Best Brands for Social Impact, Powered by HundredX

Why Brand Values & Trust Matters

HundredX data suggests the most successful modern corporations need to deliver a combination of top-tier customer experiences and social impact that matters to customers – '

performance & purpose

.’ Companies that do both are more likely to retain customers loyalty and drive sustainable, long-term growth.

Earlier this year, HundredX powered the

Forbes Customer Experience All-Star List

,

covering

performance

, as

measured by

customer satisfaction

and

treatment of customers

. The Forbes'

Best Brands for Social Impact 2023

list

covers

purpose

,

double-clicking into the

Brand Values & Trust

driver of customer satisfaction to identify which brands have the most positive societal impacts, as determined by their customers.

The relationship between

Brand Values & Trust

and consumers’

Future Purchase Intent

is notable. Only 22% of customers call out

Brand Values & Trust

as a key reason why they are positive or negative about a brand when providing their feedback on brands across our coverage universe. However, when it IS called out, it has

the second highest impact on whether a customer intends to purchase

or use that brand’s service or product more, less, or the same in the future relative to all the factors we track. The purchase intent for customers that select

Brand Values & Trus

t as a positive is 18% higher than those who do not select it at all, and it is 49% higher than those who select it as a negative factor.

When providing feedback to HundredX, customers share all the reasons they believe

Brand Values & Trust

for their chosen brand are either positive or negative. The chart below shows '

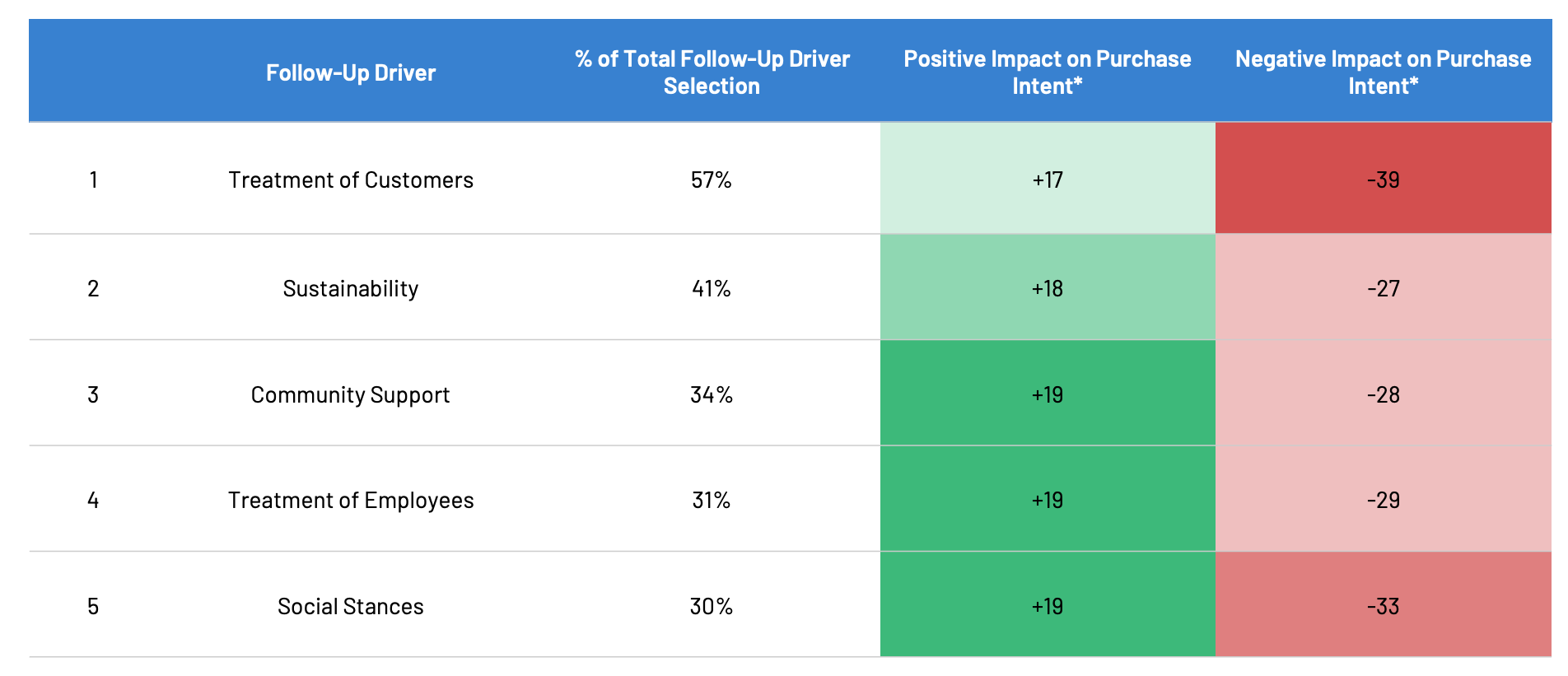

Treatment of Customers

' as the most selected reason.

Upon analyzing customer comments on Brand Values & Trust , it becomes evident that achieving this shift it is by integrating positive social impact strategies into a brand's business — starting with the way customers are treated on a daily basis.

The Power of the Crowd

- Where are fundamental market share movements going to happen?

- How are customers making future purchase decisions and why?

- What actions should I prioritize to increase market share growth?

- How do our values connect with our customer base?

Ready to see how your company can improve its performance and purpose? Discover how HundredX can help you with both. Book a 30-minute session with our team to review how your business compares with peers on the factors used by Forbes in the

Best Brands for Social Impact

list (as well as

Customer Experience All-Stars

list).

Here's to continuing to make a difference together!

Understand your Forbes Ranking

Request a 30-minute Session

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of Brand Values Trust, other companies within 75+ industries we cover, or if you'd like to learn more about becoming a partner in the Data for Good movement, please reach out:

https://hundredx.com/contact

.

Share This Article