HX Trends Report: Beverages - Alcohol Consumption

Less cheer for the holidays this season?

As we approach one of the busiest times of the year for beverage sales, we look at current drinking trends, which age groups plan to consume more vs. less alcoholic beverages, and which brands appeal the most by age.

“The Crowd,” real consumers that purchase and drink a variety of beverages, and who share immediate feedback with HundredX, indicates that:

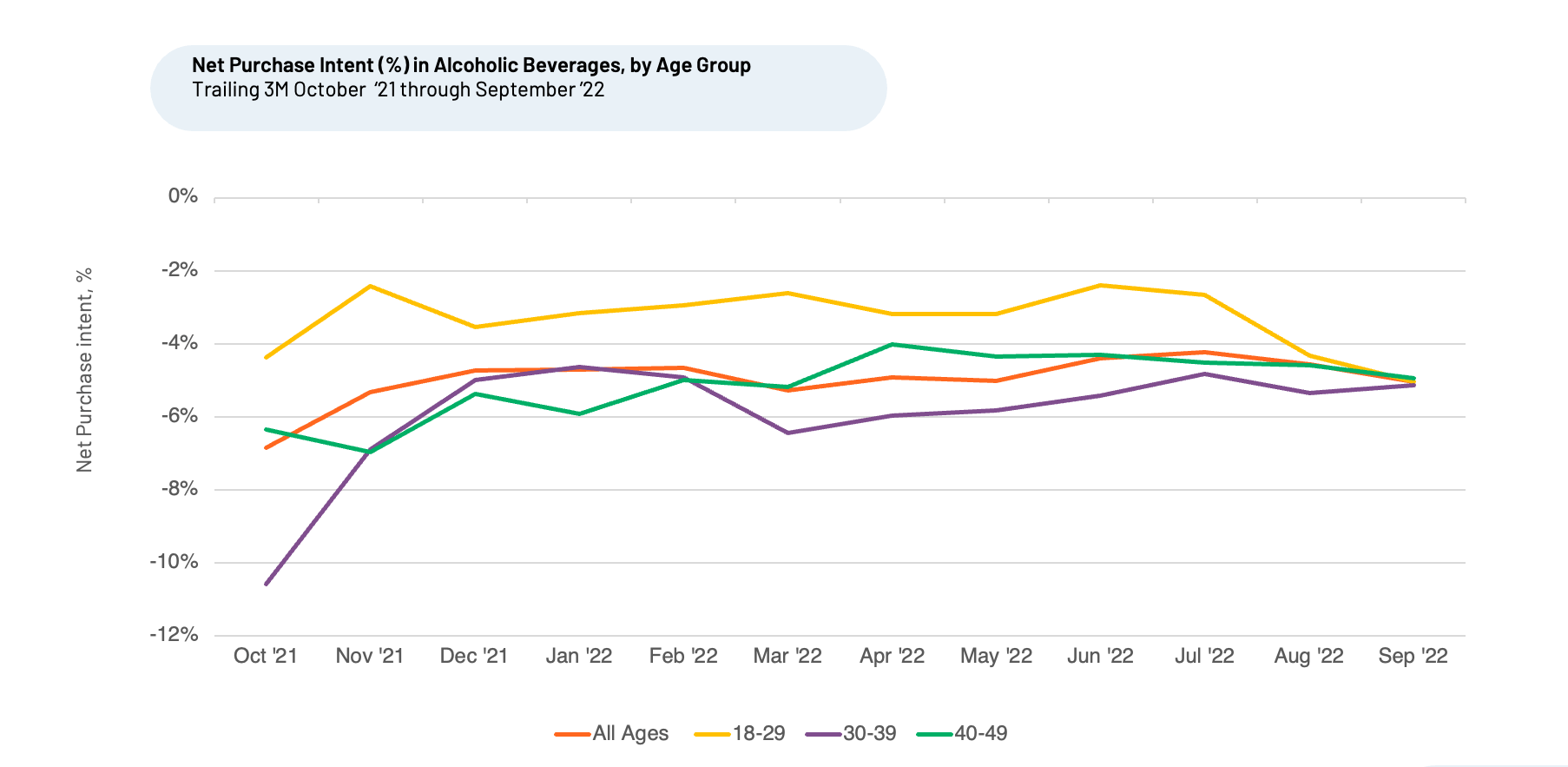

- Growth in US alcohol consumption will likely remain stable or slow modestly during the coming months. Net Purchase Intent for Alcoholic Beverages has been relatively stable over the last year, but has declined slightly over the last few months.

- The 30-39 cohort is the only group that says it intends to drink more alcohol.

- The 18-29-cohort intends to drink much less alcohol.

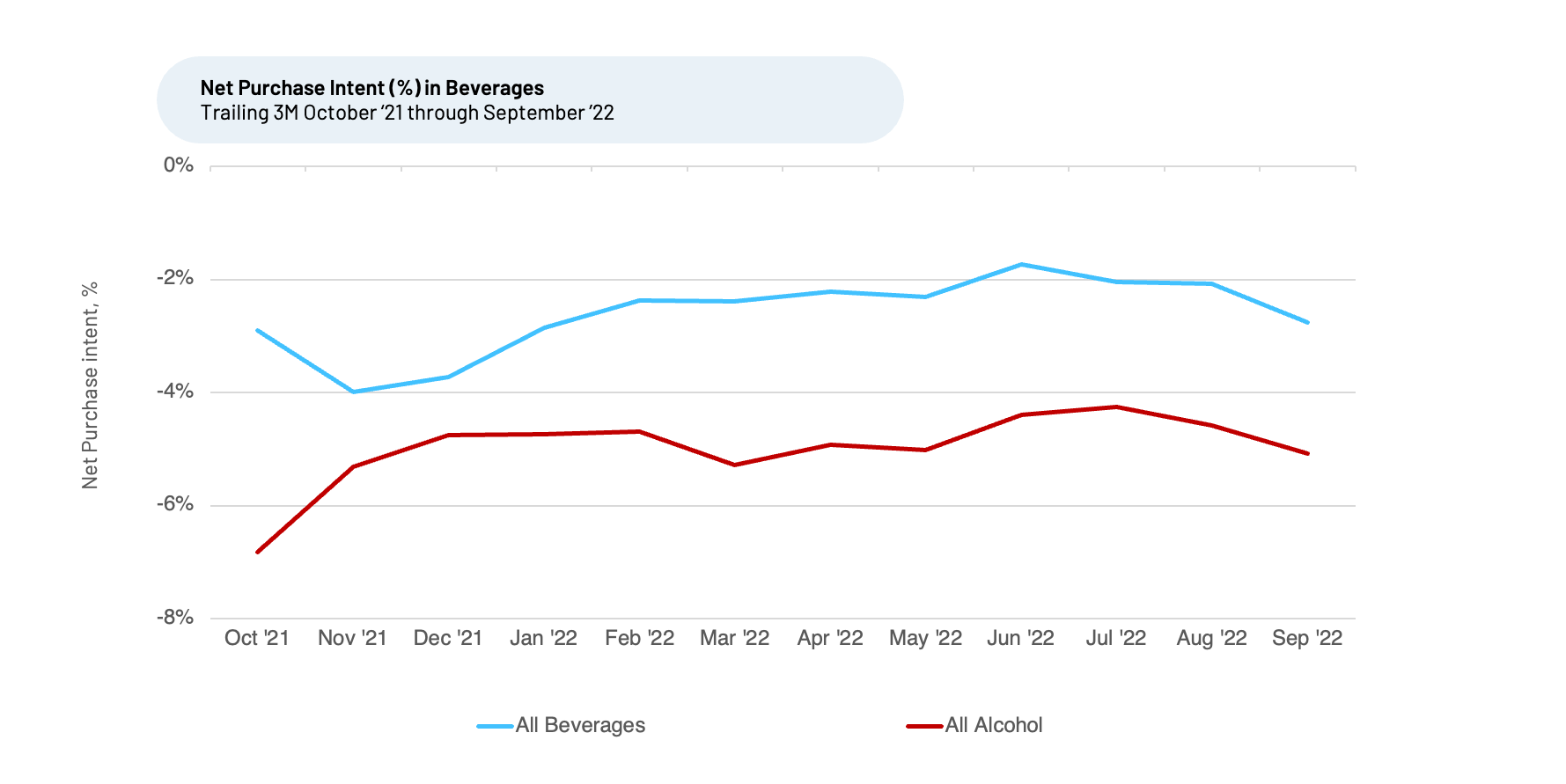

Collected from thousands of real customers and 290,000+ data points on beverage brands, Net Purchase Intent (NPI) directly indicates consumers’ future drinking plans. NPI measures the percentage of consumers who plan to drink more over the next 12 months minus the percentage that intends to drink less. For both Beverages and Alcohol, we observe continued, declining NPI.

NPI for Alcohol Beverages across all age groups is up year-over-year but has been declining modestly during the last few months. We believe this indicates growth in US alcohol consumption, as measured by the Retail Sales collected by the US Census Bureau, will likely be stable or slow modestly in the coming months. Retail sales YTD through August 2022 was up just under 1% vs. YTD August 2021, though the monthly growth figures have been volatile ― between -2% and +3%.

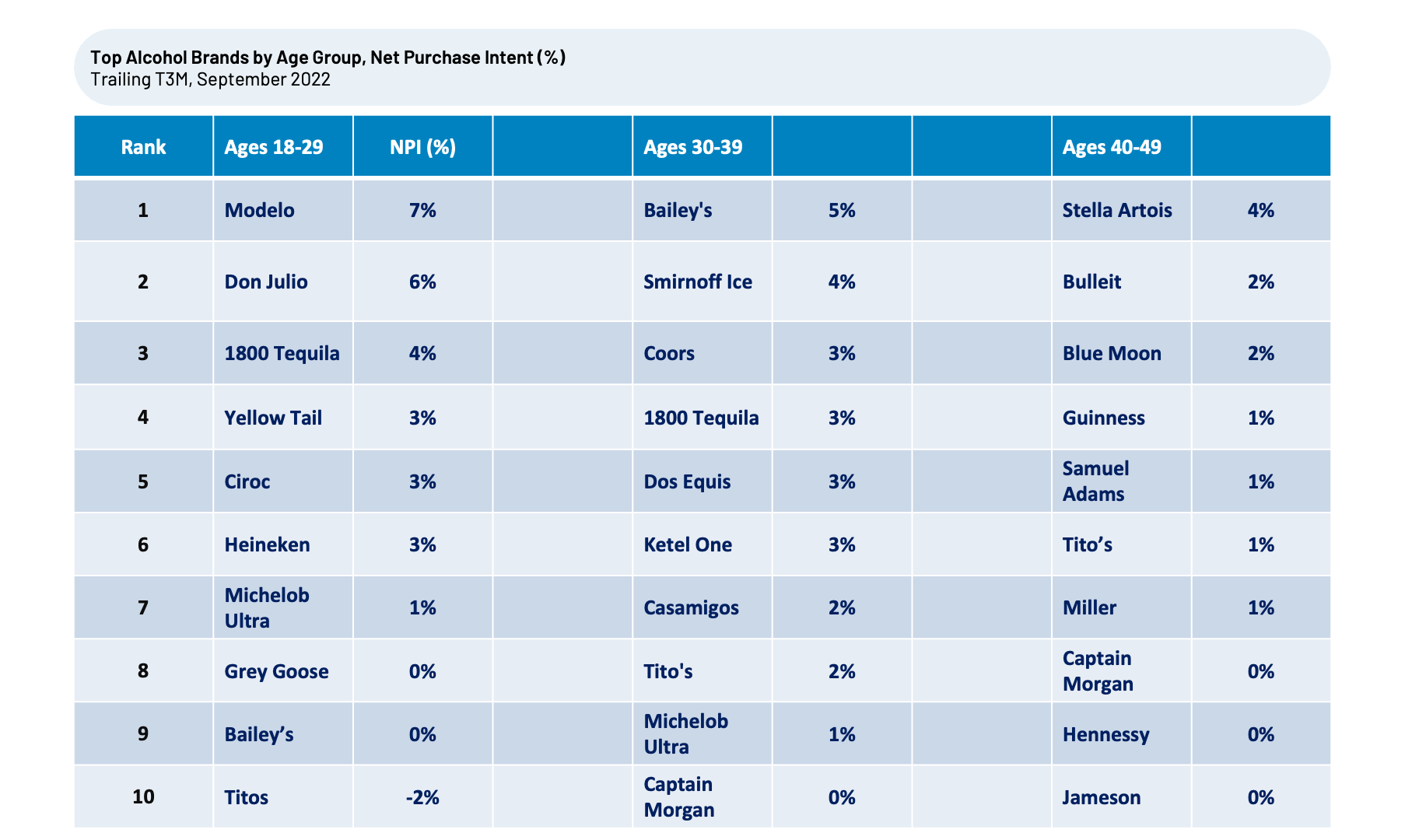

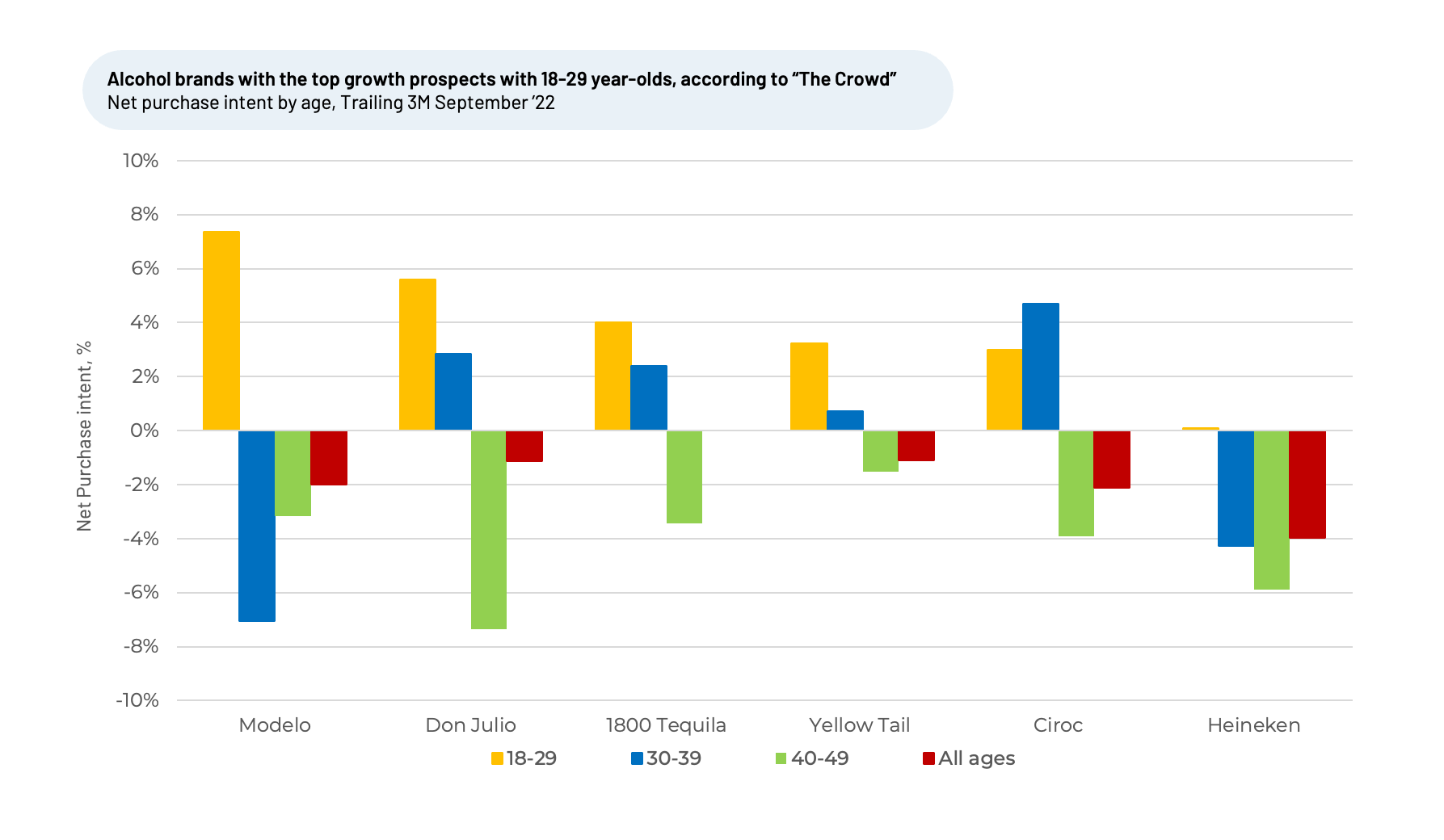

We next look at what alcohol brands consumers favor and intend to drink more of in the future. Within each age group we see much variety and differences.

Age 18-29, intend to drink lighter, relatively "healthier" drinks

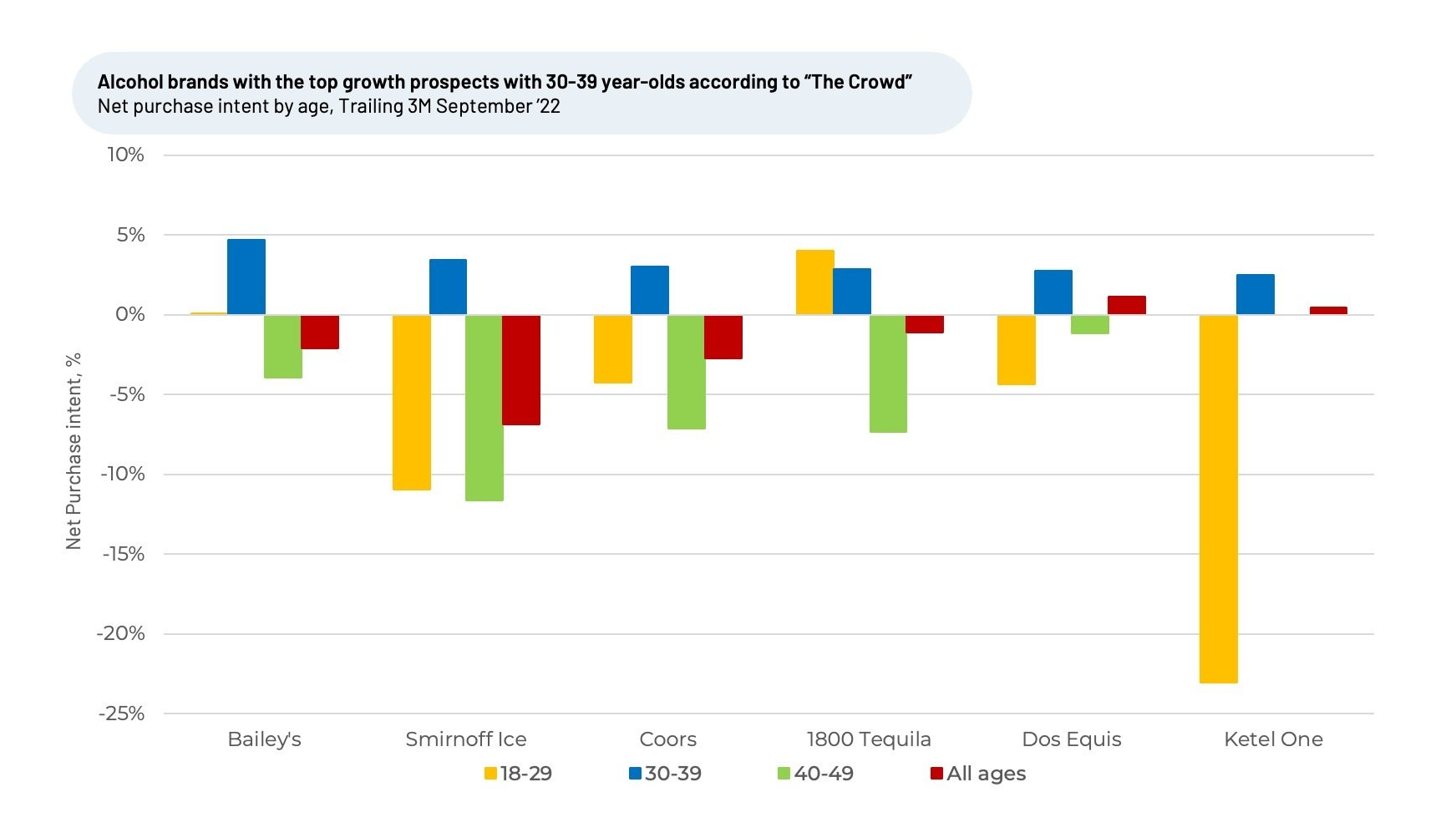

Ages 30-39, intends to drink more of a range of alcohol types

This group intends to drink more of a wide mix of different drinks, ranging from tequila and vodka to flavored drinks and beer.

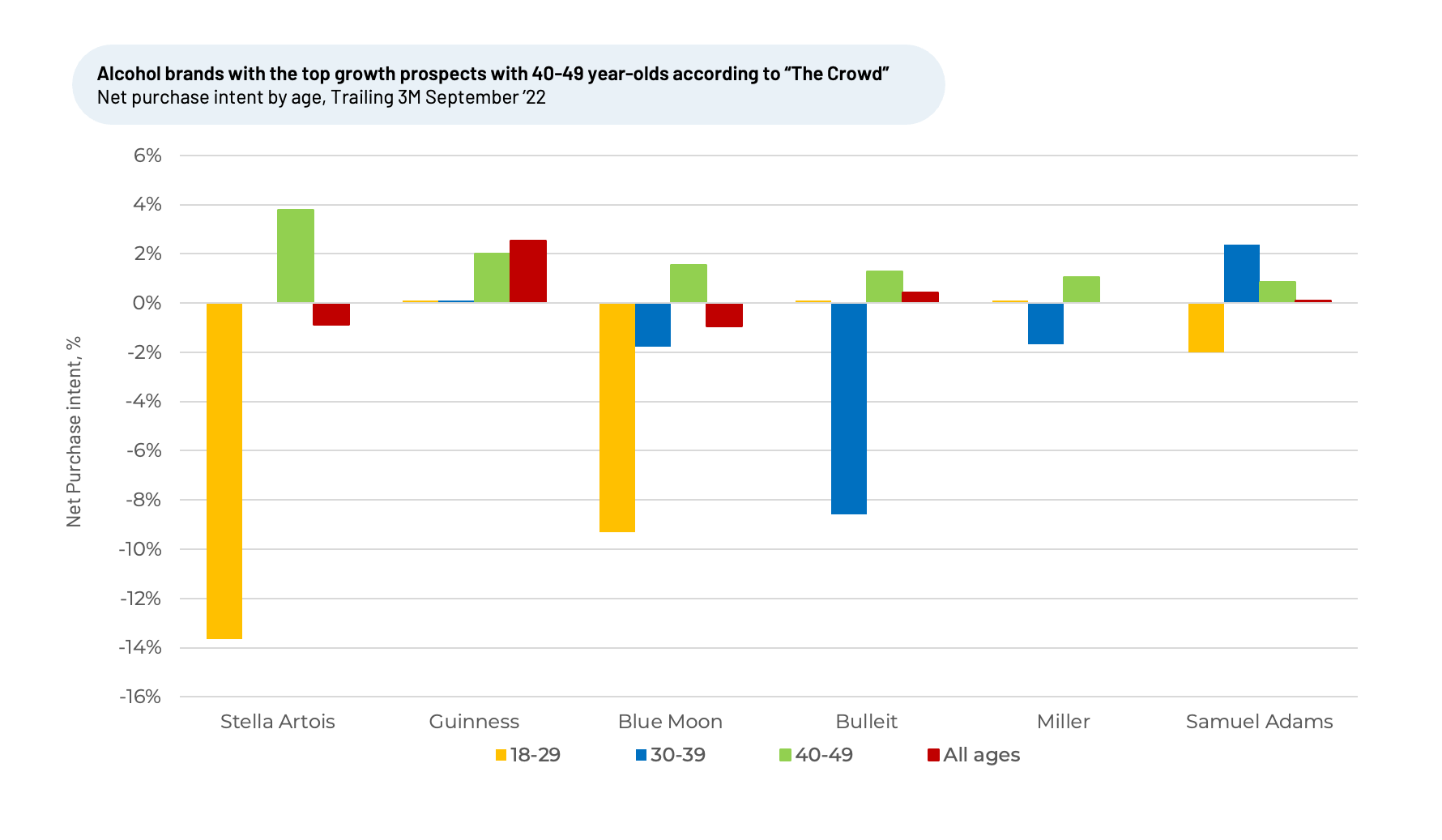

New Ages 40-49, plan to drink less overall, but consume more beer and brown liquor

Purchase intent data indicates this group expects to drink more beer and brown liquor such as whiskey and rum.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on specific drivers of customer satisfaction (the top three for Alcohol Beverages are Taste, followed by Price and Product Availability), other companies within 75+ other industries we cover, or to learn more about using Data for Good, please

contact us

.

Share This Article