The Crowd Report: Sports Entertainment + Sports Betting

Sports and online betting resonating with younger fans.

Live sports and sports broadcasting continue to enjoy healthy demand trends in the United States, with a competitive World Series in full swing and the NFL, NBA, and NHL seasons all underway. We continue our coverage of the Sports Entertainment and Online Sports Betting industries, looking into trends specific to 18–29 year-olds, observing that this age group plays an important role and should remain an area of investment for these industries.

“The Crowd,” real consumers that watch and attend sporting events and who share immediate feedback with HundredX, indicates that:

- 18–29 year-olds should be the strongest growth segment for Sports Leagues for at least the next few quarters.

- demand growth for Sports Entertainment should remain stronger for the 18–29-year age group than the other forms of entertainment we track this year.

Overall, we examine close to 50,000 pieces of feedback across Sports Entertainment and Online Sports Betting and more than 487,000 pieces of feedback across the entire Entertainment & Media sector, August 2021 through September 2022.

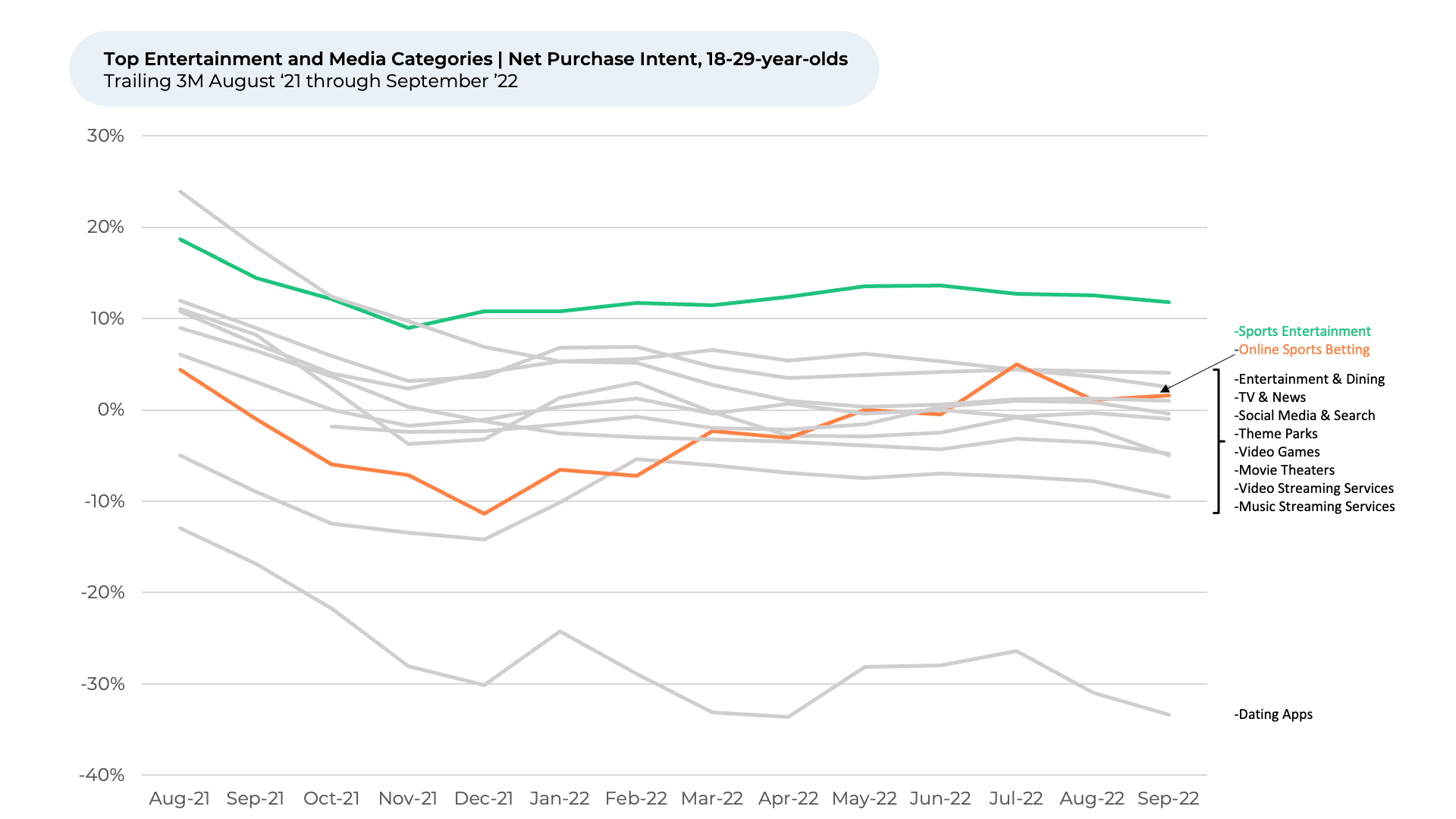

In our Winning at Sports Entertainment note from September 2022, we found Sports Entertainment had the highest future Net Purchase Intent (NPI) for the trailing three months ended (T3M) September 2022 of all the segments of entertainment that we cover, inclusive of all age groups. NPI for entertainment categories reflects the percentage of customers who plan to engage more with a type of entertainment over the next 12 months minus the percentage that intends to engage less. We find NPI correlates well with demand growth trends and market share shifts.

Sports Entertainment shows the highest NPI for T3M September 2022 for 18–29 year-olds specifically, ahead of Entertainment & Dining, Theme Parks, Video Games, Streaming Media and others. Sports Entertainment enjoys an even greater lead over other entertainment sectors within the 18–29-year-old segment than it does for all age groups in general.

We also find Sports Entertainment is the only entertainment category we cover that has NPI for T3M September 2022 that is both positive (12%) and up versus January 2022 (when T3M was 11%).

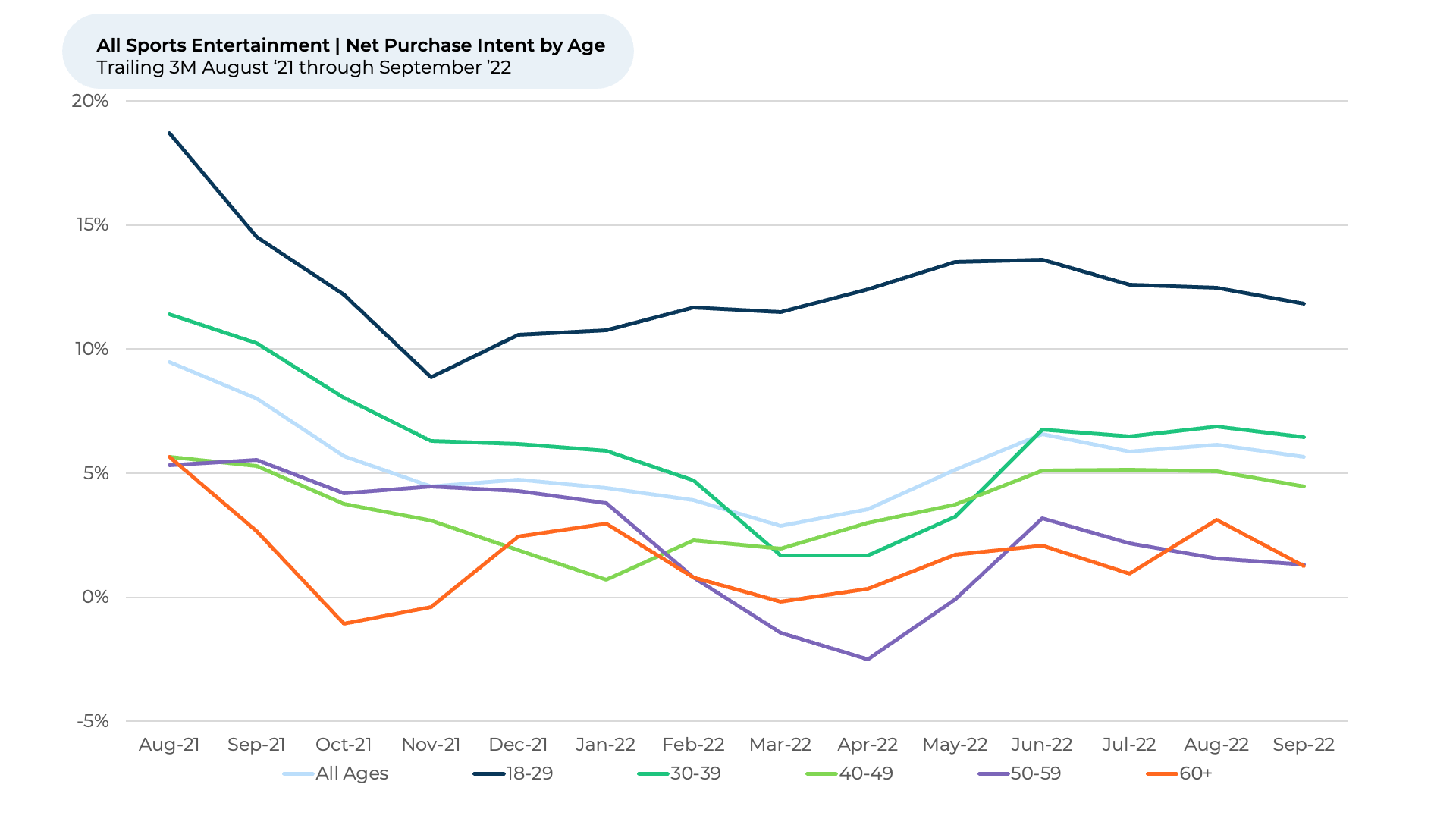

Looking closely at NPI by age segment for only the Sports Entertainment industry, we see 18–29-year olds show the highest NPI of all age groups (12% for T3M September 2022), with a healthy lead over the next closest group, 30–39 year-olds, with an NPI of 6%. Online Sports Betting may help explain why.

While Online Sports Betting does not post the strongest NPI for T3M September 2022 (2% for 18–29-year-olds), we find it enjoyed the biggest positive NPI move since the start of the year compared to other forms of entertainment (up 9% from -7% for T3M January 2022). All other categories ranged from up 1% since January 2022 to down 6%. This finding implies Online Betting should enjoy a stronger sequential improvement in demand growth with the younger population than other forms of entertainment.

This fact doesn’t appear lost on the industry, which has and should continue to invest in attracting younger gamblers. Influencer Jake Paul has noticed the rising popularity of online sports betting platforms among younger audiences. In September 2022, Paul and Simplebet founder Joe Levy launched Betr, a micro-betting app with a simple, easy-to-use interface made to appeal to Gen-Z.

DraftKings, in its 2021 Annual Report, notes a large portion of its users are in a “younger demographic.” BetMGM, meanwhile, in September 2022 signed actress Vanessa Hudgens as its newest celebrity brand ambassador. Hudgens, 33, rose to fame in the High School Musical movies ― a series that resonates strongly with Millennial and Gen Z viewers.

The growth in demand for both Sports Entertainment and Online Sports Betting with young consumers is highly correlated, potentially indicating increased interest in gambling could support continued growth in spending on sports. We find an 80% correlation between Sports Entertainment and Online Sports Betting NPI from T3M January 2021 through T3M September 2022.

Among the biggest sports leagues, we find Premier League is one of the breakout stars with 18–29 year-olds, surging from an NPI of 13% in T3M November 2021 to 41% in T3M April 2022. Although its NPI has since declined to 25% for T3M September 2022, Premier League remains ahead of other major leagues with younger consumers and appears poised to gain market share.

Formula One, the top sport in NPI across all ages, has the second highest NPI among 18–29 year-olds at 18% for T3M September 2022. Of the four largest sports leagues in the United States, the NFL posts the highest NPI for T3M September 2022 at 16% for 18–29 year-olds.

As the major league seasons progress, we continue to monitor NPI and growth trends among all age groups and the critical 18–29 year-olds demographic to find if that age group continues to outpace on NPI. Contact HundredX to learn about the factors that drive 18–29 year-olds’ interest in Sports Entertainment and Online Sports Betting.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform outlook for businesses and industries. For more info on any of the sectors mentioned above, as well as any of our 75+ other industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article