Sector Snapshot: Restaurants, Grocery, and Food Delivery

Amid supply chain issues, labor shortages, and rising costs, the overall Food sector experienced a slowdown while navigating a tricky landscape in 2022. These challenges impact grocery chains, restaurants, food delivery services, and their shoppers.

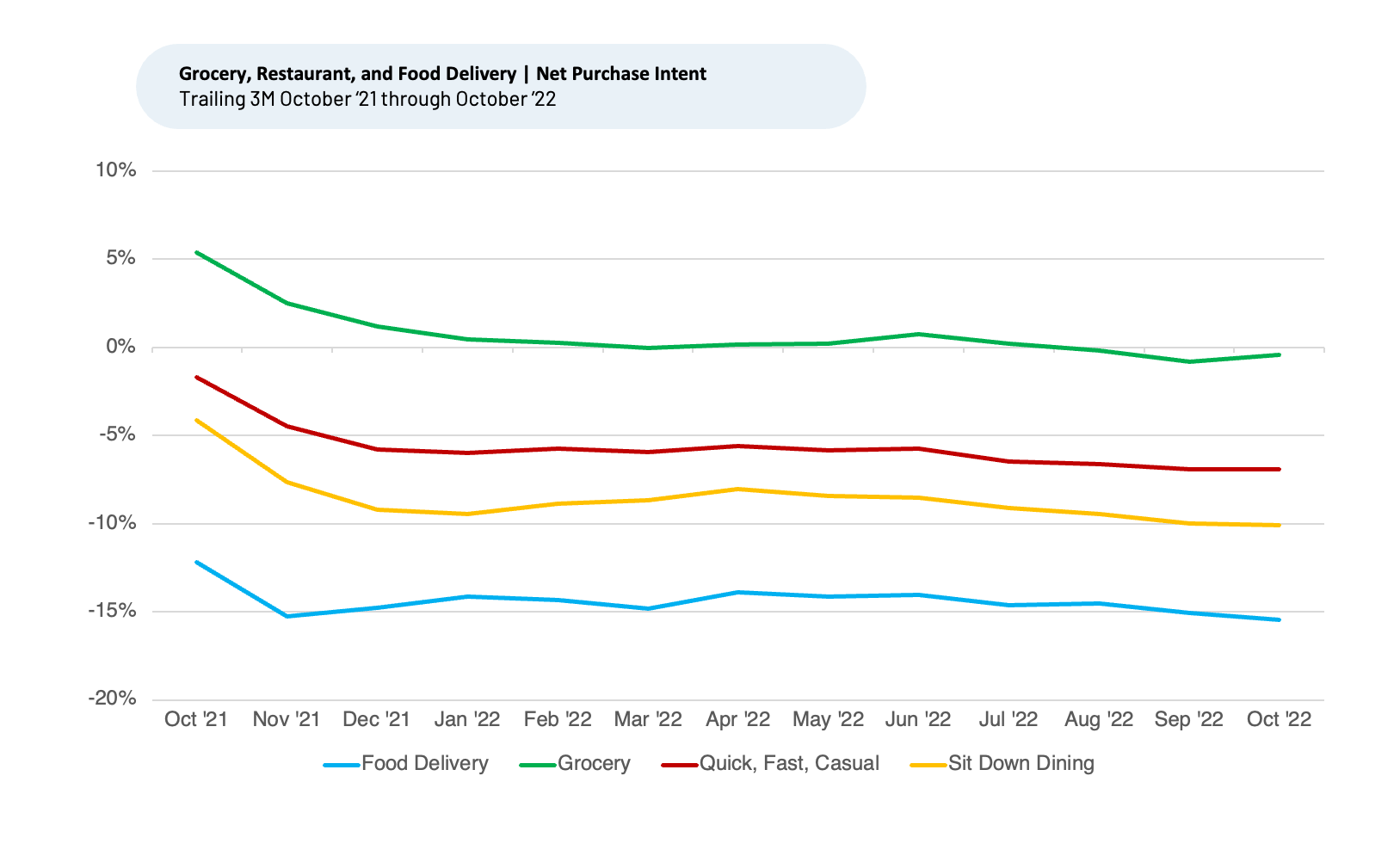

- October 2022 overall Purchase Intent1 remains negative for all but Grocery.

- Price sensitivity appears to affect all subsectors.

- Customers will most likely continue spending at grocery stores vs. other food outlets, given current prices and inflationary uncertainty.

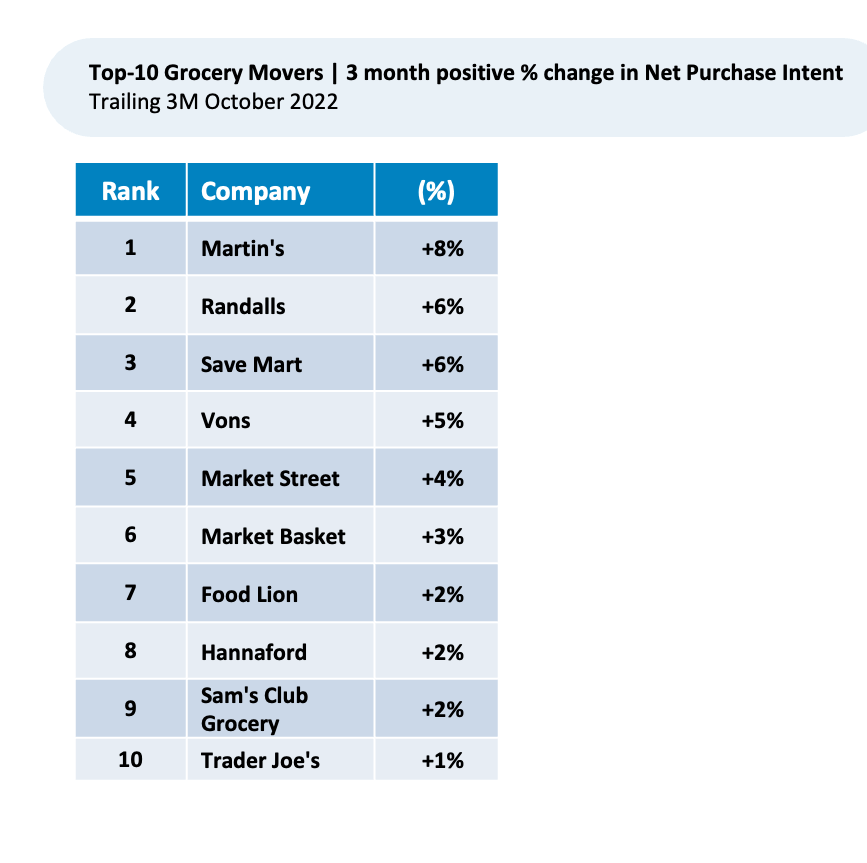

- Regional grocery chains Martin’s, Randalls, and Save Mart saw the biggest increases in Purchase Intent during the last three months.

Leveraging HundredX’s proprietary listening methodology, we look at more than 140,000 pieces of customer feedback since October 2021 on major grocery chains, restaurants, and food delivery services. We leverage that data for insights into customers’ future purchase intent, changing demands on grocery chains, and which companies look to benefit most.

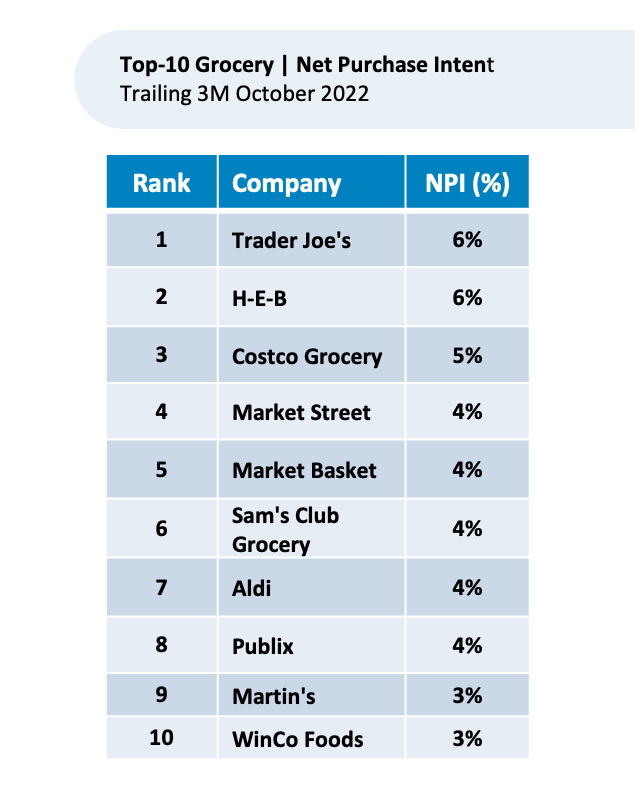

Top Overall Purchase Intent Leaders

According to “The Crowd” — real shoppers who share immediate feedback with HundredX — people expect their spending to increase more at Grocery stores than with Food Delivery or Restaurants. Purchase Intent,1 which represents the percentage of customers who expect to spend more with that brand over the next 12 months minus those that intend to spend less, remains the most positive for grocery shoppers.

Within Grocery, the following stores are likely to see the greatest increase in spend and market share.

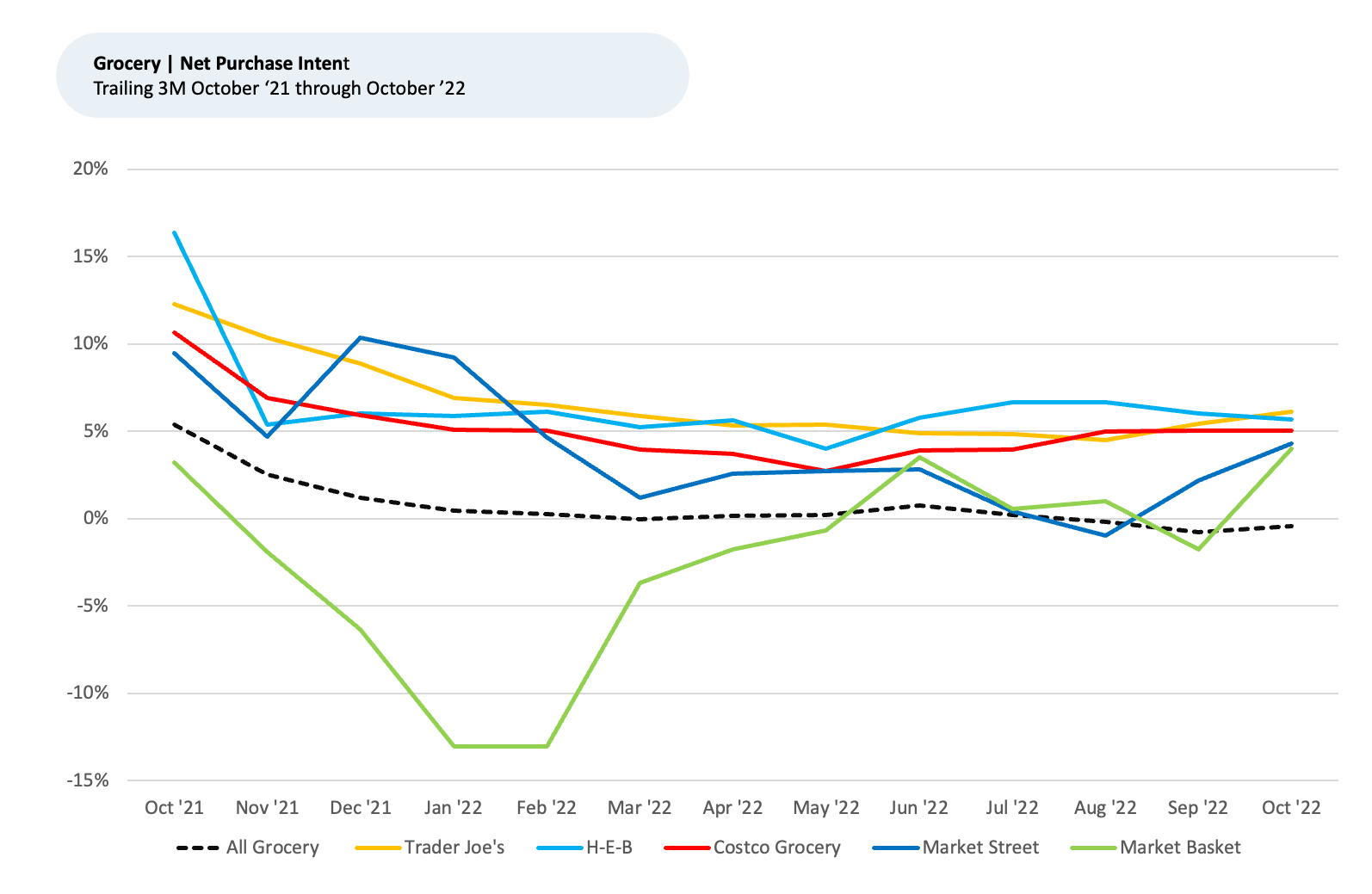

Customer purchase intent has been positive or stable for select, top chains throughout 2022, though down year over year for the grocery space overall.

Top Purchase Intent Movers

To get an idea of which grocers appear poised to gain market share, we look at which stores saw the greatest increase in Purchase Intent during the last three months.

Purchase Intent appears to be rising the most for smaller regional chains Martin’s (+8% during the last three months) and Randalls (+6% the last three months), both seeing growth in the Midwest and Texas. California-based chain Save Mart (+6%) also improved during the three-month period.

Grocery stores improving the most during the past three months showed higher customer satisfaction with the main factors customers select as the most important when shopping for groceries. Price is selected as the most important factor determining satisfaction with a particular brand, followed by Selection, Speed/Checkout, Cleanliness, and Quality.

Martin’s Supermarkets, a Midwest chain operated by SpartanNash, leads Grocery in Purchase Intent improvement over the last three months, up from -5% in July 2022 to 3% in October 2022. The improvement implies the store is getting credit for some of its recent innovations. For example, in November, nearly 100 SpartanNash locations, including Family Fare, Martin’s Super Markets and D&W Fresh Market storefronts, will be available to shop through Uber and Uber Eats. Over the last six months, Martin’s saw the greatest improvements in customer sentiment towards its Selection, Speed/Checkout, Cleanliness and Quality.

Randalls, an Alberstons’ company with locations in Texas, improved its Purchase Intent from -13% to -7% during the past three months. The chain has been reducing its number of stores, cutting costs, and focusing efforts on its key properties and core customers. For decades, Randalls was a leading upscale supermarket chain in Houston catering to the upper-middle class. However, Safeway acquired Randalls in 1999, and then Albertsons acquired Safeway and the Randalls brand in 2015. These corporations removed high-end products and replaced them with more generic, less high-end products. Randalls has been trying to lure back customers by remodeling stores and introducing online ordering, curbside pickup, and home delivery services. These efforts have been improving sentiment and satisfaction with customers, who now recognize the chain for better Price, Selection and Cleanliness.

Save Mart, up from -8% to -2% over the past three months, added hundreds of new items per year to its existing lines, as well as creating new ones as part of its ongoing private label expansion. It is focusing on a three-tier approach to its own brands’ value proposition: unique flavors, national brand equivalents and cost-saving options. “With the economic pressures our shoppers are facing today, the ongoing expansion of our proprietary brand options and everyday solutions we provide, reaffirms our commitment to our customers in the strongest way possible,” said Rebecca Calvin, chief merchandising officer in a press release this year. Over the last six months, Save Mart saw the greatest improvements in customer sentiment towards Selection, Speed/Checkout, and Cleanliness.

Stores with the most improved Purchase Intent during the past three months show high customer satisfaction with Price and Selection. These two factors, more important during inflationary periods, are helping top grocers to gain market share from the competition. We continue to monitor these trends as the economic and pricing uncertainty unfolds.

1 All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article