HX Trends: World Cup Fan Favs + Flavs

Now, during the 2022 FIFA World Cup in Qatar, numerous restaurants and sports bars across the U.S. have modified their hours to stay open during matches. At HundredX, we want to understand which food establishments should potentially form partnerships with soccer leagues, because they are top of mind for soccer fans.

We looked to “The Crowd,” real MLS and Premier League fans who share feedback with HundredX. By analyzing more than 20,000 pieces of feedback on MLS, Premier League, and four largest U.S. sports leagues, along with more than 450,000 pieces of feedback on restaurants from January through October 2022, we find:

- Sports fans are at least 1.5x more likely to leave feedback on Quick, Fast, Casual and Sit-Down restaurants than the average HundredX respondent.

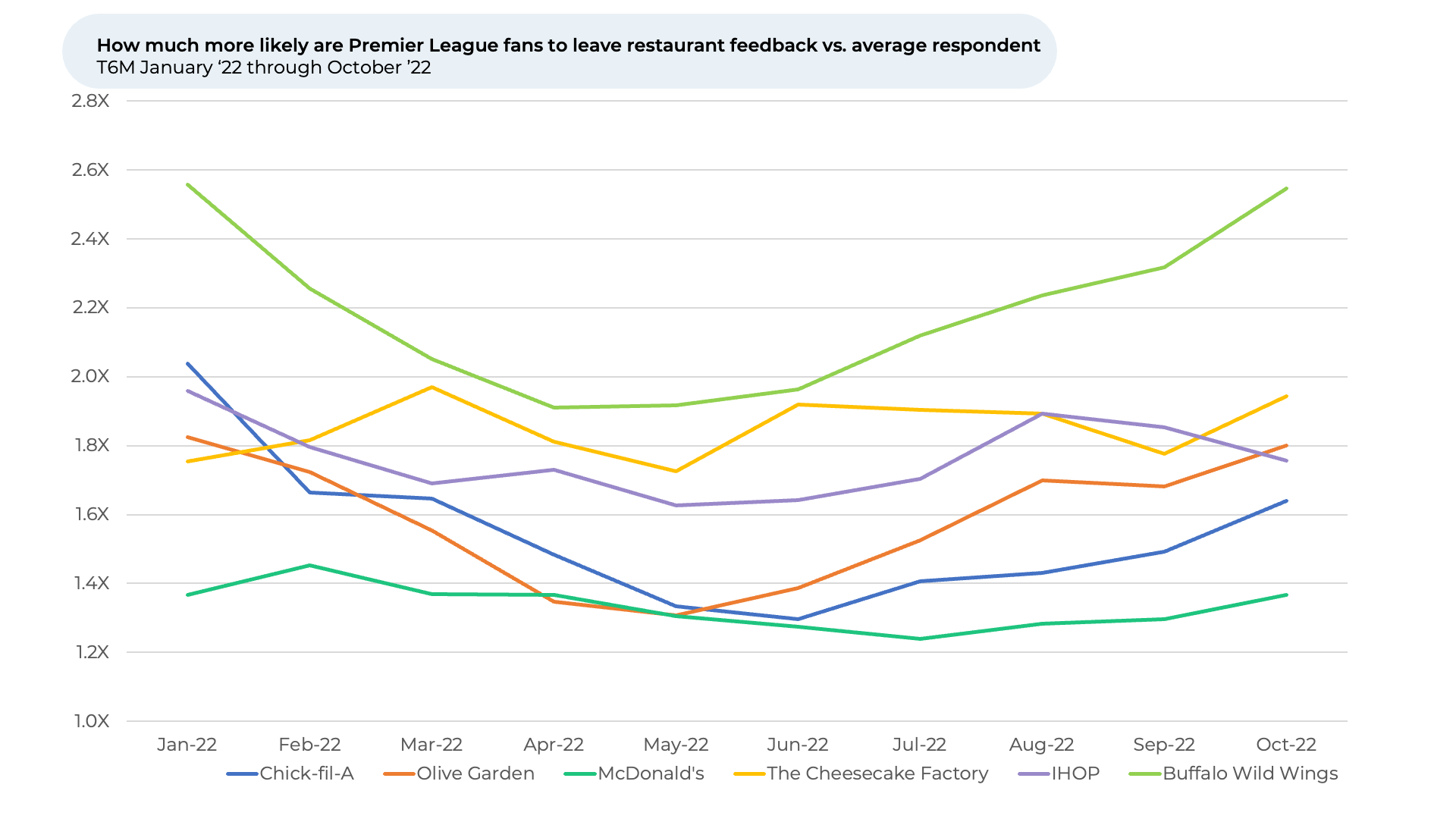

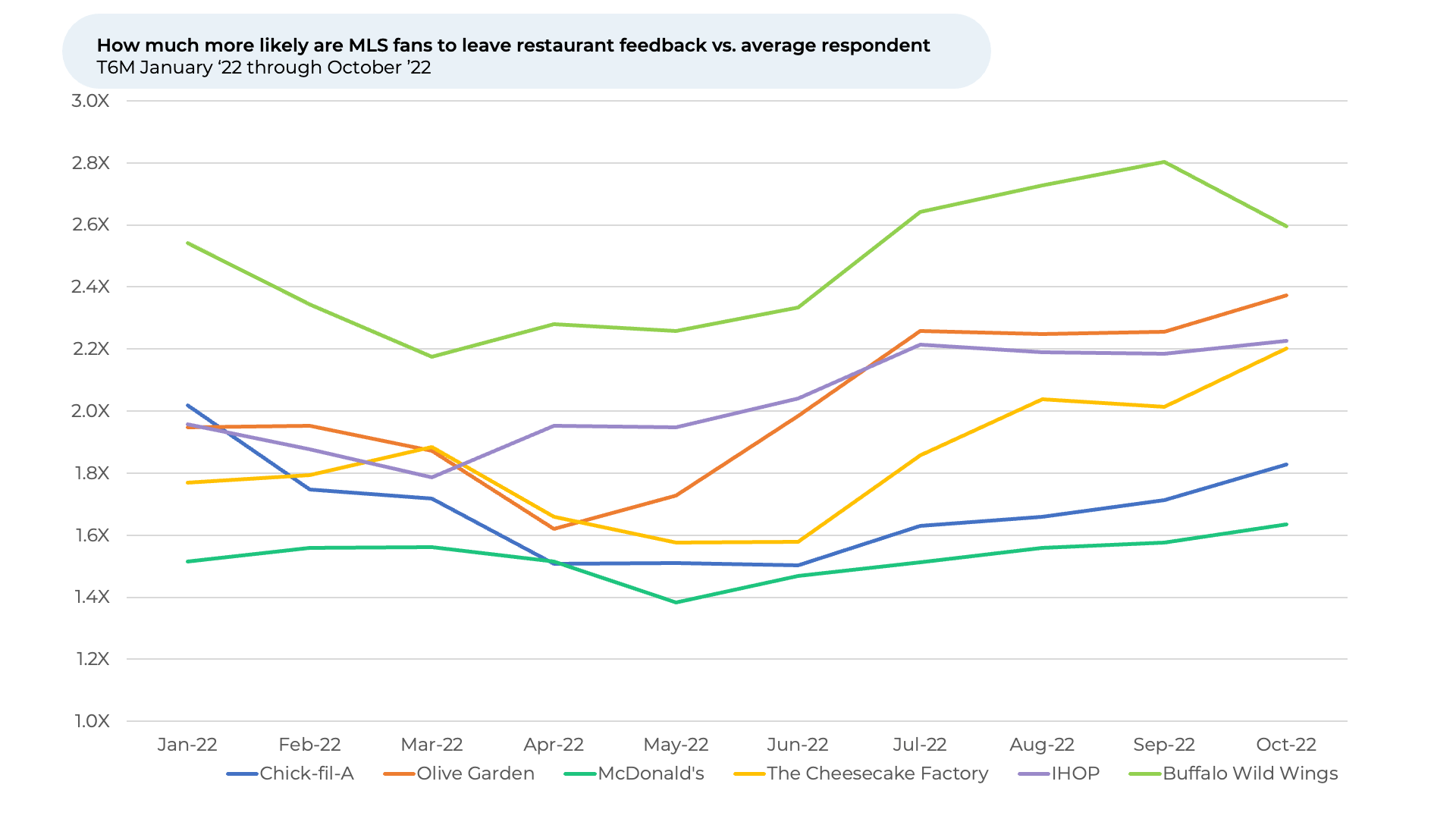

- Soccer fans are 2.5x more likely to review Buffalo Wild Wings, the highest of all restaurants we cover.

- Soccer fans began leaving dramatically more feedback on Buffalo Wild Wings and Olive Garden at the start of the MLS and Premier League 2022–23 seasons.

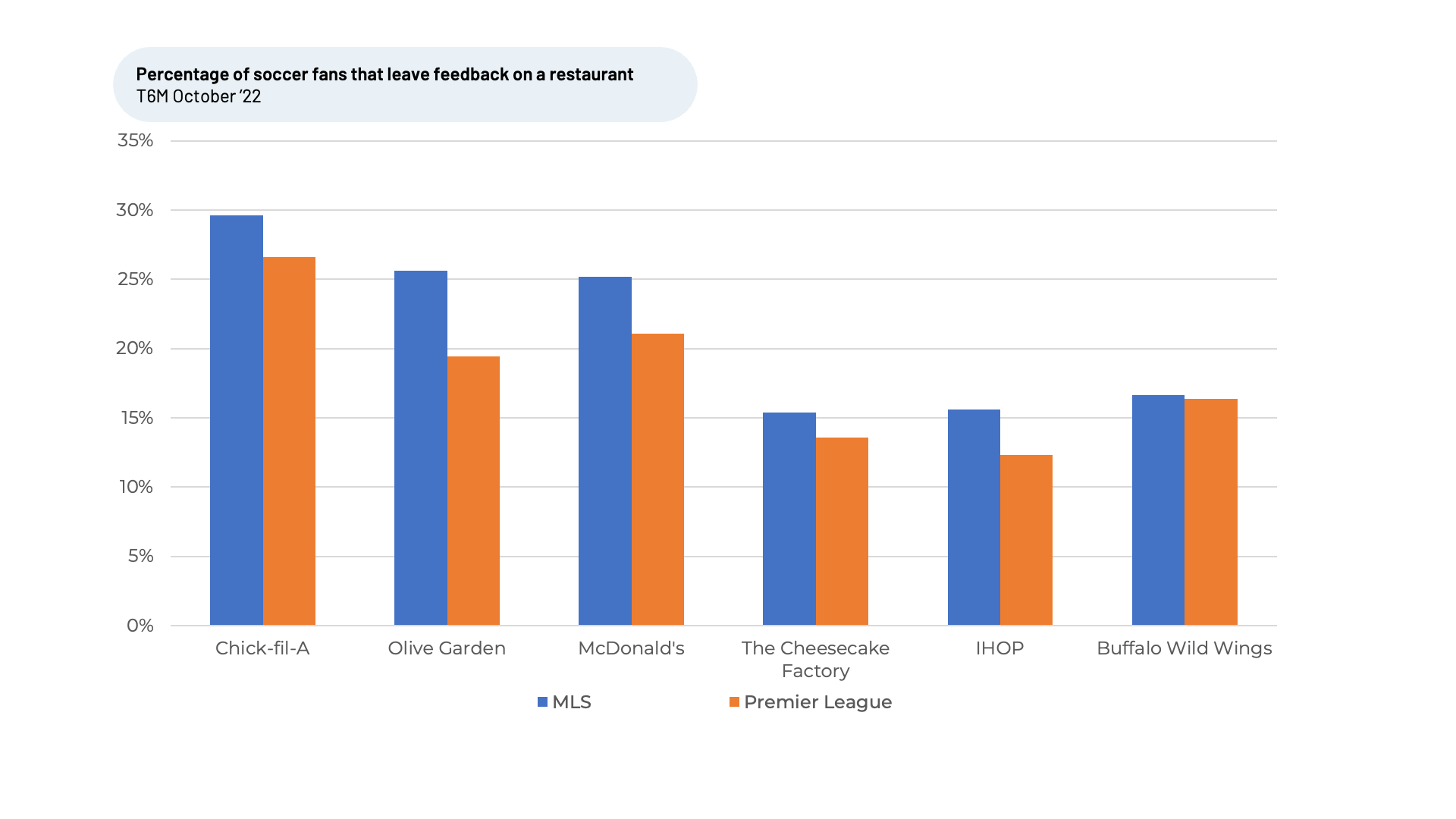

HundredX data from “The Crowd” shows that people who provided feedback on MLS or Premier League were 1.5 to 2.5x more likely to also provide feedback on one of the below restaurants, compared to the average person who shared their views with HundredX. For example, 16% of HundredX respondents in 2022 shared thoughts on Chick-fil-A, versus 30% for those that reviewed MLS and 27% for Premier League. Note, people only leave feedback with HundredX for products or services they use.

Soccer Goals

MLS and Premier League fans prefer many of the same restaurants as well, though different names rise to the top and a few new ones make an appearance in the top 10:

“My kids love this place. My son’s soccer team eats here every time they are out of town for a tournament. No matter the city, we are at [Buffalo Wild Wings],” one person told HundredX.

As of October 2022, Purchase Intent

1

for Buffalo Wild Wings is higher for MLS (+5%) and Premier League (+3%) fans compared to the average person as well. Purchase Intent for the Restaurant industry represents the percentage of customers who expect to eat at the restaurants more over the next 12 months, minus those that intend to eat there less.

The rise corresponds with the 2022–23 Premier League season, which started August 5, 2022 and runs until the end of May 2023. The increase could mean Premier League fans are going to Buffalo Wild Wings to watch the games or taking wings home.

We also see notable movement with Olive Garden. From April to October, Olive Garden made the largest gains both in the percentage of feedback left by MLS fans and how much more likely MLS fans were to review Olive Garden relative to the average respondent. “I travel with a soccer team and in every city we go to [Olive Garden is] always willing to seat our large group. They are always friendly and the service is fast and friendly,” one person said to HundredX.

Interestingly, a number of professional soccer players have said they like Olive Garden, including United States national team members Tim Ream and Kellyn Acosta. It is possible their support is driving more fans to Olive Garden lately.

As the World Cup 2022 rages on, we monitor soccer trends to best understand the likes and dislikes of soccer fans. We will continue watching these trends during the 2023 MLS and Premier League seasons.

1. All metrics presented, including Net Purchase Intent / Purchase Intent, Net Usage Intent (Usage Intent), and Feedback Numbers are presented on a trailing six-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article