Home Improvement: Spring Surge Insights

As the days grow longer and warmer, the seasons of spring and summer usher in not only blooming flowers but also ideal conditions to tackle home improvement projects. Consequently, home improvement brands typically see increased sales during these seasons, as homeowners take advantage of the favorable weather to renovate, upgrade, and enhance their living spaces.

With spring now fully underway, HundredX looks to see which home improvement brands are outperforming this year with The Crowd, real customers who shop at home improvement retailers. We analyze more than 1.1 million pieces of feedback across 14 retail subsectors over the last year, including 75,000 on 14 home improvement brands, to find:

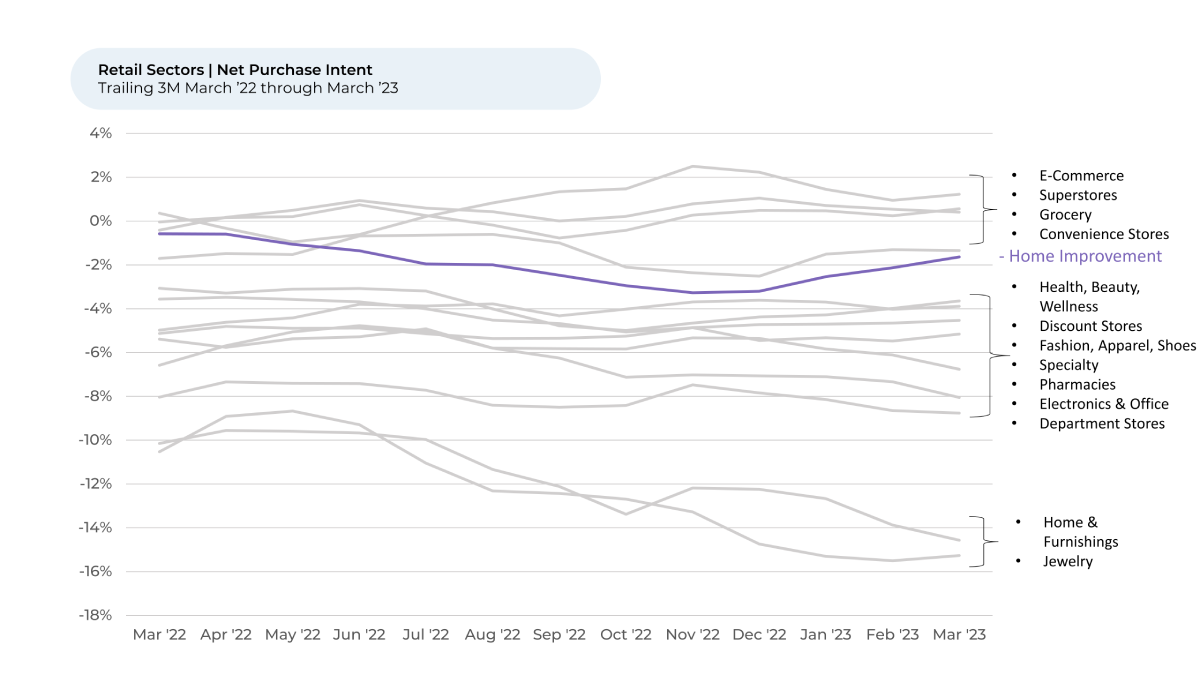

- Purchase Intent¹,² remains pretty stable for most major retail sectors. E-commerce remains stable and the highest.

- Purchase Intent rose more for home improvement over the past three months than any other retail sector.

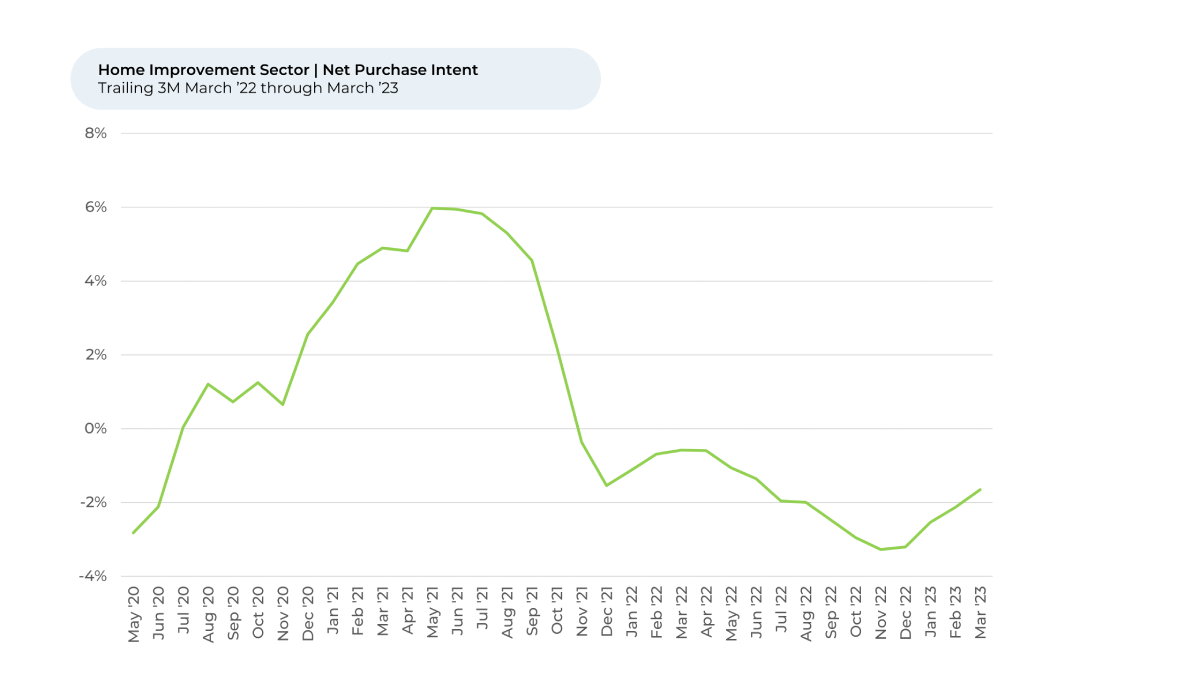

- Though up seasonally, purchase intent for home improvement is lower now than it was in spring of 2020 and 2021, likely reflecting the softer housing market, higher economic uncertainty and less pent-up demand.

- While leaders Home Depot and Lowe’s have seen increases in Purchase Intent the last three months, Menards appears poised to be the big winner, driven by improving customer sentiment³ towards its prices on the back of its rebate offers.

Since December, Purchase Intent rose 2% for the home improvement sector after falling during the fall and winter of 2022. The gain is moderate, but it’s still the largest of any other retail sector.

We’ve seen Purchase Intent tend to increase around springtime. The pickup has been correlated with seasonal improvements in earnings from home improvement retailers including Home Depot, Lowe’s, and Sherwin-Williams.

Still, Purchase Intent for the home improvement sector is lower now than it was in 2020 and 2021, when the housing market was white hot. As Harvard’s Joint Center for Housing Studies recently found, home remodeling and maintenance

is slowing this year, a view that is supported by recent home improvement Purchase Intent trends.

Menards appears poised to be the big winner, driven by improving customer sentiment³ towards its prices on the back of its rebate offers. Wisconsin-based Menards has shown a consistent improvement in Purchase Intent, going from -1% in September 2022 to 2% in March 2023. The positive shift has made it the only home improvement company with positive Purchase Intent as of March 2023.

Menards’ Purchase Intent improvement seems linked to the price, value, and quality of its products, as well as the attitude of its employees. Customer sentiment regarding these factors increased between 6% and 9% over the past three months, even though customers already love Menards’ price, value, and selection.

HundredX feedback respondents seem to love Menards’ rebates program. The store regularly offers sales on products after customers submit a rebate. Its 11% rebate deal even allows customers to get a rebate on an item that later went on sale.

“Really like the 11% rebates, returns are easy, the staff is helpful, stores are nicely organized,” one Menards customer told HundredX.

“Menards is a top-rate store for good value. They also have the best prices,” another person said.

The home improvement sector may not appear poised to experience the same rapid growth this season as in previous years, but it still remains an important period for the retailers. HundredX will continue watching the home improvement industry to see which brands outperform during the warm weather.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent is measured by the percentage of customers who plan to buy a specific brand more during the next 12 months minus the percentage that intends to buy less. We find businesses that see Purchase Intent trends gain versus the industry have often seen growth rates for domestic users and engagement also improve versus peers.

- HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article