Sector Snapshot: Retail

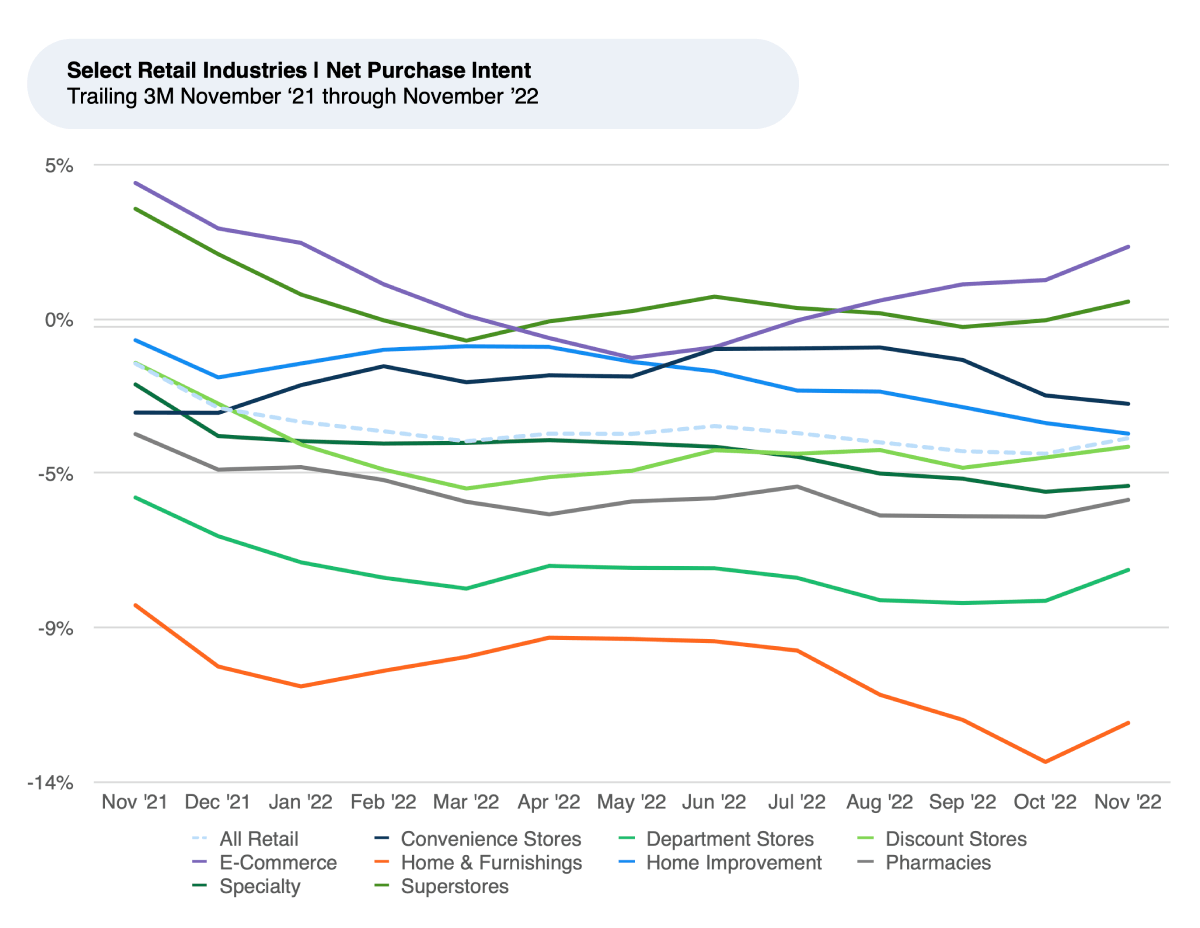

- Over the past three months, Purchase Intent has been relatively stable across Retail, with E-Commerce showing a slight increase.

- Shutterfly boasts the biggest increase in Purchase Intent as people send out holiday cards.

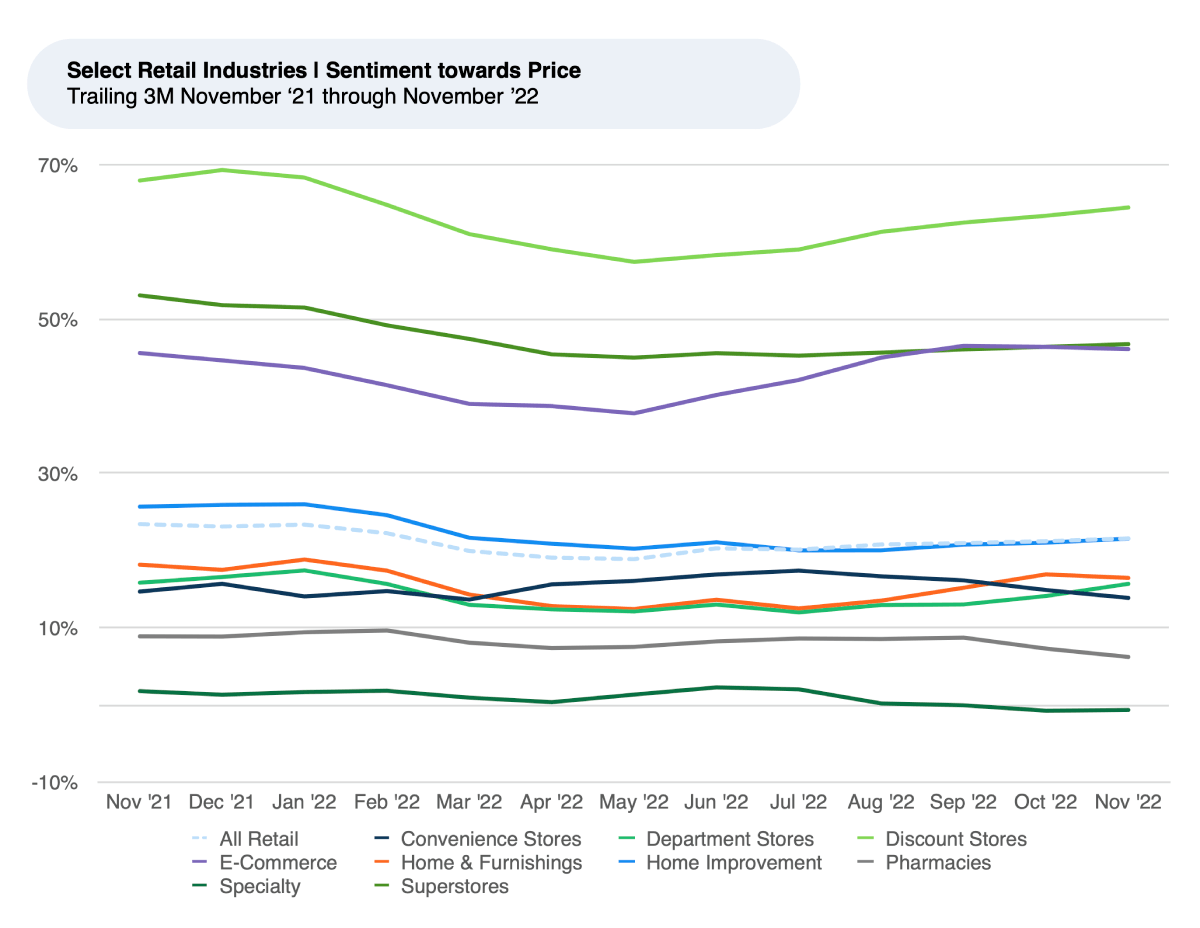

- Customers’ feel somewhat positively about Retail prices, but most positively about prices at Discount Stores, followed by Home & Furnishings and Department Stores.

- Department Stores Belk, Nordstrom, Sears, and Dillard’s saw some of the biggest recent gains in sentiment towards Price.

Purchase Intent remained relatively stable across Retail over the past three months. The sector sees slight upward movement (less than a percentage point) from October to November, possibly as people shopped for the holidays and took advantage of Black Friday deals. Home Improvement and Home & Furnishings saw some of the biggest declines since August, with both down about a percentage point. Homeowners typically start outside home improvement projects in the Spring or Summer due to weather considerations. Rising interest rates are also likely dampening demand for big projects. We have seen a 60%-80% correlation between Census Bureau sales data and Purchase Intent for covered sectors of retail over the last 18 months.

E-Commerce posted the biggest increase in Purchase Intent over the past three months and has been on an upward trend since May 2022. As we noted in our HundredX report on E-Commerce , popular brands Chewy and Etsy also posted modest gains and helped contribute to the overall industry’s gains.

Biggest Retail Purchase Intent Improvers

Warming to Prices

Unsurprisingly, customers view Discount Stores’ prices most favorably compared to other retail sectors, with E-Commerce and Superstores coming in a close second. Customers view the prices of Specialty Stores most negatively. In our coverage, Specialty Stores includes certain sporting stores, craft stores, mailing centers, bookstores, pet stores, and toy stores. Typically, due to their niche audience, these stores tend to sell their unique merchandise at higher prices compared to similar products at superstores or department stores.

We see the top ten Retail brands with the biggest gains since August in customer sentiment towards Price are:

Many people that leave feedback with HundredX on Belk comment positively on the company’s prices.

“I love when they have sales and the discounts they offer. I continue to go to the store hoping to find things I need especially for work now since I have to dress dressy casual,” one person said to HundredX. Another noted, “There prices are great and that makes a difference when you have 5 children like I do.”

Over the past three months, Belk also increased notably in Value, Attitude, and Sizes & Fit.

In the summer, Belk premiered a partnership with home goods, furniture, and appliance store Conn’s. Belk customers can now purchase Conn’s products in select stores and online.

We will continue to monitor and report on the Retail space in 2023.

₁All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a mission-based data and insights provider . HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact .

Share This Article