Sector Snapshot: Video Games

Tis’ the season of big game releases. Overwatch 2 and Call of Duty: Modern Warfare II hit stores in late October. Pokémon Scarlet and Pokémon Violet, God of War Ragnarök, and Need for Speed Unbound all came out in November. CD Projekt RED just released the next-gen update for The Witcher 3 in December.

Despite some titles getting pushed back into 2023 (we’re looking at you, Hogwarts Legacy, Dead Island 2, and Skull & Bones), the games that did release should keep gamers busy during the holiday months.

To get a feel for which titles gamers will hunker down for the winter with, we looked to The Crowd, real video game players who share feedback with HundredX. By analyzing more than 39,000 pieces of feedback on more than 50 of the top game franchises we cover from January to November 2022, we find:

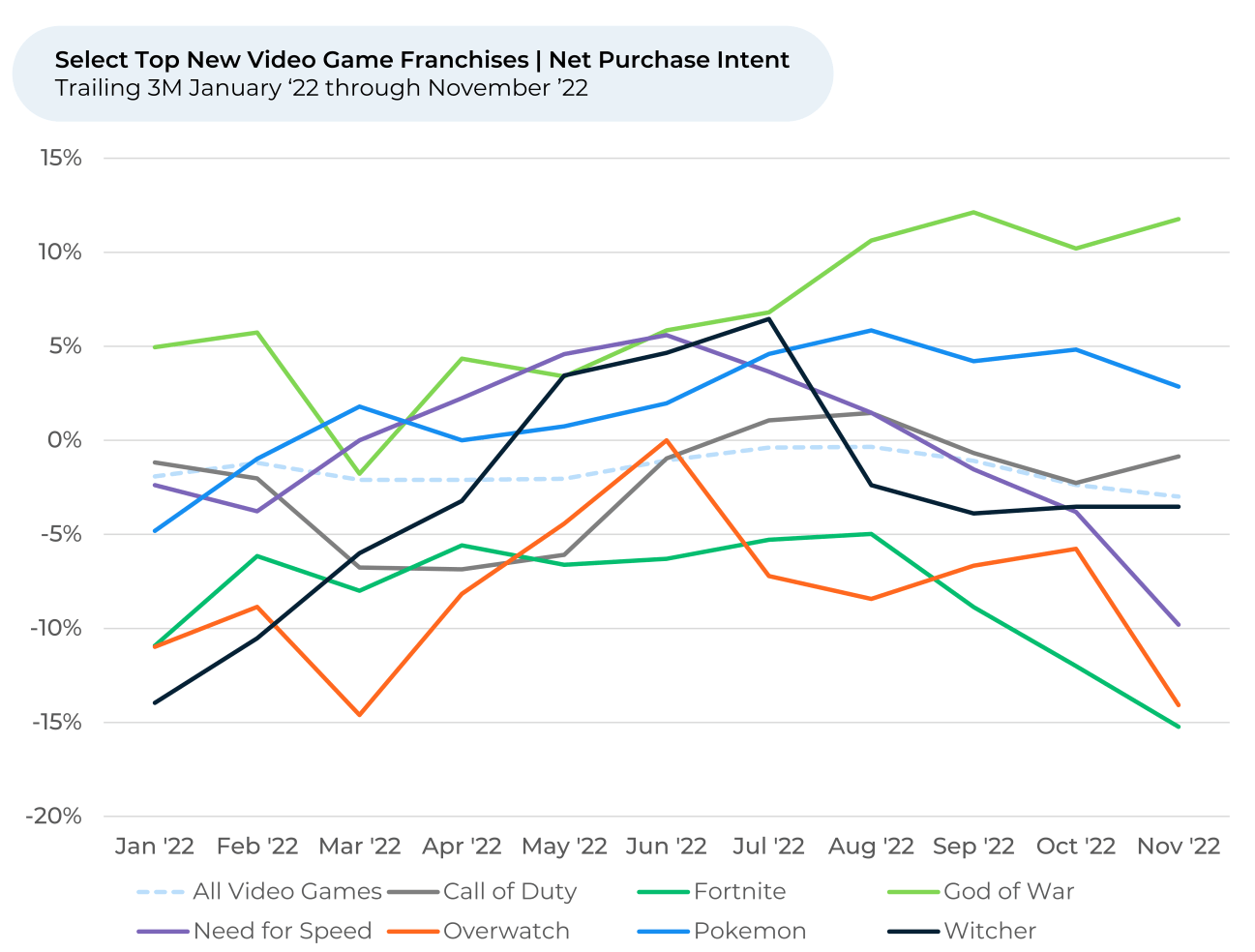

- The willingness of gamers to spend money on their favorite franchises was down modestly over the last three months, but was up for God of War.

- Gamers care most about a game’s entertainment and challenge factors, followed character and storylines and graphics and sound. God of War and The Witcher outperform on all three.

- Gamers’ sentiment towards characters and storylines also increased noticeably for Pokémon over the past three months, driven by positive reviews of Pokémon Scarlet and Violet.

- Need for Speed saw a surge in satisfaction with graphics and sound ahead of its November 29 release, with gamers applauding its animation style.

Where do gamers want to spend more money?

We find the willingness of gamers to spend money on their favorite franchises was down modestly over the last three months, but was up for God of War. HundredX data shows it was the only major franchise with a release out in the three months leading up to the holidays with an increase in Purchase Intent1 . The significant increase in people indicating they would spend more on the franchise actually started in July 2022, the same time Sony released the “Father and Son” cinematic trailer for the God of War Ragnarök. Maybe major marketing efforts do pay off! God of War Purchase Intent rose from 3% in May 2022 to 12% in November 2022.

Note, Purchase Intent represents the percentage of customers who expect to spend more on that game franchise (including the games themselves, downloadable content, in-game purchases, etc.) over the next 12 months minus those that intend to spend less.

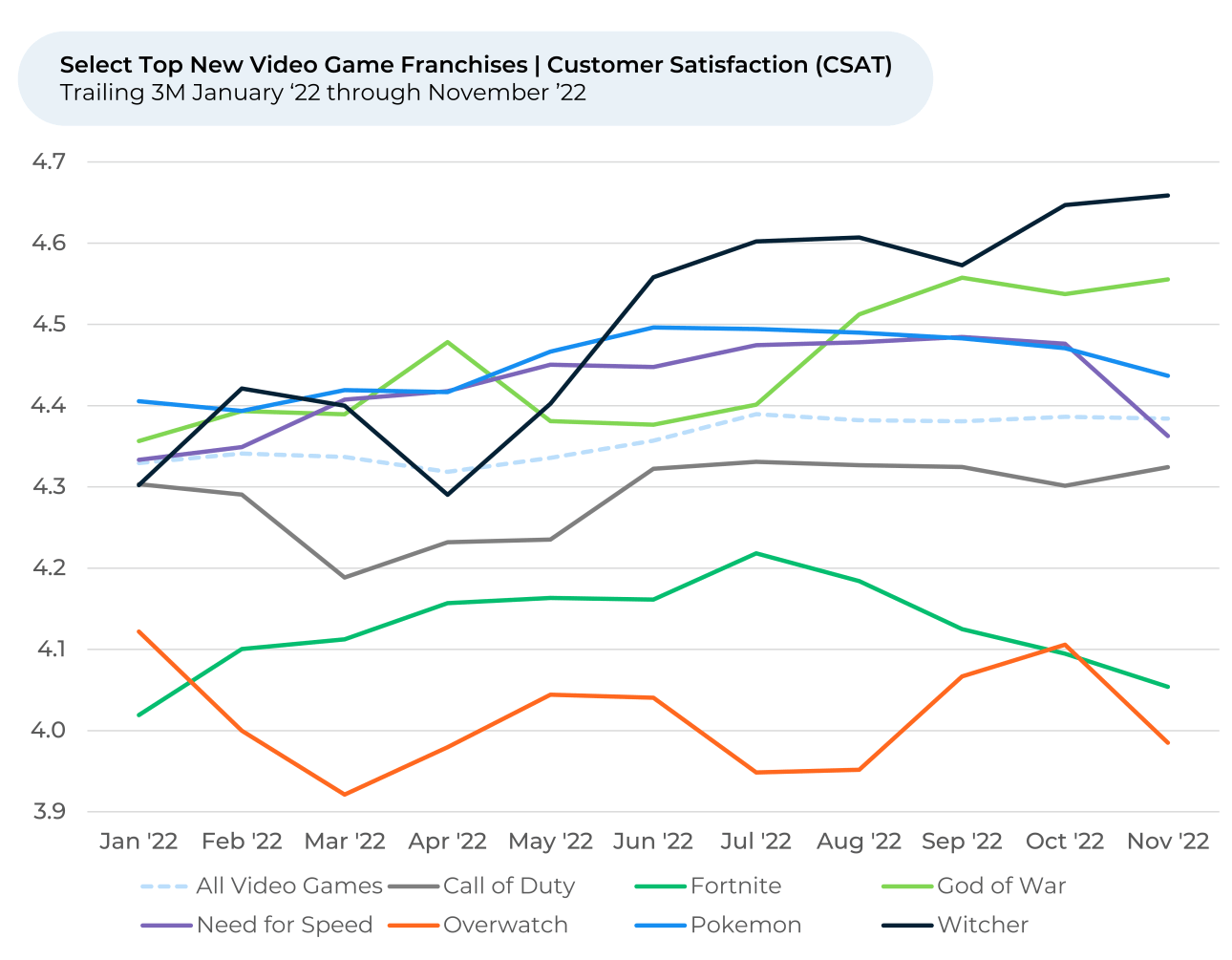

Looking at HundredX Customer Satisfaction data for major releases in the last three months, which measures how “The Crowd” likes a specific game on a five-point scale, we find gamers like

The Witcher

franchise best, even as more people plan to reduce their spend on the franchise than the average franchise we cover.

Its significant increase to become the top franchise in Customer Satisfaction isn’t surprising, given its recent next-gen upgrade, the first since The Witcher 3 was released in 2015. The dramatic increase started in May, the same month developer CD Projekt RED announced the game would be getting a free next-gen upgrade in Q4 2022. That upgrade, released December 14, introduced new content, 60fps, and ray tracing.

“The Witcher 3 is a great game. The story is awesome, and the game is immersive. My wife and I both enjoy the game,” one person said to HundredX.

The God of War franchise also began to significantly increase in Customer Satisfaction in July, again lining up with Sony’s big-budget cinematic trailer.

Why gamers like or dislike a game franchise

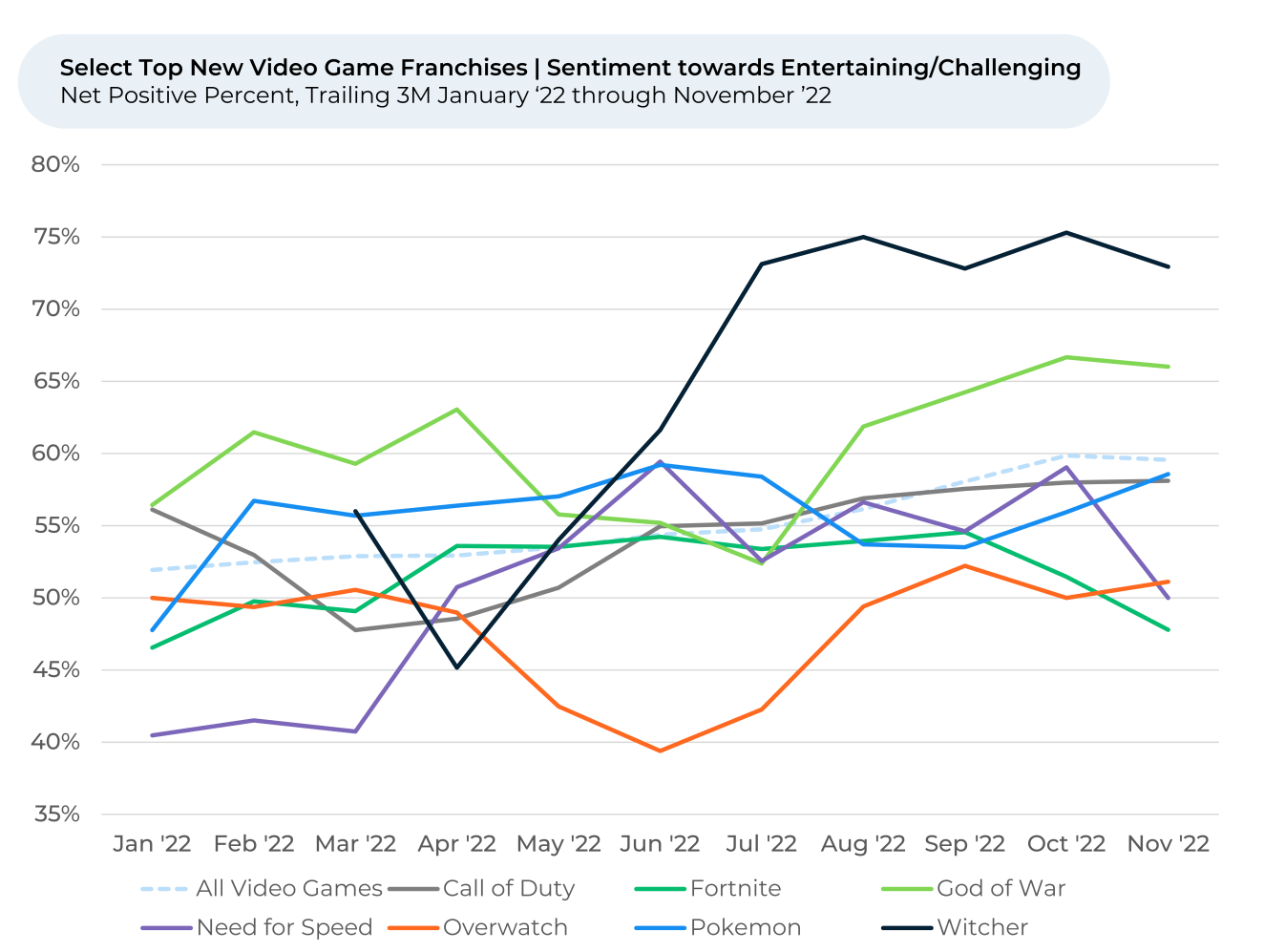

But, we wondered, why do gamers like or dislike games? Looking into HundredX data, we find gamers care most about a game’s ability to “Entertain and Challenge” them, followed by “Characters and Storylines”, and its “Graphics and Sound”.

The Witcher and God of War franchises easily outperform the other games we cover in sentiment towards Entertaining/Challenging. With scaling difficulty options, both franchises are known for their fast-paced, calculated combat. HundredX measures sentiment1 as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like the brand.

God of War Ragnarök and Pokémon Scarlet and Violet had the highest increases in sentiment towards Entertaining/Challenging over the last three months. Again, marketing likely plays a big role here, but for good reason: God of War Ragnarök enhanced the challenging gameplay of the first current-gen God of War title, while Pokémon Scarlet and Violet introduced a new open-world concept that allows players to challenge any gym leader in any order.

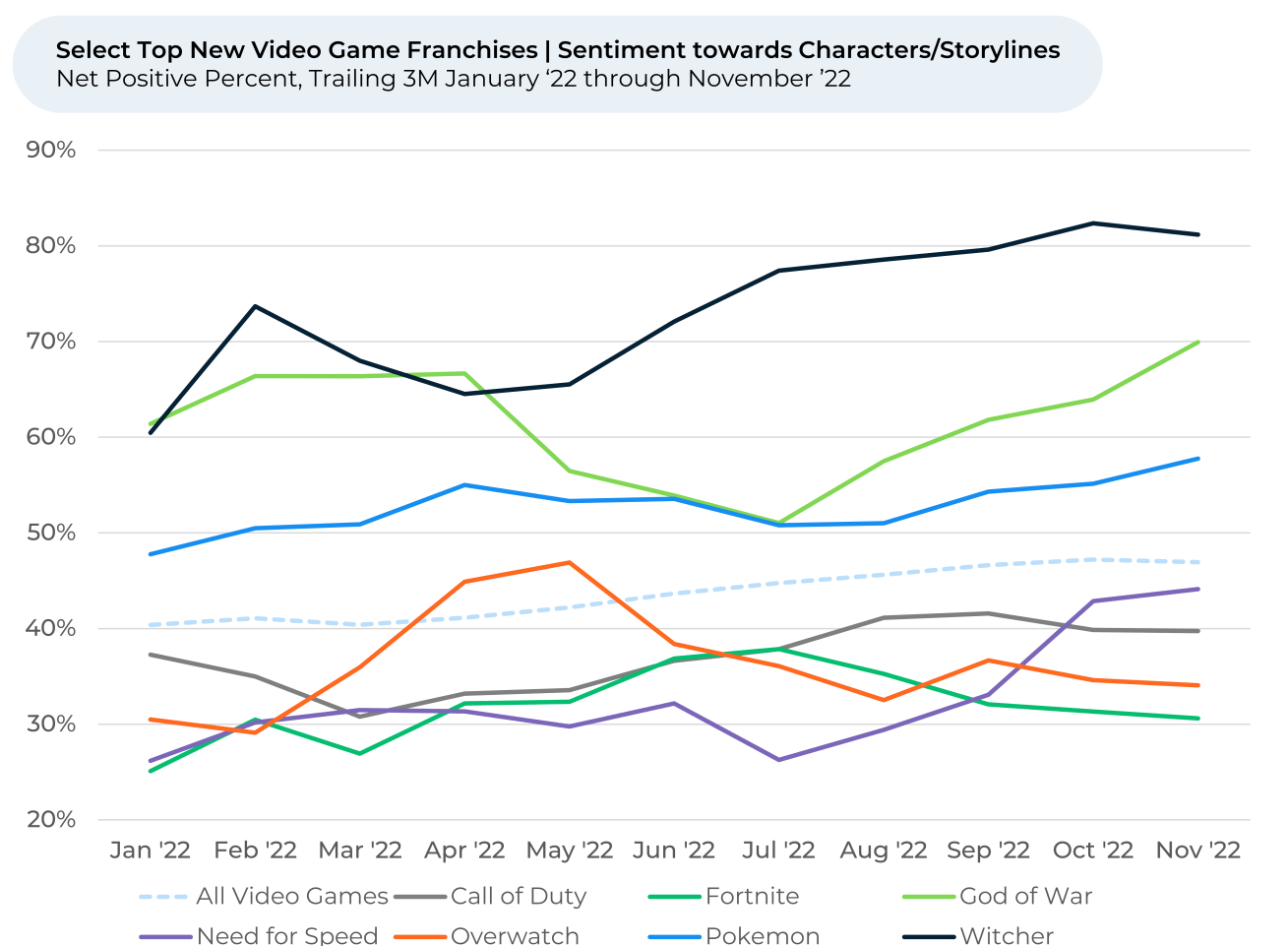

The Witcher and

God of War

franchises also dominate in sentiment towards Characters/Storylines. Again, not surprising – both franchises spend hours setting up characters, explaining how the game world works, and introducing emotional story arcs.

Once again, God of War is also one of the biggest movers. We see sentiment towards Characters/Storyline increase significantly after the trailer in July.

“The graphics are really cool as always but the roleplay and story line drives this gaming series for sure. The story line in God of War is awesome if you’re really into history be it fact or fiction,” one God of War fan told HundredX.

Gamers’ sentiment towards Characters/Storylines also increased noticeably for Pokémon over the past three months. Nintendo launched preorders in August and steadily released trailers and gameplay videos for Scarlet and Violet during that period. Indeed, popular gaming news site Kotaku lauded Pokémon Scarlet and Violet for their “compelling characters” in its review of the games.

Again, God of War outperformed the competition, this time in sentiment towards Graphics/Sound. Sentiment rose after gamers saw how much the graphics improved in the latest edition.

Graphics and sound satisfaction rose significantly for The Call of Duty franchise. Call of Duty: Modern Warfare II, the latest game in the main franchise, released in October following numerous trailer and gameplay videos.

“Love the CoD games, they are my favorite. Graphics are great, multi-player functionality is incredible, it allows you to connect and engage with people in a really fun way,” one person told HundredX.

Need for Speed saw a noticeable increase in sentiment towards Graphics/Sound from October to November. Need for Speed Unbound had surprisingly little marketing leading up to its release in November. However, fans and reviewers applauded the game’s graphics, revealed in an October trailer, which opted for a different look. In its review of the game, major gaming site IGN noted the game’s “bold new animated style impresses.”

With numerous releases on the horizon, HundredX will continue to monitor how gamers feel about some of the hottest franchises. 2023 looks to be a big gaming year, and we’ll be ready.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

Share This Article