Winning at Online Sports Betting: Dueling it Out to be Crowned King with Customers

As platforms hit more states, major sports leagues benefit, gamblers flock to best odds

With the NFL season now a quarter of the way complete, Major League Baseball headed into the playoffs, and the NBA and NHL preseasons recently starting, all four major U.S. sports leagues are active simultaneously. This is one of the busiest times of year for American sports fans, so we look closer at the online gambling platforms fans use to bet on their favorite teams, players, and more.

Online sports betting continues to become legal across the U.S. Just five years ago, most states could not legalize sports betting. Following the Supreme Court’s ruling striking down the federal ban on sports betting in general, sports gambling is now legal in about half the country. Many of those states continue to only allow in-person bets, but that’s quickly changing. Since the start of 2021, a dozen states have legalized online sports betting, and more are poised to ask their residents to vote to legalize online sports betting over the next year.

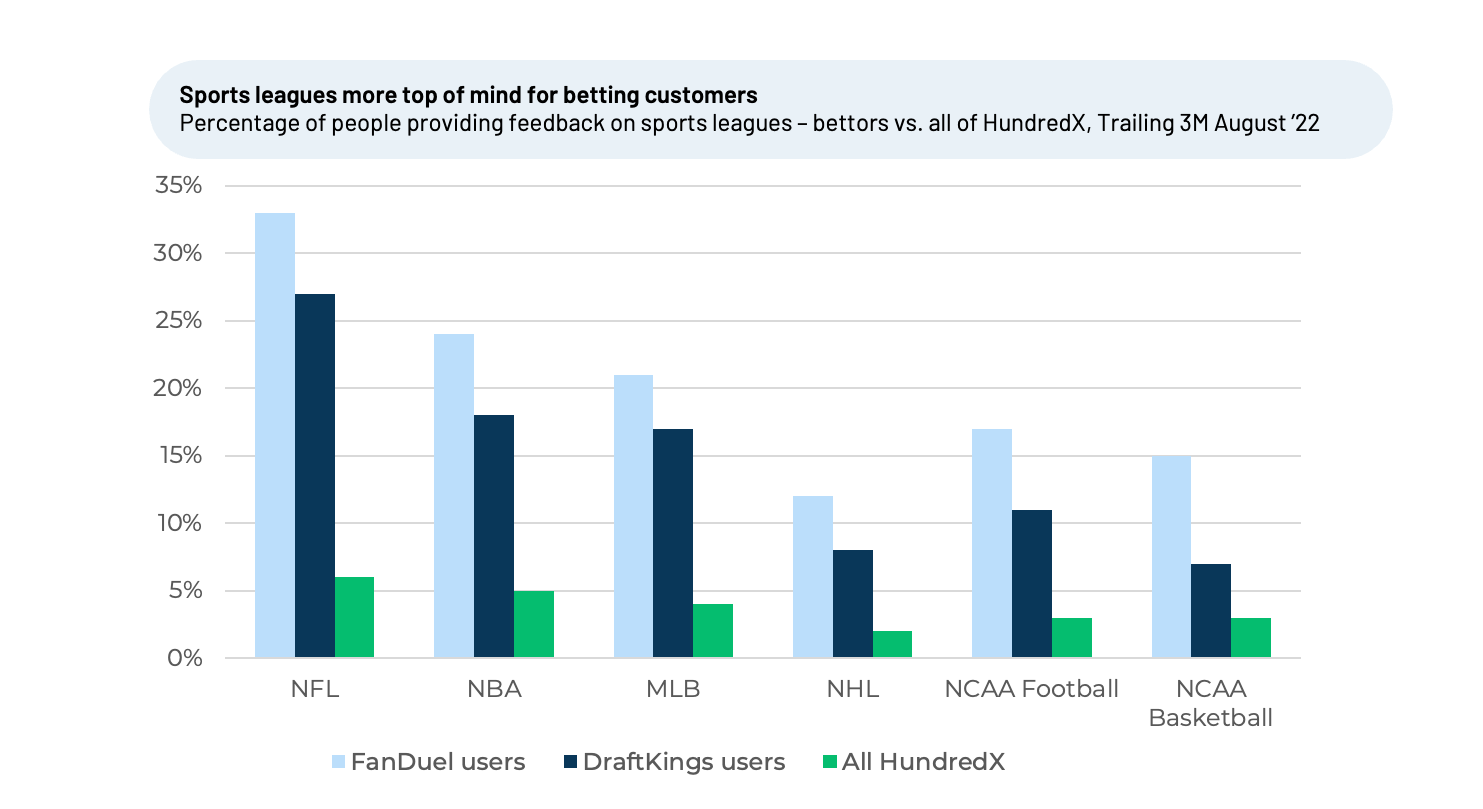

Listening to “The Crowd” ― real consumers who use online sports betting platforms and share immediate feedback about future usage intent and brand satisfaction with HundredX ― we can gain insights into which leagues are most popular with online bettors, which betting platforms are winning, and why. Examining more than 9,000 pieces of consumer feedback on six of the most popular online sports betting platforms since January 2021, we see that users of online sports betting platforms think more about major sports leagues and are likely to watch more games and attend more events over the next year than the average consumer sharing feedback with HundredX. The NFL is most top of mind, followed by the NBA and MLB.

Recent Indicators from The Crowd

HundredX data from “The Crowd” shows that people who provided feedback on FanDuel or DraftKings were two to five times more likely to also provide feedback on one of the major sports leagues, compared to the average person who shared their views with HundredX. For example, 6% of people who provided feedback for the trailing three months ended (T3M) August 2022 shared thoughts on the NFL, versus 33% for those that reviewed FanDuel and 27% for DraftKings.

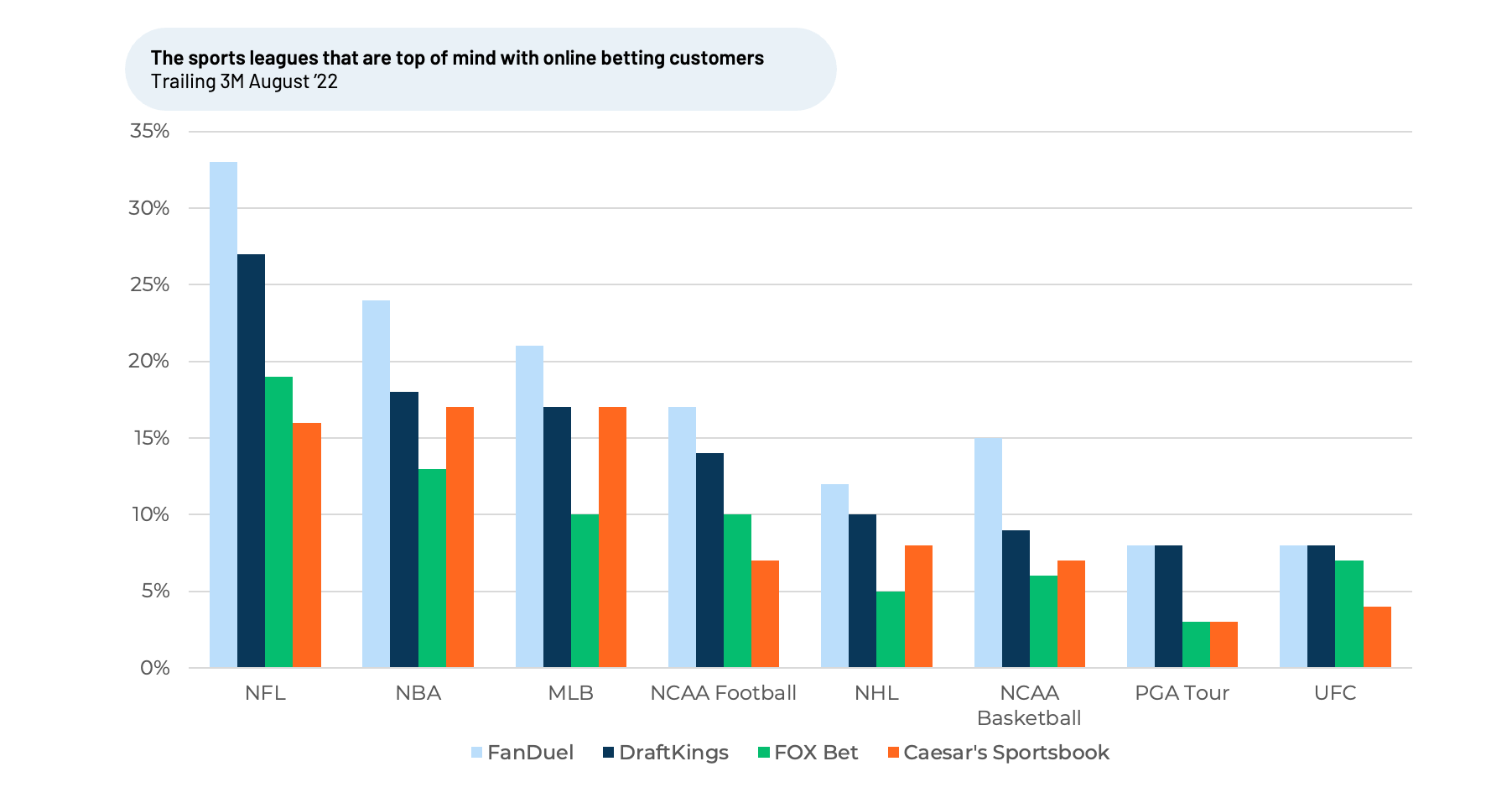

While most online sports betting platforms allow users to bet on all types of professional sports, we find the NFL is the most top of mind for people who provided feedback on FanDuel, DraftKings, FOX Bet, and Caesar’s Sportsbook. The NBA followed second, and MLB third. NCAA Football and Basketball closed out the group, coming in ahead of other professional sports leagues tracked by HundredX.

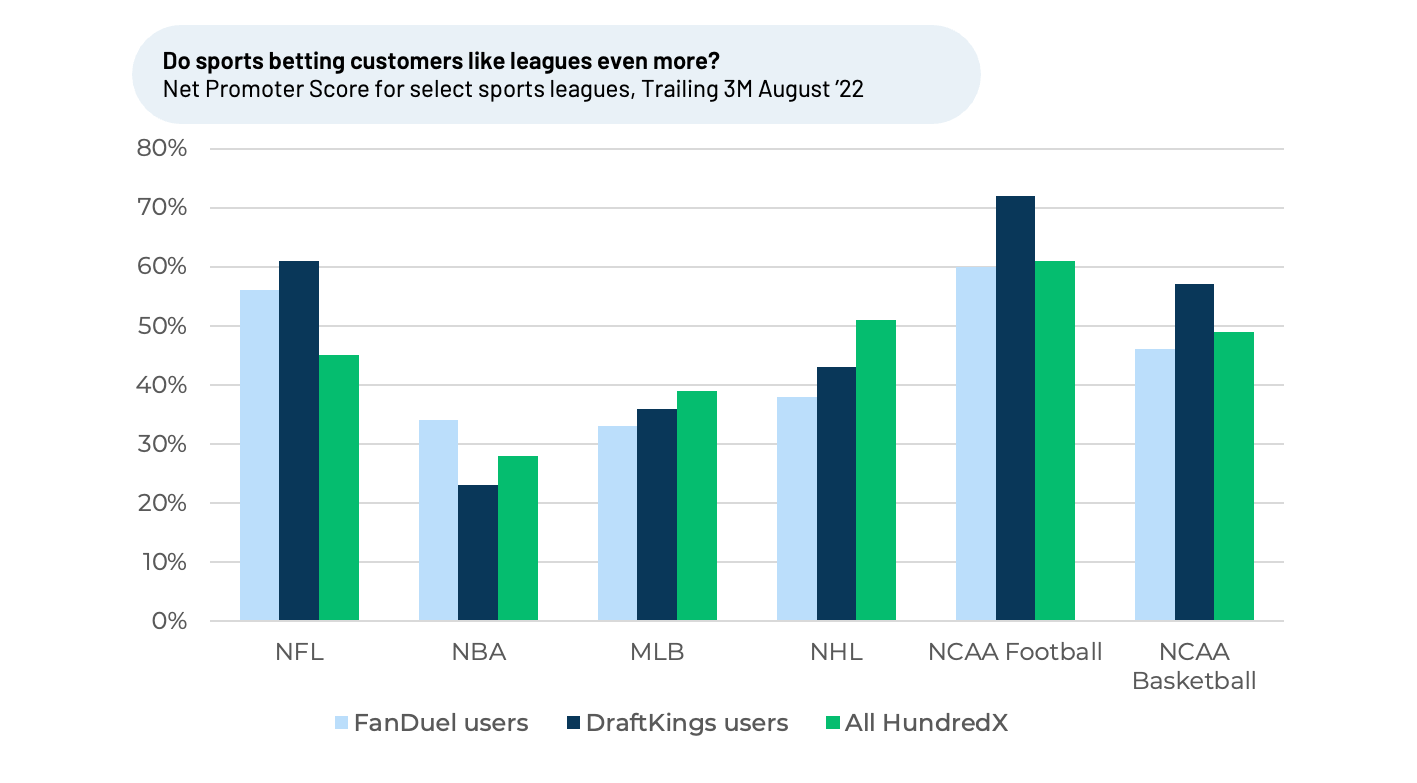

While our analysis of data from “The Crowd” shows betting platform users consistently think about the top sports leagues more than the average person, signs users actually like the leagues more were not as consistent. The NFL was the only sports league that saw a consistently higher Net Promoter Score (NPS) for T3M August 2022 for both FanDuel (56%) and DraftKings (61%) customers relative to the average for all who shared feedback with HundredX (45%). The Net Promoter Score captures the percentage of people who are “promoters” of the brand minus the percentage who are “detractors.” Promoters chose 9 or 10 out of a 10-point scale when asked if they would recommend that brand to a friend. Detractors chose six or lower.

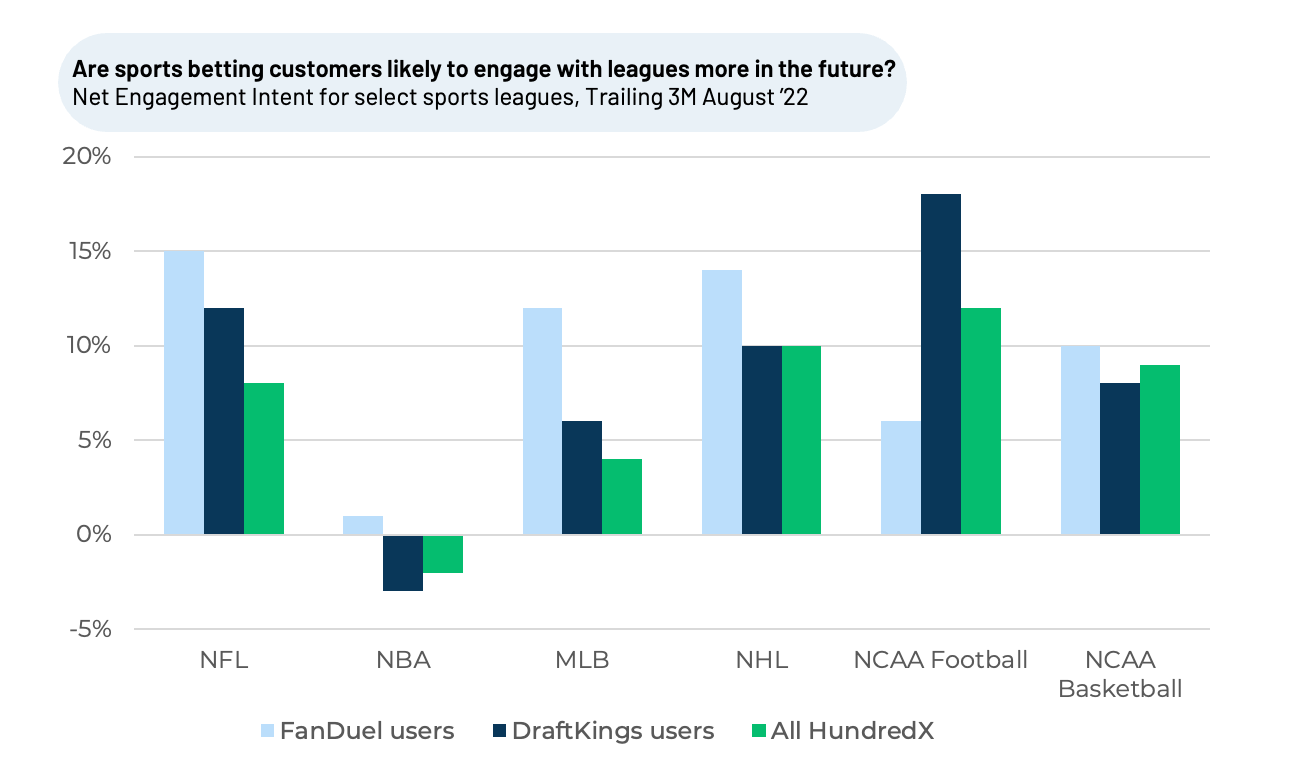

FanDuel and DraftKings users also indicate they are more likely to engage more with major sports leagues over the next 12 months than the average consumer. The Net Engagement Intent (NEI) for users of both platforms was higher than the average consumer for the NFL, MLB, and NHL, potentially implying that betting is helping to drive people to want to watch and attend more games. The NEI uplift for a FanDuel consumer over the average consumer was highest for MLB (8%), the NNFL (7%), and NHL (4%) for T3M August 2022, while the uplift for DraftKings consumers was highest for NCAA Football (6%) and the NFL (4%).

NEI captures the percentage of customers who indicate they plan to follow the sport more over the next twelve months minus the percentage that indicate they plan to follow less

A Winning Formula for Online Sports Betting

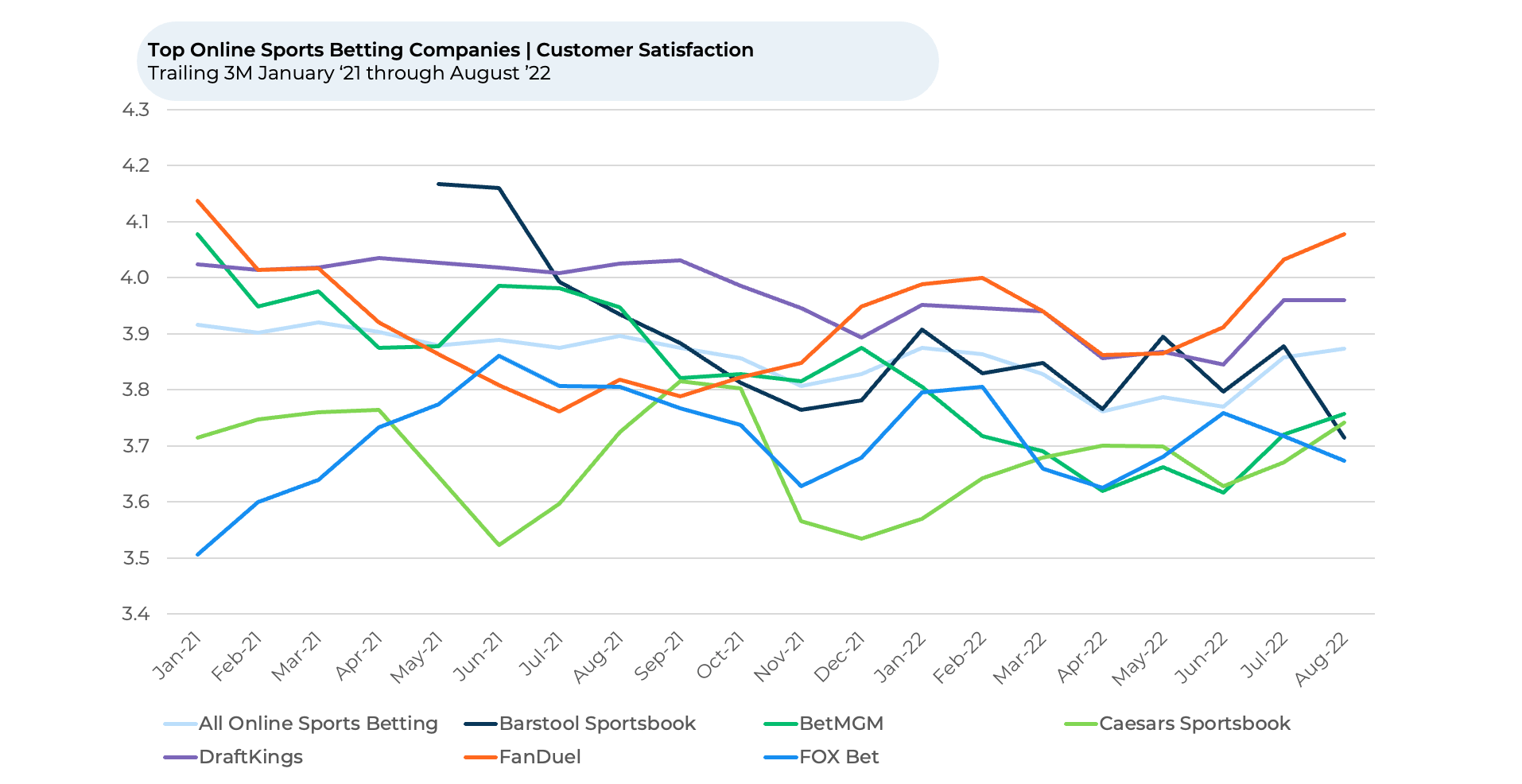

FanDuel currently leads the online sports betting group in terms of keeping “The Crowd” happy, followed closely by DraftKings. FanDuel has made significant strides during the past year in its positioning for Customer Satisfaction (CSAT) versus the peers we follow. It rose from the second lowest score in the group for T3M July and August 2021 to now lead with a 4.1 (on a five-point scale) as of T3M August 2022, ahead of the group average of 3.9.

“Don’t use it so often, but when there’s a big game or event to bet on, it’s my go to site to gamble,” one DraftKings user told HundredX. Another experienced user shared, “FanDuel is my best betting app thus far. I've tried about 5 total apps. (It) has the best experience, hands down.”

To understand why some online sports betting brands beat the competition on CSAT, we dig into specific drivers to uncover “the why behind the buy." Our analysis indicates online sports betting companies with a higher CSAT tend to do a better job than the peer group at delighting customers on Lines and Odds, Stats and Research, and Bonuses.

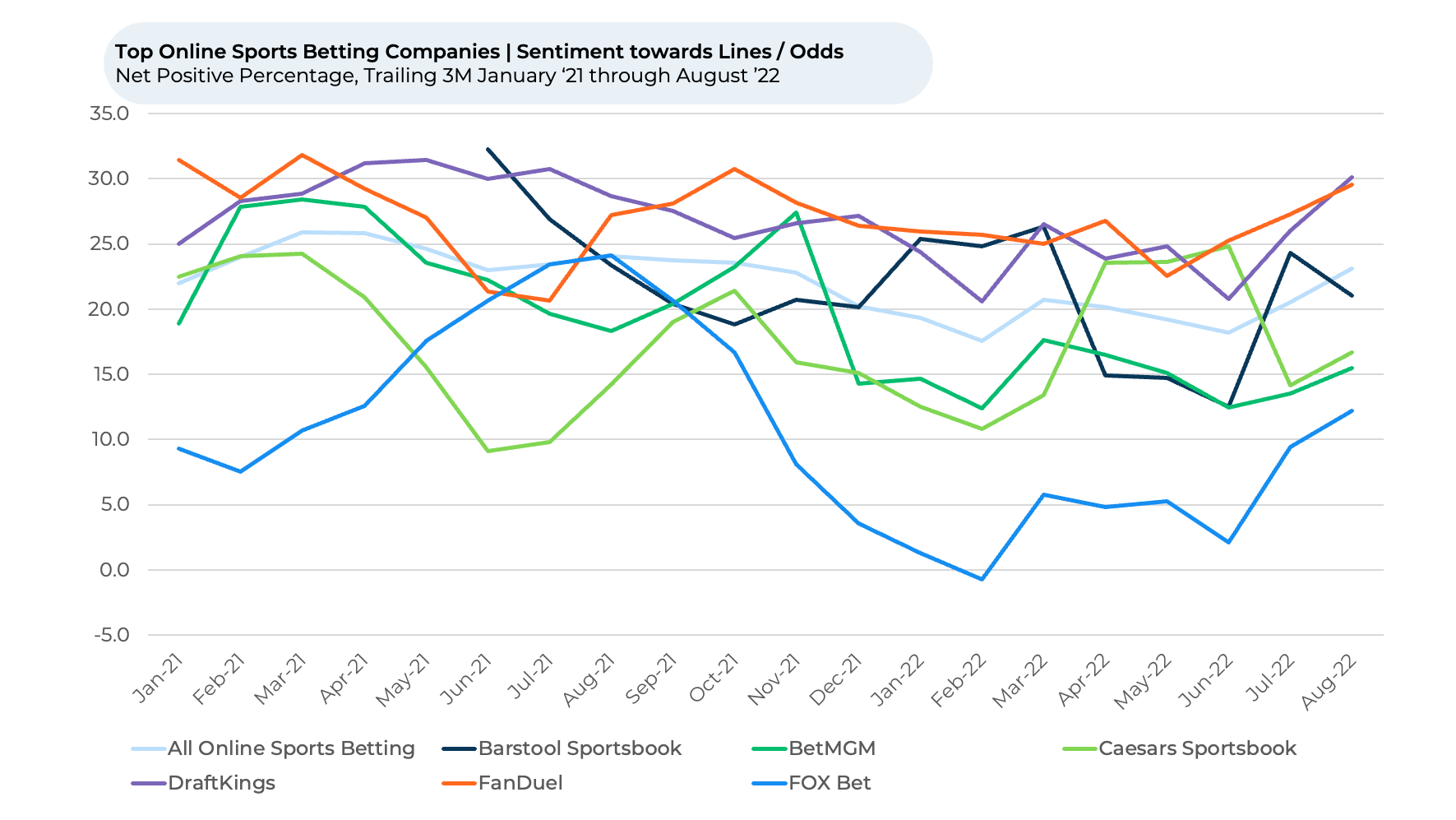

Lines/Odds

“The Crowd” most frequently selects Lines / Odds — the probability of winning and the potential payout — when considering why they like their favorite online sports betting sites. We find consumers view the lines and odds of DraftKings and FanDuel more favorably than the rest of the competition, both posting Net Positive Percentages (NPP) for lines and odds of 30% for T3M August 2022, ahead of the group average 23%. One FanDuel user told HundredX, “Love the in-game features and boosted odds specials.”

Net Positive Percentages captures the sentiment or level of satisfaction towards a particular driver, measured as the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Stats and Research

Stats and research provided by online sports betting platforms are also crucial to customer satisfaction. DraftKings and FOX Bet win on sentiment here, with 22% NPP for T3M August 2022, ahead of the 19% average for the group. Each major betting site features free sports statistics and research for users to make more informed bets, but our data indicates gamblers like DraftKings and FOX Bet the best. FOX Bet has rallied from one of the weakest on Stats & Research sentiment during T3M March 2022 to second this period.

In 2019, DraftKings launched its free-to-use DraftKings Nation website in partnership with SB Nation, Vox Media’s sports blogging network. Updated numerous times a day with new content, DraftKings Nation provides readers with sports news, betting picks, and fantasy league advice.

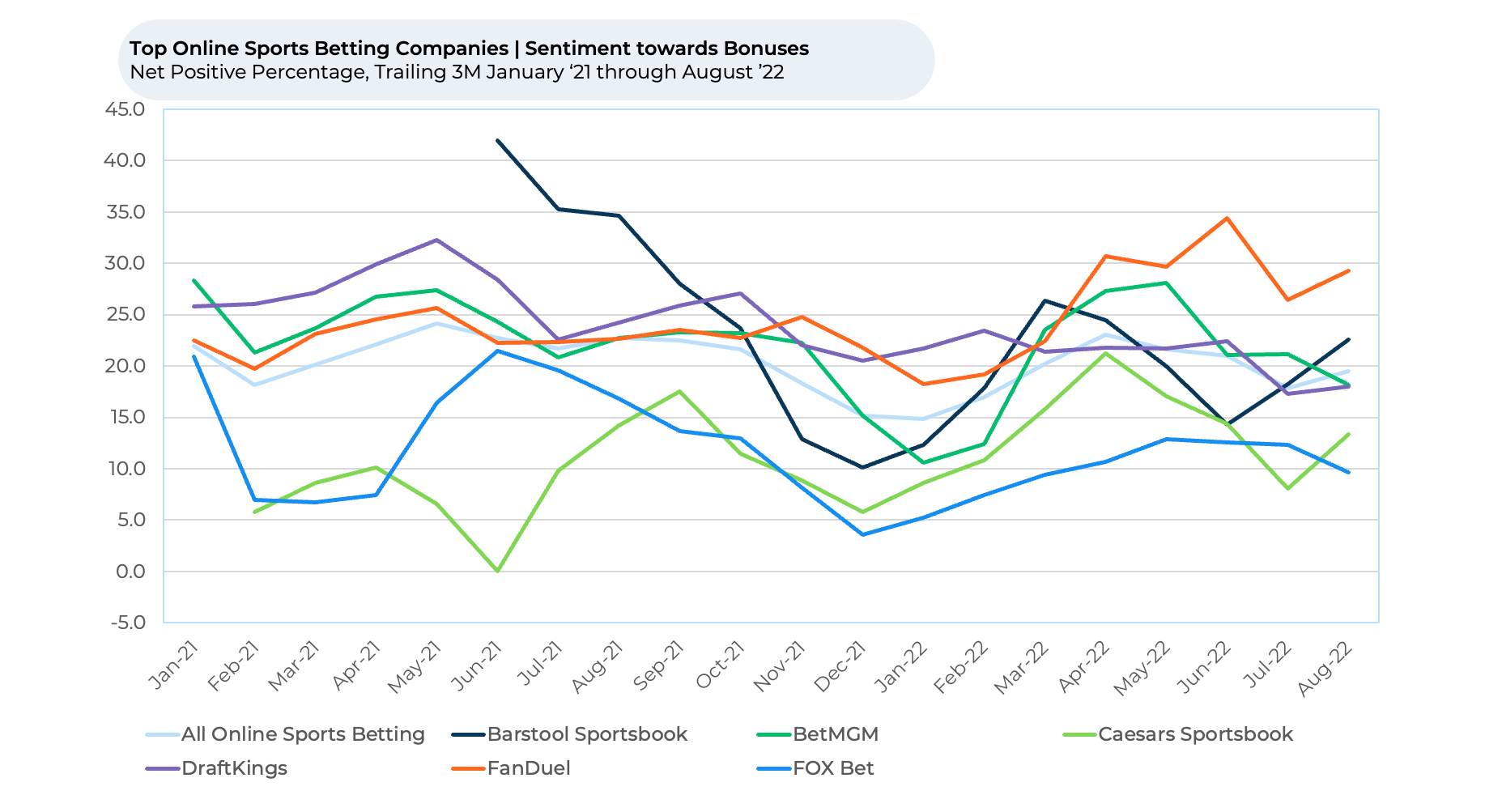

Bonuses

FanDuel leads for “Bonus” Customer Satisfaction at 29% NPP for T3M August 2022, with Barstool Sportsbook second at 23%.

“Bonus” NPP began an upward trend for FanDuel early this year, rallying from a low of 18% for T3M January 2022. When online sports betting went live in New York in January 2022, many online betting platforms offered New York players promotions for signing up or placing new bets.

Bonus NPP began an upward trend for FanDuel early this year, rallying from a low of 18% for T3M January 2022. When online sports betting went live in New York in January 2022, many online betting platforms offered New York players promotions for signing up or placing new bets.

FanDuel offered some of the best promotions, including a $1,000 risk-free bet, which gave players up to $1,000 in site credit if they lost money on their first bet. The company also provided new players the option to boost their odds 30-1 on any NFL game.

Meanwhile, Barstool Sportsbook jumped from 14% NPP in June 2022 to 23% in August 2022. The company offers a $1,000 risk-free bet, which it advertised heavily during the 2022 MLB season and NFL and NCAA Football seasons.

“Love the promotional bets and merch giveaways,” one Barstool Sportsbook consumer told HundredX.

Based on our data, we find that online sports betting platforms looking to increase customer satisfaction should invest in improving Lines and Odds, Stats and Research, and Bonuses. These drivers keep customers coming back. We will keep an eye on trends in the Online Sports Betting industry as it continues to mature and the seasons for the major sports leagues play out.

To read more about our Sports coverage and see who leads for The Crowd in the

Sports Entertainment

category, please see our recent report on "Winning at Sports Entertainment," or contact our team to learn more.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more details on our data for Online Sports Betting companies and any of our 75+ other industries, or if you'd like to understand more about using Data for Good, please reach out: https://hundredx.com/contact

Share This Article