The potential for Kroger-Albertsons merger to create more happy shoppers

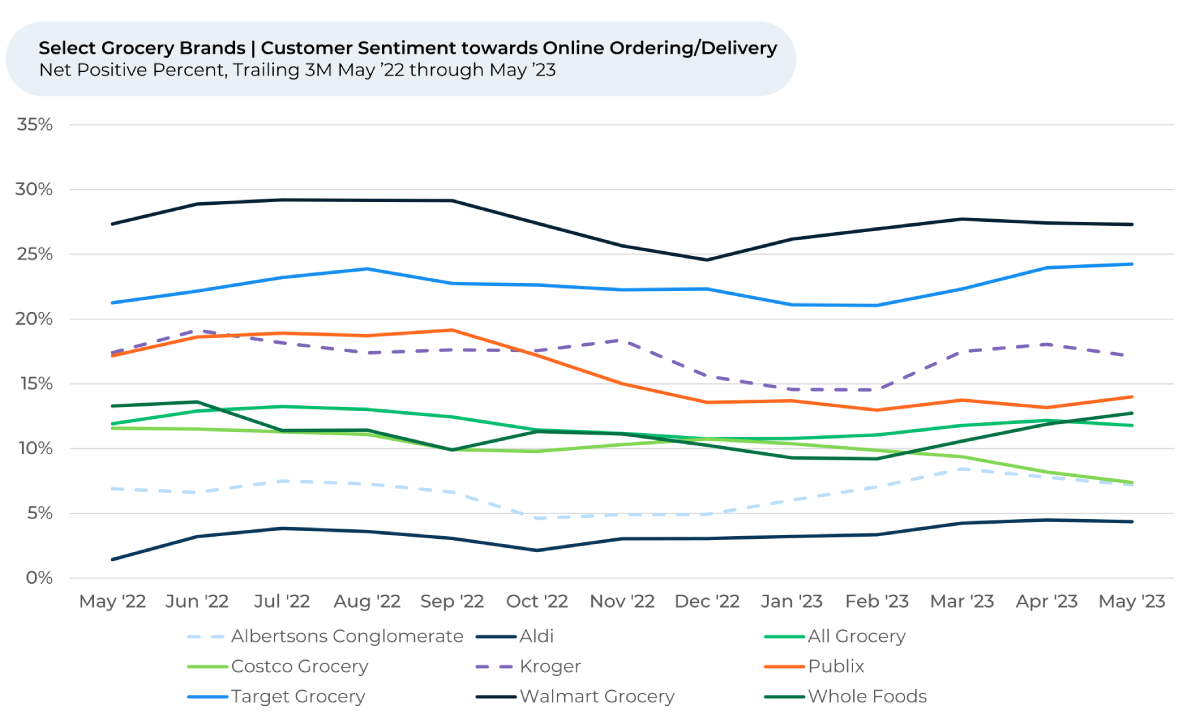

- If they leverage each other’s strengths and enhance Albertsons’ digital services, such as online ordering and delivery (a Kroger’s strength) and improve Kroger’s checkout efficiency (an Albertsons’ strength), they can better meet customer expectations in these important areas. This would enhance competitiveness in a landscape increasingly influenced by e-commerce giants.

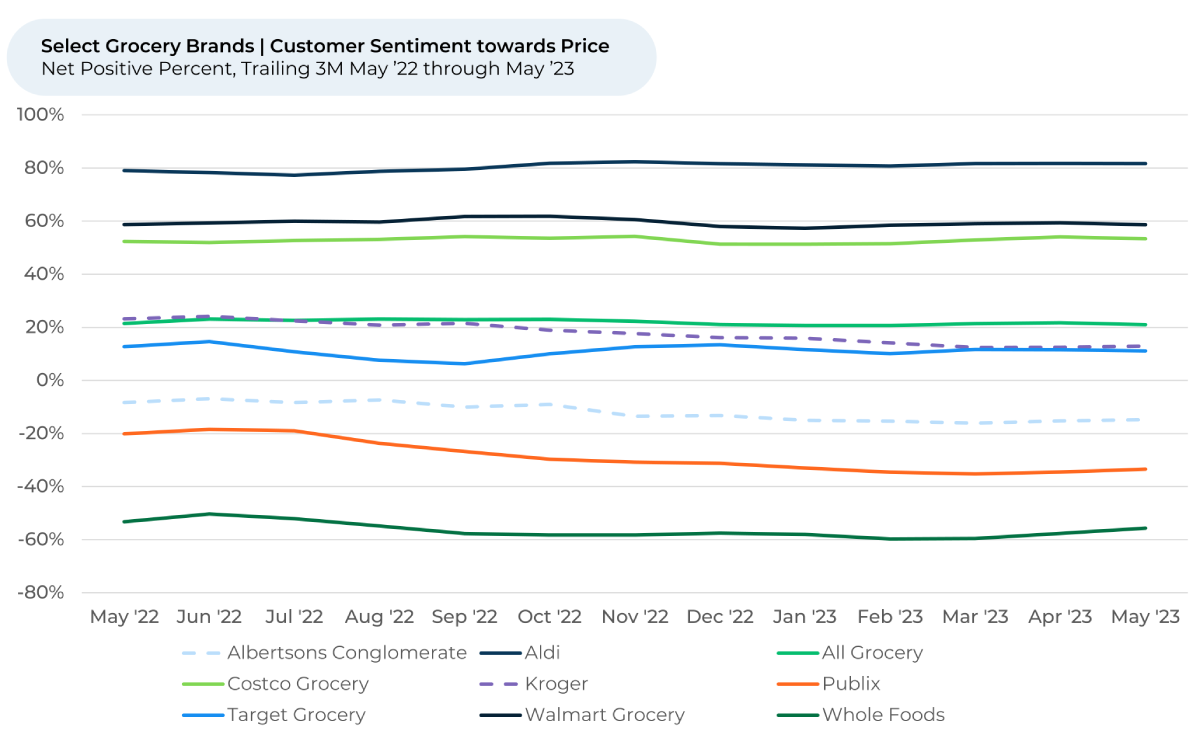

- This strategic fusion could provide the scale to offset potential price hikes that worry some customers and better position the new entity to compete with e-commerce giants.

Potential benefits from sharing online ordering and checkout best practices

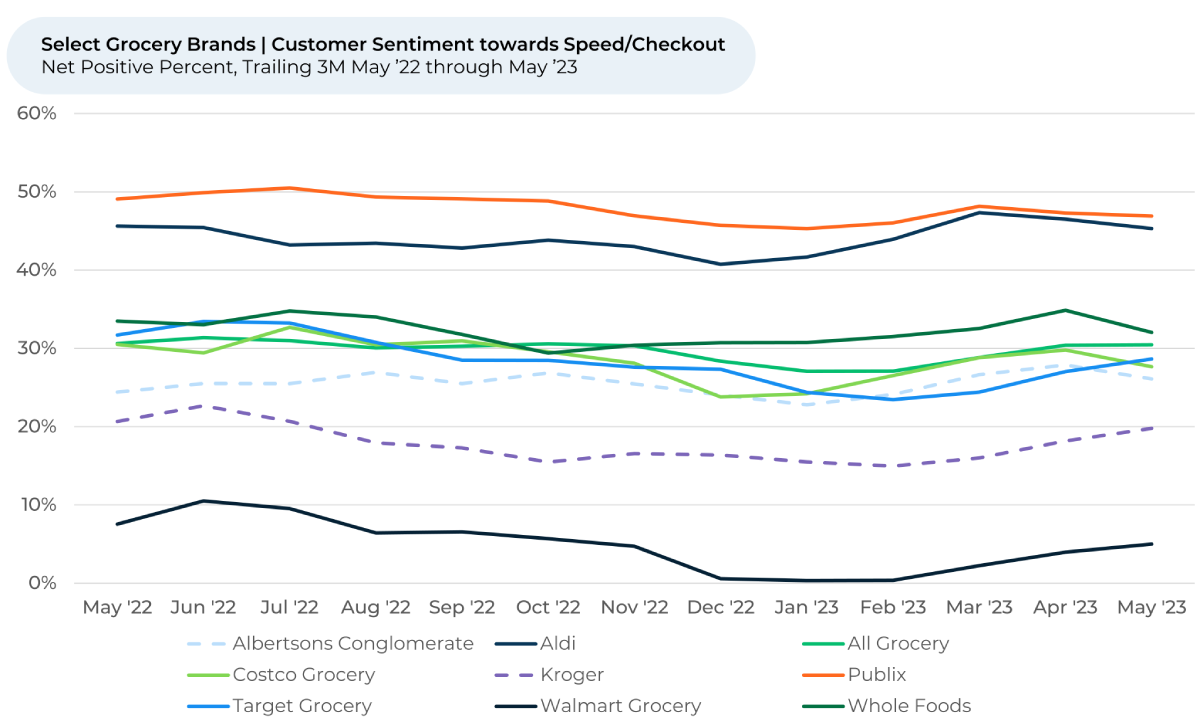

Albertsons, meanwhile, has started opening micro-fulfillment centers . By incorporating Kroger's established and efficient online infrastructure and new fulfillment and delivery centers, a merged Kroger and Albertsons stands to enhance its digital customer experience drastically and widen its delivery reach, better equipping them to stand against e-commerce adversaries The proposed merger could also help Kroger and Albertsons better its checkout process. After price, speed/checkout is the second most selected reason why grocery shoppers like or dislike a grocery brand.

Albertsons and its subsidiaries perform fairly well compared to competitors with the speed of its checkout process.

“I loved that they put self-checkout at Albertsons at my store because they make it so much easier for you to check out,” a customer told HundredX in December.

For its part, Kroger has also been rolling out new automatic rolling self-checkout lanes across some of its locations. Still, it may want to take a page from Albertsons’ book as the two companies come together.

Merger could actually result in lower prices, not higher ones as many fear

Better supply chain infrastructure could help the companies cut costs, as could eliminating some digital overhead. The sheer number of stores the merged companies would operate, in the thousands, could also give the brands increased negotiation power with food vendors. Walmart has long used this tactic to offer its customers relatively cheap groceries.

By strategically merging their individual strengths and addressing weaknesses, Kroger and Albertsons can forge a powerhouse capable of better contesting with e-commerce leaders. This is an opportunity for transformation – a chance to redefine standards and set a new pace in the grocery industry.

- We’re showing Albertsons as a weighted average of the major Albertsons brands that we follow: ACME Markets, Albertsons, Hannaford, Jewel-Osco, Market Street, Randalls, Safeway, Shaw's, Stop & Shop, Tom Thumb, United Supermarkets, and Vons.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article