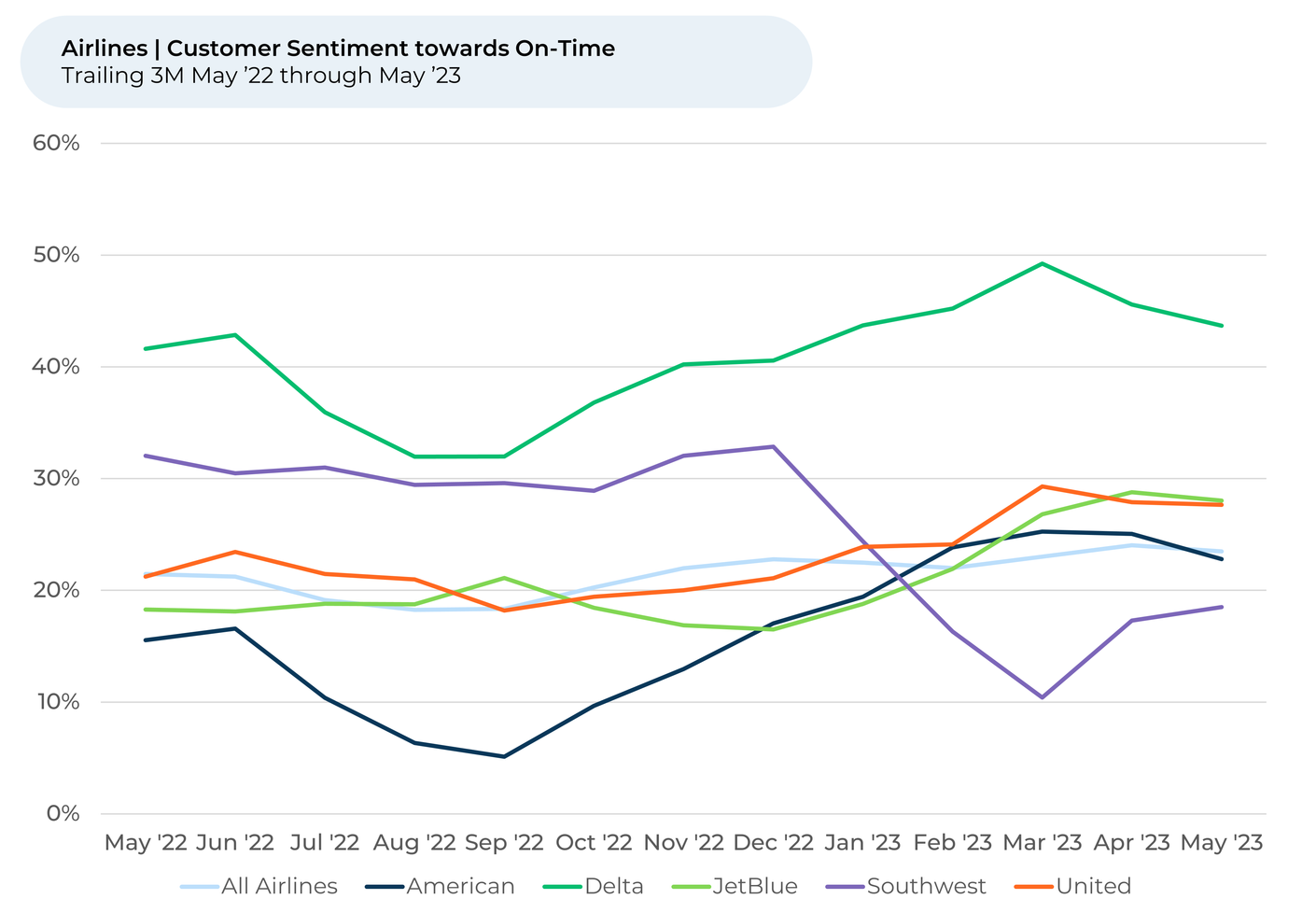

- Southwest also continues to recover from its winter holiday drama, improving on Travel Intent and sentiment 3 towards on-time flights. It seems positioned to be regaining market share, as some of its biggest competitors slipped on these metrics.

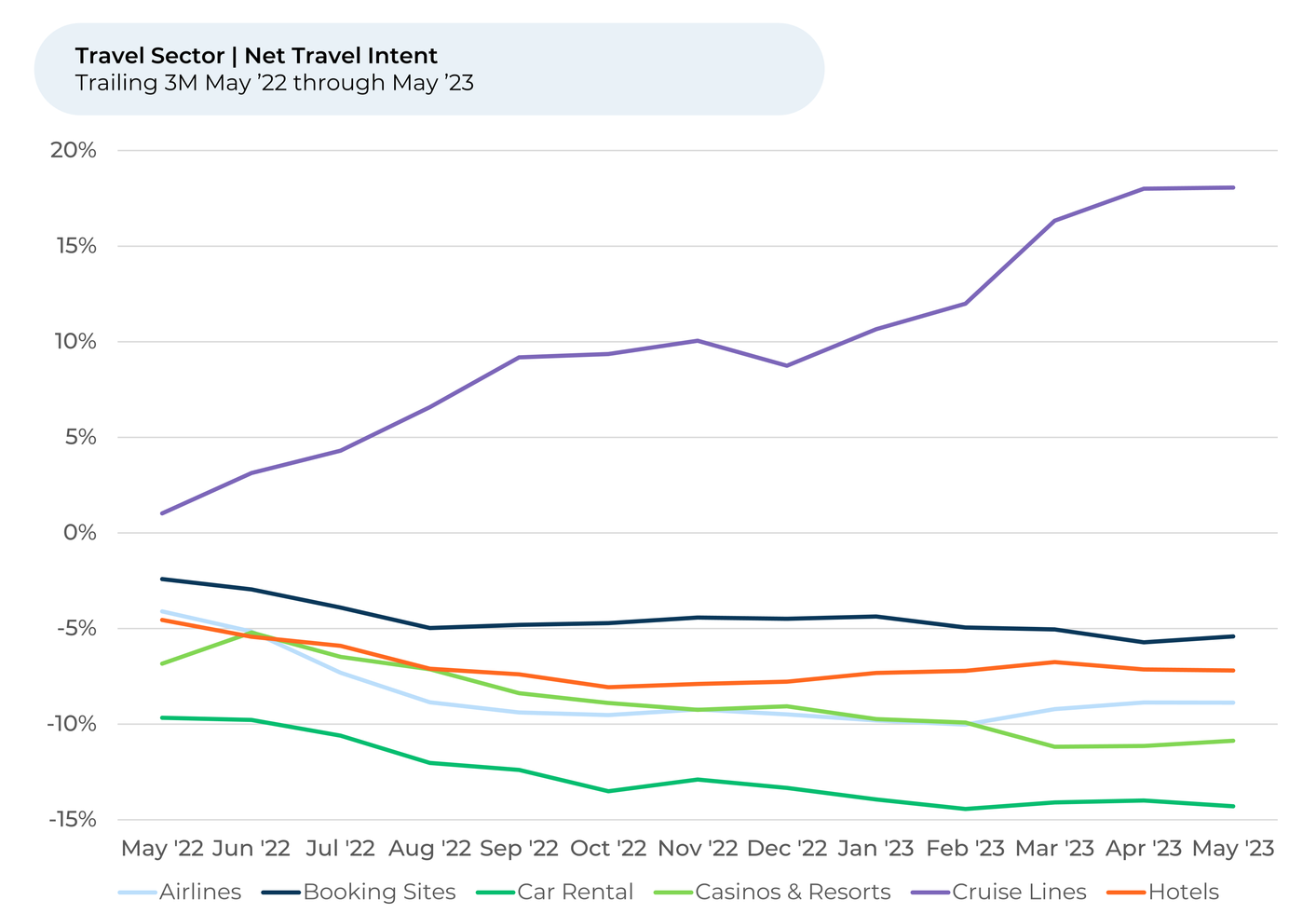

- Travel Intent stayed stable for all the travel industries from April through May. Over the past three months, Travel Intent increased significantly for the cruise industry and slightly for airlines.

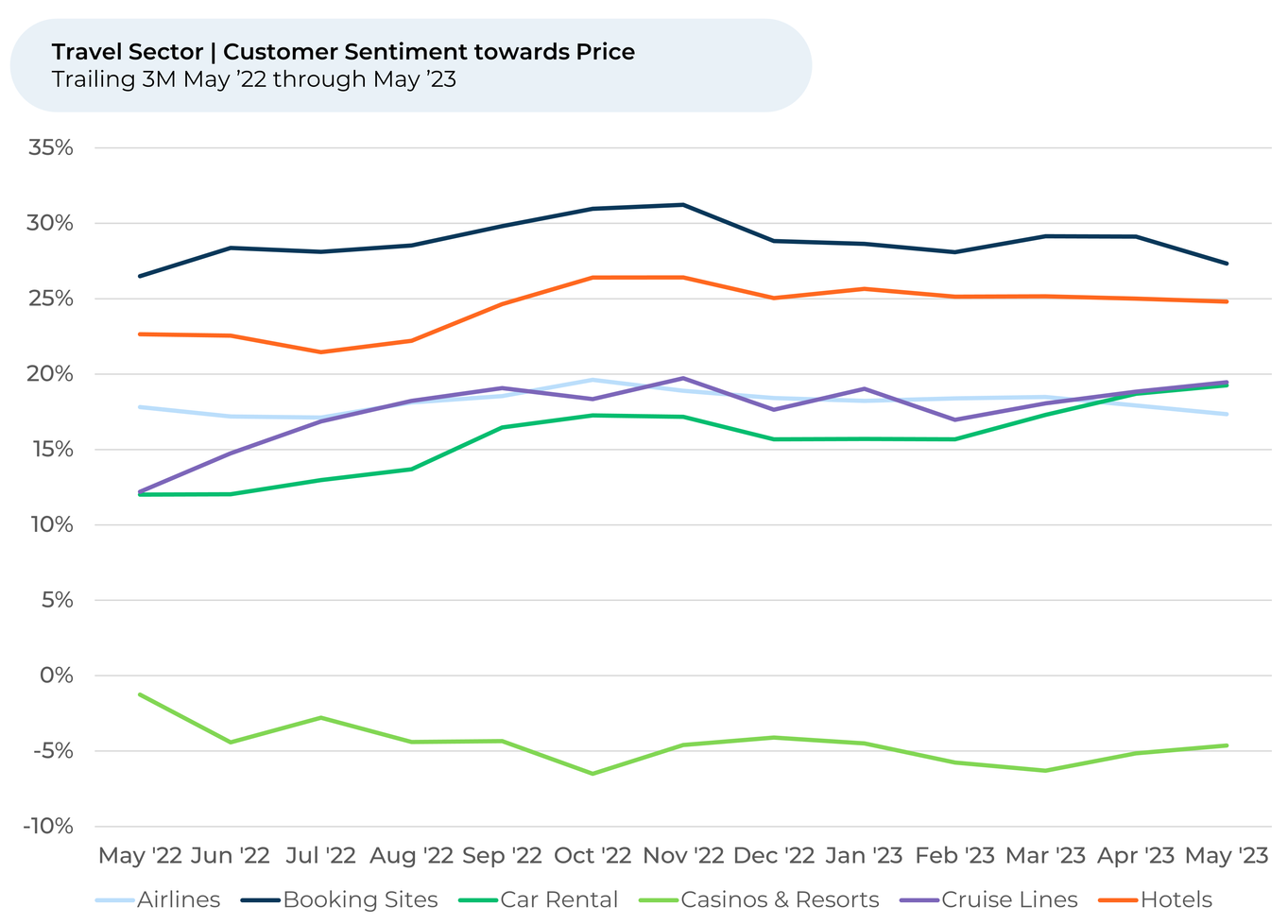

- Customer sentiment towards airline prices slips as travel heats up but inches higher for cruises and car rentals.

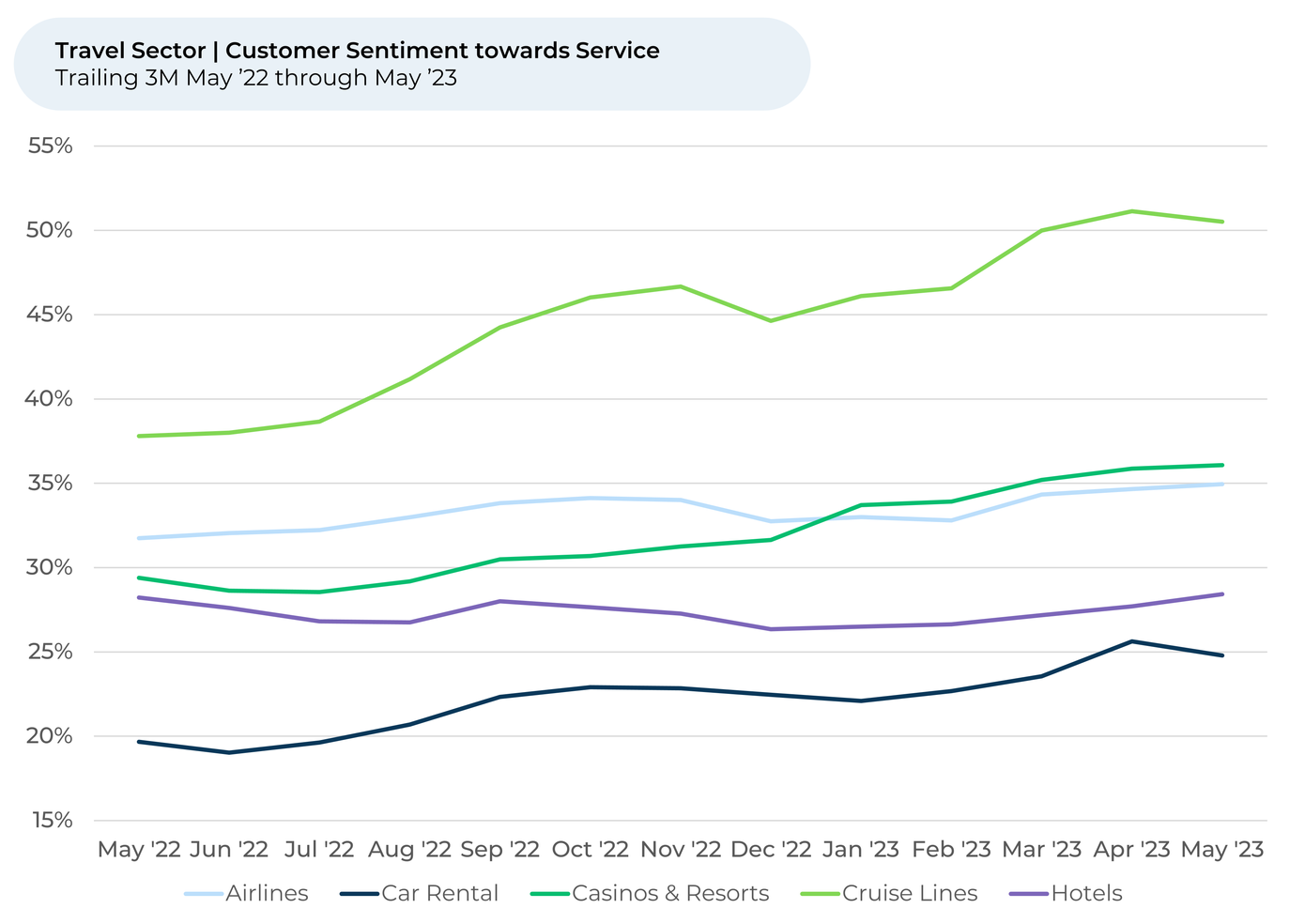

- Travelers are feeling happier about the service crew members provide them. Sentiment for service

4

of airlines, cruises, car rentals, hotels, and casinos & resorts are up. Perhaps we are moving past the recent uptick in unruly passengers, largely due to an increase in training.

Travel Intent increases for Southwest

From March, Southwest flyers’ sentiment toward On-Time increased by 8%, more than any other major airline. Again, we see Delta, which saw an On-Time sentiment spike earlier this year, relinquish some of its gains, falling 6% on On-Time sentiment since March. JetBlue gained 1%, while American and United both dropped 2%.

Customers appear ready to give Southwest another chance. “I like Southwest overall. They’ve had a rough year, but I’ll try them again,” one flyer told HundredX in April.

If Southwest has genuinely left its technical issues behind with its proposed infrastructure upgrades , it appears the airline may be poised to recover to having one of the highest On-Time sentiment scores in the industry.

Despite Southwest’s tumultuous last few months, Travel Intent remained relatively stable for the broader airline industry. Over the past three months, airline Travel Intent increased by just 1% and remained within a tight range over the past six months.

Cruises keep increasing on Travel Intent and Price sentiment

The cruise industry outperforms airlines, car rental services, and casinos & resorts on Price sentiment, though it lags behind hotels and booking sites. But it’s closing the gap on those industries as well.

A happy Regent Seven Seas Cruise customer recently highlighted its value to HundredX. “Good value because everything is included in price. No nickel and dime on board,” she said.

But it’s not just prices that appeal to cruise travelers. Compared to three months ago, cruisers feel happier about every aspect of the cruise line industry, from the food to the rooms. One area they feel notably happier about is cruise lines’ staff and service, which rose 4% in sentiment over the past three months.

Is the travel sector getting better at dealing with unruly customer behavior?

The past two years haven’t been easy for service workers. “Flight from London to L.A. diverted to Salt Lake City due to unruly passenger” – news headlines like this one from NBC, July 27, 2022, appeared almost daily. It looked like more than ever before, more people across the U.S., especially airline passengers, were becoming agitated, unruly, or even violent toward service workers. In June 2023, a report from the International Air Transport Association (IATA) found the number of unruly incidents on airlines increased by 47% from 2021 to 2022. Many of the incidents occurred after crew members told passengers to comply with airline rules, and many times the passengers directed their anger at these employees.

Over the past several months, major airlines have started providing extra de-escalation training to crew members. United just opened a new training center in Houston that will include de-escalation training for future crew members, and Delta recently put millions into revamping its Atlanta training center. In late 2022, the FAA passed a regulation that increased the mandatory attendant resting period by an hour to ensure attendants are well-rested and better able to do their jobs.

The increase in Service sentiment could mean these efforts are paying off. We at HundredX will watch it over the coming months to see if the trend continues. It could mark a turning point in the unruly passenger saga if it does.

- All metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- HundredX calculated “Service” as the weighted average of sentiment scores for: Agent Knowledge/Attitude, Attitude, Staff Attitude, Crew/Attendants, Staff Availability, Staff Knowledge, and Knowledge.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article